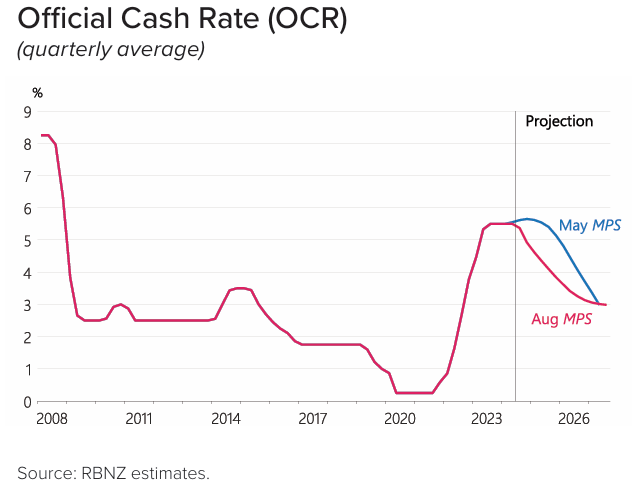

The Reserve Bank of New Zealand’s unexpected 0.25% cut to the official cash rate was an admission that the economy is deteriorating considerably faster than the central bank had anticipated.

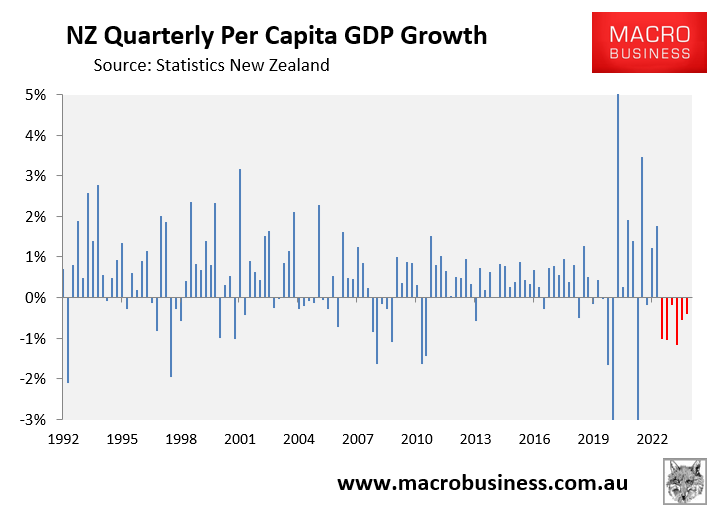

New Zealand’s per capita GDP has fallen by 4.3% from its late 2022 peak, following six straight consecutive declines:

High-frequency indicators continue to show that New Zealand’s economy is contracting at an alarming rate.

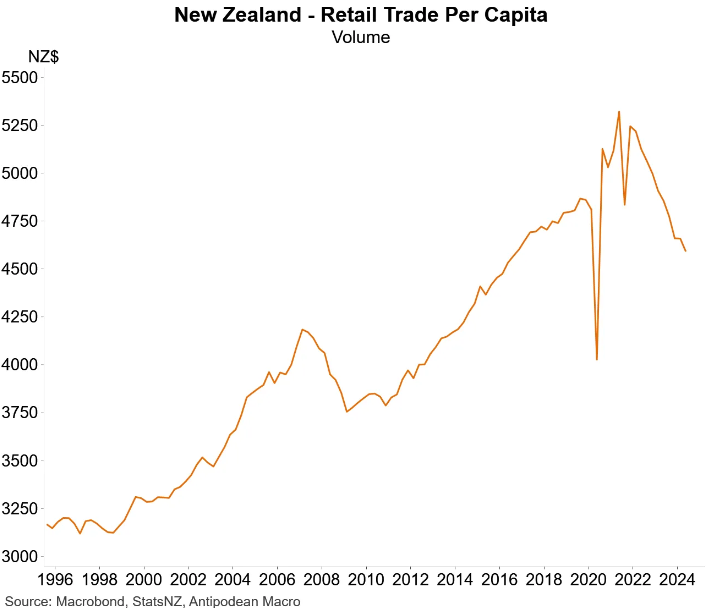

Justin Fabo at Antipodean Macro reported that per capita retail sales volumes have collapsed, now tracking at the same level as Q4 2016, excluding the pandemic dip:

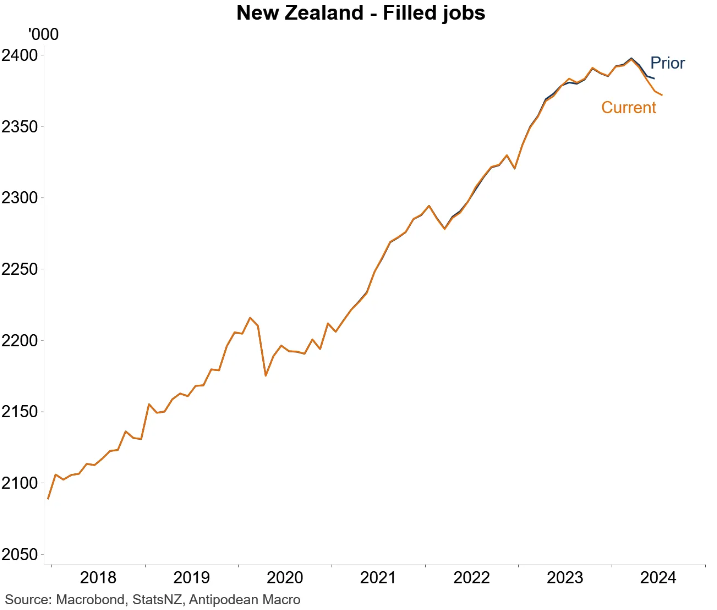

Data on filled jobs in New Zealand has also been revised sharply lower and continues to fall:

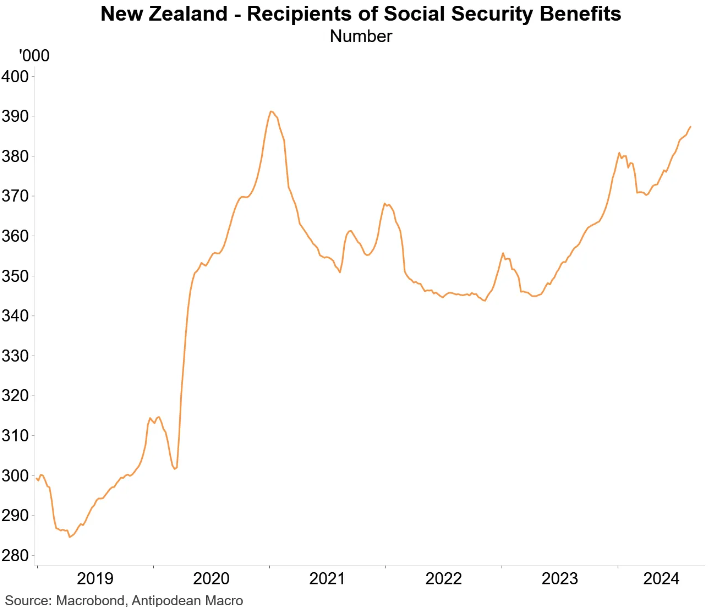

The number of social security recipients has almost climbed back to the pandemic peak:

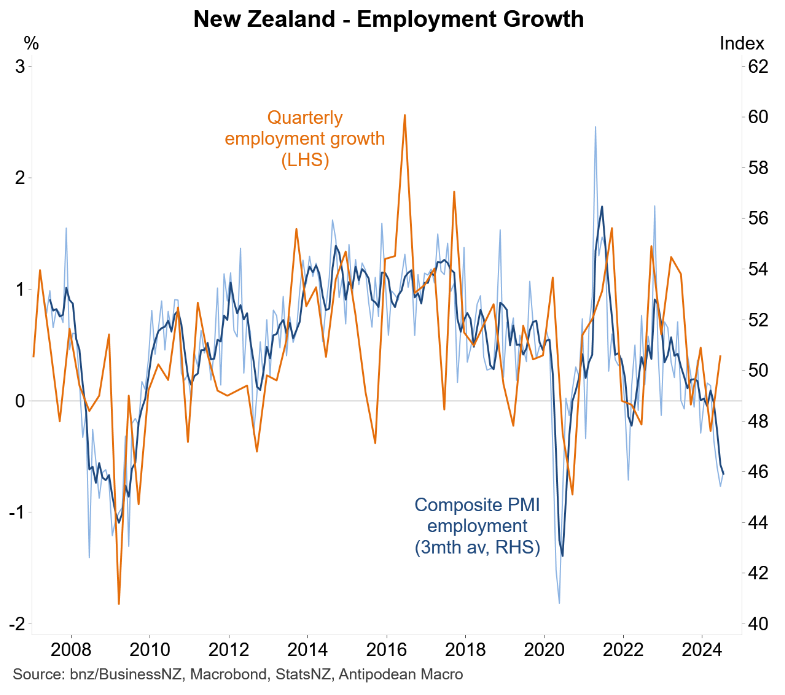

And leading indicators of New Zealand employment growth have collapsed:

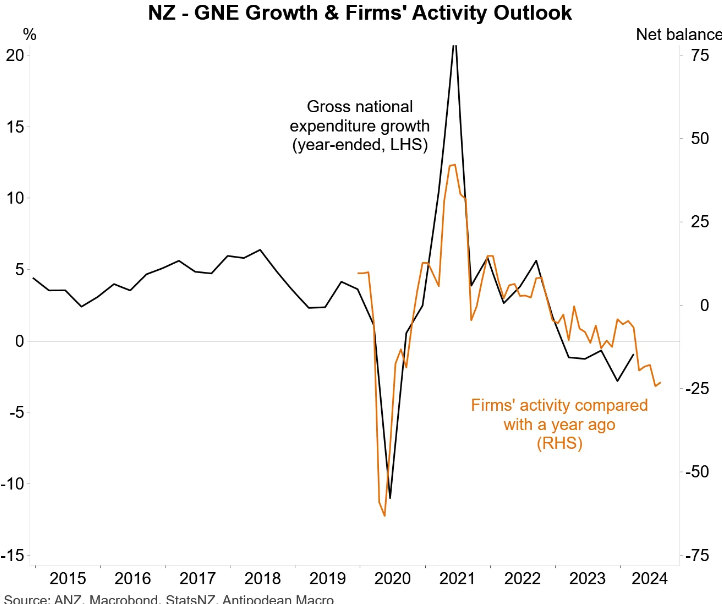

Finally, New Zealand firm activity continues to contract in August:

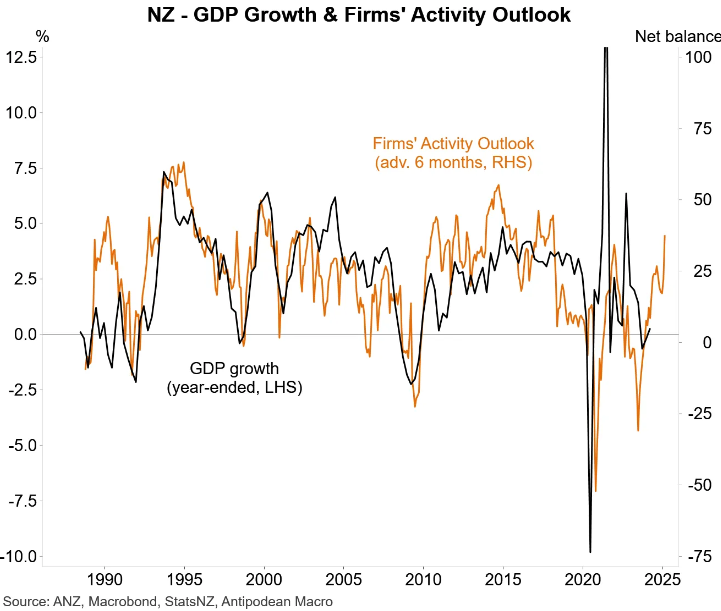

However, it is not all bad news, with Kiwi firms also reacting positively to the start of policy easing by the Reserve Bank by upgrading their views about the activity outlook:

Clearly, the Reserve Bank will need to cut rates further to drag the economy out of its deep recession.

The Reserve Bank’s latest official guidance has the official cash rate declining to around 3.0% by 2026, from 5.25% currently:

Based on the above data, it may need to front-load the rate cuts.