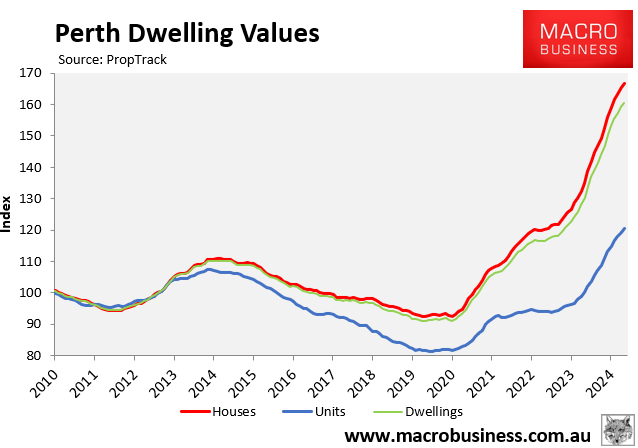

Perth’s property market has undergone a massive boom, surging by 76% from the beginning of the pandemic in March 2020, according to PropTrack.

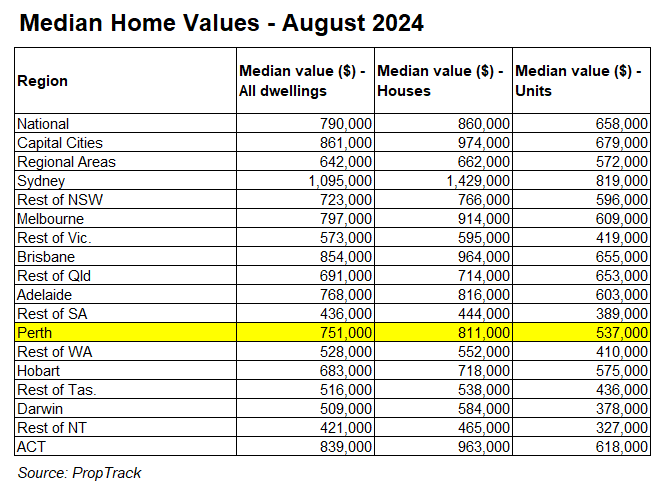

Despite the boom, Perth home values are still comparatively “affordable” with a median value of $751,000 in August, compared to $861,000 throughout the Australian combined capital cities:

This relative affordability means that Perth home values have further headroom to climb.

Indeed, Housing Industry Association (HIA) chief economist Tim Reardon believes the Perth property boom could continue for “at least 5-10 years” and leave boom-bust cycle behind.

“Western Australians are not accustomed to seeing continuous house price growth, and that’s likely to be the scenario for at least the next five to 10 years”, Reardon said.

“Given the levels of migration we’re seeing at the moment that volume of homes that are being delivered aren’t sufficient to meet underlying demand – that will see established house prices continue to grow”.

“What we’re likely to see over the next five years is much more of a typical cycle where house prices rise, you get a short period of stabilisation, before they rise again”, he said.

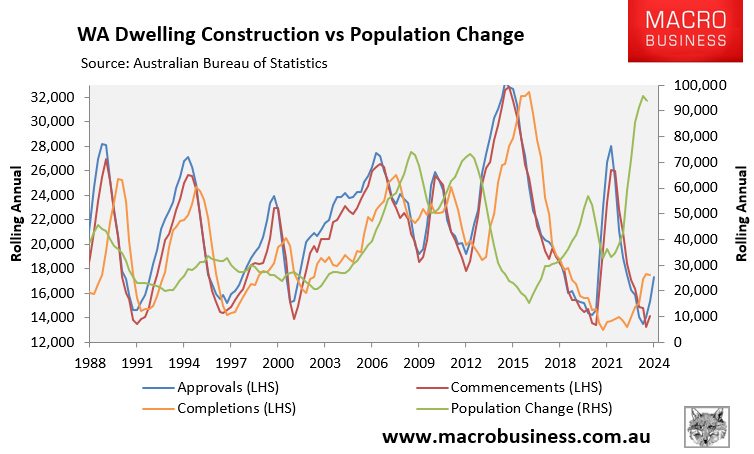

Reardon is correct that Western Australia’s housing market is woefully undersupplied.

As illustrated in the next chart, Western Australia’s population grew by 93,800 against an approvals and completions rate of around 17,500:

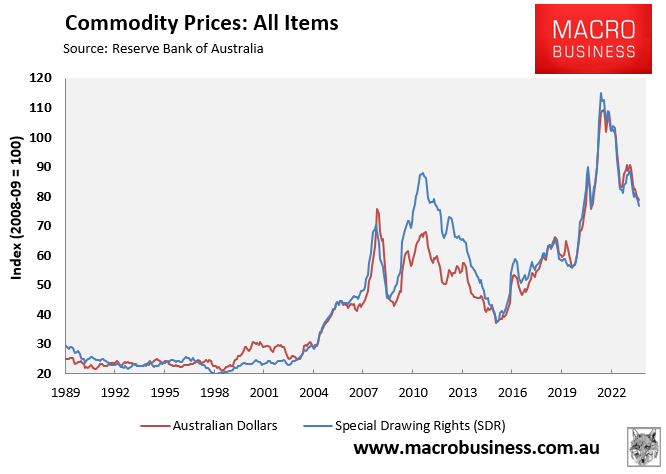

That said, the biggest risk to Perth dwelling values is a protracted decline in commodity prices and a mining sector downturn.

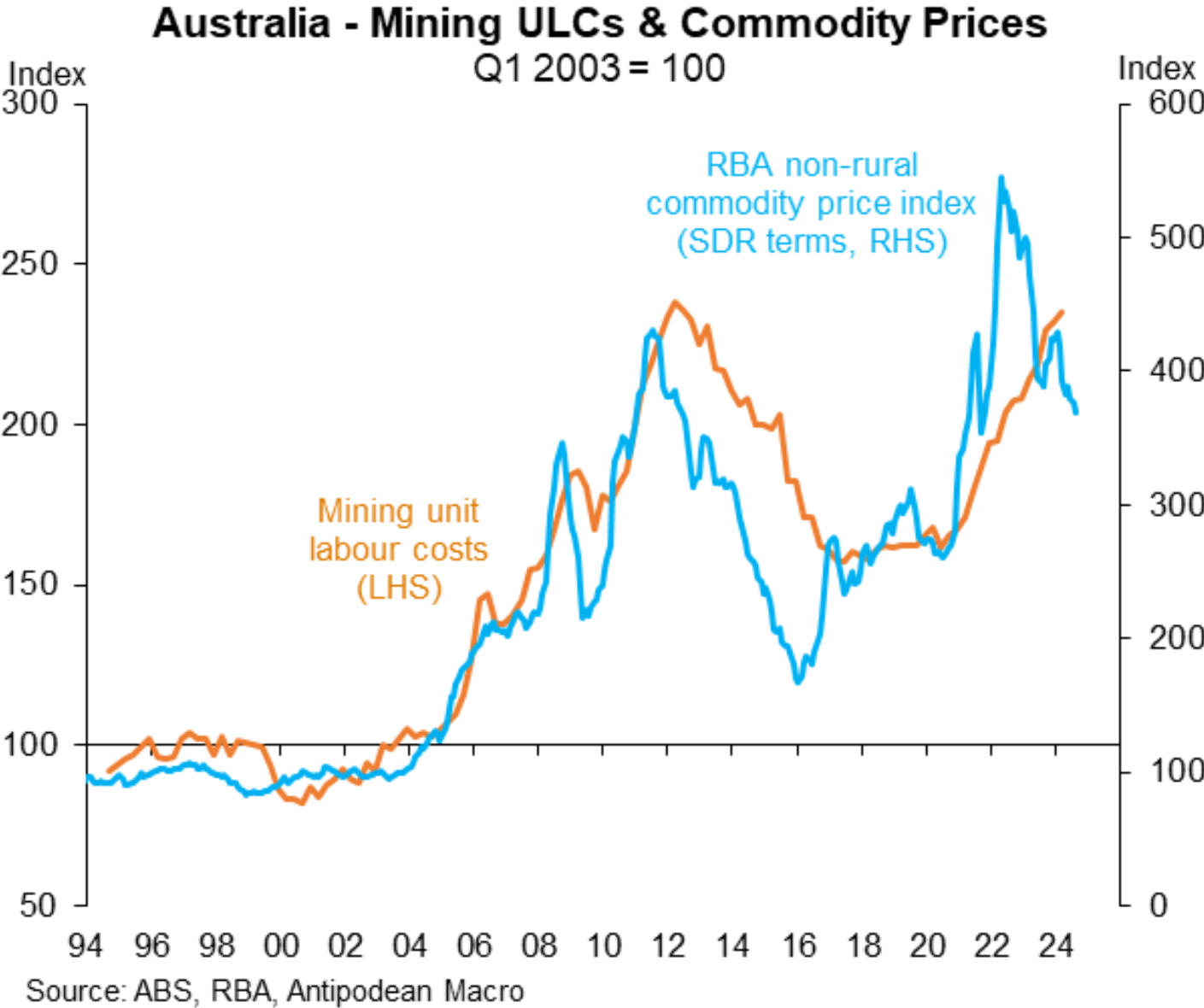

Perth’s economic and housing markets are inextricably linked to the mining industry. And commodity prices are now plummeting, as shown in the chart below:

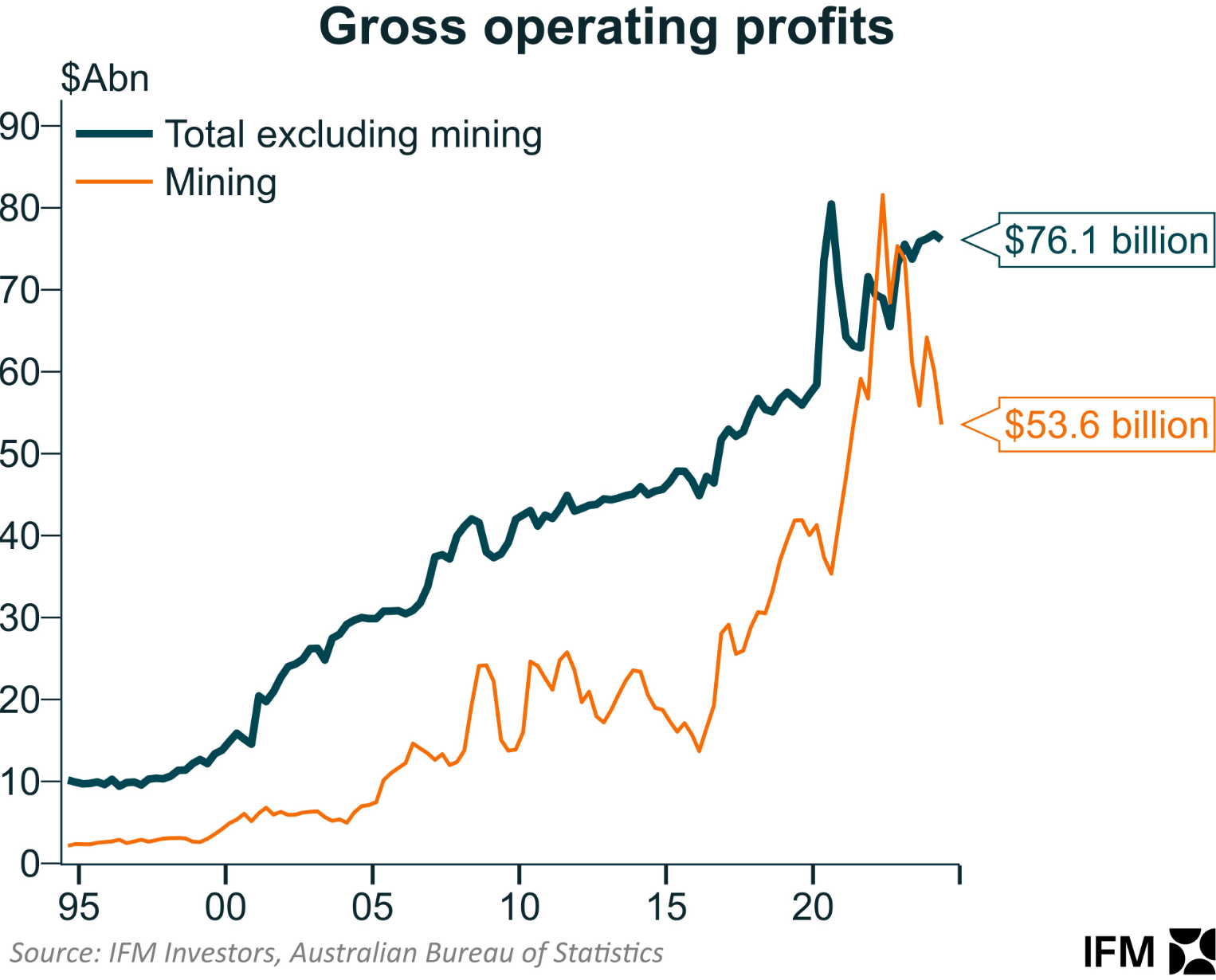

As a result, mining profitability is currently falling:

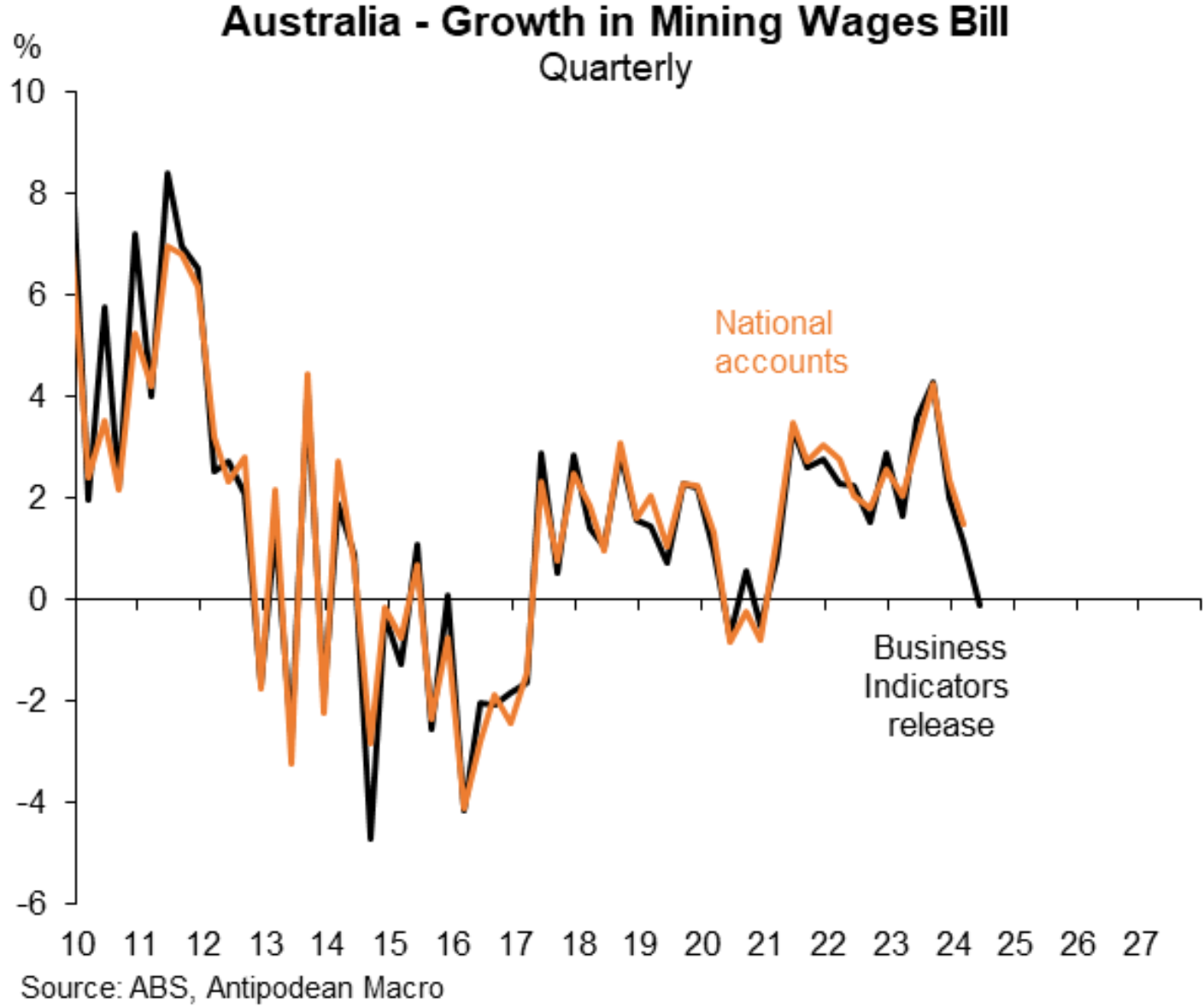

Total salaries in the mining sector are also falling:

Furthermore, when commodity prices and earnings fall, greater cost-cutting and rationalisation are likely in the mining sector:

Perth has historically been Australia’s most volatile main capital city market, having historically suffered booms and busts alongside the mining industry.

For instance, the figures above show that the commodity bear market from the previous decade resulted in a nominal 18% decrease in Perth home values between 2014 and 2019 (a much larger decrease in real terms).

Therefore, while Perth’s housing market is currently hot, it risks another extended decline, along with the mining sector and commodities prices.

While Perth’s property market may appear to be reasonably affordable, investing now should be viewed as a high-risk proposition.