The Reserve Bank of New Zealand has clearly erred in leaving the official cash rate at its highly restrictive level of 5.50%.

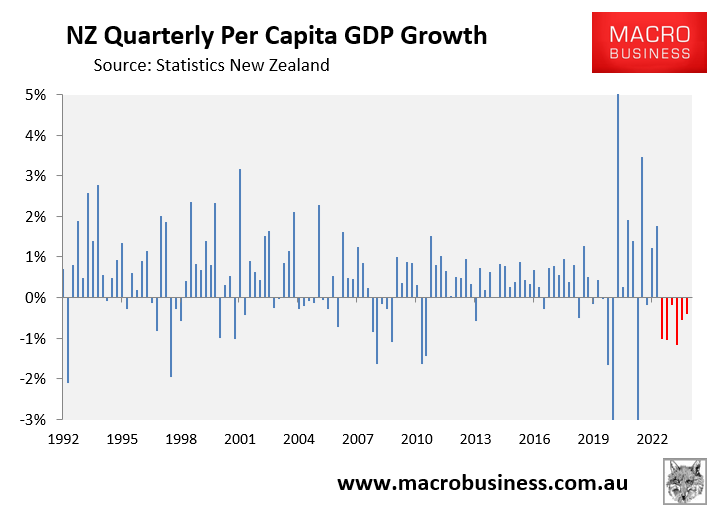

New Zealand’s economy is mired in a deep per capita recession. Real per capita GDP has collapsed by 4.3% from the late 2022 peak, following six consecutive quarterly declines:

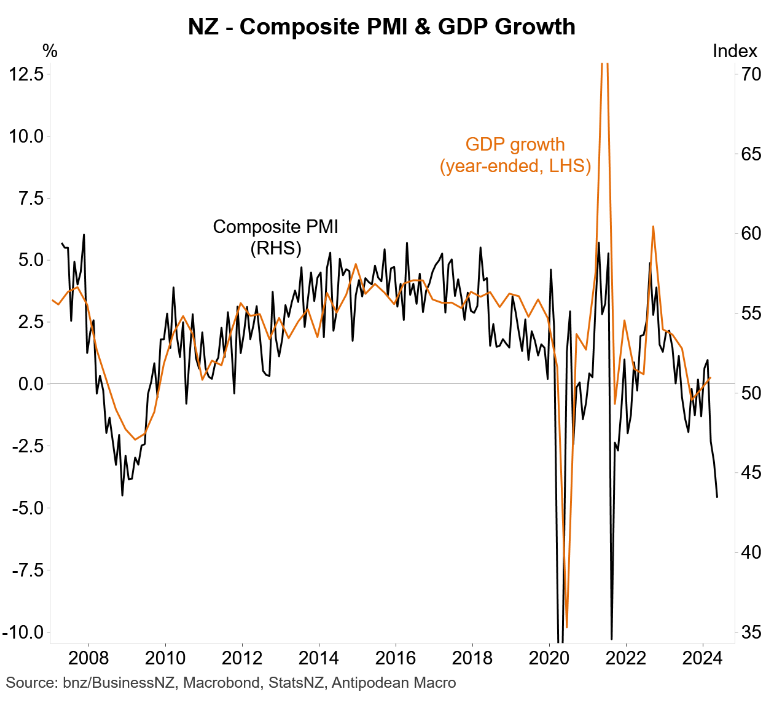

The leading composite PMI also suggests that New Zealand’s aggregate GDP fell heavily in Q2:

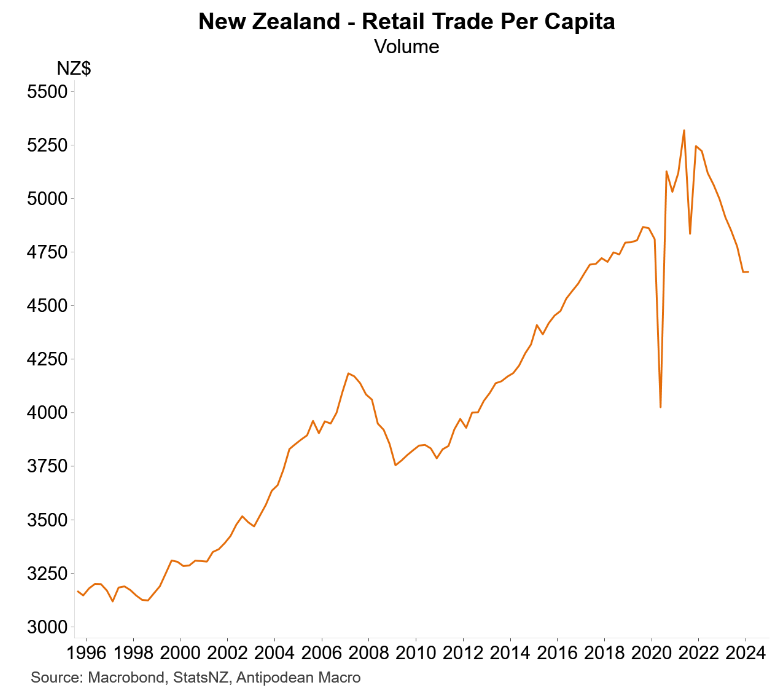

New Zealand consumers have retreated into their shells, as evidenced by the collapse in real per capita retail sales:

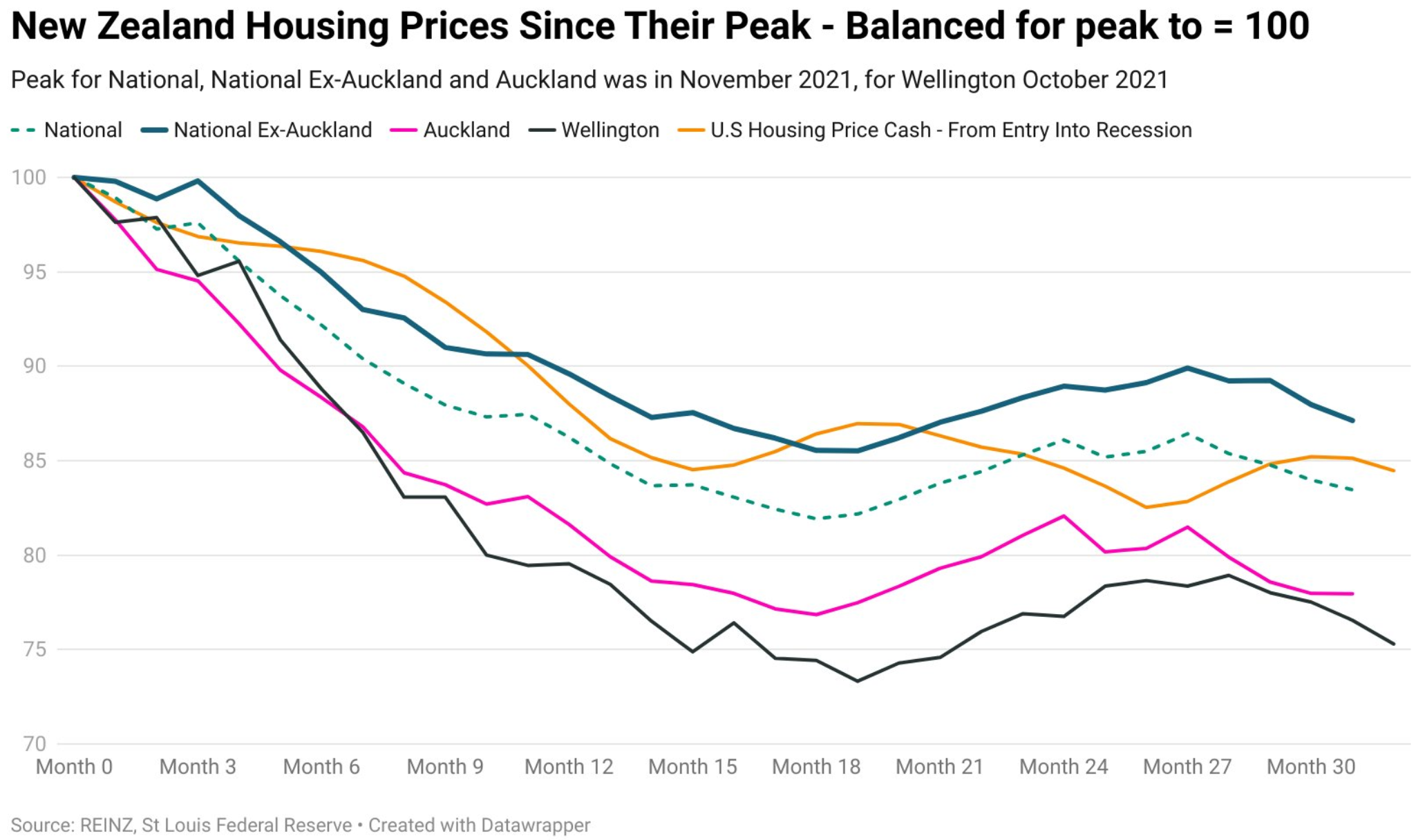

House prices have also fallen by 16.5% from their peak, led by Auckland (-22.1%) and Wellington (-24.7%):

Source: Tarric Brooker

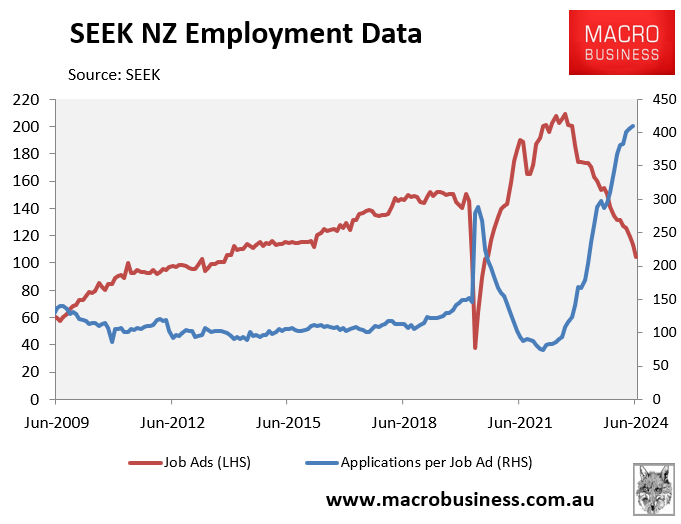

Finally, New Zealand’s labour market is imploding with job ads tanking and the number of applicants per job ad surging to all-time highs:

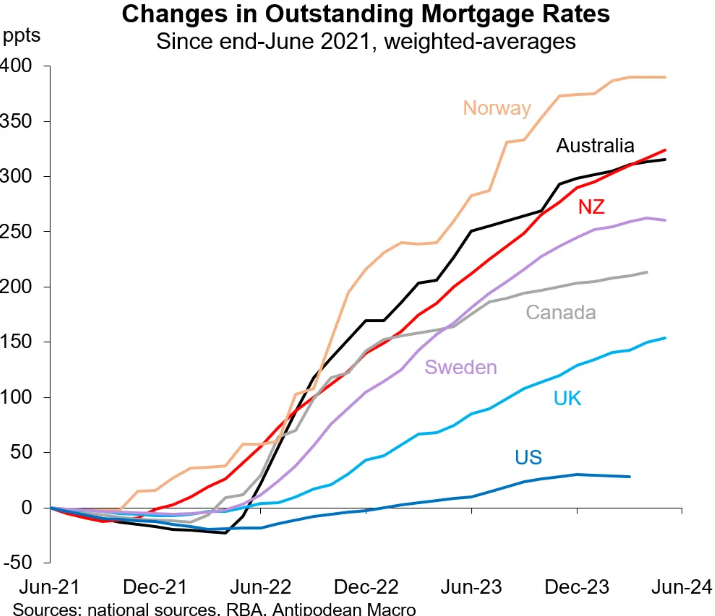

The next chart from Justin Fabo at Antipodean Macro shows that New Zealand’s mortgage rates have experienced one of the sharpest increases in the developed world, overtaking Australia’s rise:

To add insult to injury, average mortgage rates in New Zealand will continue to rise unless the Reserve Bank commences an easing cycle.

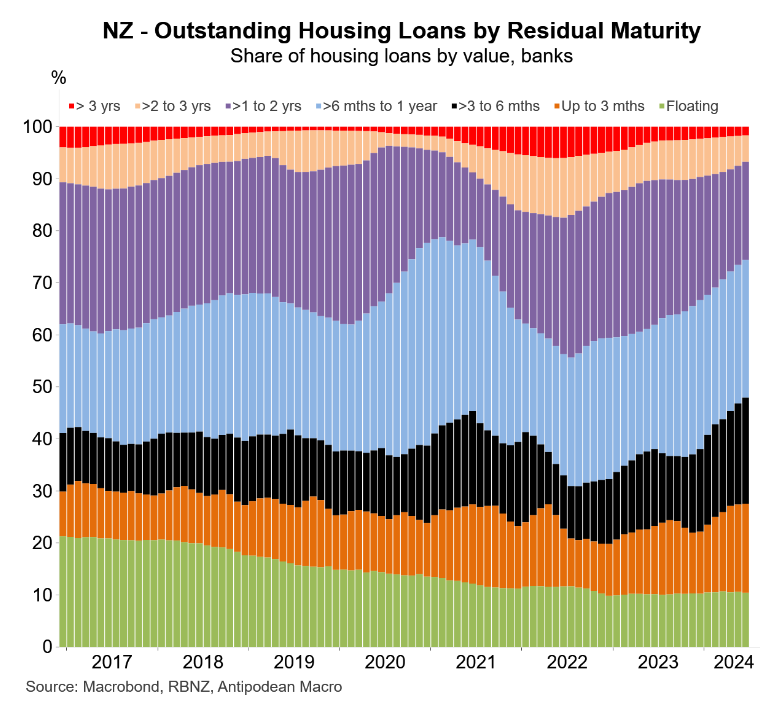

37% of outstanding mortgages in New Zealand are fixed-rate with expiries in the second half of this year, whereas a further 26.5% of mortgages by value will reset in the first half of 2025:

New Zealand’s banks now anticipate that the Reserve Bank will cut rates before the end of the year and have begun lowering their fixed mortgage rates.

The Reserve Bank best not disappoint. Otherwise, the New Zealand economy will sink deeper into recession.