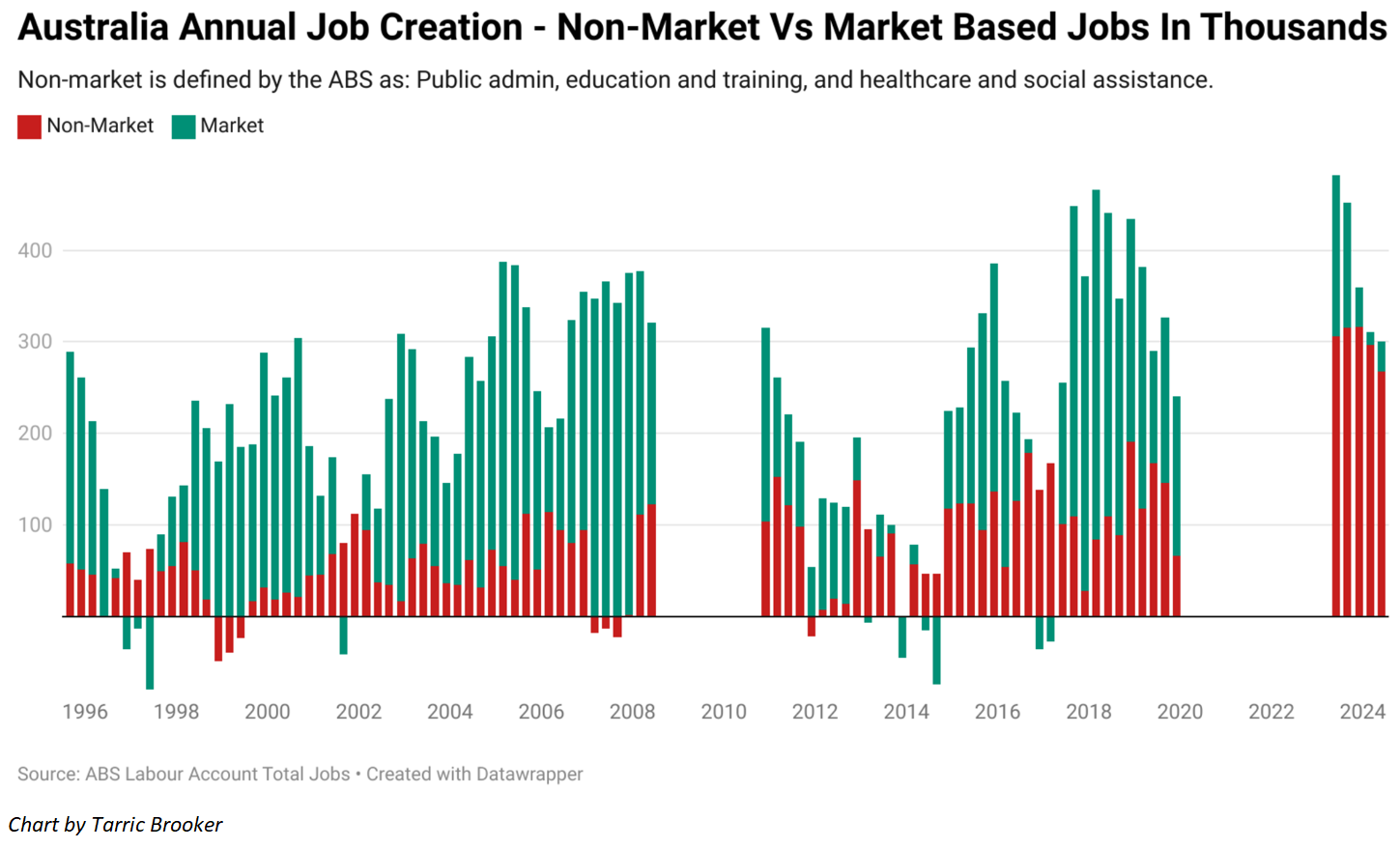

Independent economist Tarric Brooker posted the below analysis of the Australian Bureau of Statistics (ABS) Q2 2024 Labour Market Account, showing the extent to which the nation’s job growth is being driven by government roles:

“Government-funded industry jobs are still being printed in huge numbers (268,000 YoY). There have only been 33,000 new market based jobs (i.e., every other industry). But the impulse of government-funded jobs is slowly fading and can’t last”, noted Brooker on Twitter (X).

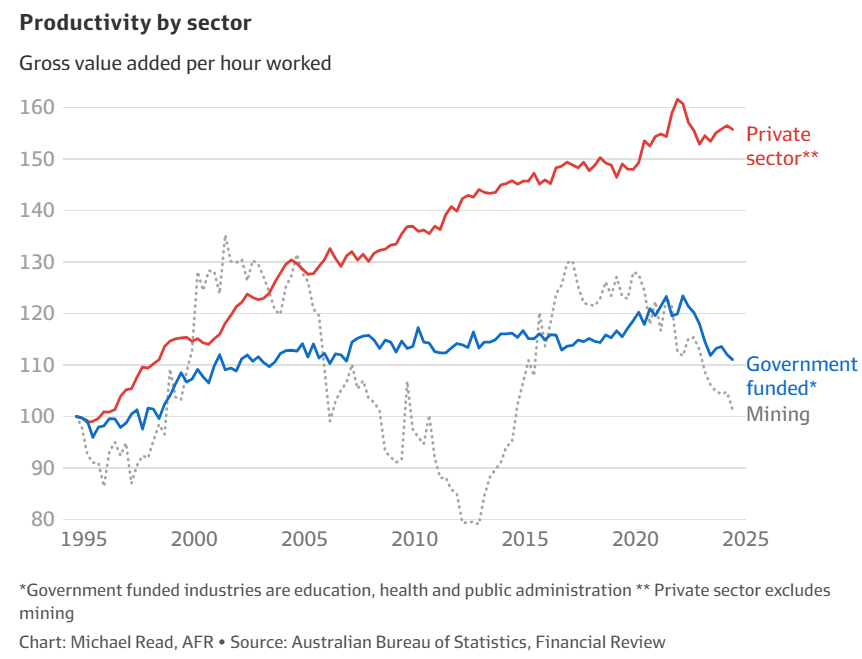

Analysis of the Q2 national accounts data by Michael Read at The AFR shows that productivity in the public service – as well as government-funded sectors such as health and education – fell to 2006 levels during the quarter:

By contrast, productivity in the private sector has continued to rise. Since 2000, productivity in the private sector has improved by 35%, but only by 2% in the non-market sector.

IFM Investors chief economist Alex Joiner believes that job growth in these ‘non-market sectors’ is fuelling the decline in productivity; he adds that when these sectors are excluded, productivity is quite good.

“Lots of people are getting jobs in those [non-market] sectors – overwhelmingly, that’s where employment is focused rather than the private sector”, Joiner told The AFR.

“That’s a problem in itself … and that’s adding to the productivity issue. Those sectors are experiencing very poor productivity in a post pandemic environment”.

“When you remove those non-market sectors, productivity hasn’t been too bad, even in the post pandemic period”, he said.

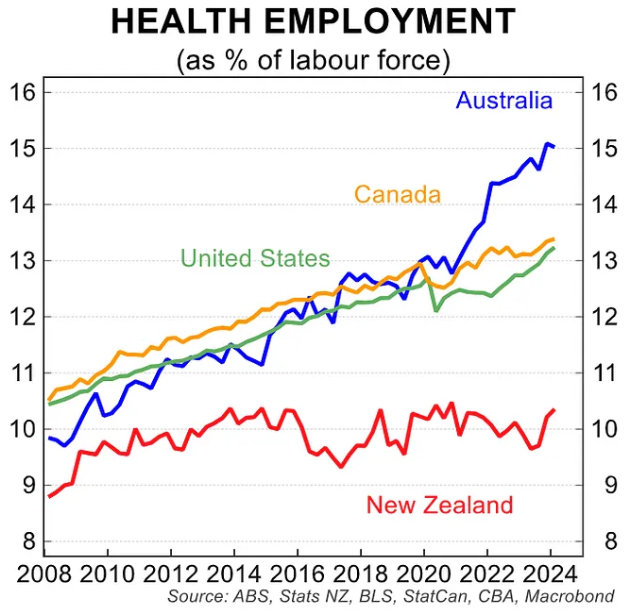

The below chart from CBA encapsulates the issue, with Australia’s healthcare & social assistance jobs expanding at a far greater pace than other nations on the back of NDIS and aged care spending:

The NDIS presently costs around $42 billion and has a higher annual operating cost than aged care ($36 billion), Medicare ($32 billion), federal hospital financing ($30 billion), and medicines ($20 billion).

The NDIS is also growing at a rate of almost 20% per year and has become one of the federal government’s major fiscal burdens, alongside paying interest on government debt.

According to the Parliamentary Budget Office, the NDIS could cost more than $100 billion within a decade, which is equivalent to the Aged Pension:

This is obviously problematic for Australia’s productivity picture and fiscal sustainability, given that the NDIS is projected to comprise an increasingly large share of the economy over the coming decades.

Where will Australia’s future productivity growth come from?