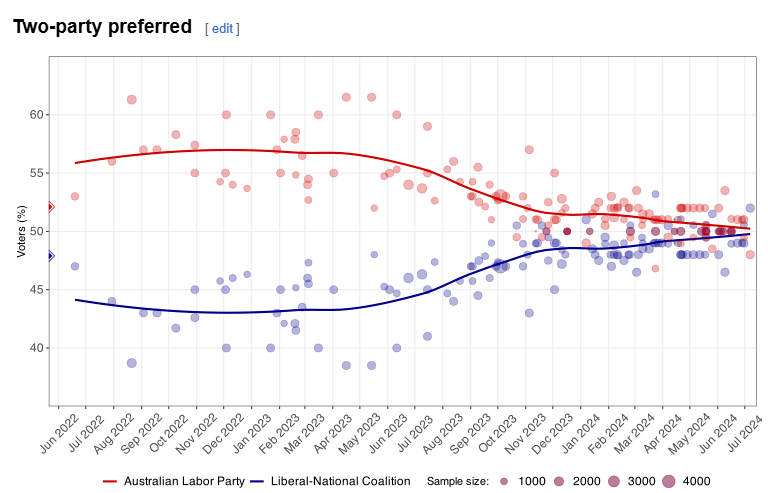

Most opinion polls have federal Labor and the Coalition roughly neck-and-neck, with a hung parliament looking increasingly likely.

We also know from the latest RedBridge polling that the Albanese government is failing to connect with voters over the cost-of-living, with only 24% of Australians surveyed stating that they could name a single thing that had improved their lives since Labor came to power.

With the next federal election due in the first half of 2025, Labor will be praying that the Reserve Bank of Australia (RBA) commences an easing cycle, as it could hold the keys to victory.

One only needs to look across the pond to New Zealand for guidance.

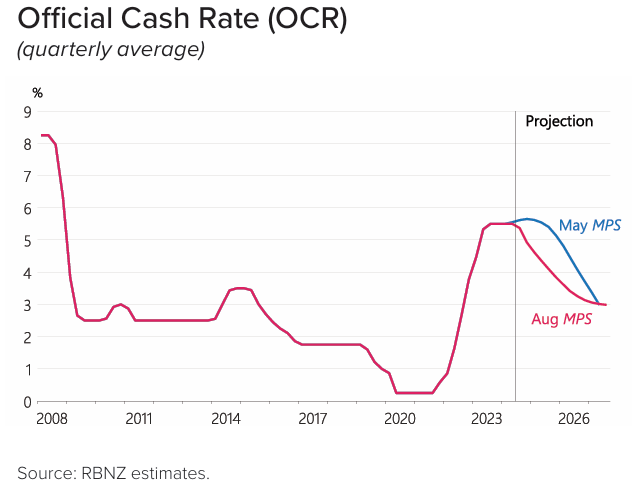

The Reserve Bank of New Zealand unexpectedly cut the official cash rate by 0.25% in August and forecast additional cuts:

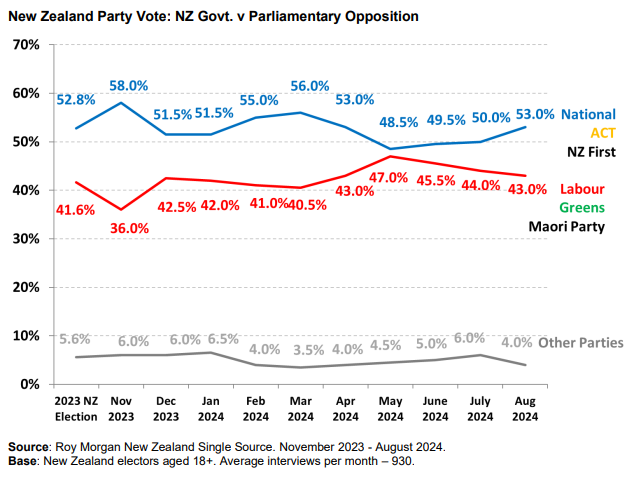

Immediately, the incumbent National-led government has experienced a strong bounce in the polls, according to Roy Morgan, up 3% points to 53%:

The Roy Morgan Government Confidence Rating also increased 7.5pts to 97.5 in August, as has consumer confidence.

Michele Levine, CEO Roy Morgan, explained that support for Prime Minister Christopher Luxon’s National-led governing coalition has increased to its highest for four months and news on the economic front is improving with inflation down and the Reserve Bank cutting interest rates:

“The good news for National is that on the economic front there are signs that that the future is beginning to look more positive than it had been. Both Government Confidence, up 7.5pts to 97.5 (and the highest since February 2024) and the latest ANZ-Roy Morgan New Zealand Consumer Confidence Rating, up 4.3pts to 92.2, improved markedly in August”.

“This increase in confidence across the board was helped by the decision by the Reserve Bank of New Zealand (RBNZ) to cut interest rates by 0.25% to 5.25% in mid-August. This was the RBNZ’s first cut to interest rates for over four years since March 2020 – at the start of the COVID-19 pandemic – and global panic”.

“The decision of the RBNZ to commence cutting interest rates augurs well for both Consumer Confidence and the National-led Government in terms of gaining and increasing support in the months ahead”.

Perhaps this explains why Treasurer Jim Chalmers has publicly attacked the Reserve Bank of Australia (RBA), claiming that its restrictive monetary policy is “smashing the economy”.

Chalmers knows that if the RBA doesn’t start cutting rates, Labor faces the prospect of becoming a one-term government.