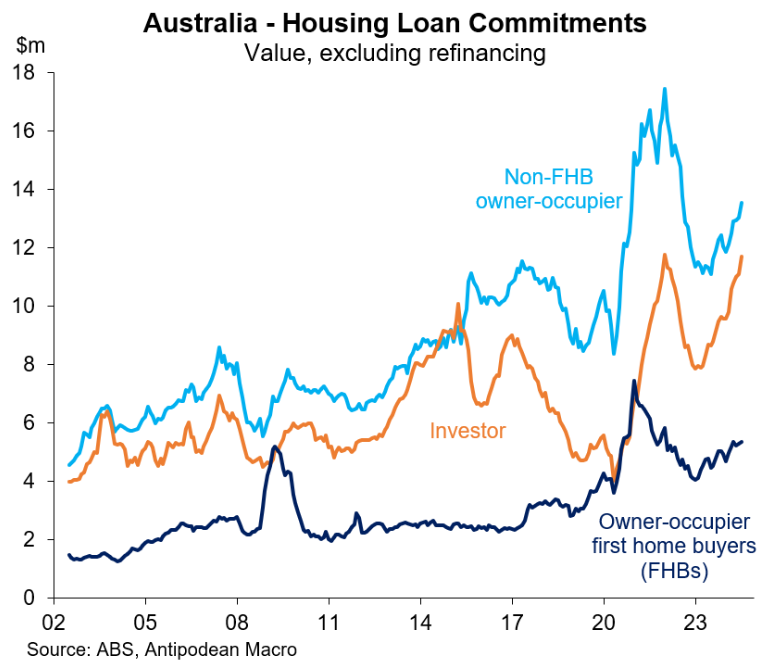

I noted on Monday how first home buyers were being crowded-out by investors and upgraders:

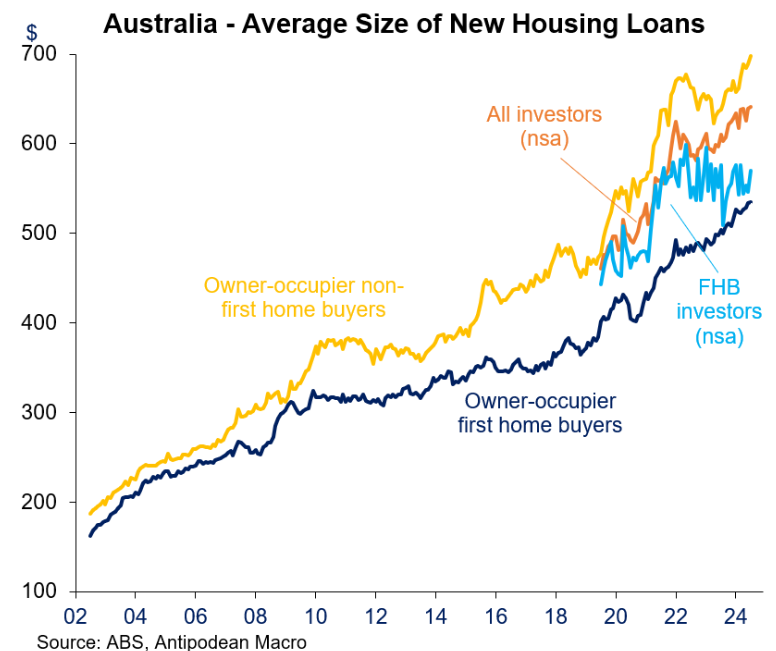

The relative weakness of first home buyer demand is attributable to stretched affordability, reflected in the average loan size for first home buyers being well below upgraders and investors:

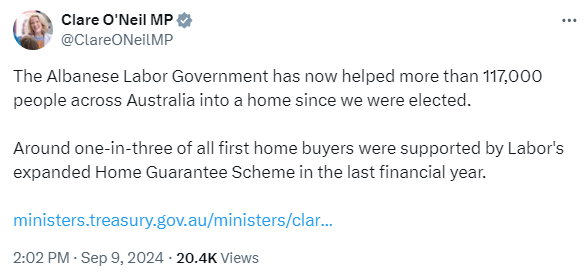

Housing Minister Clare O’Neil posted on Twitter (X) that one in three of all first home buyers last financial year were supported by Labor’s expanded Home Guarantee Scheme:

“Labor’s expanded Home Guarantee Scheme helped 43,800 people – including over 11,000 key workers – to buy a home in 2023–24, a 34% increase on the previous year”, noted O’Neil via a media release.

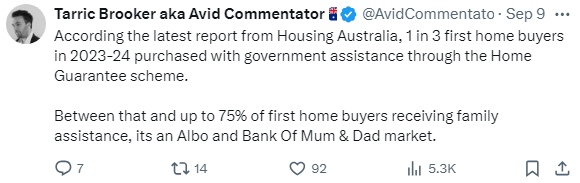

Separate data on the ‘Bank of Mum & Dad”, released late last year, showed that up to 60% of first home buyers were receiving some form of financial assistance from parents to buy, a large increase from 2010 when it was around 12%.

Independent economist Tarric Brooker hit the nail on the head with the following Tweet, acknowledging that “its an Albo and Bank Of Mum & Dad market”:

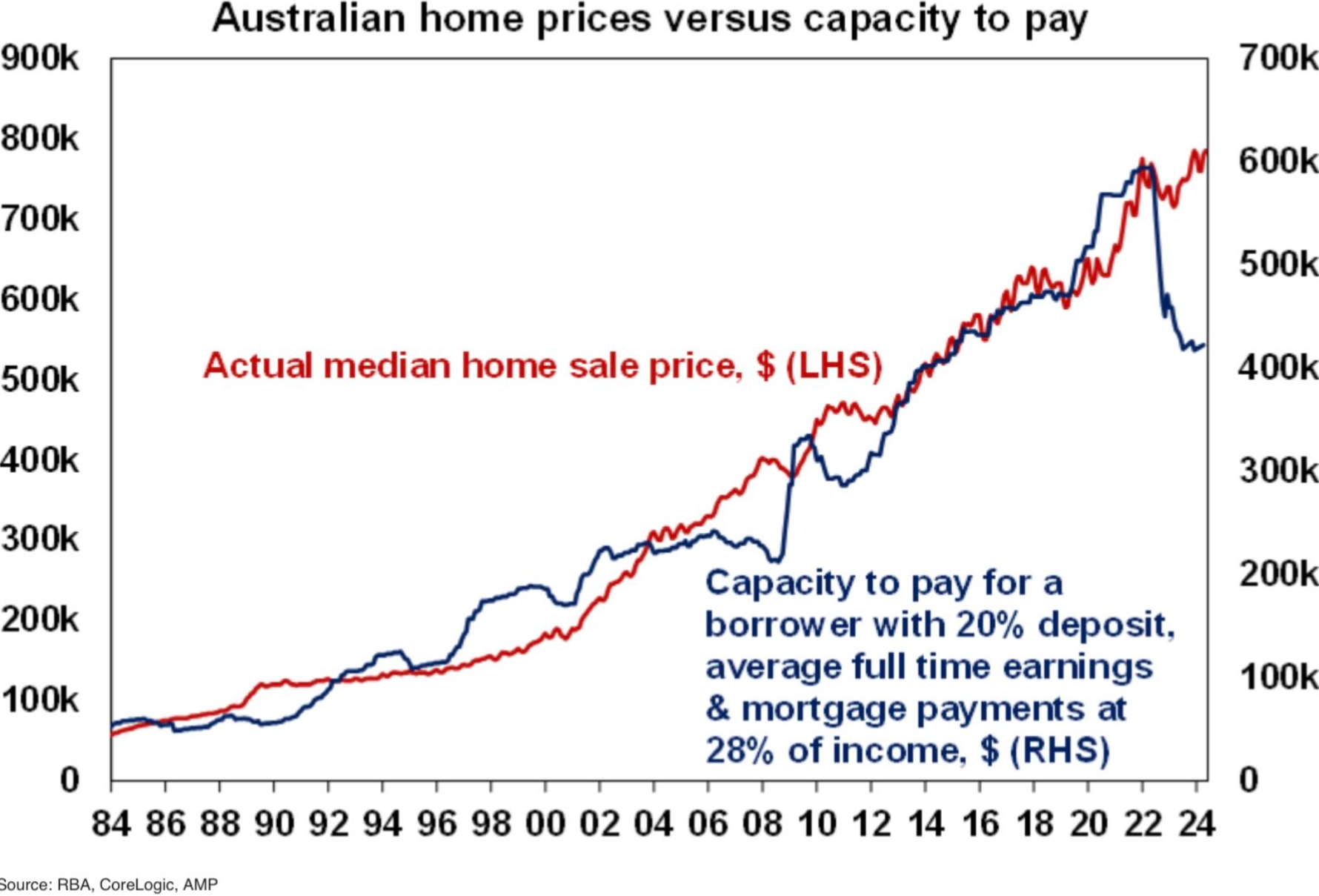

The problem is encapsulated by the following chart from AMP showing the massive disconnect between borrowing capacity and median home values:

Put simply, Australian homes are too expensive and need to fall if the typical first home buyer is to have any realistic hope of purchasing without welfare from taxpayers and their parents.