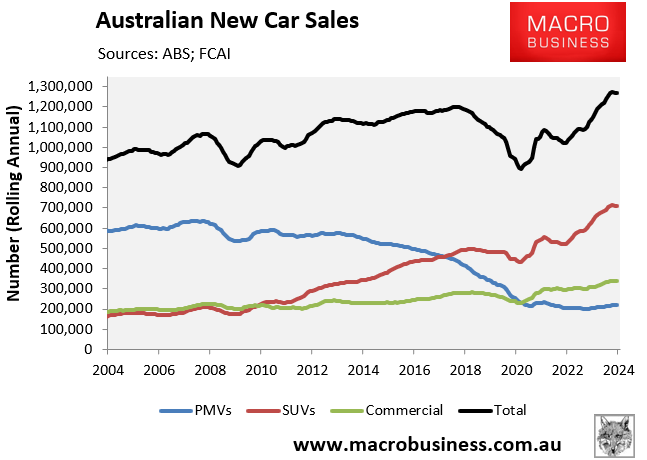

Figures from the Australian Automobiles Association reveal that new car sales hit a new July record of 99,486.

FCAI Chief Executive Tony Weber noted that the result would have exceeded 100,000 if Tesla and Polestar sales were included in the VFACTS numbers.

Hybrid vehicles continue to grow in popularity. Sales of hybrid vehicles were up 88.4% year-on-year and plug in hybrid vehicles were up 128.9%.

“The hybrid performance is highlighted by the fact that the Toyota RAV 4 was the top selling vehicle for the month ahead of Ford Ranger and Toyota HiLux. Most RAV 4 sales are hybrids”, noted Weber.

By contrast, sales of battery electric vehicles – with the inclusion of the reported Tesla (2592) and Polestar (103) results – were 6.6% of the market, down from 7.0% in 2023.

The increased popularity of hybrid vehicles is seen as both a reflection of the rising cost of petrol and a concern about the lack of charging infrastructure for purely electric vehicles. Hybrids have now outsold electric vehicles in four consecutive quarters.

In June, 7News reported that a ‘graveyard’ of unsold Tesla cars had piled up in Port Melbourne:

“All of a sudden we’ve got a huge backlog of Teslas that aren’t moving”, Peter Anderson from the Victorian Transport Association told 7News.

“Teslas usually come into this country pre-sold. These ones aren’t, they’re sitting here”.

I’m not surprised that demand for Tesla vehicles has declined. The cars were cool when they initially came out, but they now appear monotonous and tired.

More broadly, I do not believe that battery-electric vehicles are ready for prime time. They are still too expensive, lack fast and convenient charging options, lack range, are expensive to insure, expensive to fix, lack parts, have no towing power, etc.

Until they can create an affordable car where you can hot-swap a battery, similar to exchanging a Soda Stream or BBQ gas bottle at a petrol station, they will struggle to gain traction.

As noted by the Telegraph’s Matthew Lynn last week, “there has been a steady stream of bad news from auto manufacturers”.

Mercedes, the company founded by Gottlieb Daimler that pioneered petrol driven cars, is struggling to replicate that success in the battery version. Group net profits were down 21pc on Friday, mostly on falling sales of its new range of EVs.

Earlier in the week, its great rival Porsche watered down plans for its electric models.

Across the Atlantic, Ford reported that profits were down by 35pc in the latest quarter amid losses in its EV unit. And Tesla slashed prices and offered generous financing deals to try and revive flagging demand…

In reality, the EV balance sheet looks to be awash with red ink…

There is too much capacity in the industry, with companies over-investing in too many factories and distribution centres.

Demand for the end product has started to crumble, with consumers increasingly nervous over what may become obsolete technology.

Insurance and maintenance costs are proving far higher than expected for many, once the vehicles are actually on the road…

And all that was before the Chinese entered the market with a new range of slick, cheap vehicles…

Surely it is time that political heads started to roll for the catastrophe that is now unfolding. Policymakers, under pressure from industrial and climate change lobby groups, picked this “winner” and spent eye-watering amounts of taxpayer money on it…

Economists have long warned that net zero provides a golden opportunity for waste and rent-seeking. But some elites chose not to listen. We should start holding them accountable.

Lobbyists argued for the subsidies, civil servants supported them, and finance ministers enthusiastically virtue signalled with other people’s money.

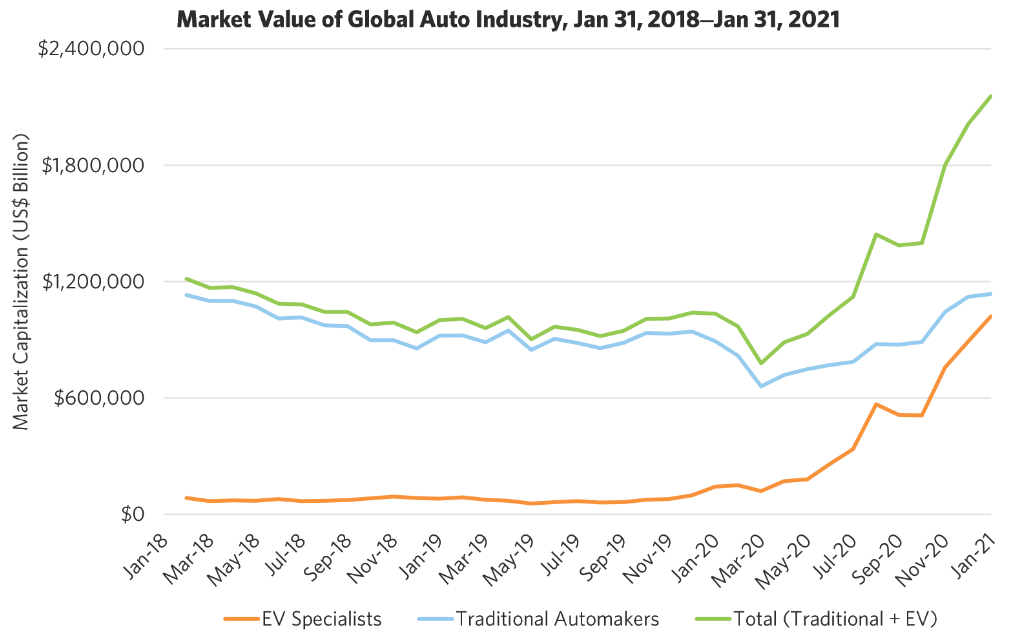

The overinvestment in battery-electric vehicles is looking more and more like a bubble.