I do not like the Coalition’s spokesman on home ownership, Andrew Bragg.

However, Bragg is correct in cautioning against build-to-rent housing, warning that it will “put Australia on a path to emulate the US’s corporate housing model”.

“We do not want to emulate the American corporate housing model. We want people to own our homes – not BlackRock, Vanguard or super funds”, Bragg wrote in The Australian.

“Corporate housing funds held $US1 trillion in assets in 2023. They provide returns to their investors by developing residential properties to perpetually rent out”.

“The GAO says institutional investors own 25% of the rental stock in Atlanta, 18% in Charlotte and 21% in Jacksonville”, he wrote.

Bragg went on to explain how governments across the US are now pushing back against corporate ownership amid concerns that it is distorting the market and making it harder for the average family to purchase a home.

“Across the US, there is a growing bipartisan push away from corporate housing and back towards individual home ownership. Republicans and Democrats rarely agree”, Bragg wrote.

Meanwhile, the federal government and the housing lobby are pushing for more build-to-rent housing in Australia as a fake solution to the nation’s housing crisis.

“Under the HAFF, Labor will provide institutional investors with $350 million over the next five years to expand their footprint in the residential property market”, notes Bragg.

“More concerning is Labor’s commitment to build-to-rent for foreign fund managers”.

“In the 2023-24 budget, the government committed to halving the managed investment trust withholding tax rate for build-to-rent developments from 30% to 15%”.

“This reduction will apply to institutional investors with more than 50 properties. This is no accident; Labor aims to cement institutional advantage”, Bragg warned.

I have always argued that build-to-rent is an affordability gimmick that adds a layer of profit-driven corporations to the housing market. This will strengthen the sector’s already powerful lobbying and pricing leverage.

Further, because foreign-owned corporations deliver most build-to-rent projects, tax breaks and rental income will flow offshore rather than to domestic “mum and dad” investors.

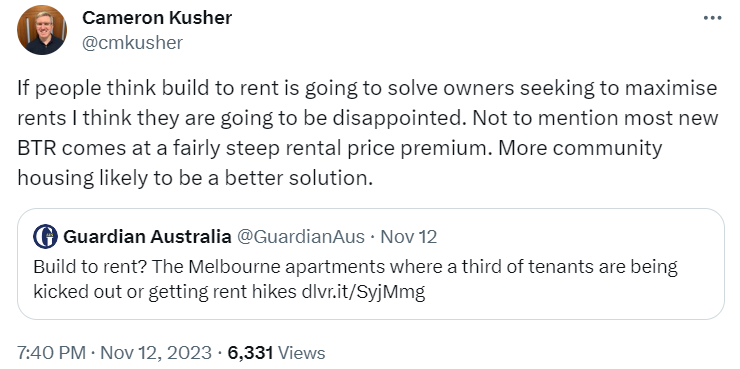

Last year, PropTrack’s Cameron Kusher commented that most build-to-rent projects come with “a fairly steep rental price premium”:

The Guardian offered a prime example of the build-to-rent affordability mirage:

When tenants moved into 43 brand new apartments at a building in Melbourne’s inner north 12 months ago, some thought they would be there for years.

The apartments at 221 Kerr Street, Fitzroy, were marketed as setting “a new standard for apartments in the suburb”.

A year later, some residents claim about one-third of the building has received either notices to vacate or rent increases. Of the 43 apartments, a group of residents claim the tenants of seven apartments have received notices to vacate and eight have received rent increases of between 9% and 17%.

“We’re being evicted in the middle of a housing crisis,” says Ella, who did not want her real name published and who has to move out along with her housemate…

Housing advocates argue the situation raises concerns about corporate landlords…

Housing supply expert, Dr Cameron Murray, has also questioned whether build-to-rent offers genuine benefits to tenants:

“Existing build-to-rent projects are predominantly high-end luxury apartments, and the owners of them report to investors how successful they are at charging more than the local market rent by bundling in premium features like fancy gyms, food services. Is this something that we should be providing subsidies to?”.

“There is already a huge wave of build-to-rent projects under current tax rules, so it is not clear why more tax breaks are needed”.

Ross Stitt has raised similar concerns about build-to-rent:

“The concept is a high standard of apartment in a complex with generous amenities, often in sought-after inner-city suburbs”.

“The quid pro quo of ‘high-quality’ is of course a premium rental rate for the landlord. That’s the element that makes BTR attractive to institutional investors”.

“Presumably, investors of this calibre know what they’re doing. The only question is whether enough Australians will be able to afford the higher rents demanded by BTR”.

Finally, a Charter Keck Cramer survey of comparable one and two-bedroom apartments showed that build-to-rent projects charged a 20% premium on traditional rentals:

“Advertised rents at Mirvac’s LIV Indigo BTR development in Sydney Olympic Park and rents for nearby private rental apartments shows the median one-bedroom, one-bathroom apartment rent is 19% higher than an equivalent build-to-sell unit, while the difference was 27% for a two-bed unit”, The AFR reported.

Let’s be real: build-to-rent will institutionalise wealth into fewer hands.

It is another “affordability” con that vested interests are promoting for their own financial gain.