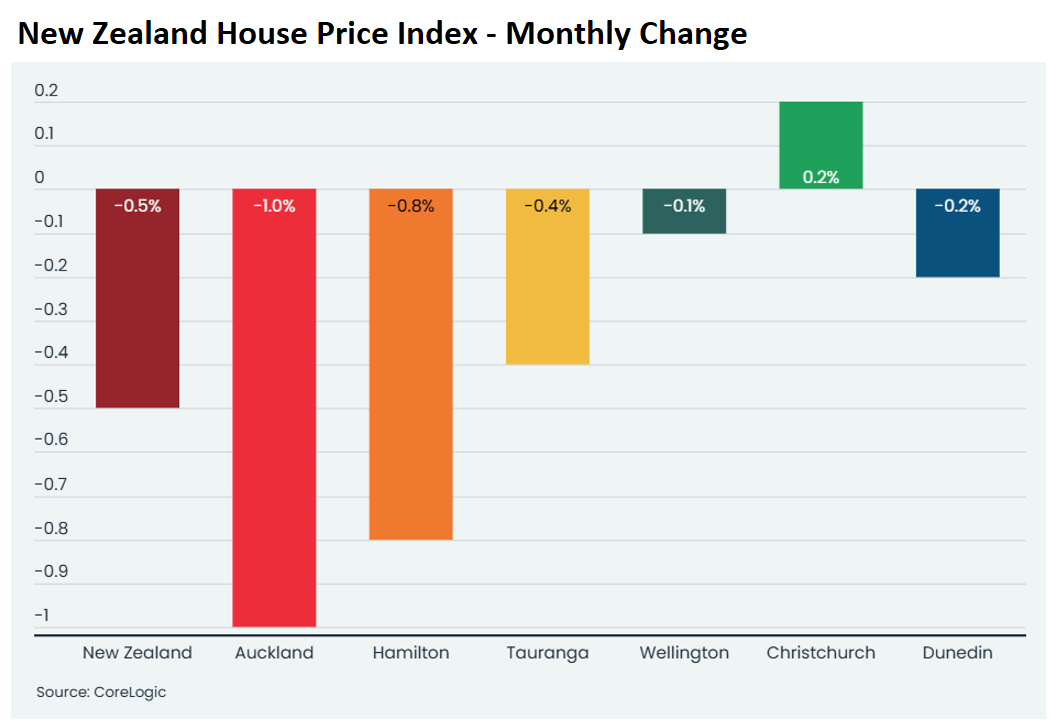

According to CoreLogic, home values across New Zealand fell by 0.5% in August, with Auckland seeing the biggest decline at 1.0%:

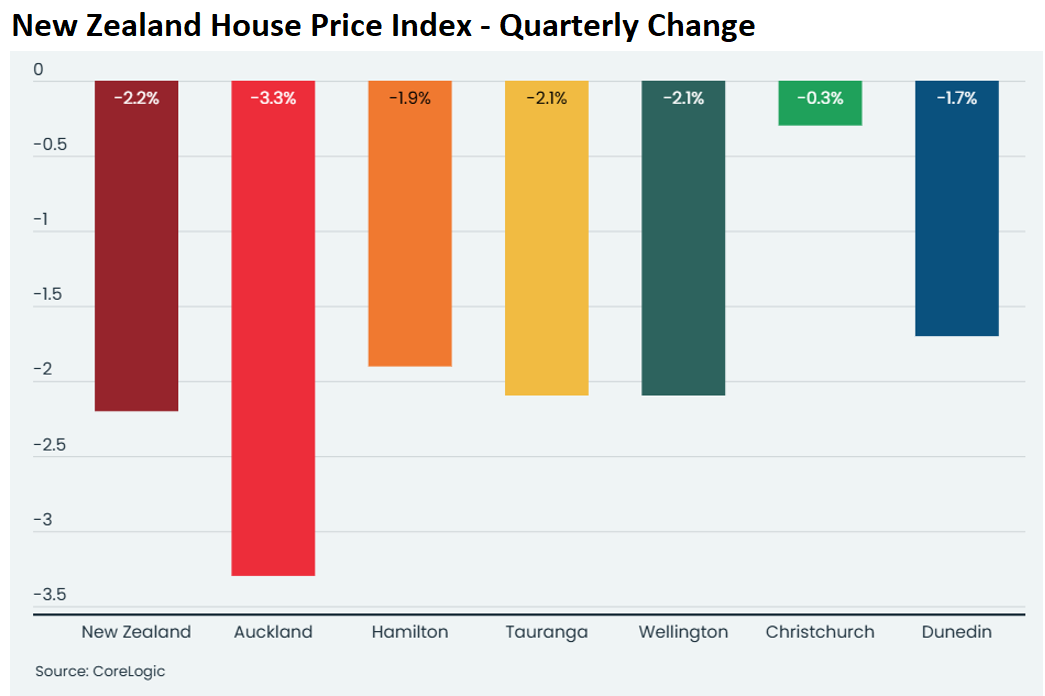

On a quarterly basis, dwelling values declined by 2.2% across New Zealand, with falls recorded across all major markets:

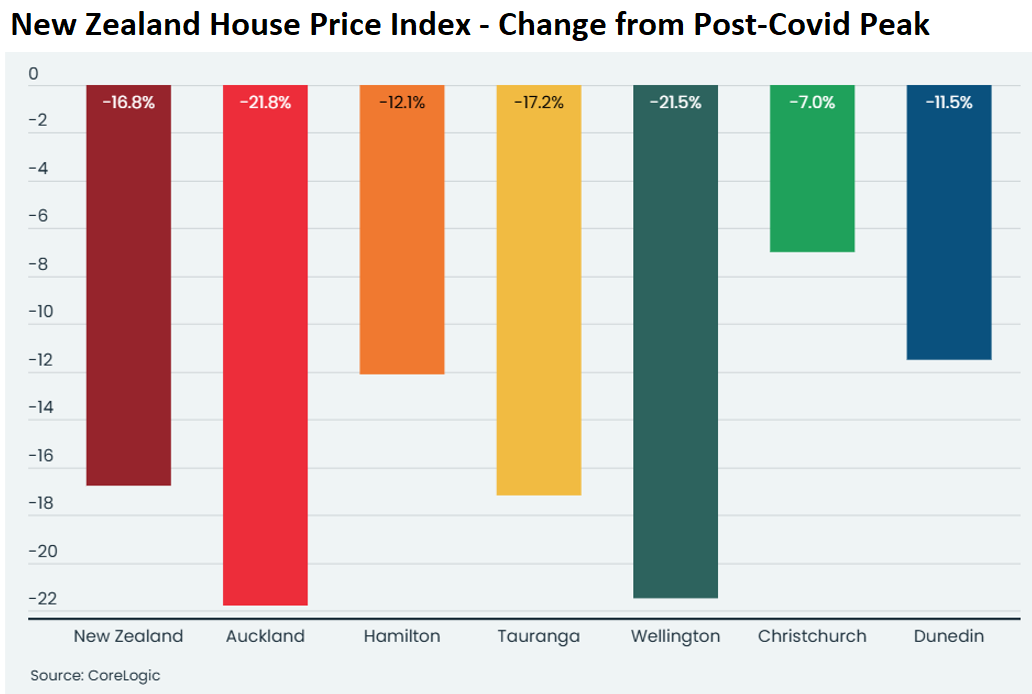

Home values have fallen 16.8% from their post-Covid peak, with Auckland (-21.8%) and Wellington (-21.5%) registering the largest declines:

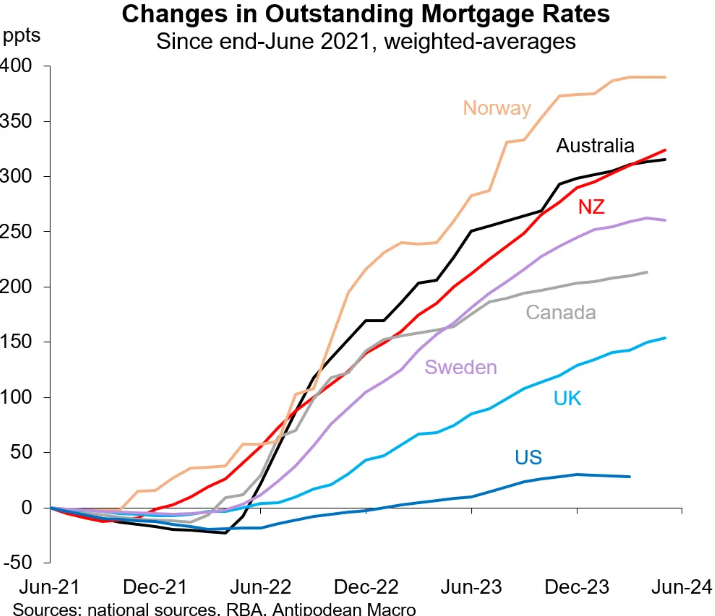

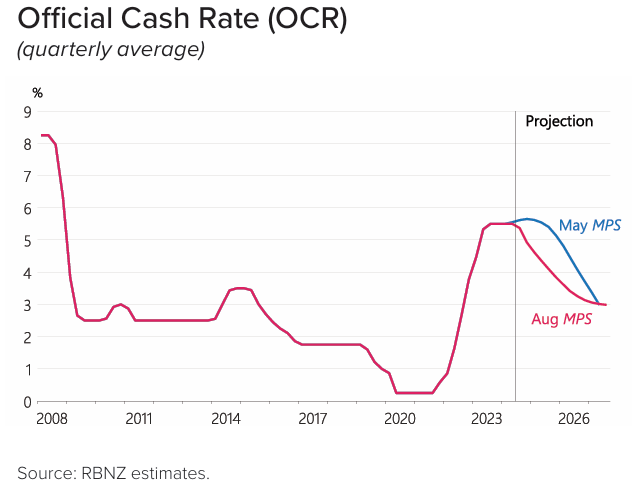

The Reserve Bank’s ultra-aggressive monetary tightening, which saw the Official Cash Rate (OCR) peak at 5.50% and produced one of the world’s greatest increases in average mortgage rates, is behind the decline in New Zealand home prices.

The Reserve Bank reduced the OCR by 0.25% last month, with more reductions expected over the next 24 months:

CoreLogic NZ Chief Property Economist, Kelvin Davidson, believes that the reduction in the OCR should put a floor under home prices, although headwinds remain.

“No doubt many households will be feeling happier now that the official cash rate is falling and mortgage rates are headed lower too. This sentiment effect, as well as the direct boost to borrowers’ finances, could support housing in the near term”.

“Yet the latest, actual fall in values is a timely reminder that the market still faces considerable challenges too. For a start, housing affordability is still stretched, while at the same time the labour market downturn is fully underway”.

“Even if people haven’t lost their jobs, the increased feelings of insecurity will still tend to flow through to less enthusiasm to trade property or pay top-dollar”.

“It’s also clear that the bargaining power lies with buyers in a market where the stock of available listings is sitting at multi-year highs. But that’s still only for the more limited pool of buyers who can actually secure the finance”.

“This all adds up to likely further restraint on property values in the coming months, although the potential impact of lower mortgage rates can’t be ignored”.

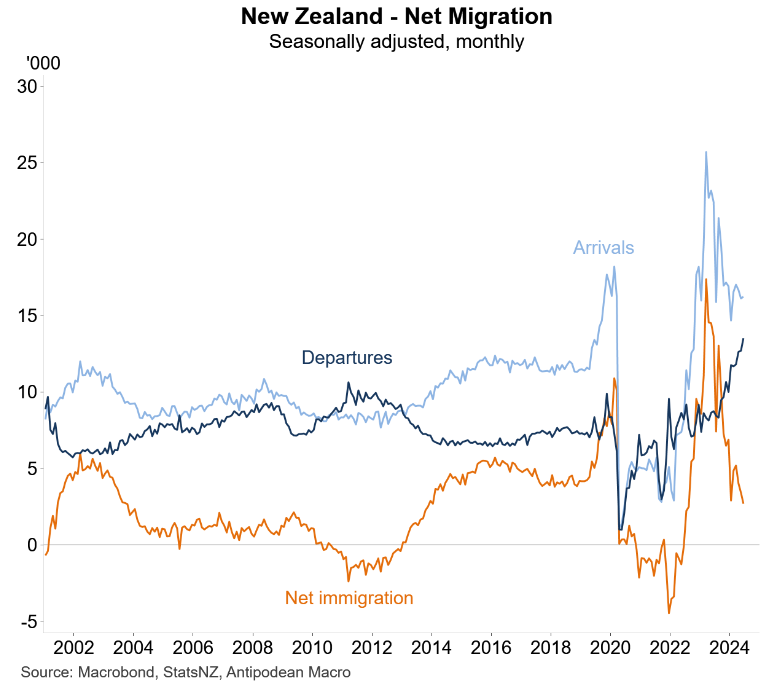

While these cuts to the OCR will undoubtedly provide support to home values, they will be offset to some extent by a substantial slowdown in net overseas migration into New Zealand:

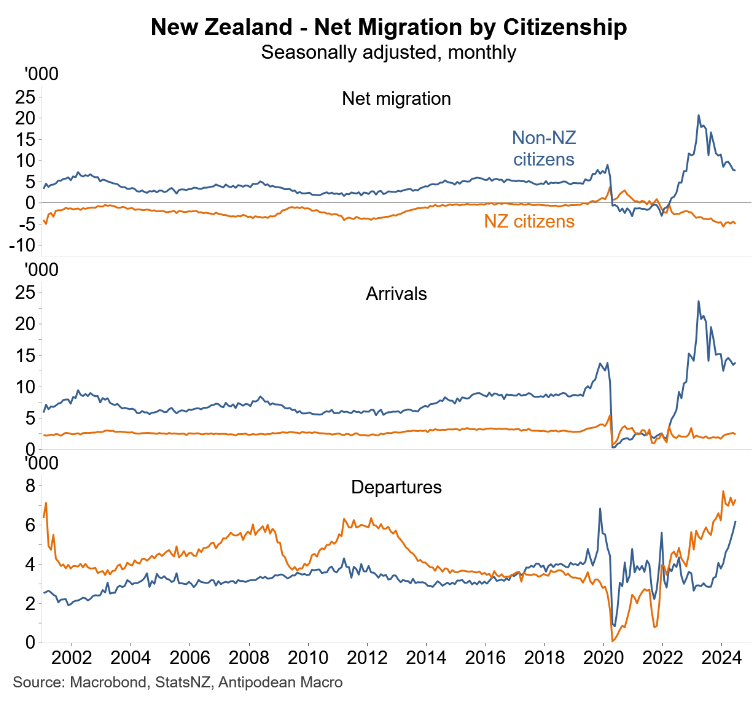

Incumbent New Zealanders, in particular, are leaving in droves:

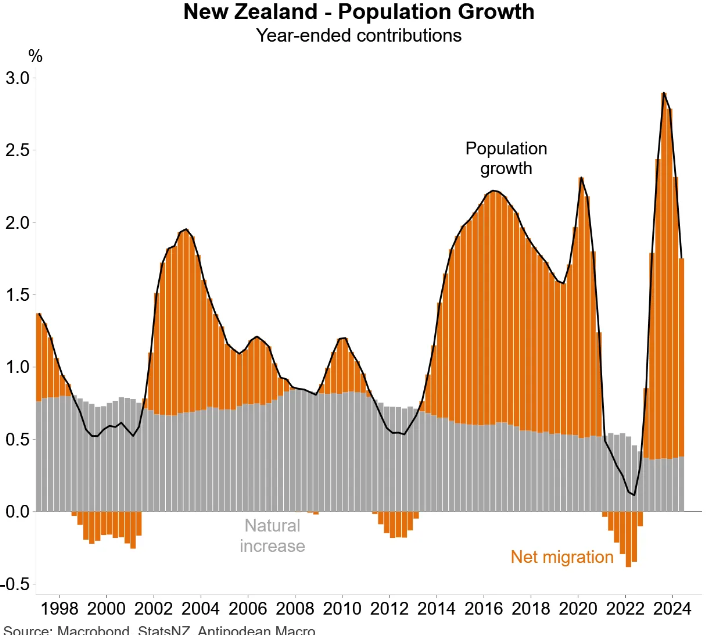

As a result, New Zealand’s population growth is slowing, which will relieve pressure on housing demand:

Independent economist Tony Alexander recently provided a balanced assessment of the situation:

“Buyers will feel more confident to return to the market. Property enquiries will pick up, FOMO will recover more than it has, and vendors will feel more emboldened to hold out for the price they dream they can get rather than the one which will allow them to move on with their lives straight away”.

“But we are not talking about a boom. Net migration is dropping away fairly sharply, and young Kiwis (potential home buyers) are leaving the country”.

It will be fascinating to watch how New Zealand’s housing market reacts to the cuts in the OCR and the subsequent drop in mortgage rates.