It is becoming increasingly clear that monetary conditions in New Zealand are too tight following the Reserve Bank’s 5.25% interest rate hikes, which have sent the economy into a tailspin.

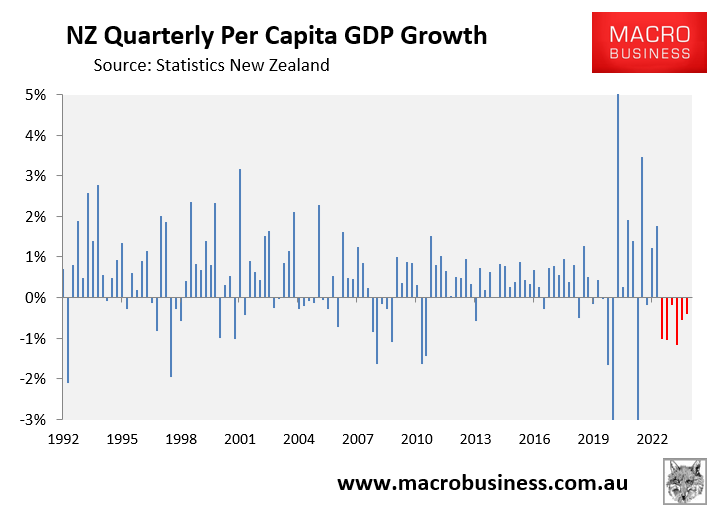

As of Q1 2024, New Zealand’s per capita GDP had plummeted by 4.3% from the late 2022 peak, following six straight quarterly declines:

Key macroeconomic data since Q1 has materially worsened, pointing to a deepening of the recession.

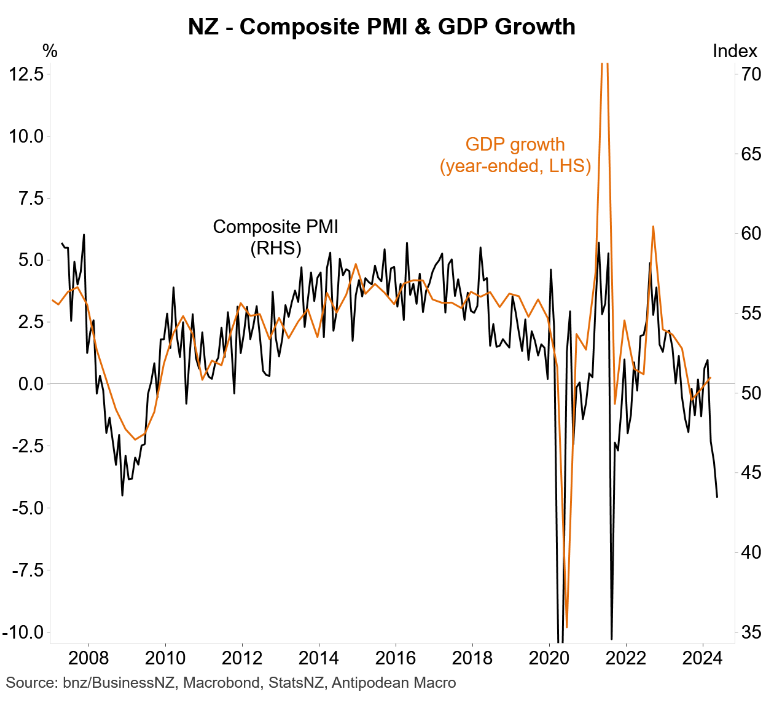

The forward-looking composite PMI has collapsed, pointing to a ghastly GDP print when the Q2 national accounts are officially released in September:

Data released on Tuesday, reported by Justin Fabo at Antipodean Macro, confirmed the deterioration of economic conditions.

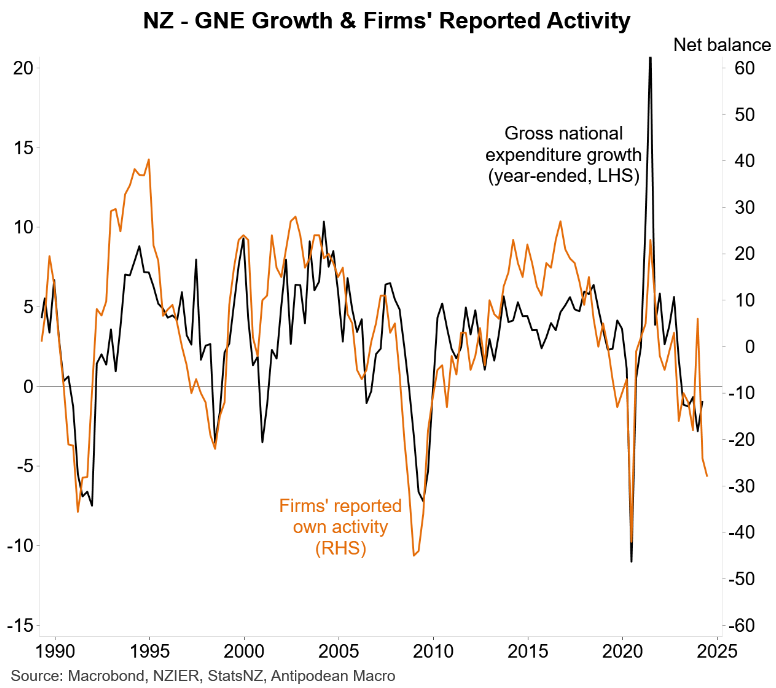

New Zealand businesses reported a sharp deterioration in their own activity in Q2, pointing to weakening economic growth:

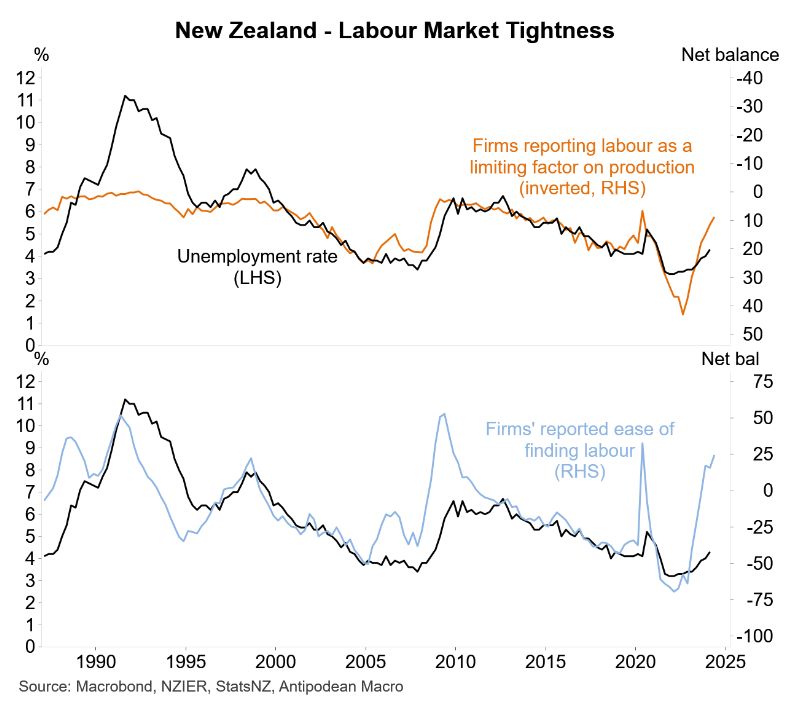

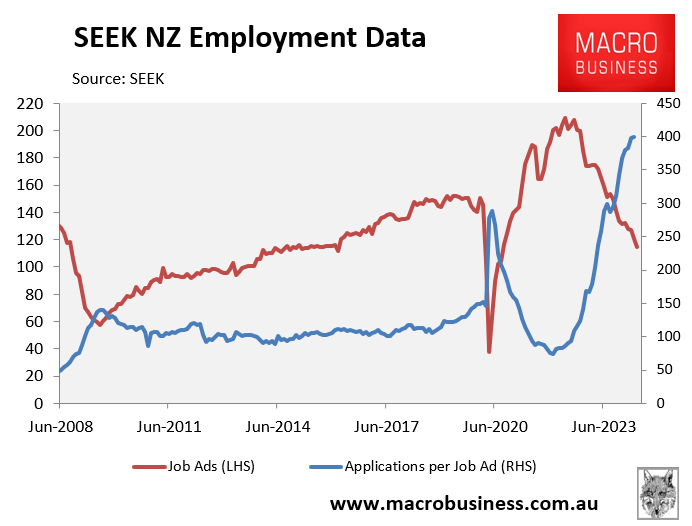

New Zealand firms also reported that they are finding it much easier to find both skilled and unskilled labour:

This follows a sharp decline in job ads alongside a massive increase in the number of applicants per job:

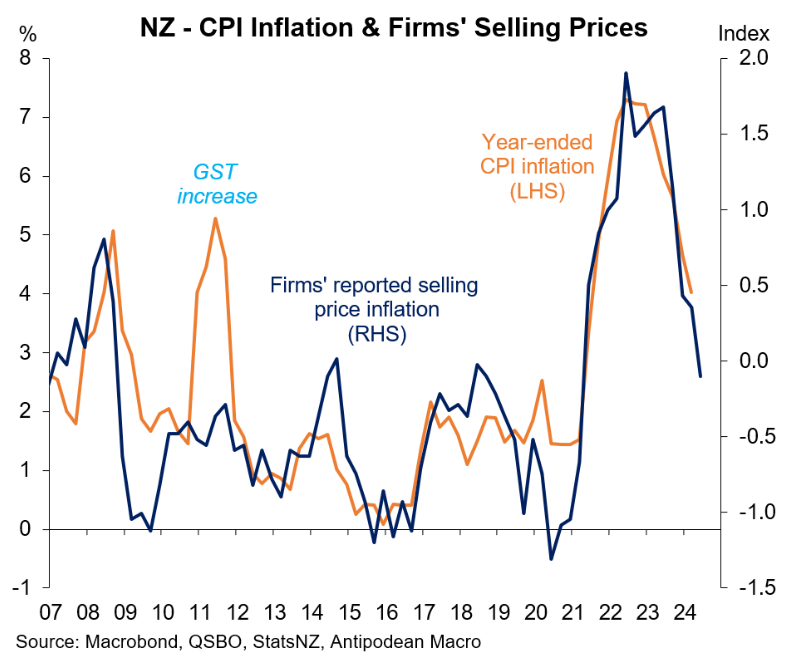

New Zealand firms also reported further moderation in average cost inflation and actual and expected selling price inflation in Q2, which points to lower CPI inflation:

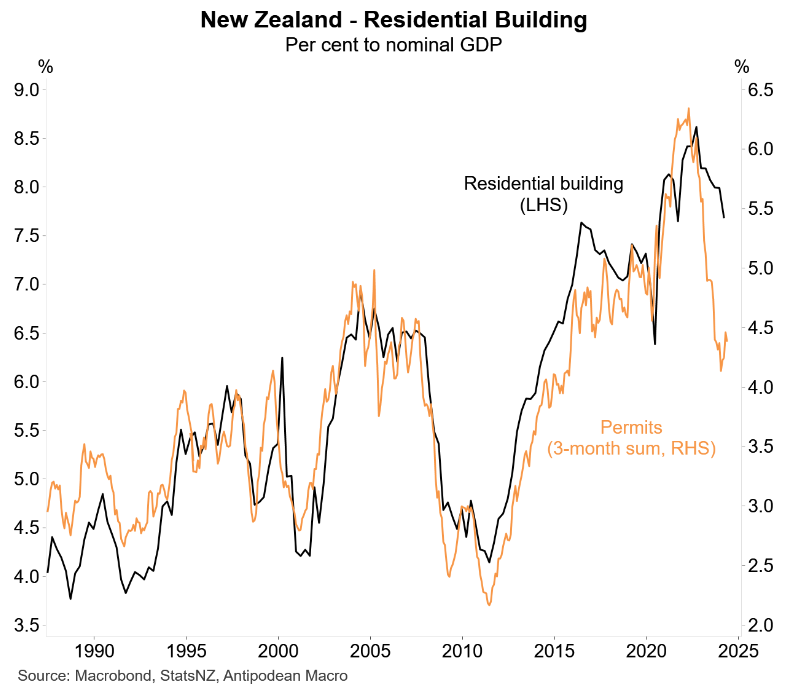

New Zealand residential building activity is also falling alongside house prices.

The next Reserve Bank of New Zealand board meeting will be held on 10 July.

Expect to see the Reserve Bank clear the path for cuts to the official cash rate to stem the deepening recession.

While the Reserve Bank may not cut rates next week, it will likely shift aggressively to a dovish stance in anticipation of a cut at the following board meeting in late August.