Last month, the Australian Energy Market Operator (AEMO) released updated energy supply and demand predictions for the next decade.

According to AEMO, a delayed adoption of battery-electric cars (EVs) will reduce demand on the electric grid.

In December, AEMO anticipated that seven million electric vehicles would be sold over the next 10 years. But that figure has since been slashed to four million—a massive revision in only seven months.

The downgrade from AEMO came as new car sales figures from the Federal Chamber of Automotive Industries (FCAI) suggested that demand for full-battery EVs has collapsed.

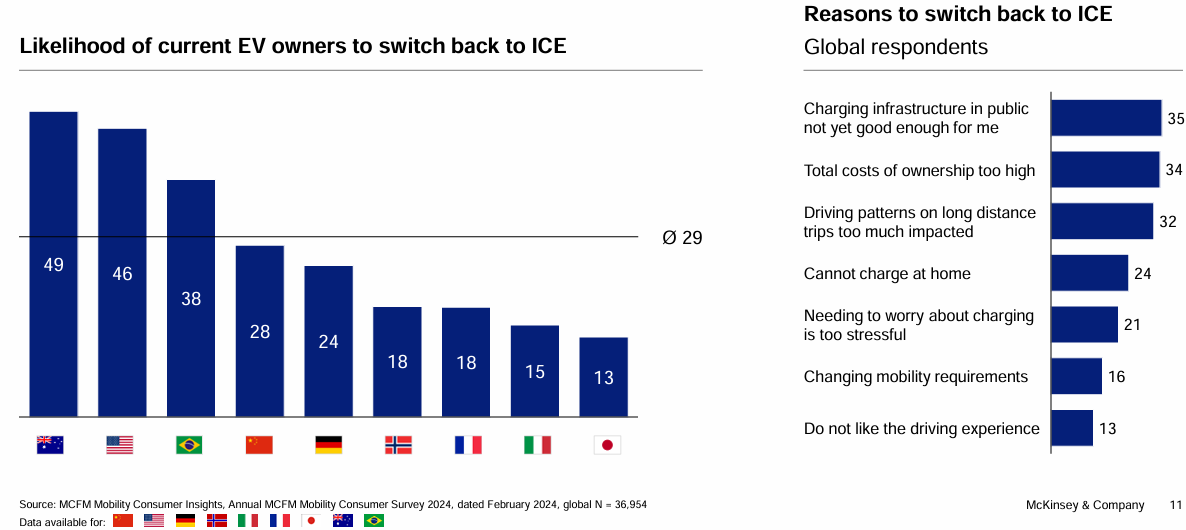

A June 2024 McKinsey Mobility Consumer survey also found that nearly half of Australian EV owners (49%) are “very likely” to return to traditional petrol and diesel vehicles:

The overriding concerns were the poor state of charging infrastructure (35%) and the high cost of ownership (34%).

Mechanical engineer John Cadogan has given another stellar presentation (video below) examining AEMO’s four million EV projection, which he has labelled “complete nonsense” and a “fantasy”:

“In five minutes with a Google spreadsheet you can model this four million EV nonsense proposition”.

“It tells you that we need sustained EV sales growth of 27.5% year on year for nine years without a break to get to four million EVS in total by the end of 2033”.

“This is clearly ridiculous”.

“In other words, next year we would need to sell 127,500 EVs. In 2026, it’s just over 160,000. And sales go up 27.5% every year so that by 2033, roughly two-thirds of all vehicles sold would need to be EVs to hit AEMO’s target, which they just pulled out of their ass”.

“The current growth rate of battery EV sales in Australia for the first eight months of 2024 was 1.4%. And this is with massive incentivisation like the federal government’s FBT exemption on novated leases for EVS and plugins”.

“But the exemption on plugins is being retired on April the 1st of next year”.

John Cadogan goes on to explain that the cost to taxpayers to stimulate the sale of EVs is more than four times over what was initially proposed.

That is, the initial cost proposal of $260 million has ballooned to $1.15 billion.

Cadogan argues that “it’s hard to see the government reaching any deeper into its hip pocket every year to ramp up EV sales as required to get to the four million projection”.

He also argued that the “critical mass concept is a complete governmental fantasy” and that there will be “no sustained effect after you bone the incentives”.

Meanwhile, GM, Ford, Volkswagen, Volvo and other manufacturers are pulling back on EV production amid stalling global sales.

By contrast, “Australia diesel light vehicle sales grew by 19% in 2021, 4% in 2022, 5% in 2023, and 6.4% so far this year”, notes Cadogan. “Our market currently buys five new diesels for every new EV”.

“Consumers are speaking with their wallets and useless politicians would do well to listen”.

As I keep arguing, battery EVs are not ready for prime time. They are too expensive, lack fast and convenient charging options, offer poor range, and are expensive to insure and repair.

Standard hybrids, on the other hand, overcome most of these shortcomings, which is why their sales have grown strongly.

John Cadogan’s terrific analysis is viewable below: