My initial reaction to Wednesday’s monthly CPI inflation indicator was lukewarm, noting that inflation remains sticky for services and non-tradeable items.

However, analysis by Stephen Wu at CBA showed that “the disinflationary impulse continued to broaden”.

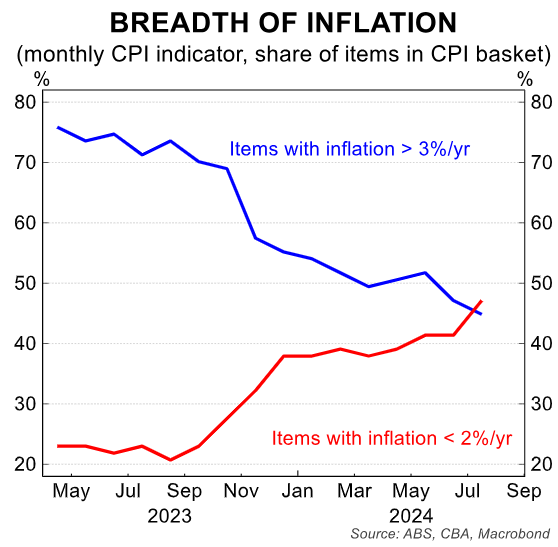

In particular, “the number of items in the CPI basket with annual inflation below 2% continued to rise and now outnumbers the number of items with prices growing above the RBA’s inflation target band, which continues to fall”:

Wu added that “measures of core inflation also eased in the month” and that “disinflation is not occurring purely because of government rebates. The news is good”.

However, Wu cautioned that “the first month of the quarter is overweight on goods and many services prices are not measured in this month”, which the RBA will be aware of.

Looking ahead, Wu forecasts that the August CPI indicator will “print with a two-handle”.

“The August numbers will provide an update on market services inflation, which we anticipate will ease further as wages growth has been modest and declining”, he says.

“The August CPI will also show the full impact of energy bill relief, with a circa 20% fall in electricity prices expected to bring headline inflation back down to within the RBA’s inflation target band”.

Moreover, Wu expects “the quarterly trimmed mean measure to ease over H2 24”.

While the decline in CPI inflation has been slow and bumpy, progress is at least being made.

That said, the chances of the RBA cutting rates this year look slim and would probably require a marked weakening of the labour market.