The issue of housing affordability was discussed at The Australian Financial Review Property Summit on Monday.

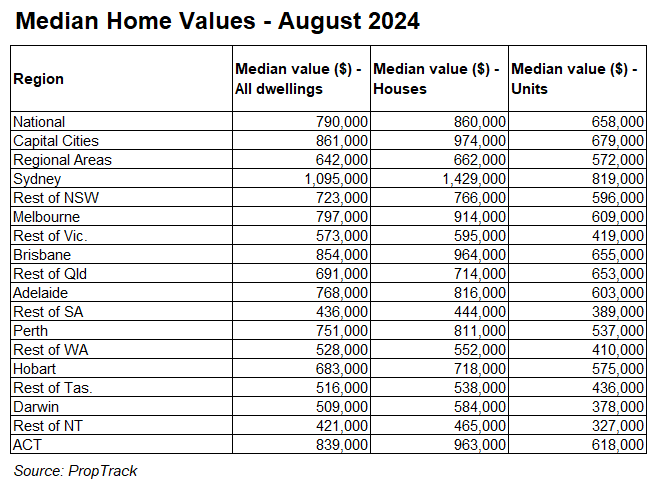

The current nationwide median dwelling price is $790,000, but Eliza Owen from CoreLogic says a home would need to be priced around $500,000 to be affordable for someone on the median income.

Owen told the summit that the pool of potential home buyers will remain limited until the official cash rate is substantially reduced.

“This discrepancy has likely narrowed the buyer pool to wealthier and higher-income buyers”, she said.

“Even if rates fall by 1 percentage point, this will only increase borrowing capacity to around $560,000, which still falls short of the national median”.

“So I think the cash rate needs to be substantially reduced to significantly widen the buyer pool”.

Mortgage & Finance Association of Australia (MFAA) CEO Anja Pannek also told the summit that factors such as higher serviceability buffers and interest rates are making it harder for some home owners to refinance their mortgages.

A 2023 survey of MFAA members revealed that 80% had customers who did not meet the serviceability buffer and could not refinance. This year, it fell to 69%.

“If you look at mortgage prisoners, even if it dropped, 69% is still a significant portion of borrowers that just cannot refinance”, Pannek said.

“Those borrowers are meeting their mortgage repayments but just can’t move across to a better rate because of the buffer”.

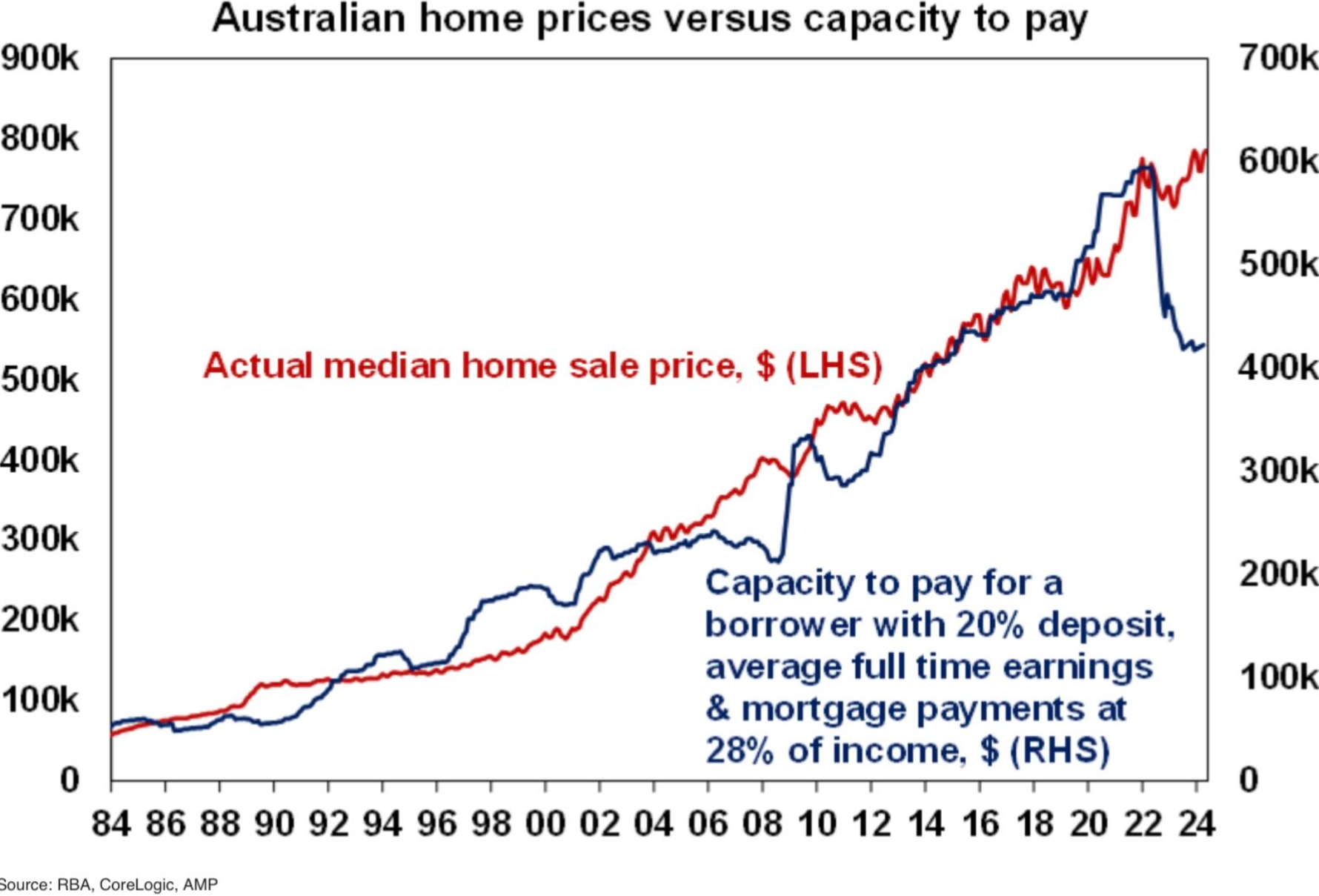

The following chart from AMP illustrates the fundamental problem with Australian housing affordability: home values have risen well beyond borrowing capacity, given prevailing interest rates:

While lower interest rates would help to breach the affordability divide, it is a sideshow to the dollar cost of housing, which is simply too high and needs to fall.

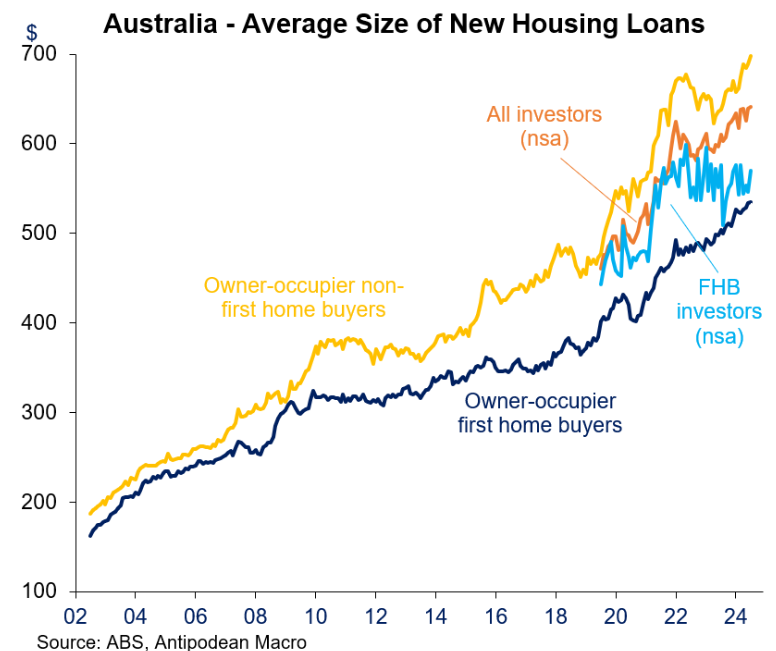

Unless prices fall, loan sizes will remain too high for the median buyer, particularly first home buyers.

We all know what will happen. Instead of implementing policies to lower the dollar cost of housing, policymakers will paper over the problem via demand-side “affordability” measures, like first home buyer subsidies and extensions to mortgage terms.

We have already seen these types of fake “affordability” policies via Labor’s expanded Home Guarantee Scheme, which accounted for one-in-three new first home buyer mortgages last financial year:

We have also seen banks push for 50-year mortgages in a bid to artificially lower monthly repayments:

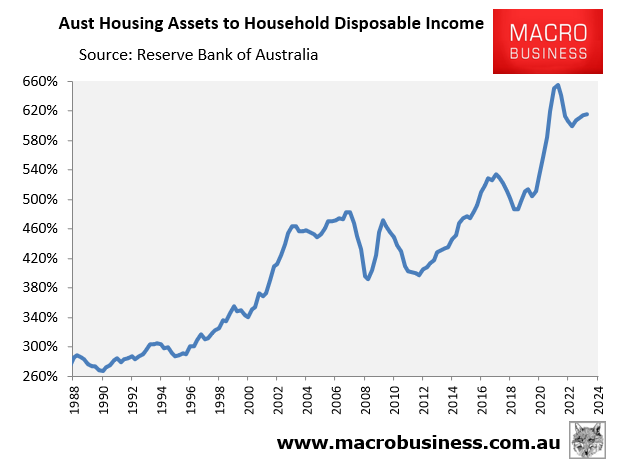

These types of demand-side “affordability” measures do what they have always done: raise debt levels and push house prices higher.

As Alex Joiner noted above, “affordability is a price issue, not a leverage one”.

If we truly want more affordable housing, prices must fall.