Reserve Bank urged by economists to cut rates

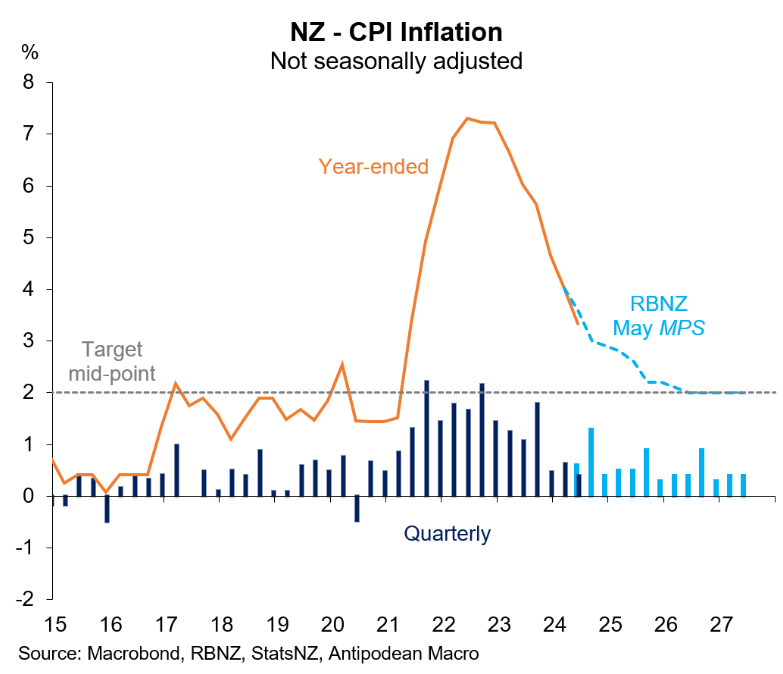

Last week’s benign Q2 CPI print has New Zealand’s economists urging the Reserve Bank to commence an interest rate easing cycle.

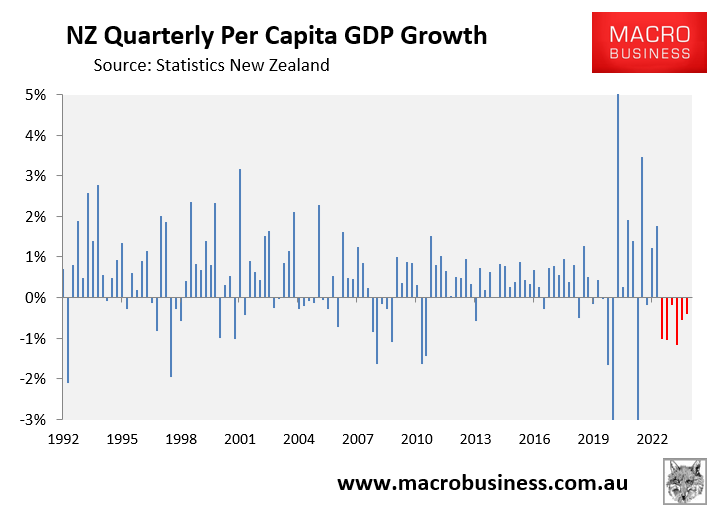

New Zealand’s economy is experiencing its heaviest economic contraction in decades.

Real per capita GDP fell for six consecutive quarters to Q1, down 4.3% from the late 2022 peak. That decline was larger than the 4.2% recorded following the Global Financial Crisis.

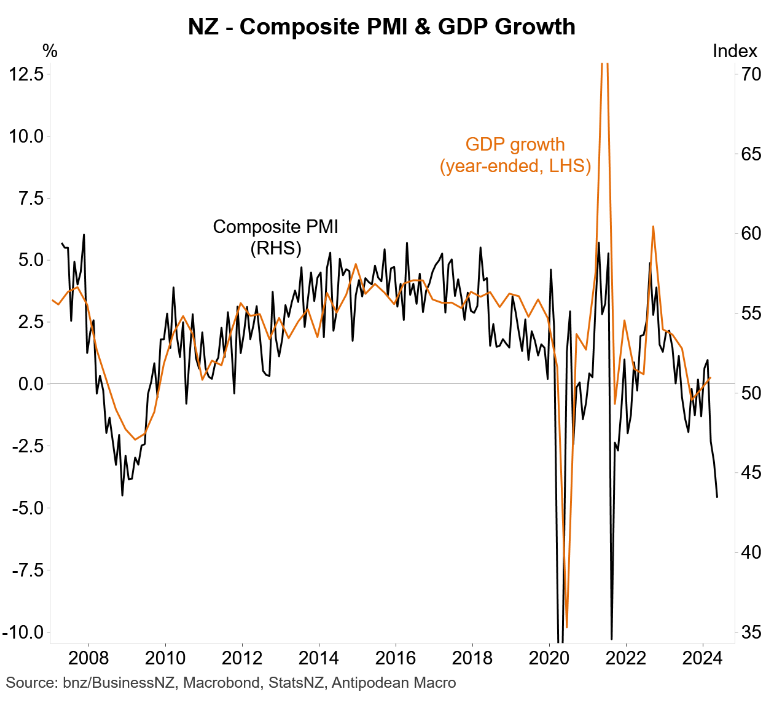

The leading indicators for the economy have deteriorated further, suggesting that per capita GDP fell sharply in Q2.

New Zealand’s composite PMI has collapsed:

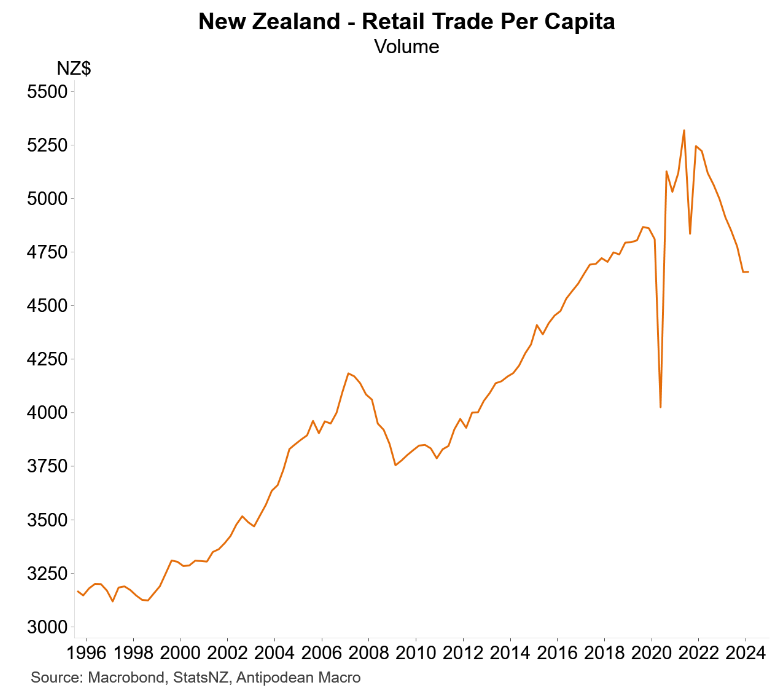

Per capita retail spending has also collapsed:

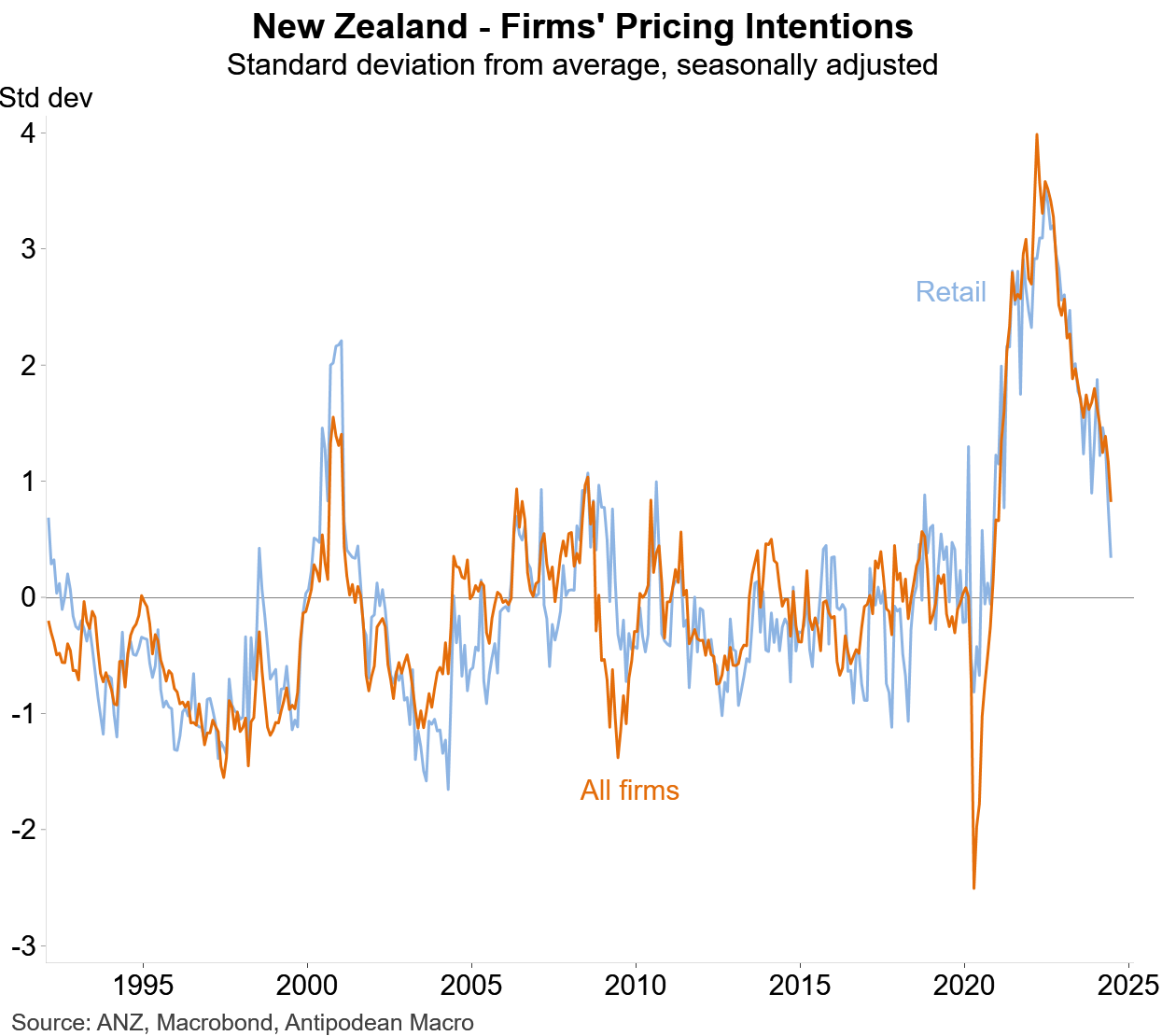

The deteriorating consumer economy has gutted pricing expectations amongst New Zealand firms, particularly retailers:

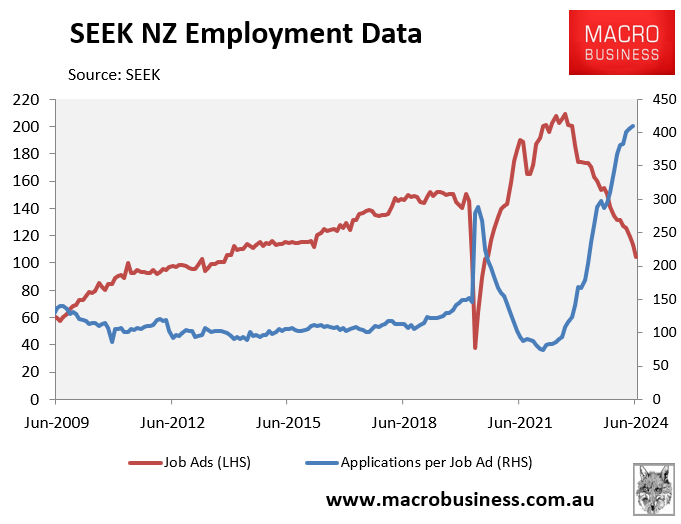

Meanwhile, New Zealand’s labour market is a mess, with job ads collapsing and the number of applicants per job ad rocketing to record highs:

In ASB’s Economic Weekly, chief economist Nick Tuffley said that the Reserve Bank’s focus should now shift from the risks of decreasing the official cash rate too soon to the dangers of keeping it too high for too long:

“We are hitting the point where the RBNZ’s worries should switch from the risks from cutting the OCR too soon to the risks of keeping it too high for too long. What we saw over the past week simply reinforced that the risks are shifting quickly”.

“It is time for the RBNZ to seriously consider cutting the OCR in our view, and if my team was the Monetary Policy Committee for the critical day of August 14 that is the way we would probably lean”.

Kiwibank’s First View publication made similar arguments, noting the following:

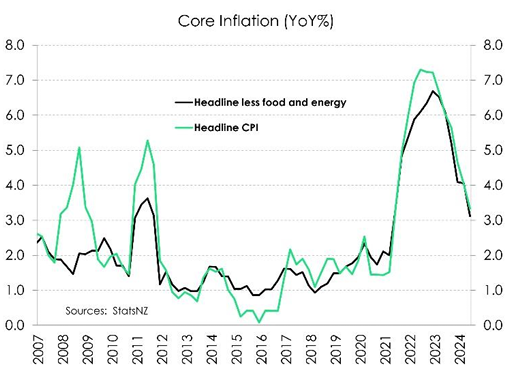

“Underlying price pressures are cooling, quickly. And the extraordinarily weak economic data of late cements the disinflation in core prices – faster than the RBNZ has forecast”.

“The RBNZ’s current growth outlook is proving optimistic. High frequency economic indicators point to a contraction in Q3 economic activity, against the RBNZ’s forecast of 0.3% growth”.

“With that likely comes higher unemployment and a faster easing in price growth than the RBNZ expected in May”.

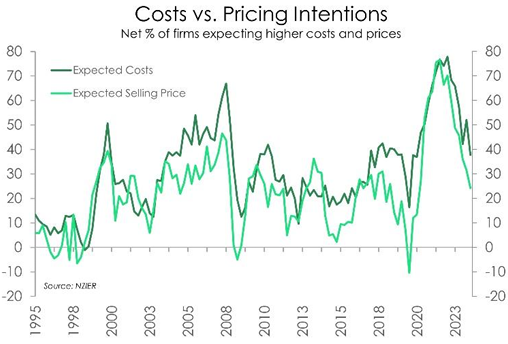

“Business pricing intentions have also weakened considerably, and slack is growing in the labour market. A slowdown in wage growth is key to quelling still-hot domestic price pressures”.

“Faced with these developments, we are growing in confidence that core inflation will settle within the RBNZ’s 1-3% target rate, sooner rather than later”…

“[This] supports our call for a rate cut in November”.

Most economists believe the first cut will occur in November, although a cut as early as August is possible.

Financial markets are pricing in a 50% chance of a 25 basis point cut in the official cash rate in August. An October cut is fully priced, and nearly three cuts are expected by November.

Banks have already begun to prepare for rate cuts by lowering mortgage and term deposit rates.