Earlier this week, Treasurer Jim Chalmers publicly attacked the Reserve Bank of Australia (RBA), claiming that its restrictive monetary policy is “smashing the economy”.

Chalmers’ salvo came about because he knew that if the RBA doesn’t start cutting rates, Labor faces the prospect of becoming a one-term government.

On Thursday, I was interviewed by Bill McDonald at Brisbane Radio 4BC, where I discussed the latest deplorable national accounts results, alongside Chalmers’ comments.

Edited Transcript:

Bill McDonald:

The treasurer is claiming the minuscule growth as a win. Can you make a bit of sense of what he is doing?

Leith van Onselen:

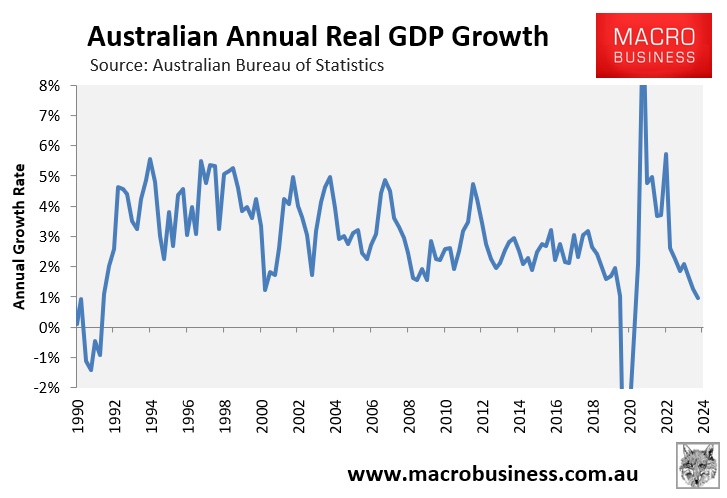

Absolutely not, mate. The economy only grew by 0.2% in the June quarter and only by 1% over the year. That’s the slowest annual rate of growth since December 1991, during the “recession we had to have”.

However, our population currently is growing by about 2.5%. That is obviously extremely high population growth through immigration.

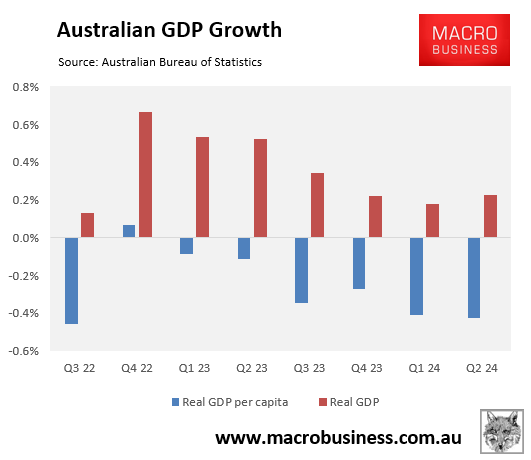

Once you subtract that, real GDP per capita shrank by 0.4% in Q2, and it has now fallen for six straight quarters and seven of the past eight quarters.

What it means is that everyone’s slice of the economic pie is now 2% lower as of June 2024 than it was two years earlier when the Albanese government entered office.

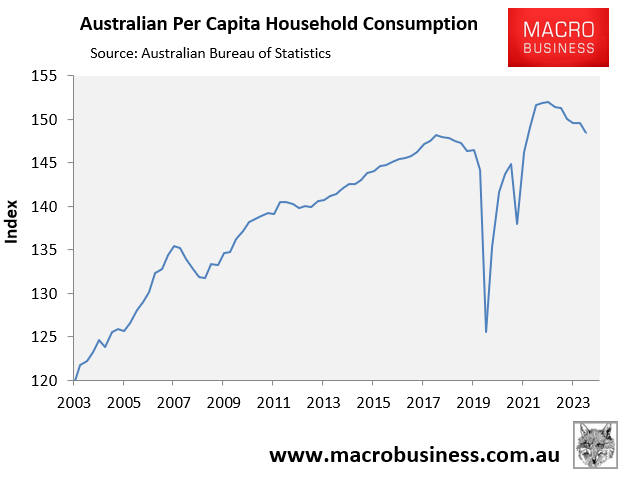

The economy is actually divided into three areas: households, businesses and government. The thing that we care about is the household sector, because that’s where we live.

The household sector has been absolutely smashed. Spending has now contracted per capita for the last six quarters. Real household spending per capita is down 2.4% over that period.

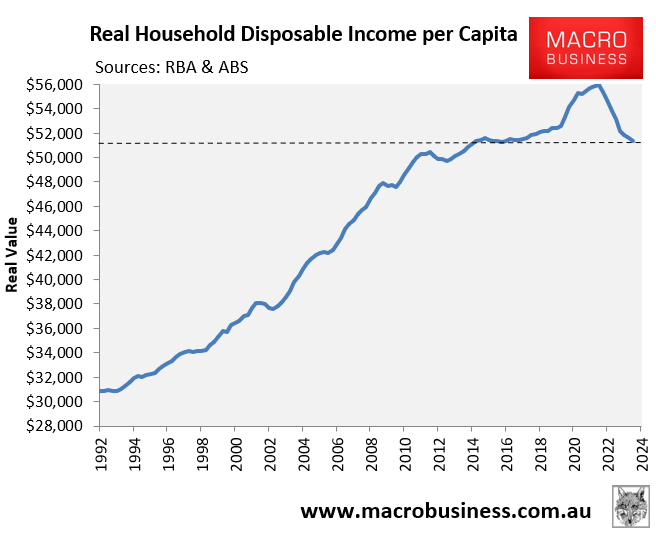

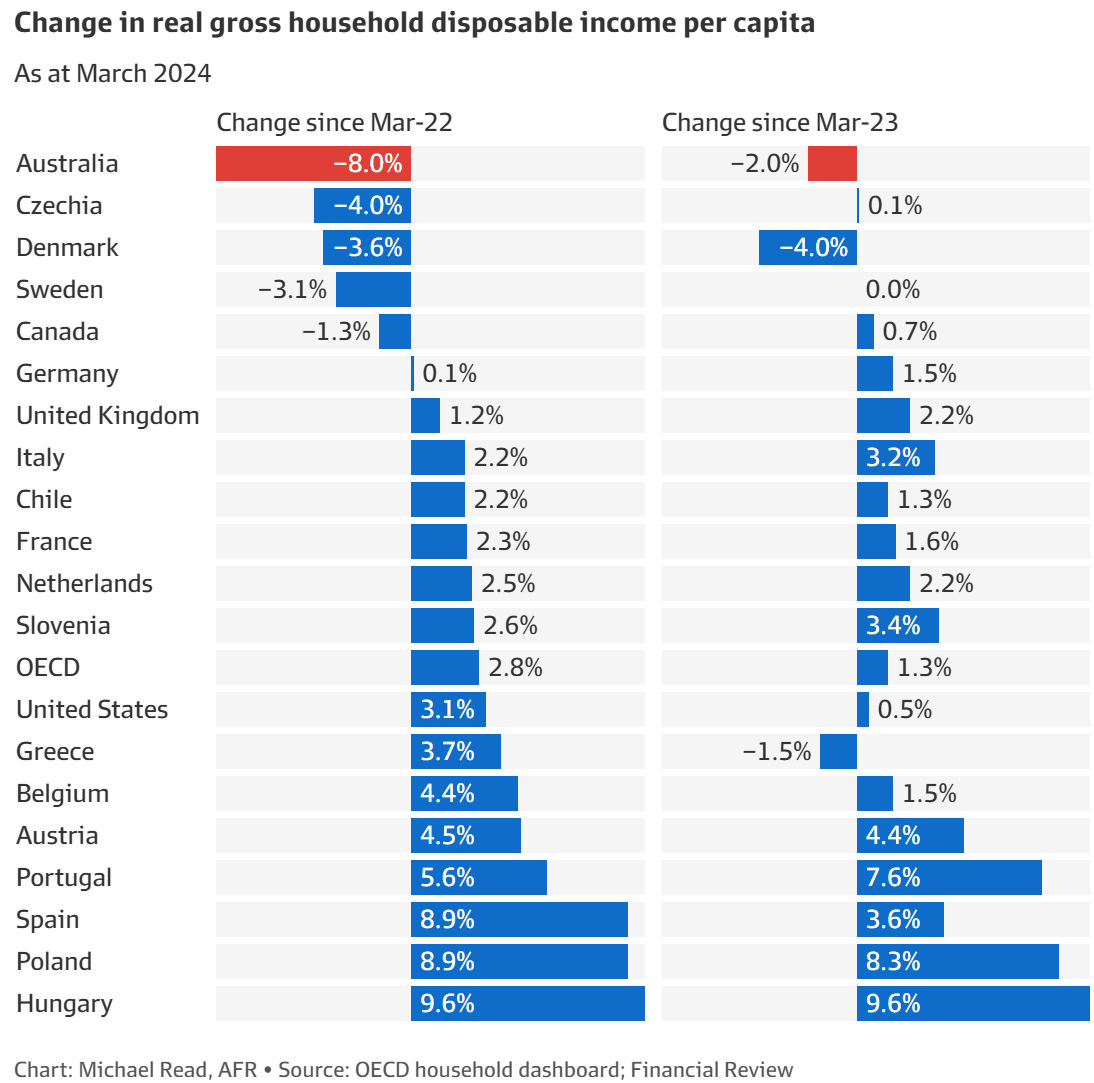

Even worse, real per capita household disposable income fell again in Q2 by 0.2%. It’s down by about 8% from the peak a couple years back.

This is actually one of the the biggest declines in the world in real household incomes.

So, it’s not really something that Jim Chalmers should be cheering about. It’s absolutely deplorable.

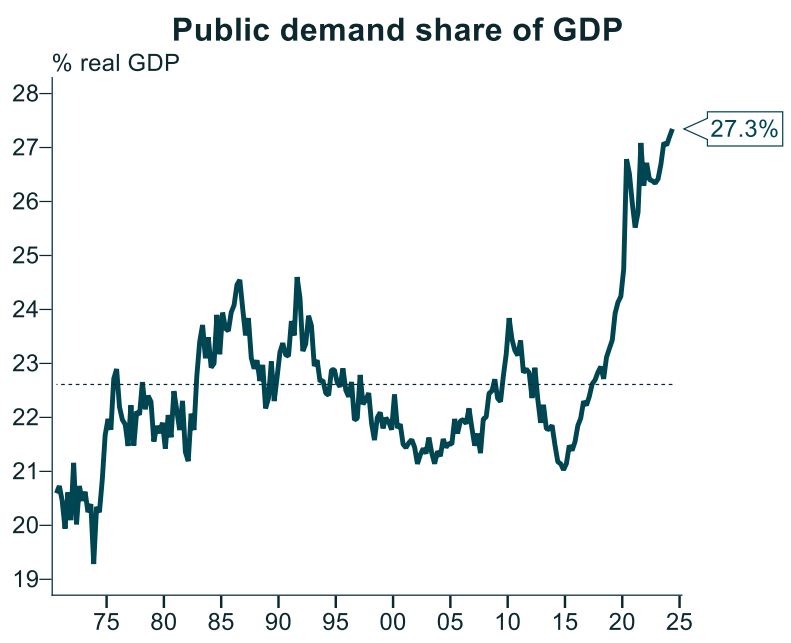

The only thing that’s kept the economy out of recession is this extreme population growth through immigration. But also, public spending.

The public sector grew by 1.5% in the June quarter, whereas the private sector actually shrank by 0.6%. As a result, public sector spending contributed 0.4% to Australia’s GDP growth of 0 2%, which means that the private sector went backwards by 0.2%.

So, we’ve got this record public spending. We’ve got near record immigration and population growth. And that is effectively what is driving the overall economy, while everyone’s slice of the pie is going backwards at an alarming rate.

I’d argue it’s a Ponzi economy because it is reliant on population growth and government spending. And neither of that is particularly sustainable.

Bill McDonald:

Okay. So Chalmers is hedging his bets here, and he is weighing up the possible recession with the prolonged inflation.

They need inflation to come down politically, don’t they, before the next election. Otherwise, they are in a bit of trouble?

Leith van Onselen:

Just about every opinion poll at the moment shows that Labor and the Coalition are neck and neck and that we are facing a hung parliament.

The Albanese government has been trying to focus on one thing and that’s the cost of living. It has identified the cost of living as a central concern among voters, quite rightly.

The problem for Labor is that new polling released this week by Redbridge Polling Group showed that only 24% of Australians surveyed could state one thing that the government has done that has helped them.

This means that three quarters basically cannot name anything that the government has done to help them.

With the next federal election due in the first half of next year, Labor is praying that the RBA starts cutting interest rates.

Across the pond in New Zealand, the Reserve Bank of New Zealand cut interest rates unexpectedly last month and said that it is going to cut rates more.

The incumbent National government experienced a really strong bounce in the polls. There has also been a bounce in consumer confidence and government confidence.

Treasurer Chalmers and Albo are praying that the RBA cuts rates before the next election; otherwise, it is going to be in a lot of trouble.

That is why Jim Chalmers has been attacking the RBA publicly, saying that it is “smashing the economy”, because he knows that if the RBA doesn’t start cutting rates, Labor faces the very real prospect of becoming a one-term government.