Independent economist Tony Alexander has published a detailed report on New Zealand’s economy and labour market, which is based in part on his latest business survey.

Barely any jobs are being created at the same time as New Zealand’s population is growing strongly via immigration. And gauges of labour market plans and concerns show a clear shift in the balance of bargaining power from employees to employers.

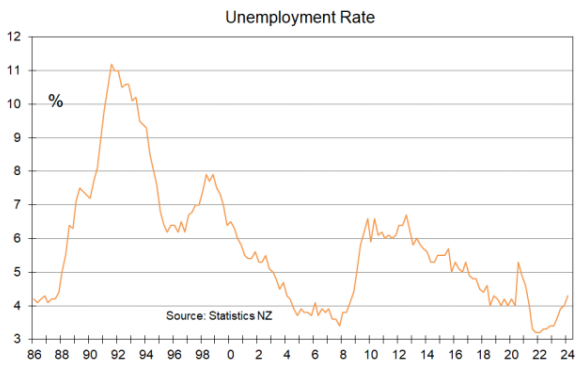

Accordingly, Alexander expects New Zealand’s unemployment rate to jump to between 5% and 6% next year.

Clearly, the Reserve Bank needs to cut the official cash rate urgently from its current highly restrictive level of 5.50%.

Below is Tony Alexander’s latest report.

In response to economic weakness stemming from the Reserve Bank’s fight against the inflation they created over 2021–22, the labour market in New Zealand is weakening.

In fact, we have essentially had no net jobs growth since the middle of last year, and the rise in the unemployment rate from 3.2% to 4.3% is likely to continue through to somewhere between 5% and 6% next year.

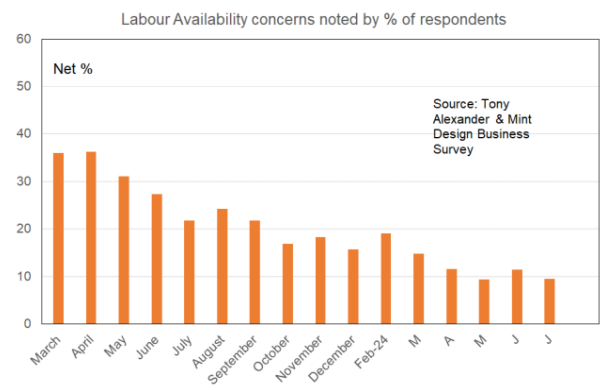

From the monthly Business Survey I run with sponsorship from Mint Design we gain some insight into how businesses are responding to the easing of labour market conditions.

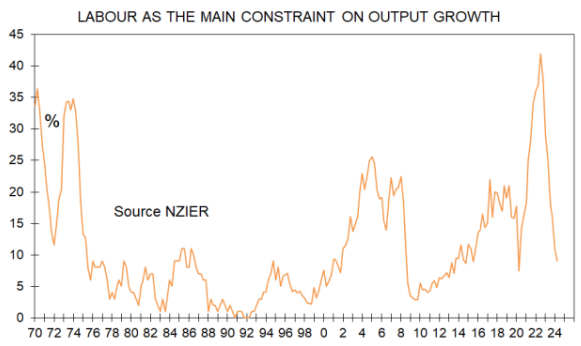

Up until a year or so ago, these conditions were exceptionally tight. In the NZIER’s Quarterly Survey of Business Opinion, a record net 42% of businesses in mid-2022 said the main reason they cannot increase output is not enough staff.

That dropped to 18% a year ago and now sits at just 9% which is as good as bang on the average reading for this measure since 1970.

My survey shows that a net 10% of firms this month consider labour availability to be a concern.

Last month, the reading was 11% and six months ago it was 19%. These results suggest the much watched NZIER number will decline again when the September quarter results are released in a couple of months time.

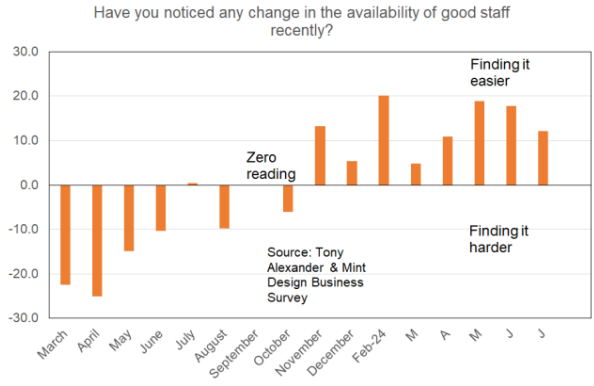

Backing this result up, a net 12% of businesses report that good staff are relatively easy to find. The main change in this measure was at the turning of the year.

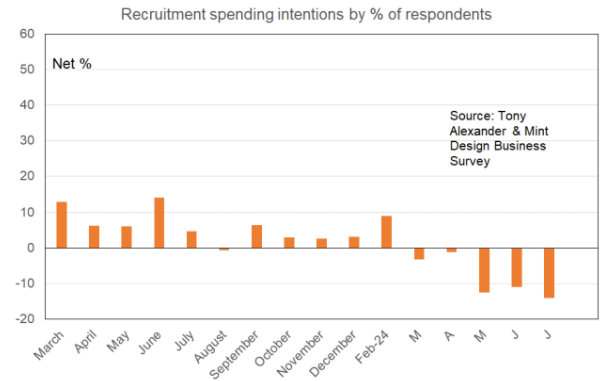

A net 14% of firms now say they will reduce spending on recruitment in the near future. The trend in this measure is down but not achingly so.

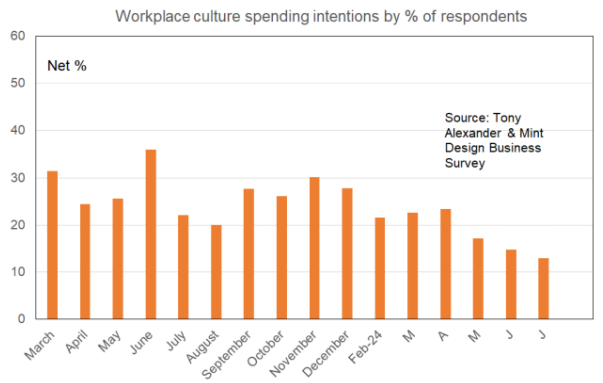

Spending on workplace culture is going down the same path as intentions of spending on climate change – downward. A net 13% of businesses plan more workplace culture spending as compared with 15% in June and 22% six months ago. The trend is firmly down.

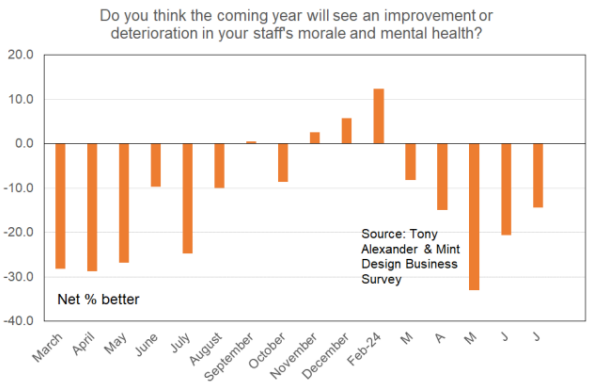

These spending plans are falling despite expectations that workplace mental health/culture will deteriorate in the coming year. Interestingly the net 14% result for this measure is an improvement from 33% two months ago but it is hard to see why this would be the case.

Unsurprisingly, in light of the weakening labour market there is a strong downward trend in business plans for paying people more. This is good for inflation and exactly what the Reserve Bank needs to see.

Only a net 1% of businesses plan raising remuneration spending compared with a net 12% in June and 35% six months ago. This is another one of the many measures from my five monthly surveys which show the strong extra deterioration in the NZ economy over the first half of this year.

It is this hastened deterioration which is causing predictions of monetary policy easing to be brought forward in time.