Justin Fabo at Antipodean Macro has published charts on New Zealand house prices, which have entered another ‘bear market’.

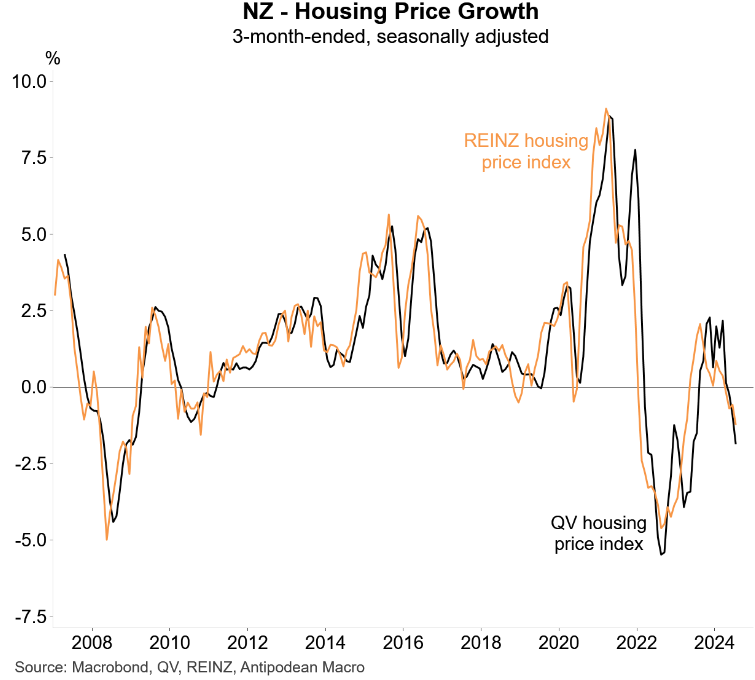

Both the REINZ and Quotable Value house price indices continued to fall in July in quarterly terms:

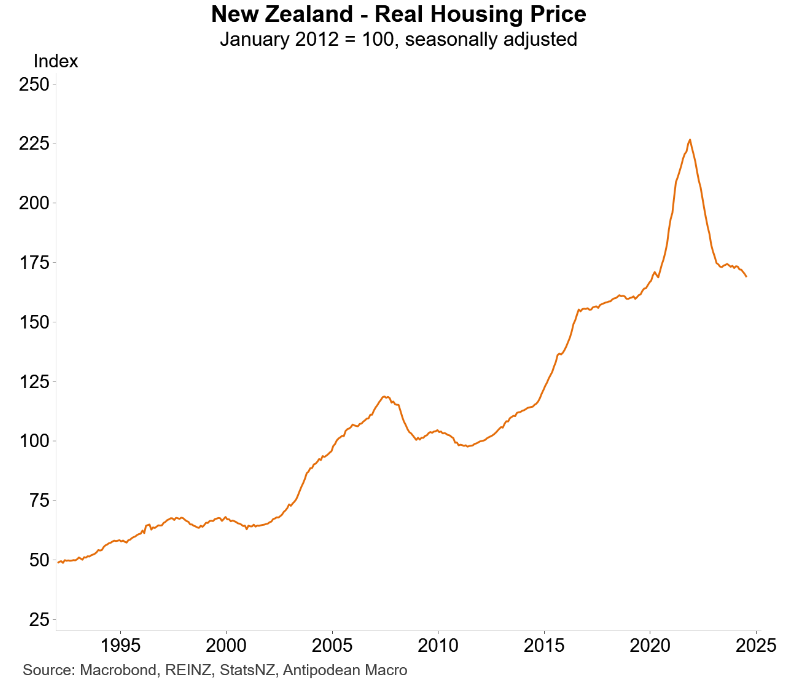

This has taken real house prices back to mid-2020 levels, effectively wiping out the pandemic gains:

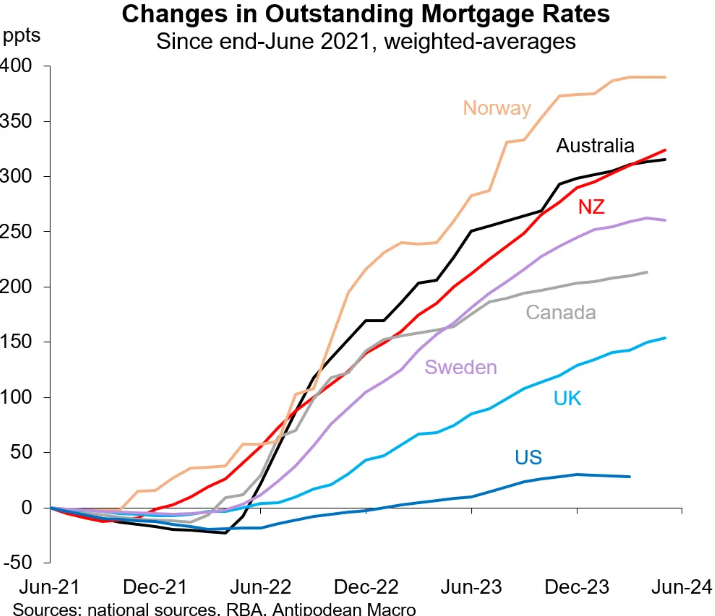

The number one driver of the decline in New Zealand house prices is the Reserve Bank’s ultra-aggressive monetary tightening, which saw the official cash rate peak at 5.50% and drove one of the world’s largest increases in average mortgage rates:

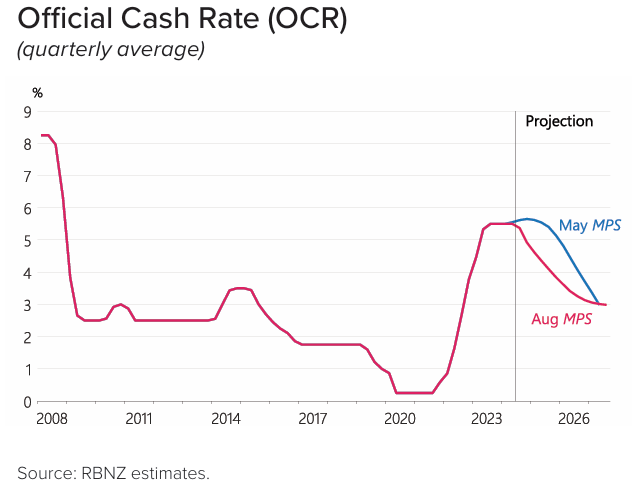

The Reserve Bank cut the official cash rate by 0.25% last week, with further cuts projected over the coming 24 months:

While these cuts will obviously support house prices, they will be offset to at least some extent by the sharp slowing in net migration into New Zealand.

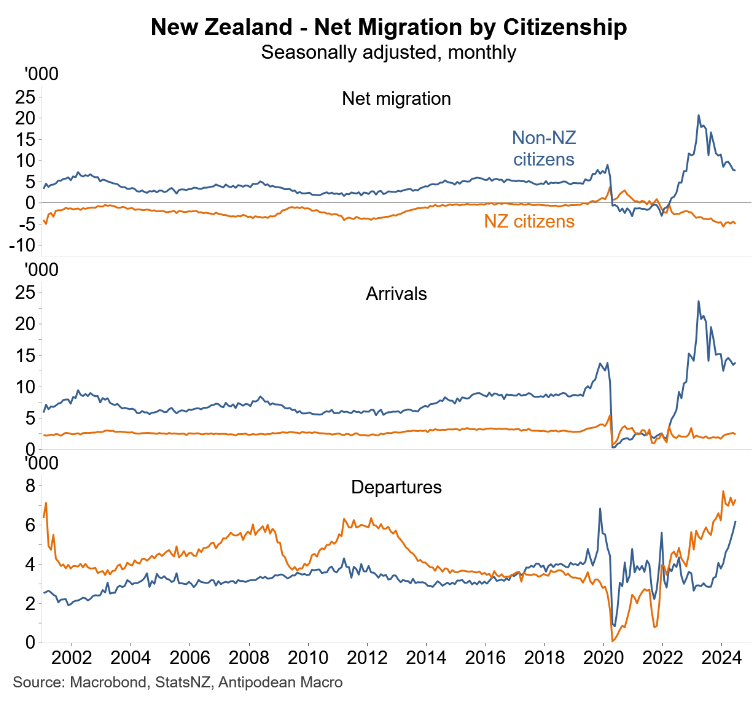

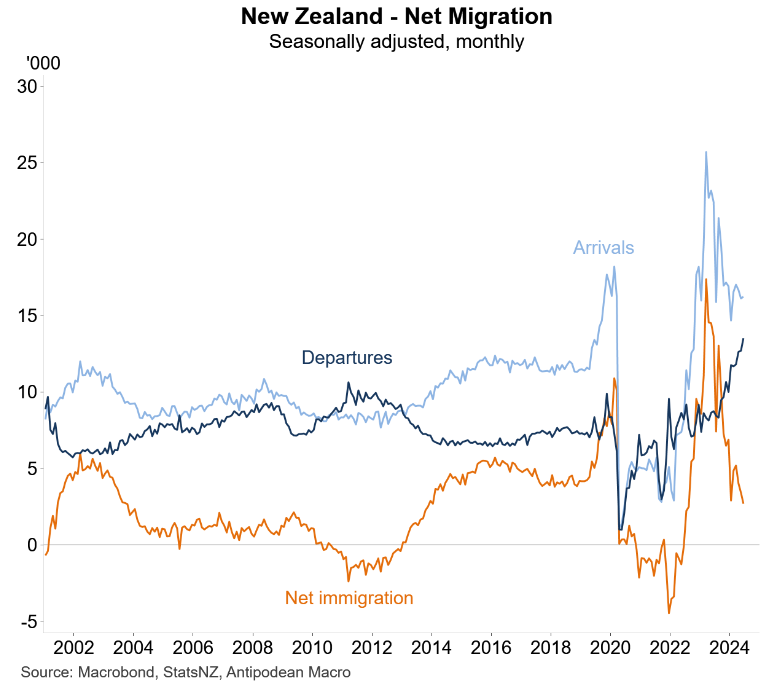

Incumbent New Zealanders are leaving in droves, which has pushed net overseas migration lower:

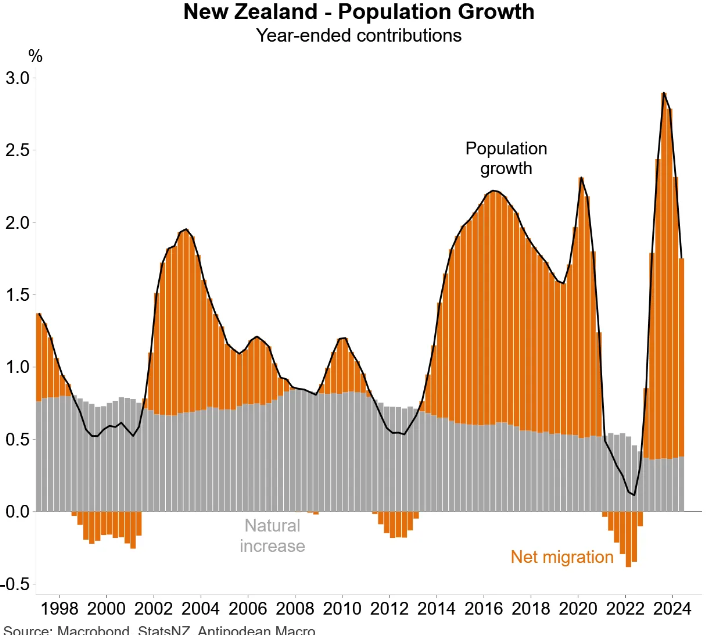

As a result, New Zealand’s population growth is falling, which will take pressure off housing demand:

Independent economist Tony Alexander provided a useful analysis in last week’s note:

“Buyers will feel more confident to return to the market. Property enquiries will pick up, FOMO will recover more than it has, and vendors will feel more emboldened to hold out for the price they dream they can get rather than the one which will allow them to move on with their lives straight away”.

“But we are not talking about a boom. Net migration is dropping away fairly sharply, and young Kiwis (potential home buyers) are leaving the country”.

It will be interesting to see how New Zealand house prices respond to the Reserve Bank cutting the official cash rate and the associated decline in mortgage rates.