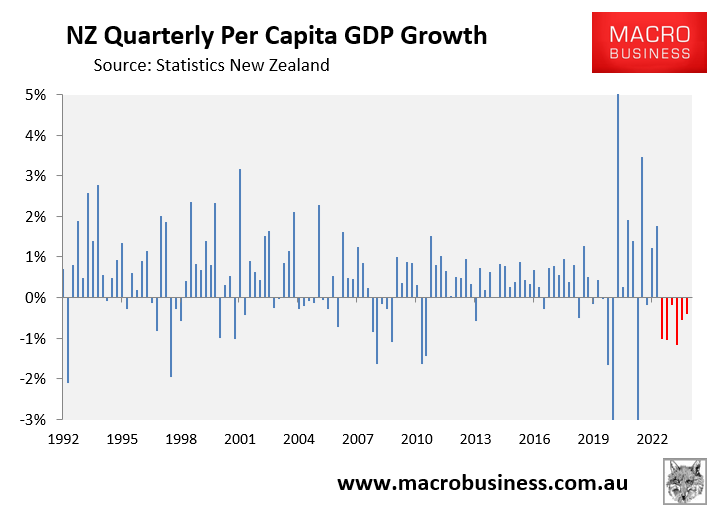

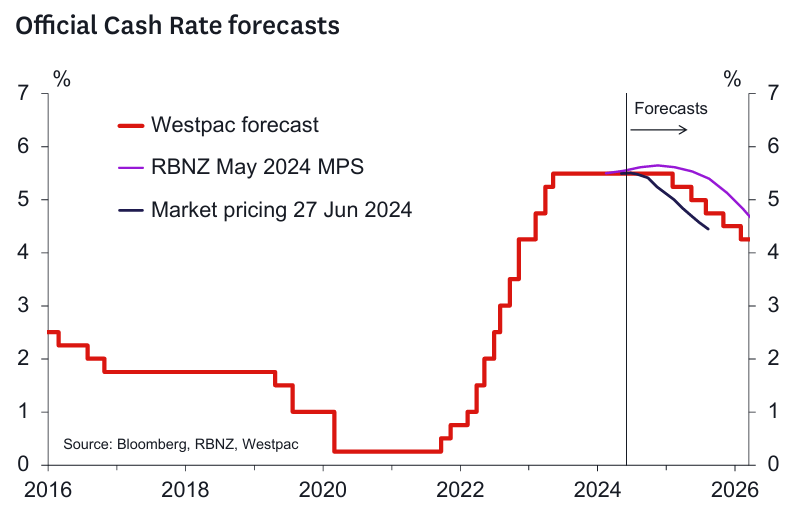

Despite New Zealanders suffering the longest and steepest decline in real per capita GDP since the Global Financial Crisis and all forward-looking indicators pointing to a deepening recession, the Reserve Bank of New Zealand is tipped to keep the official cash rate (OCR) on hold at 5.5% for the remainder of this year.

According to Westpac’s preview of next week’s monetary policy meeting, the Reserve Bank is likely to “emphasise the upside risks to consumer spending and inflation emanating from the less contractionary than expected Budget 2024”.

“But they will balance this with some dovish messages associated with potential downside risks to growth as the economy continues to stall and the labour market eases”.

“We don’t see any net dovish tilt that might bring an easing in 2024 into play”, Westpac says.

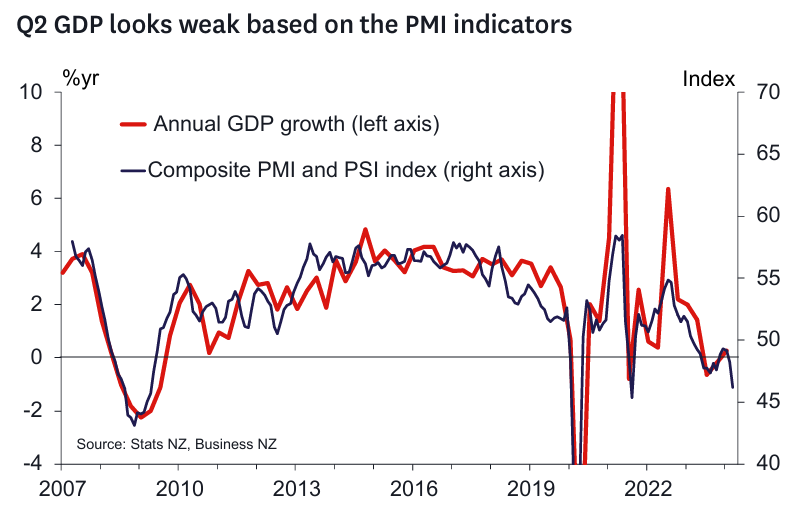

Westpac notes that the Reserve Bank’s hawkishness will remain despite a clear weakening of the economic data.

Westpac says that “monetary policy is at “peak transmission” from the interest rate rises that finished in May 2023”.

As a result, “economic activity remains weak – particularly in the interest-sensitive construction sector. The outlook for investment looks weak”.

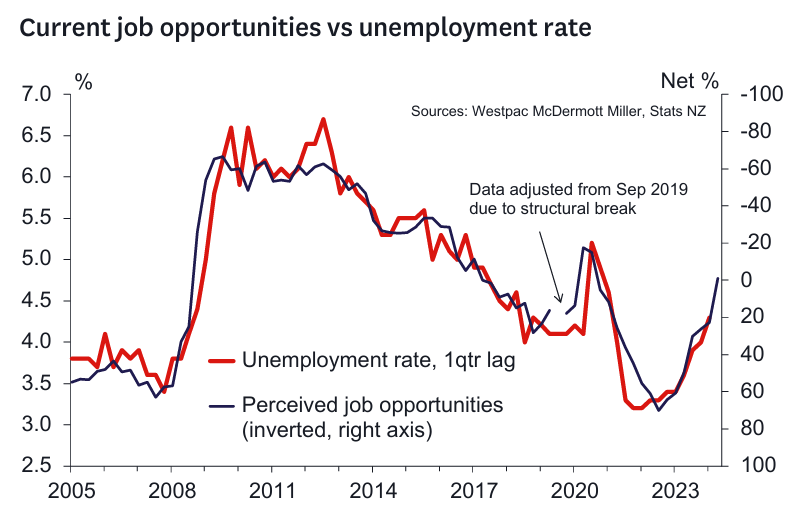

“The labour market indicators confirm that the uptrend in the unemployment rate remains firmly in place”, notes Westpac.

However, the key factor preventing the Reserve Bank from cutting the OCR, according to Westpac, is stubborn CPI inflation:

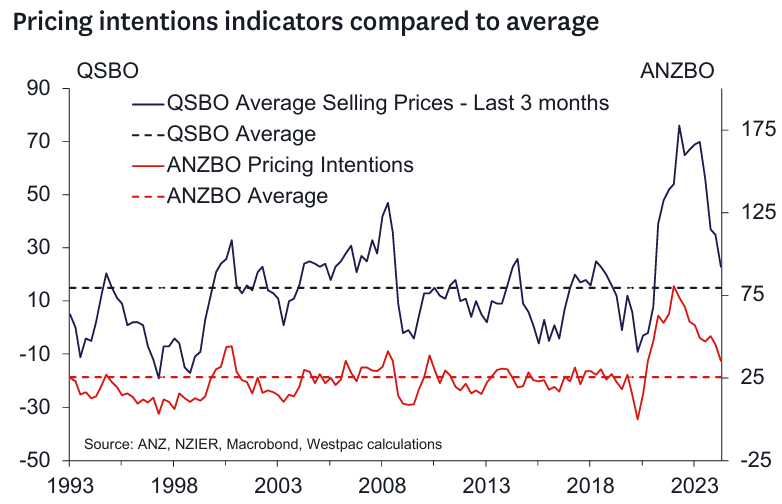

“Pricing indicators in recent business surveys and the QSBO suggest that inflation pressures are receding but remain somewhat elevated. Businesses still report that cost pressures are elevated”.

“We don’t think on balance that there will have been much to change the RBNZ’s view that they need additional confidence that inflation is reverting sustainably within the 1-3% target range”.

“The most recent pricing intentions data will have added to the RBNZ’s confidence, but future hard data in the form of the next couple of quarterly CPI prints will be most important in that regard”.

Therefore, Westpac concludes that the Reserve Bank will disappoint markets by maintaining its hawkish stance:

“We don’t think the markets will get a dovish tilt that supports recent market pricing (around a 50% chance of an easing in the October Review and around 35bps priced in by end 2024)”.

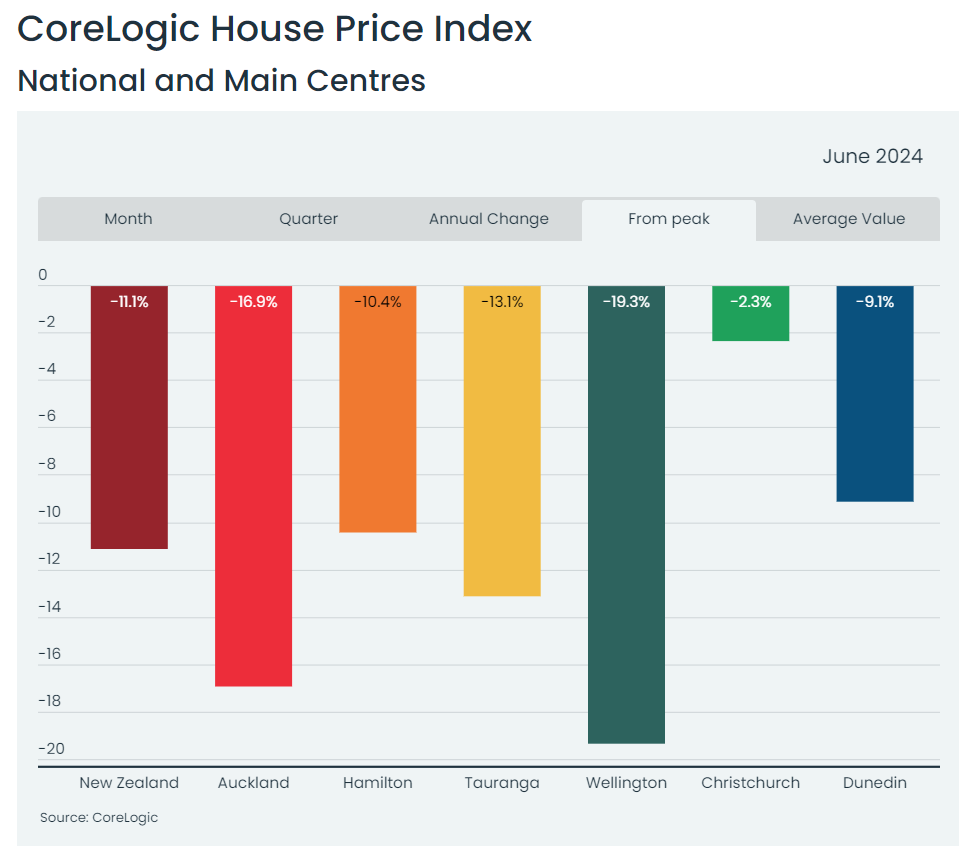

If that is the case, then Kiwis will be plunged even deeper into recession, and house prices will be pushed lower.