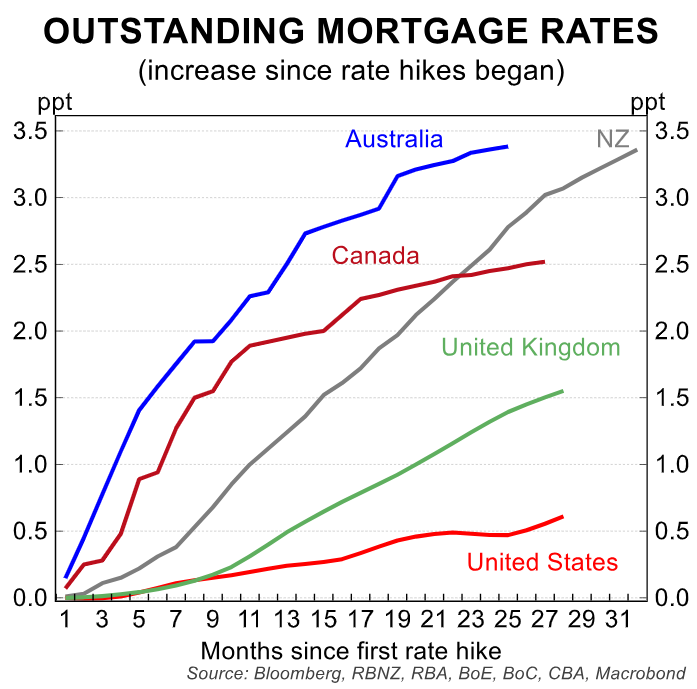

It is becoming clear that the Reserve Bank of New Zealand was too aggressive in raising interest rates, delivering one of the largest increases in mortgage rates in the world:

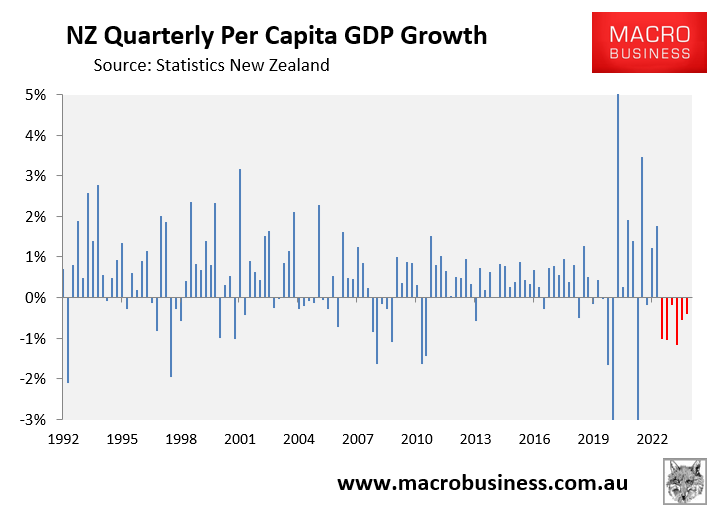

New Zealand’s per capita GDP has fallen by 4.3% from its late 2022 peak, following six straight consecutive declines:

High frequency indicators suggest that per capita GDP fell further in Q2 2024, deepening the recession.

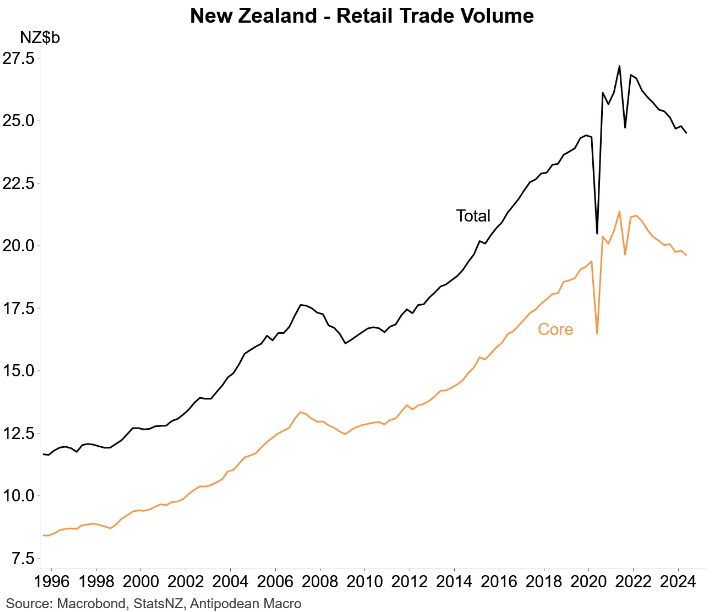

Justin Fabo from Antipodean Macro published charts on New Zealand retail spending, which continues to collapse.

As illustrated in the following chart, the volume of retail trade fell another 1.2% in Q2 to be almost back at pre-pandemic levels:

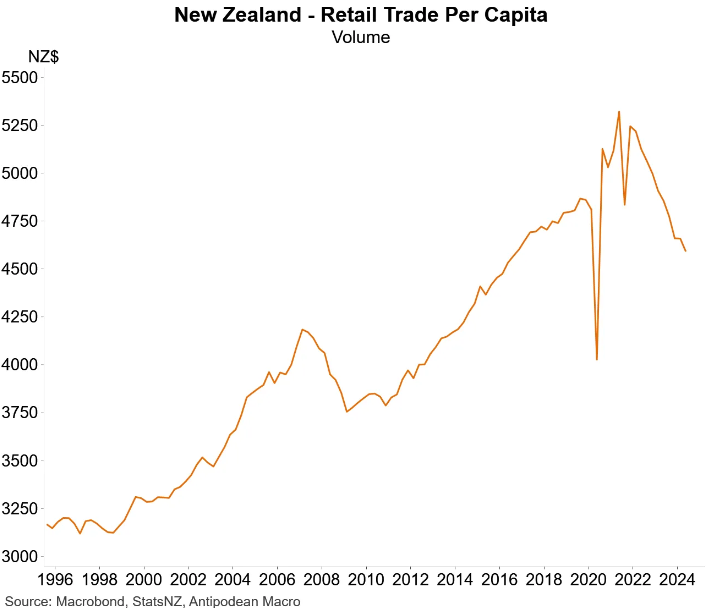

The situation is obviously much worse when sales are adjusted for population growth.

Per capita retail sales volumes are now tracking at the same level as Q4 2016, excluding the pandemic dip:

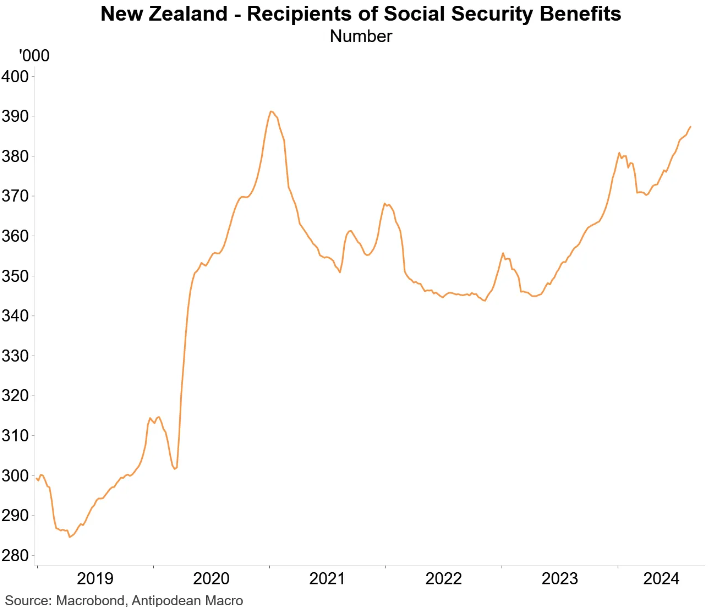

The worsening recession is also illustrated by the following chart from Fabo, which shows that the number of social security recipients has almost climbed back to the pandemic peak:

New Zealand households have clearly been hammered and are cutting back hard.

The Reserve Bank has responded by belatedly cutting the official cash rate by 0.25% this month. But they will need to cut more to drag the household sector and economy out of recession.