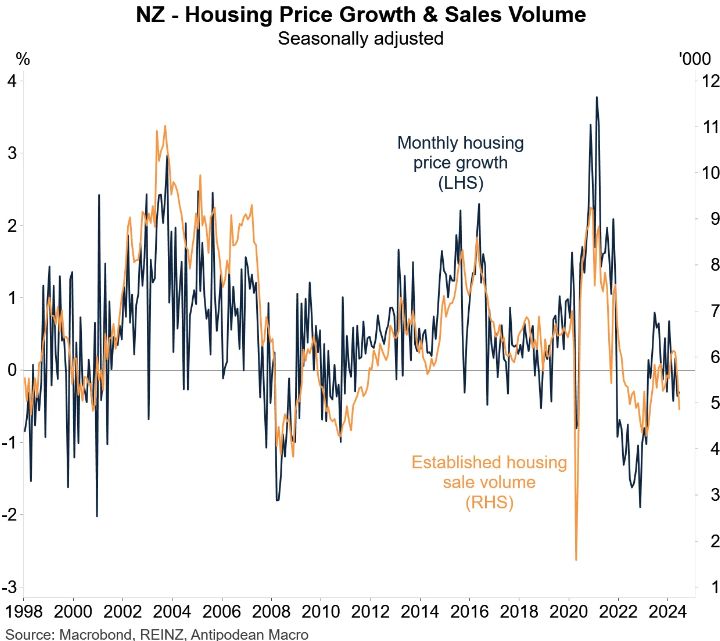

The latest house price data from the Real Estate Institute of New Zealand shows that prices and sales are falling once more after a brief period of rebound:

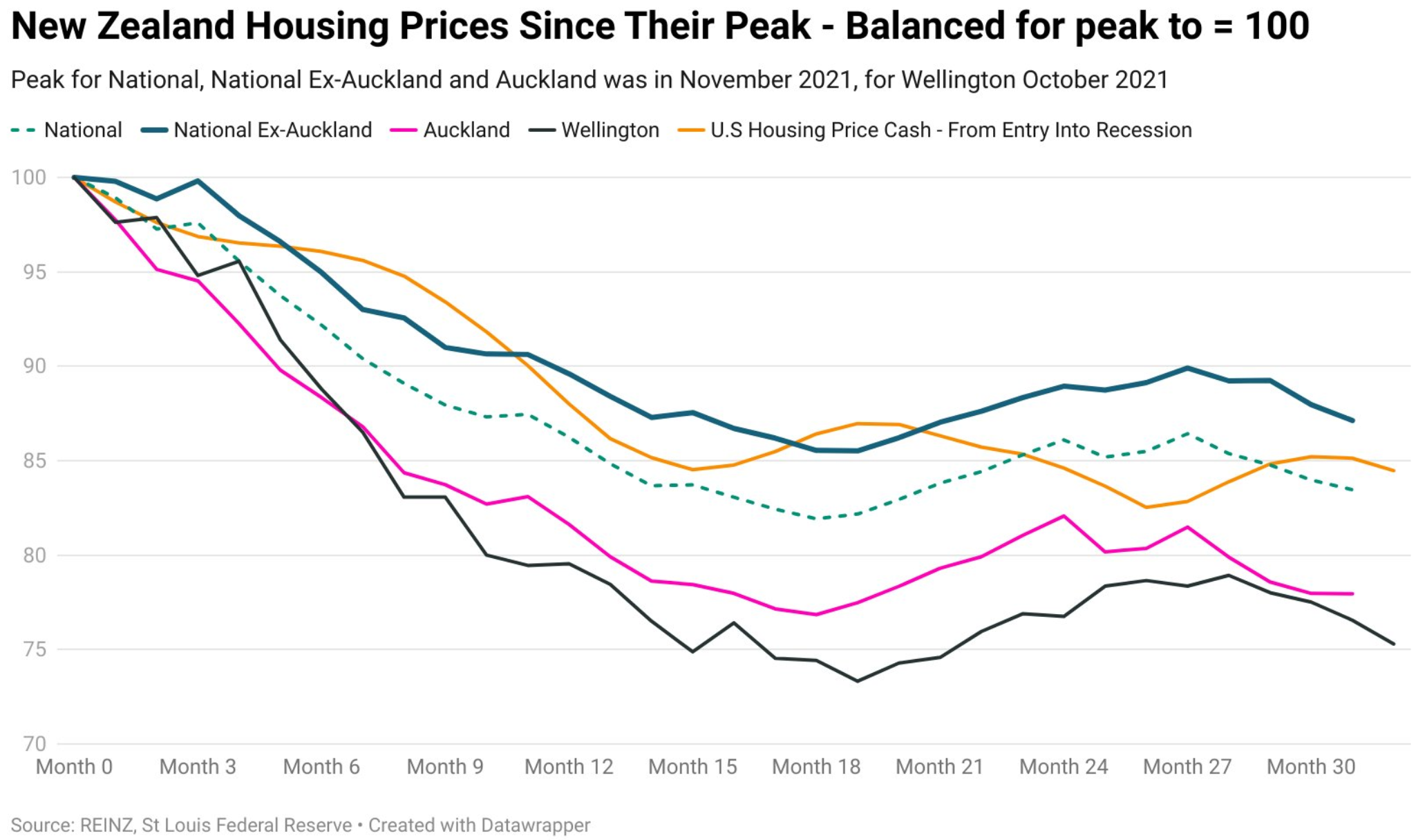

As illustrated in the next chart from Tarric Brooker, New Zealand house prices have now fallen by 16.5% from their peak, led by Auckland (-22.1%) and Wellington (-24.7%):

Source: Tarric Brooker

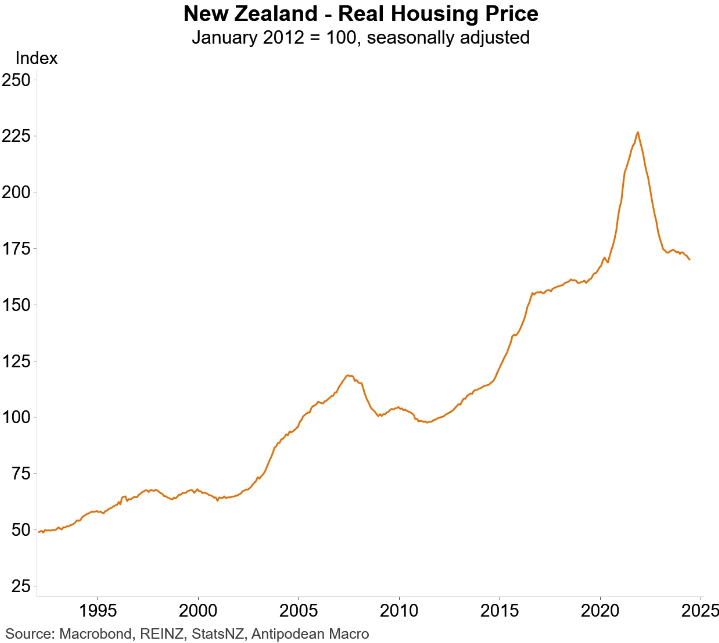

Justin Fabo at Antipodean Macro calculates that New Zealand home values have unwound all of their pandemic-related surge and are tracking at 2020 levels:

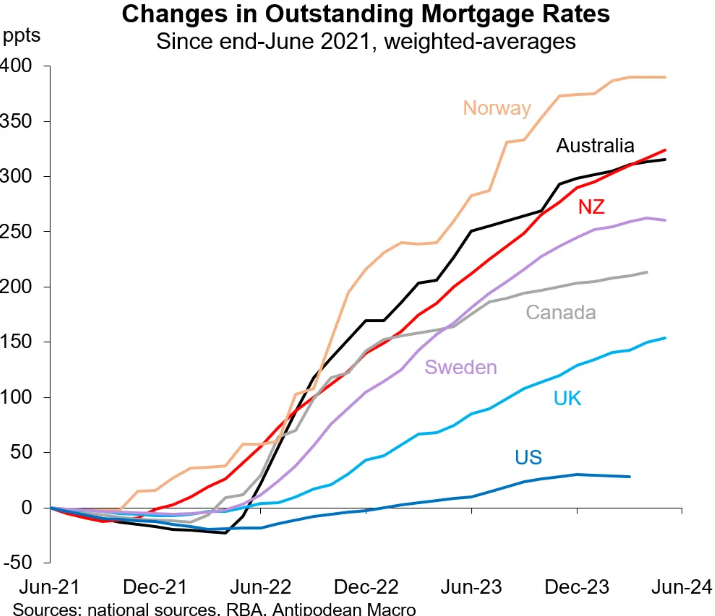

New Zealand has one of the tightest monetary policy settings in the world after recently overtaking Australia:

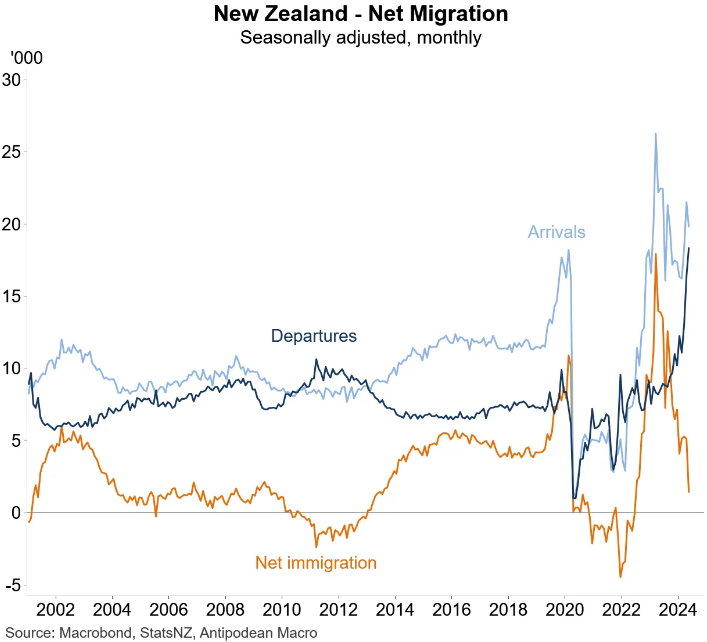

Therefore, restrictive monetary policy combined with the deeply recessionary economy and falling net overseas migration has snuffed out the housing rebound.

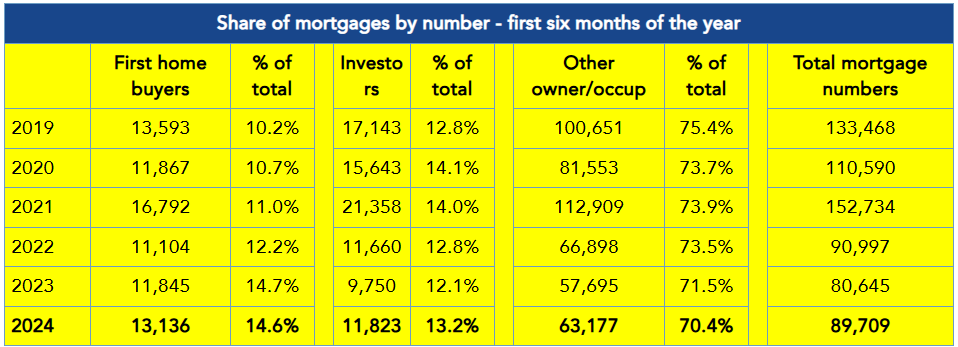

Data from David Hargreaves at Interest.co.nz shows that the number of new mortgages taken out in the first half of 2024 were the second lowest in five years and down massively from the heady days of 2019 to 2021:

Source: Interest.co.nz

“However we look at the latest six month figures overall though, the overwhelming impression is of a housing market bouncing along the bottom”, Hargreaves said.

“It will take meaningful interest rate cuts to kick start it again it appears. And even then in the short term this might not be enough if the economy continues to languish and the unemployment numbers keep moving up”.

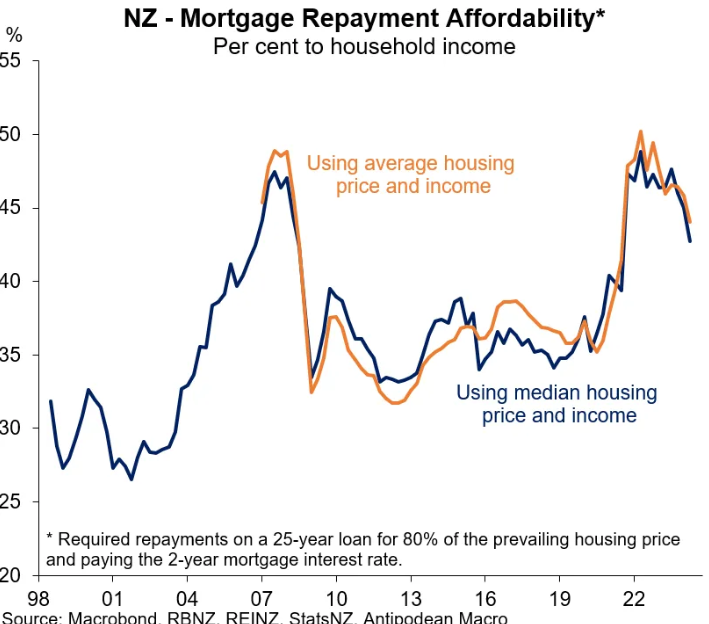

The big upside is that the lower prices have improved housing affordability somewhat and driven an increase in the share of first home buyers.