On Wednesday, the Reserve Bank of New Zealand will hold its next monetary policy meeting, where it will decide whether to change the official cash rate, which is currently sitting at a highly restrictive 5.50%.

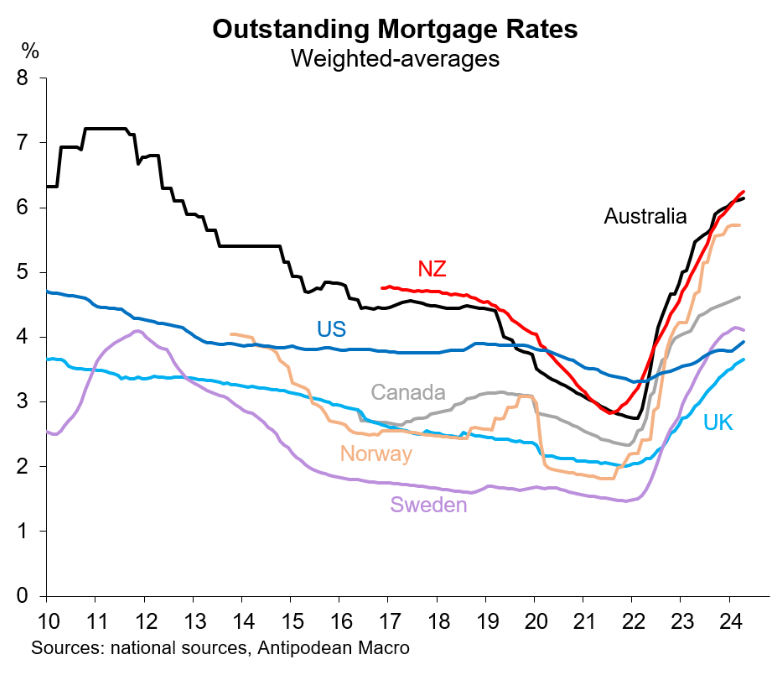

New Zealand’s monetary settings are among the tightest in the world, as illustrated in the next chart of average mortgage rates.

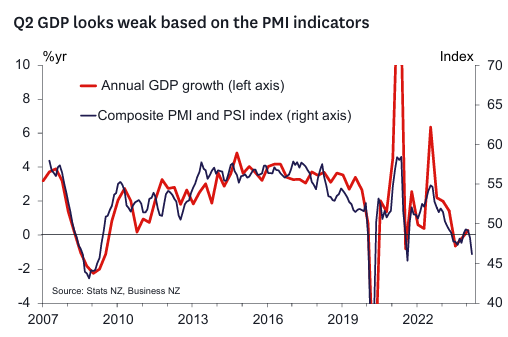

New Zealand’s economy is also suffering a deep per capita recession and a borderline technical recession, which appears to have deepened in Q2 based on high frequency indicators:

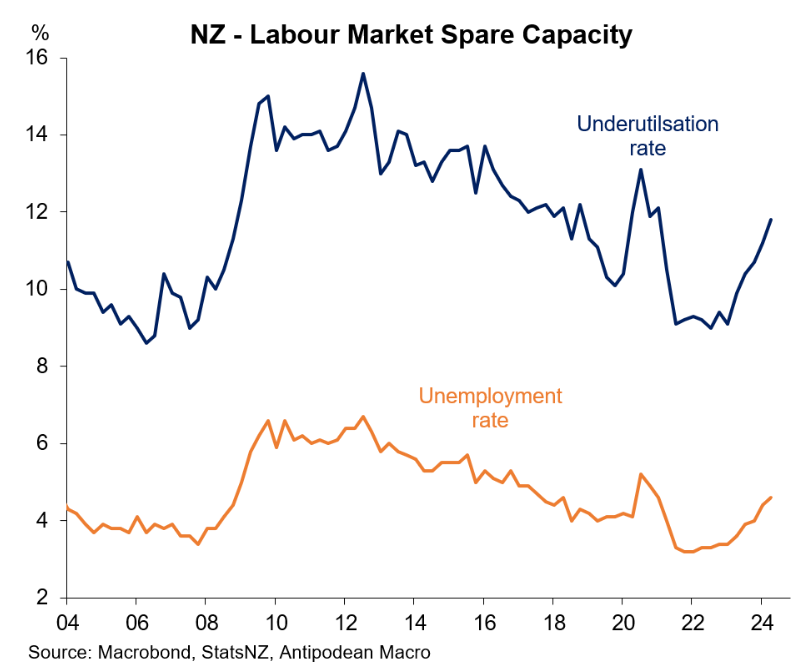

Finally, New Zealand’s labour market is also soft, as evidenced by unemployment and underemployment rising sharply:

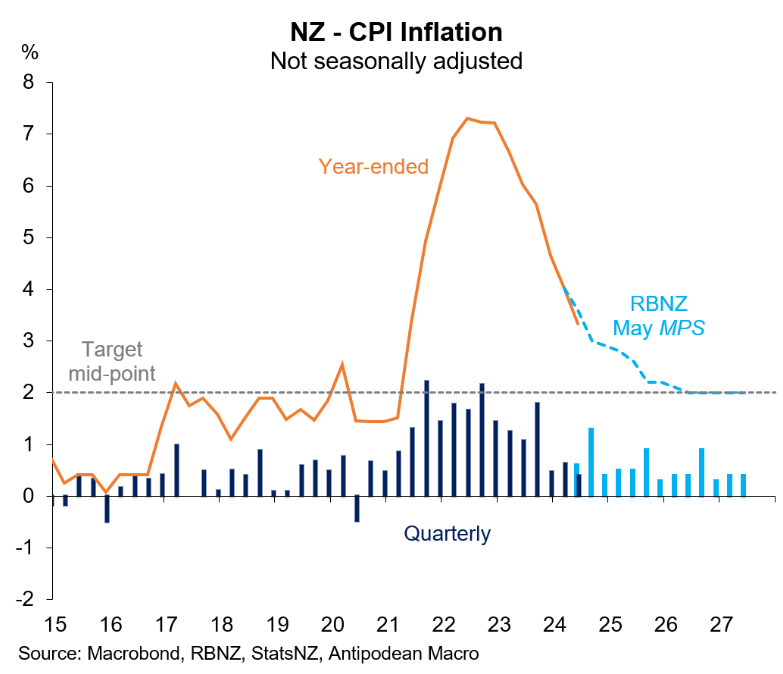

Given that New Zealand’s CPI inflation has fallen in line with Reserve Bank expectations, there is now a strong case to commence a monetary easing cycle.

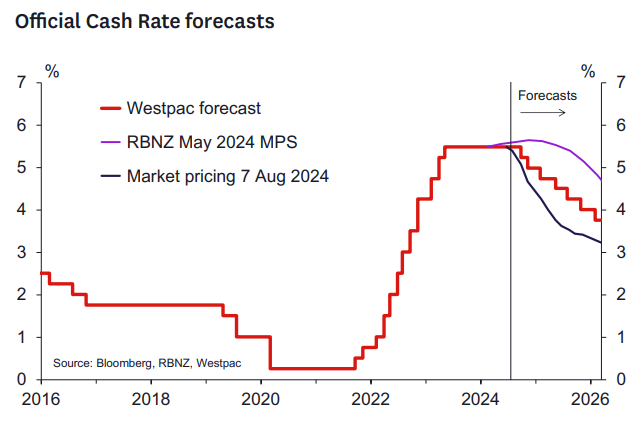

However, a new note from Westpac suggests that while the Reserve Bank is close to cutting rates, it will likely wait until the October and November meetings to commence its easing cycle:

We expect the RBNZ to leave the OCR unchanged but deliver a “hawkish cut” to their OCR outlook compared to the relatively hawkish stance taken at the May Monetary Policy Statement.

We think they will be positioning themselves to cut rates in the October and November meetings. They will leave open the option to scale up rate reductions beyond 25 bp should conditions warrant but will be looking to discourage markets from getting too far ahead of themselves…

The RBNZ will likely revise down their near-term growth outlook and take comfort from the recent fall in headline inflation. This will be the main motivation for the significant shift in forward outlook compared to the May Monetary Policy Statement.

But we expect them to continue to be cautious about the extent of the future fall in inflation given non-tradable inflation remains high and is yet to show signs of quickly normalizing…

The Reserve Bank will need to cut rates soon; otherwise, the New Zealand economy will plunge deeper into recession.