Retirement bomb headed for Australia

Vanguard Australia has warned that the nation’s housing crisis poses a direct threat to the retirement system.

Vanguard projects that a growing proportion of Australians will rent in retirement, while 30% are expected to still be paying down their mortgages in their retirement years.

“Australians have this view that they will own a home and be debt free when they get to those retirement years”, Vanguard Australia managing director Daniel Shrimski told The New Daily.

“In actual fact the research suggests that’s not going to be the case in many instances … it will be a real financial burden”.

“In about 30 years when millennials start retiring, they’re going to have much lower rates of home ownership … if housing remains expensive it means a big chunk of your diminished [retirement] income from super goes into housing”, Demographer Simon Kuestenmacher added.

The Super Members Council of Australia made similar observations in February.

They estimated that more than 40% of Australians retire with mortgage debt, up from 16% two decades years ago.

Furthermore, 40% of singles and 33% of couples will use their whole superannuation nest egg to pay off their debts.

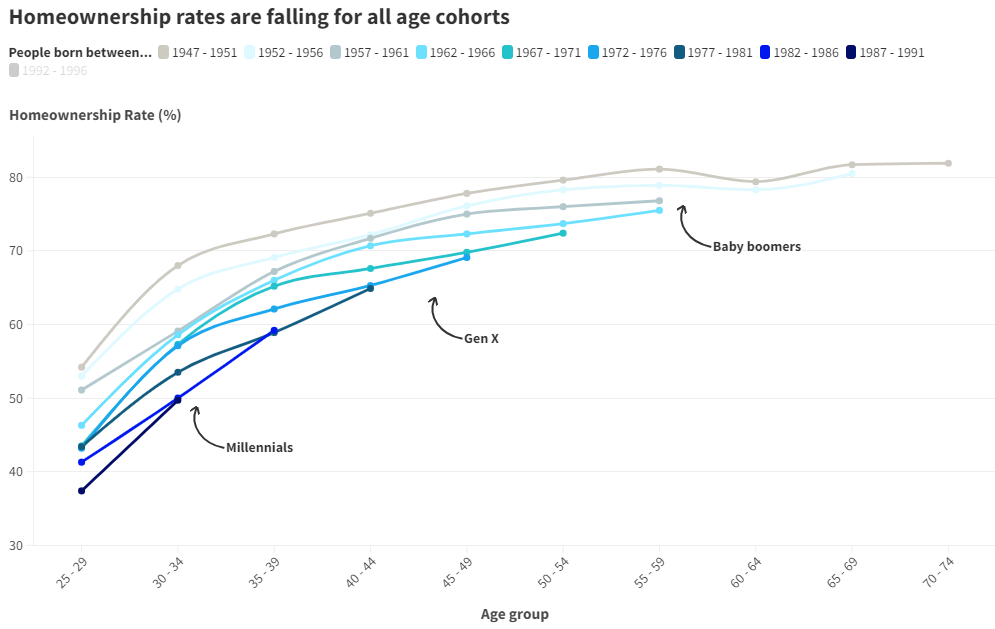

The above outcomes seem inevitable given the collapse in Australia’s homeownership rates:

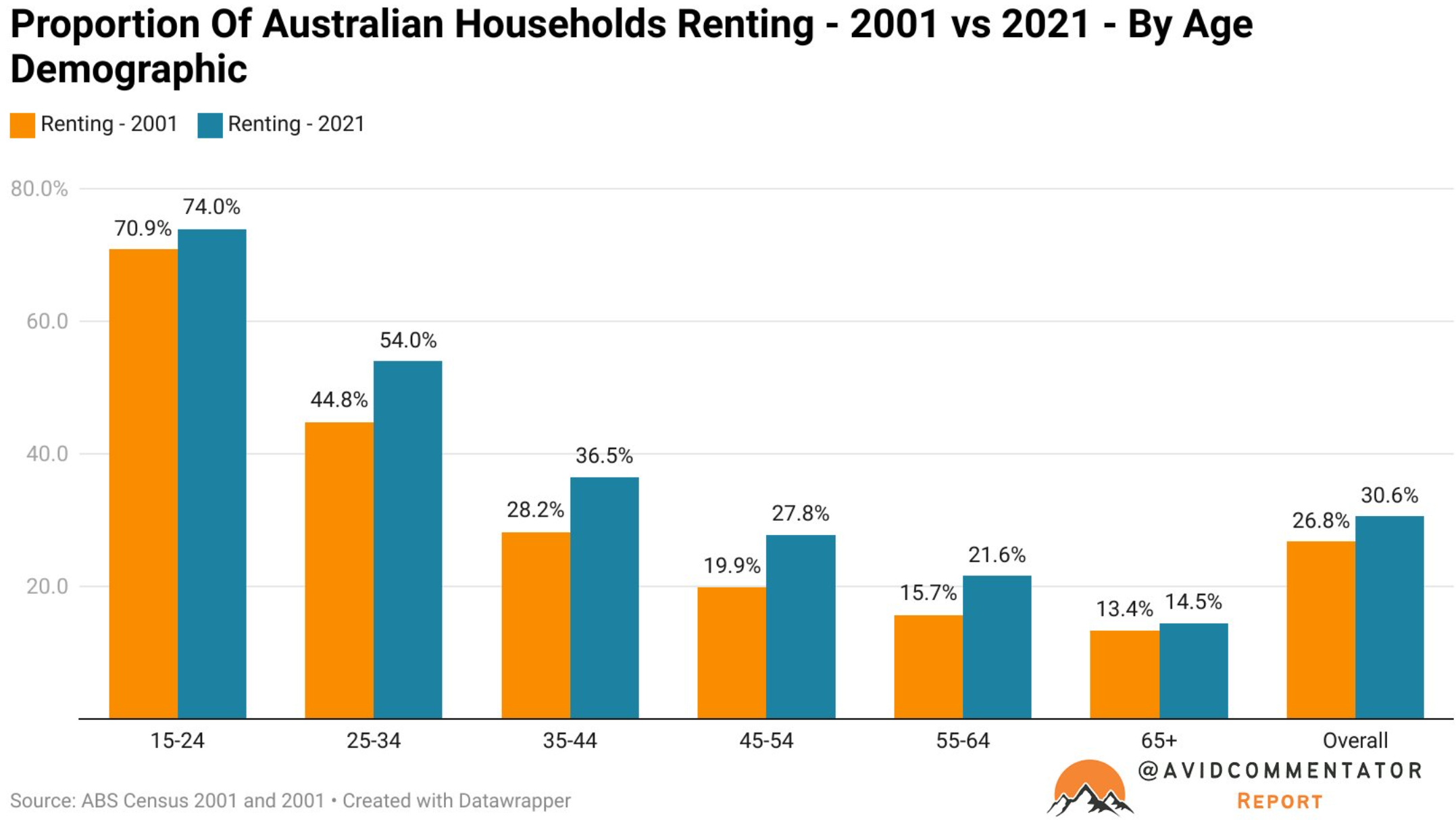

As a result, there has also been a marked increase in the share of households renting, as illustrated below by independent economist Tarric Brooker:

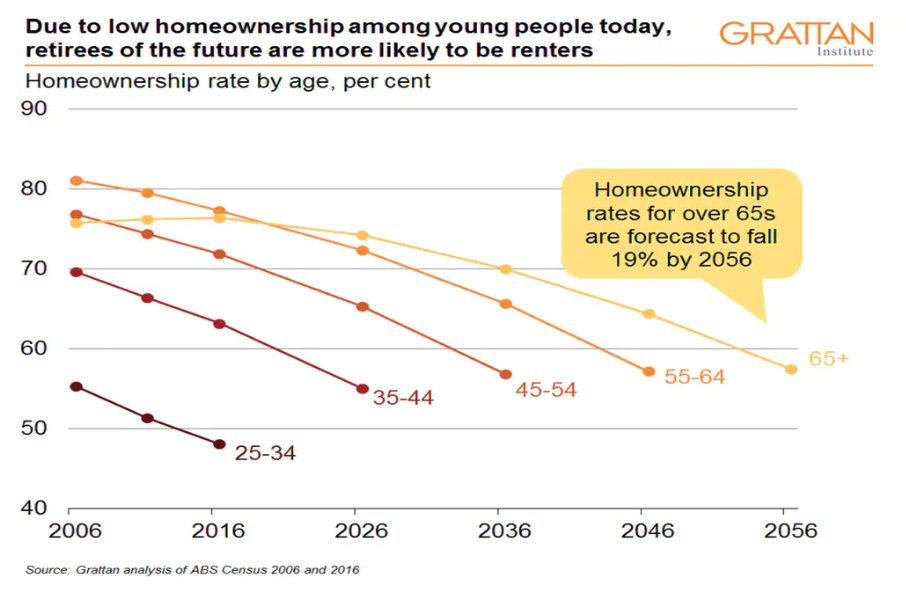

Reflecting the shrinking homeownership amongst younger people, the Grattan Institute projects that the share of Australians aged 65-plus who will own a home will fall from 76% currently to 57% by 2056:

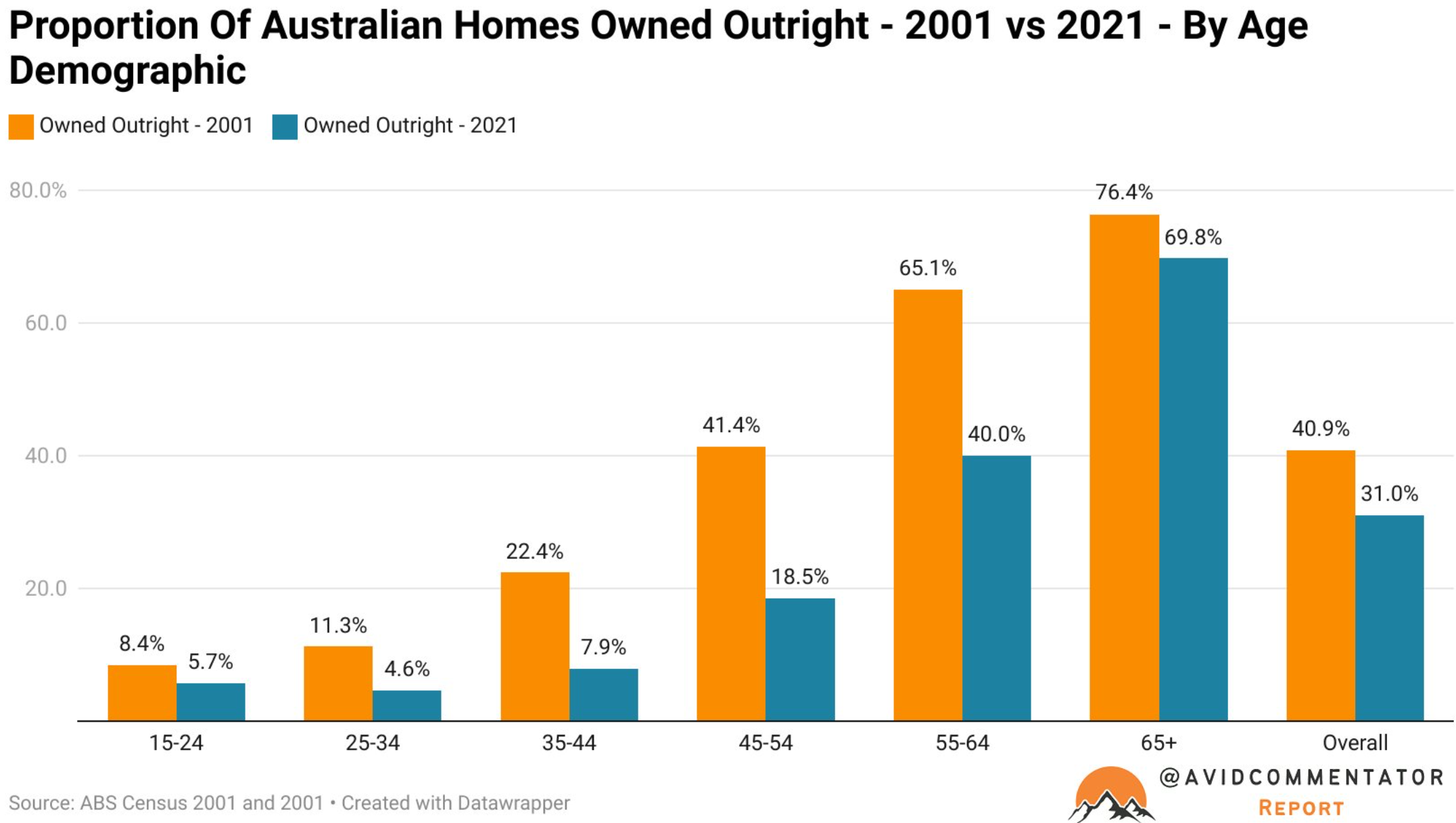

There has also been a substantial increase in Australians aged 55-64 and 45-54 who are holding mortgage debt, as well as a smaller increase among those already at retirement age (i.e. 65-plus):

The data is clear: an increasing share of Australian retirees will rent in the future, while others will be saddled with larger mortgage debts.

Both developments threaten to blow up Australia’s retirement system, which has been built around the presumption that most people would own their homes outright when they retire.