Last month, Infometrics warned that New Zealand is facing a “brain drain” as prime 25-44-year-olds relocate to Australia in pursuit of employment and higher pay.

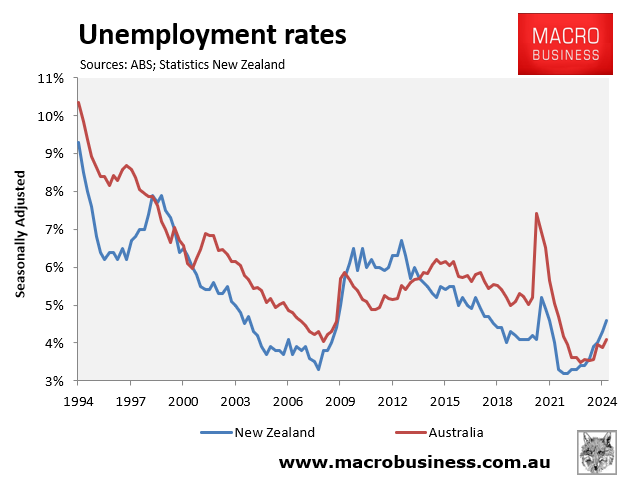

Infometrics reported that Australia’s unemployment rate was lower than New Zealand’s.

This represented a change from the average rate from 2014 and 2018, when Australian unemployment was 0.7 percentage points higher than New Zealand’s.

In June, Australia’s unemployment rate was 4.1%, 0.5% below New Zealand’s 4.6%.

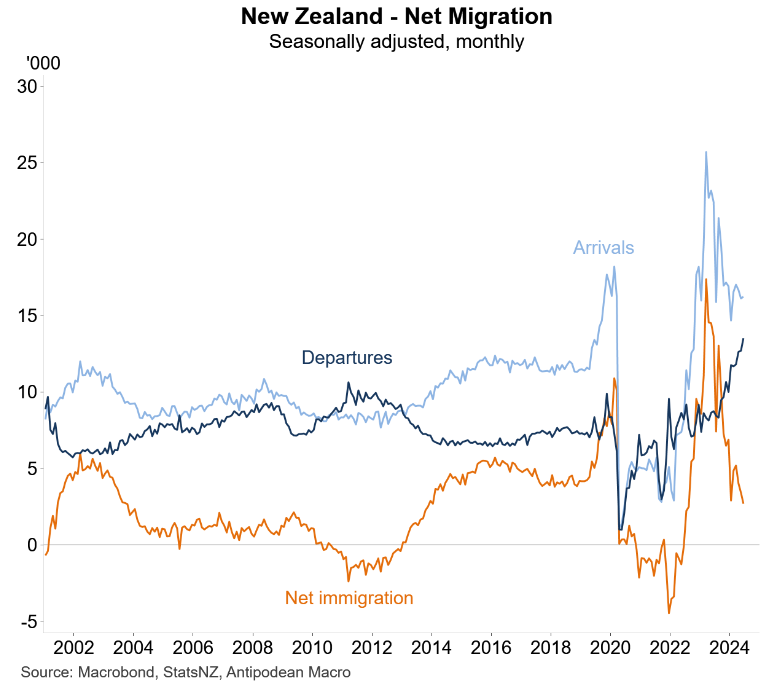

According to Statistics New Zealand data released on Tuesday, 131,200 people left New Zealand in the 2023-24 financial year, which is the provisionally highest annual departure rate on record. Around one-third of these departures were headed to Australia.

“I’ve got a lot of friends that have gone (to Australia) … purely because of better work opportunities, better living. Australia just seems to have it together”, said Merrily Allen, who is currently planning her move with her partner and 14-year-old daughter in early 2025.

The following charts from Justin Fabo at Antipodean Macro summarise the situation.

Departures from New Zealand have rocketed, which has crashed monthly net migration:

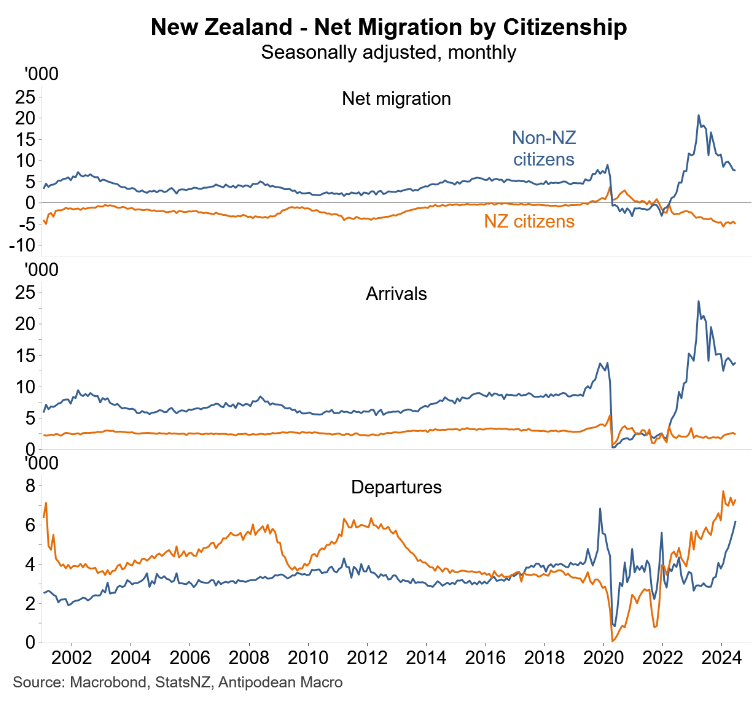

However, those losses of residents were more than offset by strong inward migration of non-citizens.

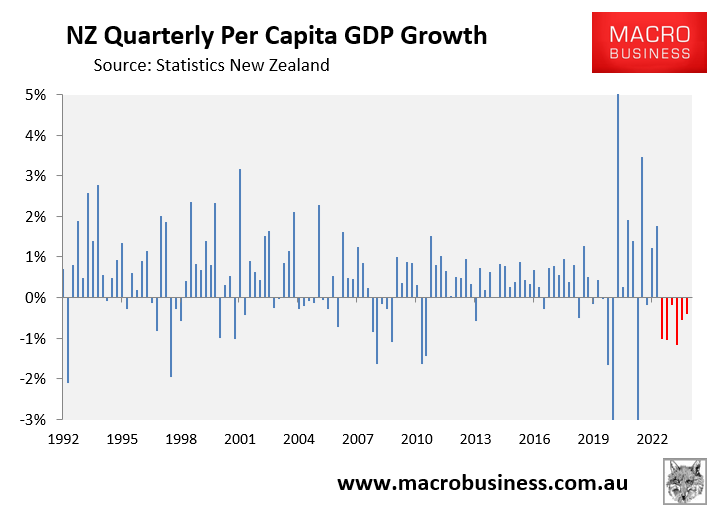

New Zealand is suffering from a deeper per capita recession than Australia, with per capita GDP down 4.3% from the late 2022 peak, following six straight consecutive declines:

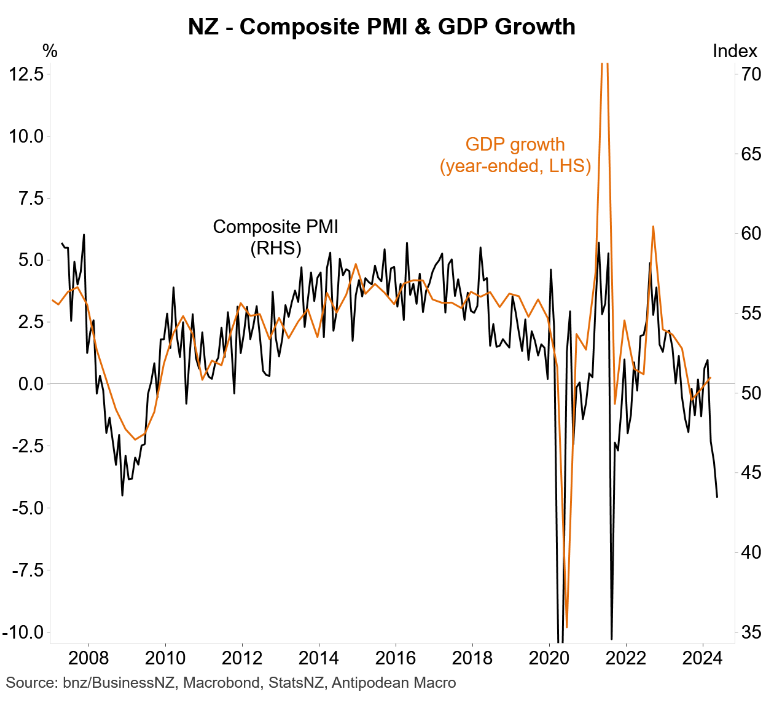

Forward-looking indicators are also disastrous for New Zealand, with New Zealand’s composite PMI crashing in Q2:

The Australian economy may be bad, but New Zealand’s is worse.

As a result, Kiwis continue to flood into Australia, replaced by migrants from developing nations.