New Zealand experienced the developed world’s largest house price boom over the pandemic.

However, since the Reserve Bank of New Zealand commenced its rate-hiking cycle in late 2021, housing has been a sea of red.

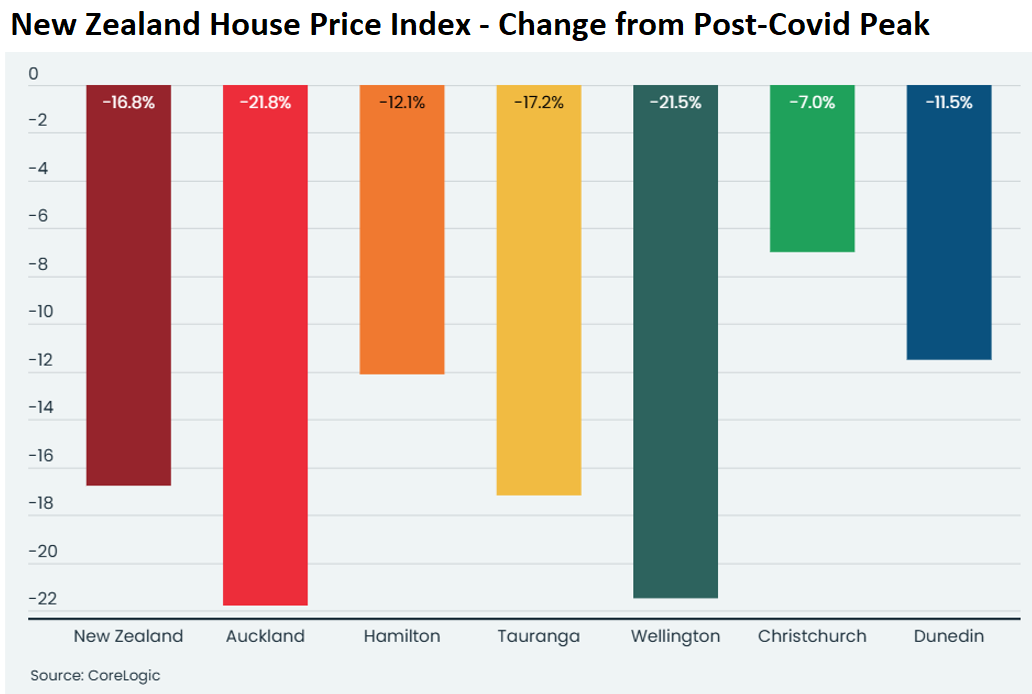

CoreLogic’s latest dwelling value results showed that average home prices nationally had fallen 16.8% from their post-Covid peak:

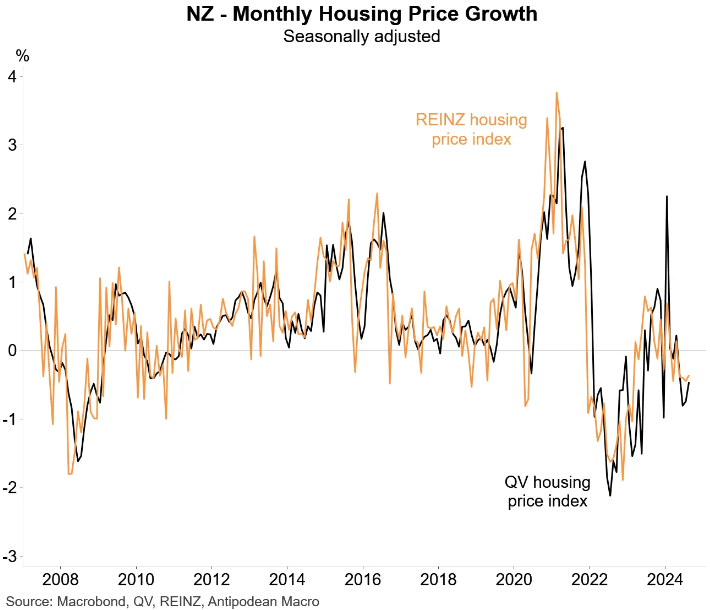

Data from the REINZ and Quotable Value (QV), presented below by Justin Fabo at Antipodean Macro, also shows that New Zealand home prices continue to fall:

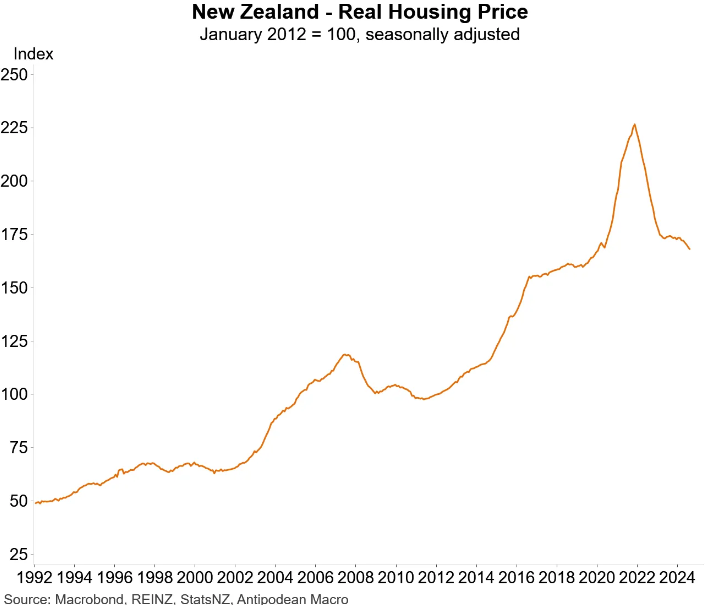

In fact, real house prices in New Zealand have nearly fallen back to their pre-pandemic level at the start of 2020, using the REINZ house price index (HPI):

This follows a 16.7% decline in the REINZ HPI from the market peak reached in 2021.

In her commentary accompanying the result, REINZ Chief Executive Jen Baird said that “a sense of confidence and positivity” had returned to the housing market following the Reserve Bank’s decision last month to commence a monetary easing cycle.

“This month, we saw further signs of a change in market sentiment, with local agents reporting increased confidence in vendors and purchasers, the return of investors, and increased activity, particularly at open homes over the last two weeks of August”, Baird noted.

“They attribute this change to the decline in interest rates. However, it would be an overstatement to say that we are at a turning point in the market – we merely have our indicators on. While there is a rise in optimism and confidence, we are hopeful that better times are still ahead”.

However, CoreLogic NZ Chief Property Economist, Kelvin Davidson, believes that the reduction in Official Cash Rate will only put a floor under home prices, and that stiff headwinds remain:

“The latest, actual fall in values is a timely reminder that the market still faces considerable challenges too. For a start, housing affordability is still stretched, while at the same time the labour market downturn is fully underway”.

“Even if people haven’t lost their jobs, the increased feelings of insecurity will still tend to flow through to less enthusiasm to trade property or pay top-dollar”.

“It’s also clear that the bargaining power lies with buyers in a market where the stock of available listings is sitting at multi-year highs. But that’s still only for the more limited pool of buyers who can actually secure the finance”.

“This all adds up to likely further restraint on property values in the coming months, although the potential impact of lower mortgage rates can’t be ignored”.

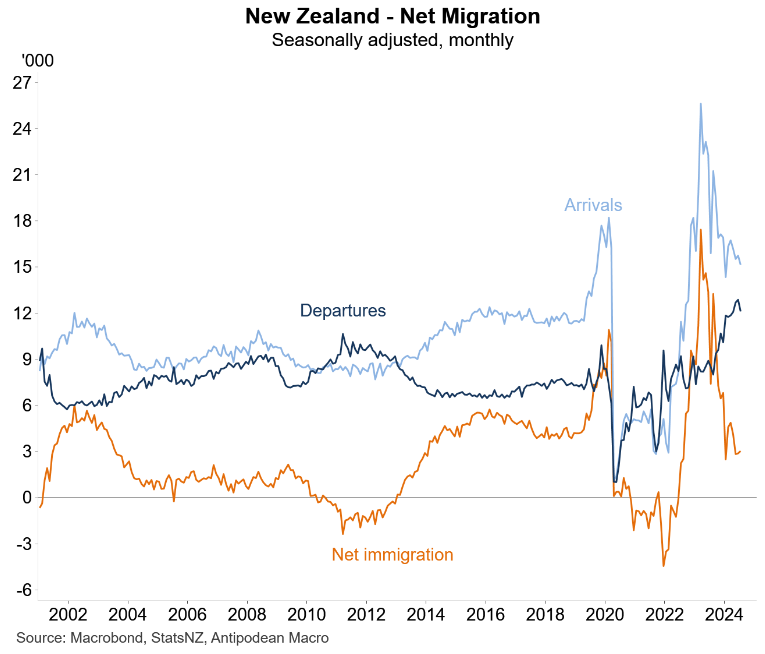

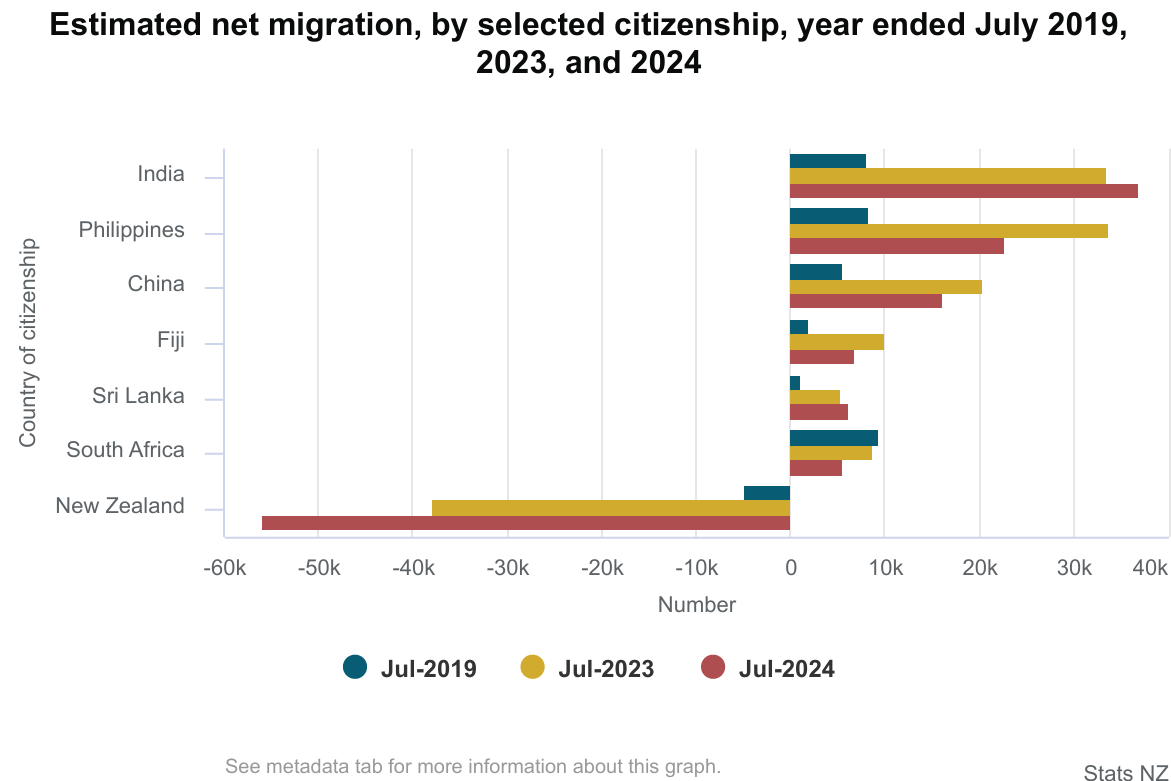

The reduction in the Official Cash Rate by the Reserve Bank will obviously help to bolster the market. However, the sharp decline in net overseas migration to New Zealand will partially offset them.

New Zealand citizens are leaving in droves, replaced by poorer migrants from developing nations:

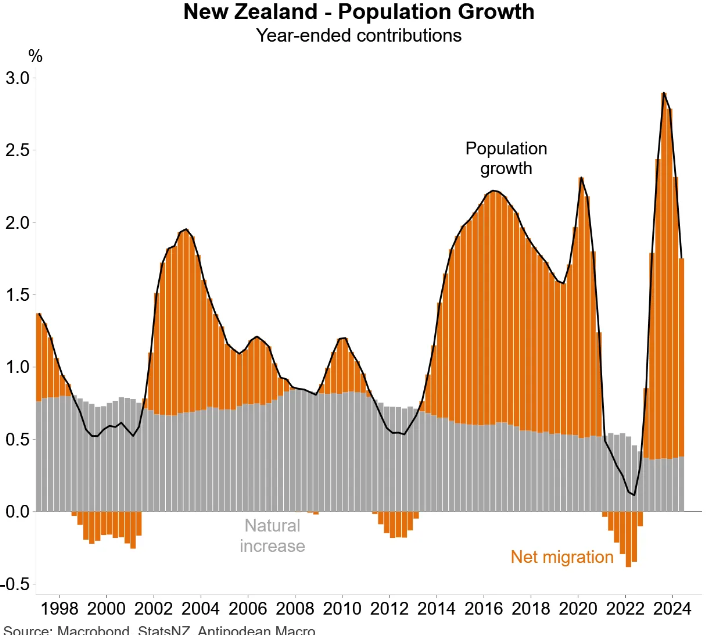

As a result, annual New Zealand population growth is slowing, which will moderate housing demand:

New Zealand’s economy is also shot to pieces and experiencing a deep per capita recession.

Therefore, it will be interesting to see how house prices respond to the cut in interest rates.