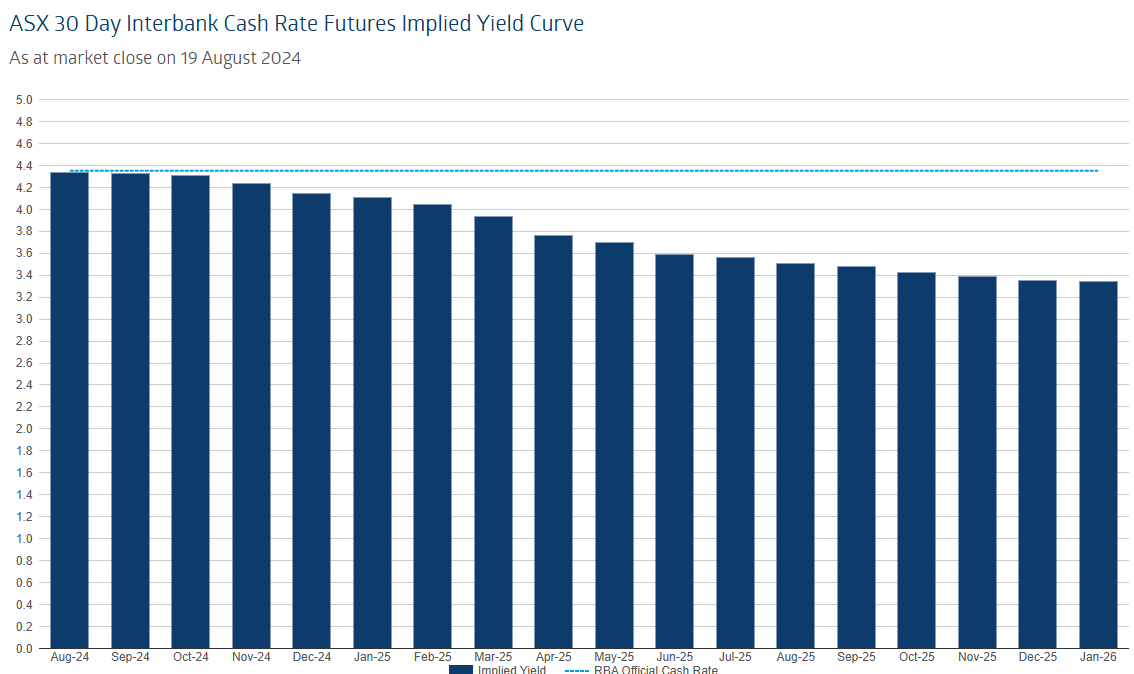

Financial markets are still pricing one cut in the official cash rate (OCR) by the end of the year, followed by further reductions next year:

However, the Minutes from this month’s RBA board meeting were released on Tuesday and explicitly stated that “holding the cash rate target steady at its current level for a longer period than currently implied by market pricing may be sufficient to return inflation to target in a reasonable timeframe”.

Moreover, the Minutes stated that “it was unlikely that the cash rate target would be reduced in the short term, and that it was not possible to either rule in or rule out future changes in the cash rate target”, suggesting that rates could still rise.

In coming to these conclusions, the Minutes noted that “based on the data and evidence over a period of time, the staff had assessed that the economy had less spare capacity than previously assumed”.

That said, the RBA Minutes also stated that the board would “continue placing somewhat greater-than-usual weight on the flow of data, relative to the forecasts”, in recognition that the outlook for the economy and interest rates is highly uncertain.

Overall, the Minutes should be viewed as hawkish.

The RBA is clearly concerned that inflation is not falling back to target as quickly as it had hoped, but is equally trying to balance risks around inflation and employment.

As a result, the RBA will be data driven and will need to see the labour market weaken materially, or underlying inflation fall more quickly than anticipated, before it commences a rate-cutting cycle.

My tip is now early 2025.