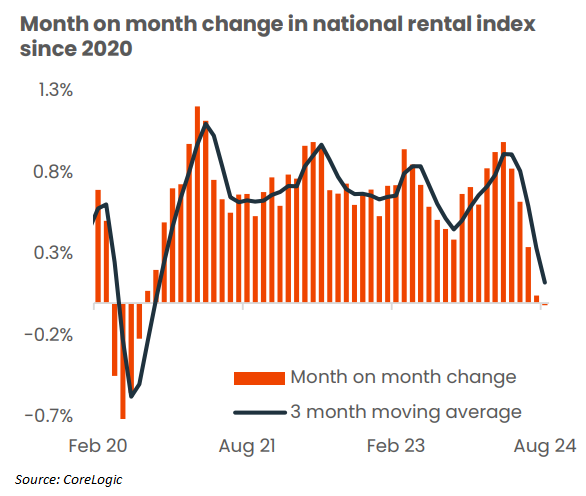

CoreLogic declared that “the end of the rental boom is in sight” after “rents flatlined in July and August”:

The stabilisation follows a 39% rent rise between August 2020 and June 2024.

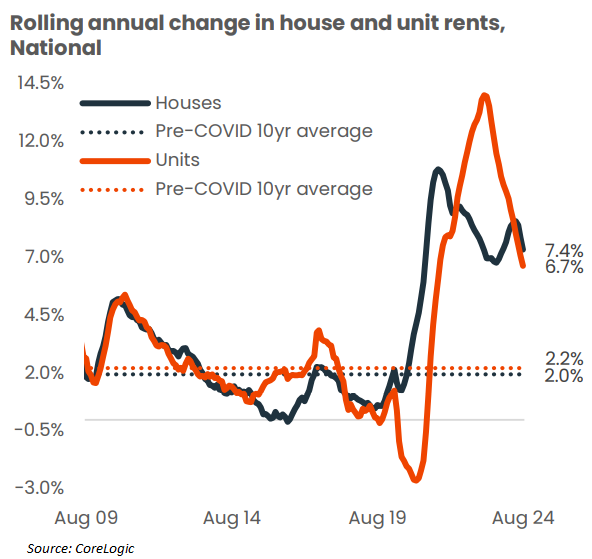

CoreLogic also shows that the annual growth in rents is also slowing. Nationally, the annual pace of rental growth peaked at 9.7% over the 12 months ending November 2021, which was a series high.

The annual growth in rents has since eased back to 7.2%, the lowest annual growth rate since the 12 months ending May 2021:

The slowing of rental growth is particularly evident in the unit sector, with the annual change in unit rents countrywide falling from 14% in the year to April 2023 to 6.7% in the most recent 12-month period.

House rental growth peaked earlier, at 10.8% in the year to September 2021, and has since fallen to 7.4%.

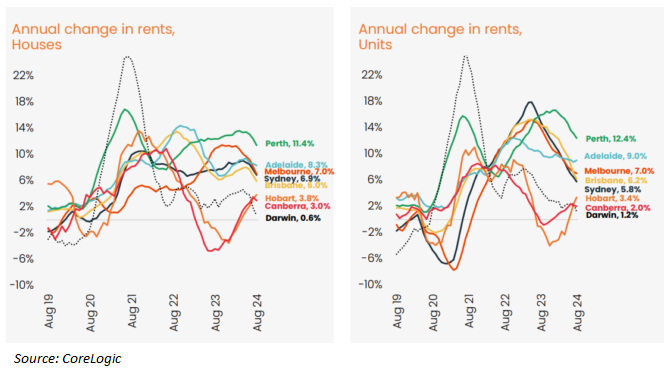

Perth and Adelaide continue to have the highest rental growth, with yearly advances of 11.6% and 8.4%, respectively.

However, even these cities are experiencing a noticeable slowdown in rental growth, particularly Perth, where rentals grew by ‘only’ 0.7% in the last three months.

CoreLogic attributes the slowing of rental growth to three primary factors.

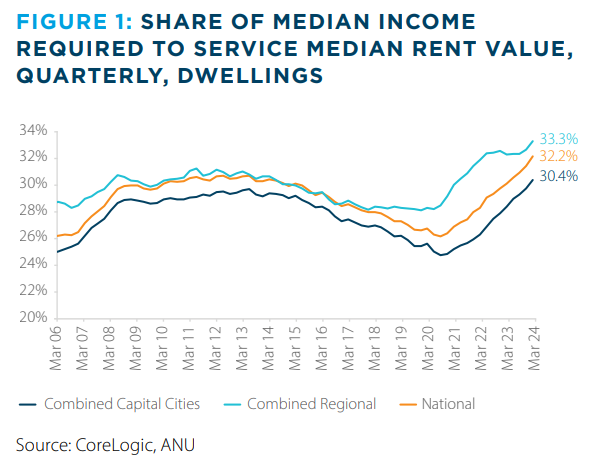

First, tenants have hit an affordability ceiling with rents costing a record share of household income:

Between March 2020 and June 2024, Australian earnings (based on the wage price index) grew by 12.7%, while rents rose by 36.1%.

CoreLogic’s most recent rental affordability report showed that a household with the median income would devote 32.2% of their gross annual income to paying the median rent, a record high.

Unlike mortgages, you cannot leverage rents. Therefore, rental growth is tied to incomes, which limits how much they can increase.

Second, with rental affordability so stretched, more households are moving into shared living arrangements, which is acting to reduce rental price pressures.

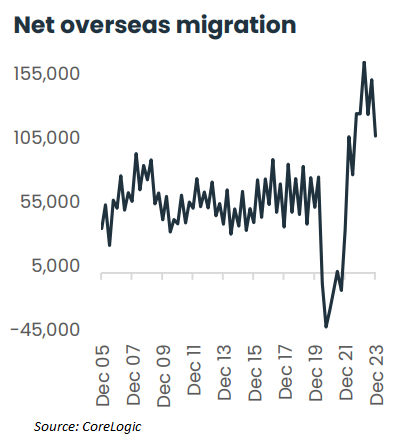

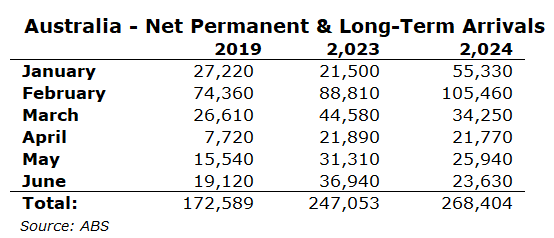

Third, quarterly net overseas migration peaked at 165,000 in Q1 2023, which aligns with the peak rate of rental growth across the unit sector in April 2023.

While net overseas migration of 107,000 in Q4 2023 was still about 1.6 times higher than the pre-pandemic decade average for the December quarter, it represented a sharp drop from the record high levels of migration:

Monthly arrivals and departures data from the ABS also pointed to a recent slowing of net overseas migration since February; although it remains at historically high levels.

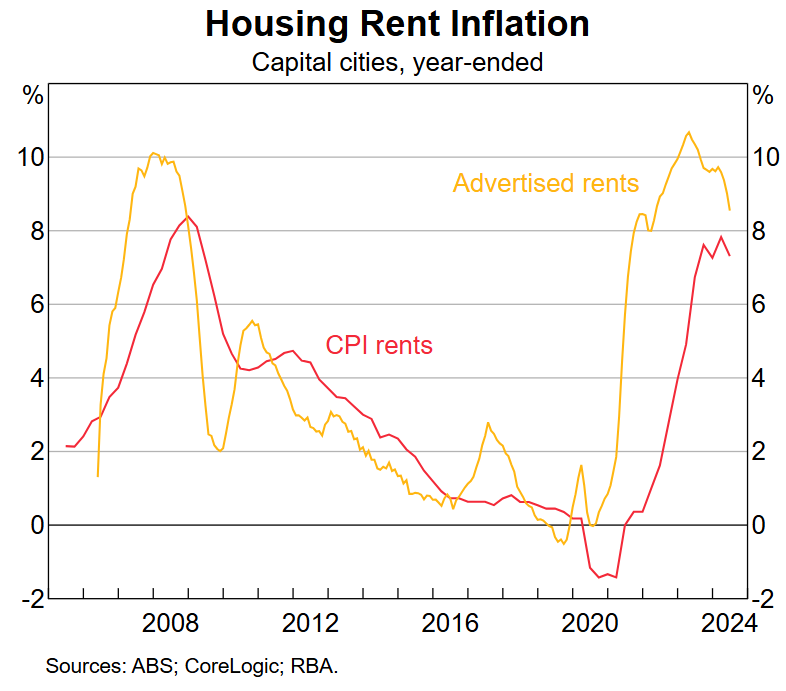

While the rental “boom” might be over, rental inflation will remain elevated due to the long lead time between advertised rents and overall CPI rents:

As noted by RBA governor Michele Bullock last week:

“Rents on new leases take time to impact overall CPI rents because only a small share of the stock of rental properties update leases in a given month and so CPI rents inflation is likely to be high for some time”.

This suggests that rents will remain a thorn in the side of the RBA as they will remain well above the 2% to 3% inflation target for a prolonged period of time.