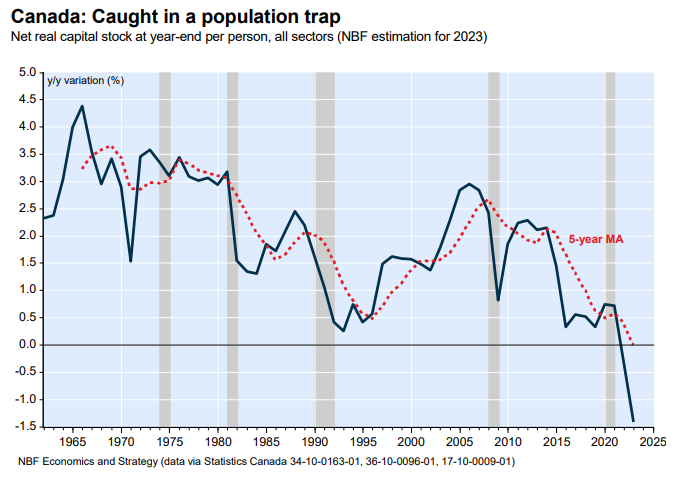

Earlier this year, economists at the National Bank of Canada published research showing that Canada is caught in a “population trap” of declining productivity and living standards.

The National Bank of Canada economists explained the nation’s productivity decline as follows:

“Why is our productivity record so bad? Could it be that our demographic ambitions are too high relative to the stock of capital available in the country?”

“This means that our population is growing so fast that we do not have enough savings to stabilize our capital-labour ratio and achieve an increase in GDP per capita”.

“Simply put, Canada is in a population trap for the first time in modern history”…

“We currently lack the infrastructure and capital stock in this country to adequately absorb current population growth and improve our standard of living”.

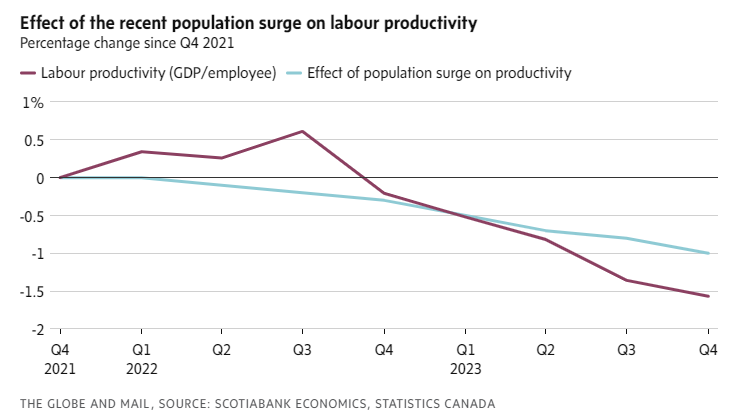

Economists at Scotia Bank likewise concluded that Canada’s population is growing at a faster pace than business investment, infrastructure, and housing, resulting in capital shallowing and reduced productivity:

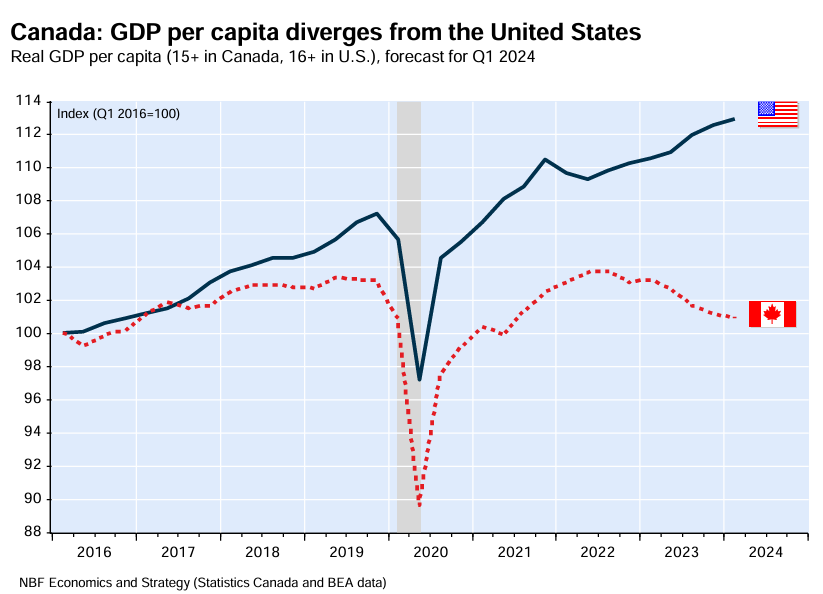

This poor productivity growth in Canada has led to a record divergence between Canadian and US GDP per capita, with Canada experiencing near-zero growth over the past decade:

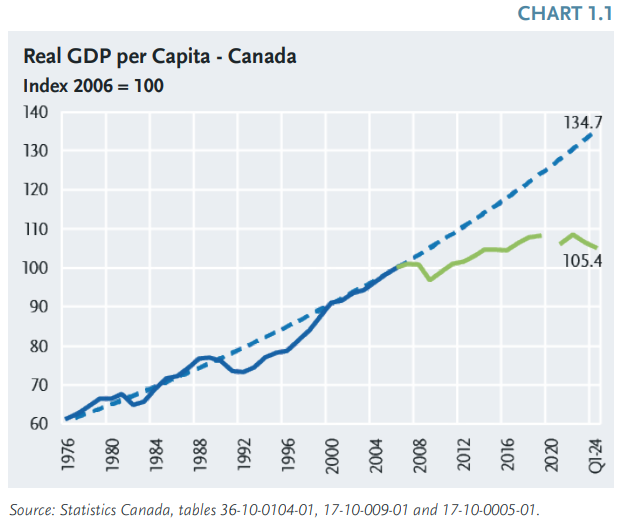

New research Bennett Jones also shows that Canada’s productivity performance has been deplorable, driven to a large extent by capital shallowing.

“The report notes that “real GDP per capita in Canada in the first quarter of 2024 was 2.4% lower than in 2018 and only 5.4% higher than in 2006, far below where it would have been if pre-2006 trends had been sustained (Chart 1.1)”.

“Weaker productivity growth is the major factor explaining the slower growth of GDP per capita since 2006″…

“The lower average growth in output per worker since 2007 in turn is explained by lesser capital deepening—i.e., lesser growth of capital per unit of labour—than over the prior period”…

“To restore stronger growth in GDP per capita and to improve standards of living, our economy needs to invest more per worker and to innovate faster in the use of capital, technology and labour”.

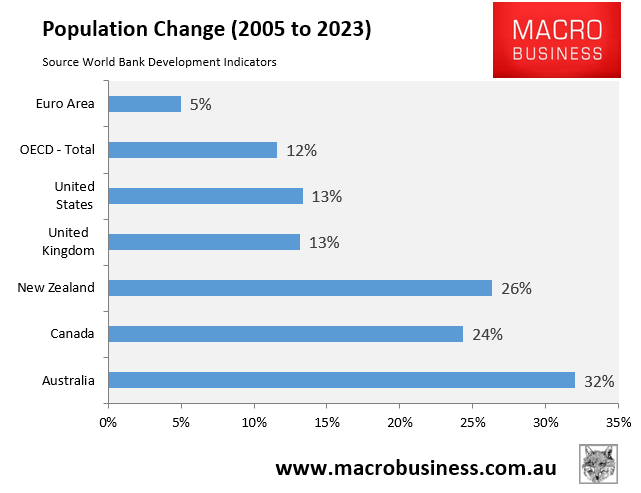

Canada and Australia have experienced among the strongest population growth since 2005 among major advanced economies:

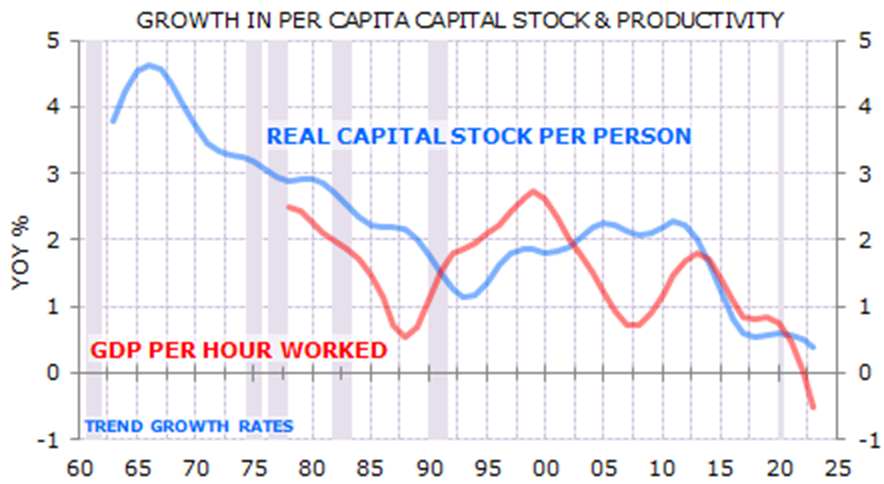

Last year, leading independent economist Gerard Minack published research showing that excessive population growth has caused “capital shallowing” in Australia, lowering productivity and GDP per capita growth:

Australia’s economic performance in the decade before the pandemic was, on many measures, the worst in 60 years. Per capita GDP growth was low, productivity growth tepid, real wages were stagnant, and housing increasingly unaffordable…

There were many reasons for the mess, but the most important was a giant capital-to-labour switch: Australia relied on increasing labour supply, rather than increasing investment, to drive growth. Remarkably, the country now seems to be doubling down on the same strategy…

The capital-to-labour switch has been massively detrimental to living standards. To maintain living standards a country’s capital stock – assets such as schools, roads, hospitals, factories, offices, and housing – needs to match its population growth. Without that investment living standards fall…

The high population growth of the past 15 years has meant that almost all Australia’s investment spending has been the equivalent of replacing smashed windows…

Capital deepening drives productivity. The switch to a population-led growth model has starved Australia of capital deepening investment. The result is declining productivity…

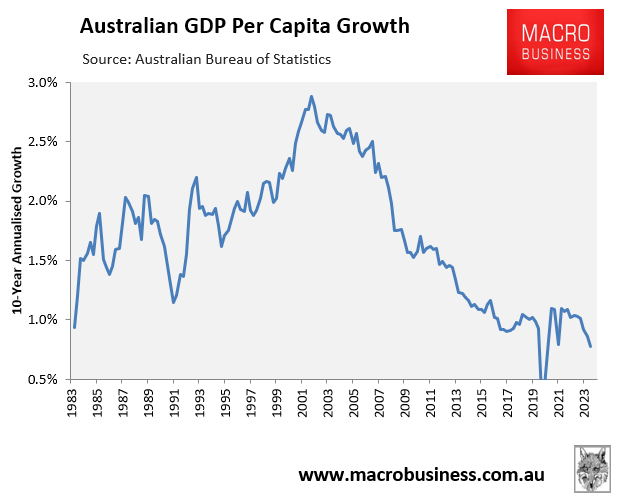

Australia’s declining productivity has dragged down per capita GDP growth, with Australia about to record its sixth consecutive quarterly decline.

Canada and Australia clearly need to break free from immigration-driven growth and build long-term, productive economies that benefit current residents rather than oligopolistic corporations.

Otherwise, both countries will be stuck in “population traps” with diminishing productivity, continuous housing shortages, and never-ending per capita recessions.