By Stephen Wu, Economist at CBA:

Key Points:

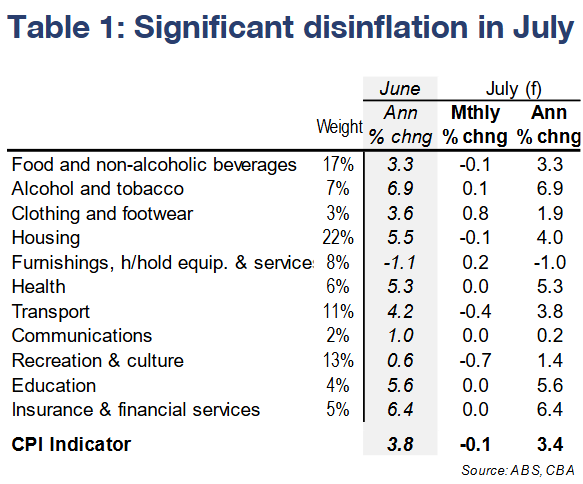

- We anticipate a large 0.4ppt fall in the annual rate of inflation occurred in July, with monthly CPI inflation easing to 3.4%/yr.

- Electricity bill relief, volatile items and base effects are expected to drive the big disinflationary outcome.

H2 24 disinflation begins, with much more to come:

We anticipate a very large drop in annual CPI inflation in July, as measured by the monthly CPI indicator.

On our forecasts, inflation falls to 3.4%/yr, a 0.4ppt decline from the 3.8%/yr pace in June, and back to the pace averaged over Dec 23-Feb 24. Risks sit on both sides of this point estimate, with electricity a downside risk.

On balance, risks are skewed to the upside given pricing adjustments at the start of the financial year. One driver of disinflation is the introduction of the 2024/25 energy bill rebates. We also expect price falls in volatile items and for holiday travel.

Base effects from a year ago also play a big role; in July 2023, prices rose by 0.3%/mth and in Q3 23 by 1.2%/qtr. There is more uncertainty than usual in our point estimate, primarily as the timing, inclusion and impact of electricity rebates are uncertain. The volatility in travel prices around school holidays/Northern hemisphere summer also adds to imprecision.

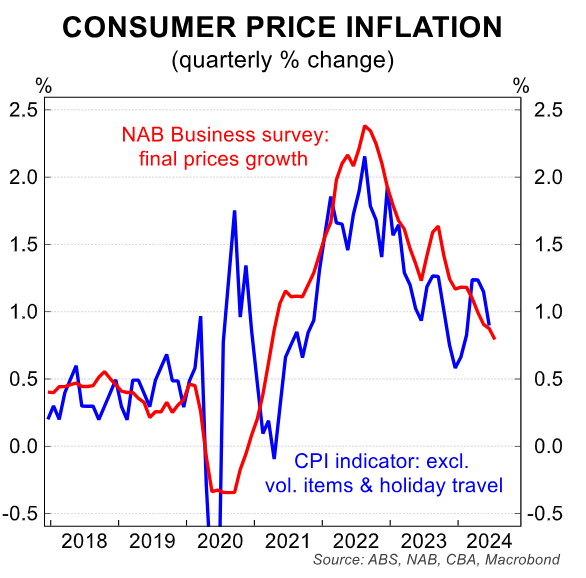

We note that the monthly CPI has wrong-footed the market in the recent past, and the first month of the quarter contains fewer price signals (i.e. biased towards goods; more items imputed). We will look more at the granular data for price signals, rather than necessarily focus on where the headline print comes in.

It’s worth noting last week’s NAB Business Survey highlighted ongoing moderation in final price growth in July.

A few key expected drivers for July to highlight are:

- A ~5%/mth fall in electricity prices as state government energy rebates begin to kick in, with much larger impacts expected from August (more below).

- Price falls in the volatile items of the basket, including a ~2½%/mth fall in holiday travel costs as demand softens (this is a key uncertainty in our forecast), a ~1½%/mth fall in automotive fuel prices and for fruit & veg prices. As a result, CPI excluding volatiles & holiday travel will likely print a tad higher.

- Some reversal of goods deflation post-EOFY sales in May and June for those items measured monthly. Goods measured quarterly (some in April and July) should see some retracement from the unexpectedly strong inflation in Q1 24

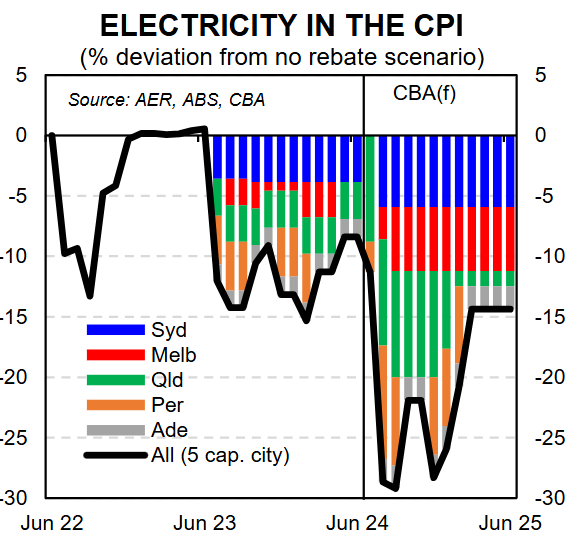

Electricity leads the disinflationary charge:

When announced in the Budget, Federal electricity bill relief was to be delivered ‘from 1 July 2024’. Recent new details indicate that the timing of bill relief will come later, with some households billed in July or August not likely to see their first rebate until their next electricity bill.

That’s in contrast to state rebates. Qld payments started from 1 July and WA from 20 July.

Electricity accounts for 2.4% of the CPI basket, of which Brisbane’s share is 8.8%. That implies the Qld rebates alone have a 0.2ppt drag on inflation over H2 24 before they add to inflation as rebates are used up. Perth’s share is 9.4%, but differences in the timing and size mean a smaller but more volatile impact on CPI.

The upshot is that the July figures only partly incorporate state government rebates, with the Federal rebate impact not expected until August.

We pencil in a much larger ~20% fall in August for electricity prices to see a 2-handle on the annual headline CPI figure.