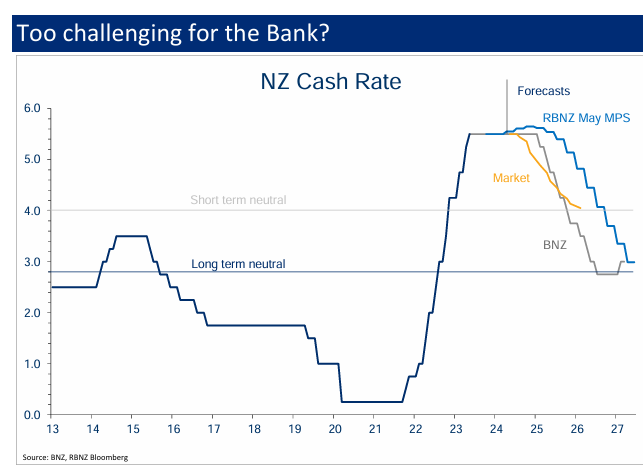

Kiwibank and Bank of New Zealand (BNZ) economists believe that the Reserve Bank of New Zealand needs to commence an interest rate cutting cycle to avoid a hard economic landing.

In a note released on Monday, Kiwibank said that the Reserve Bank’s monetary policy statement in May was far too bullish, with “everything from their tone, forecasts, and updated OCR track, more hawkish than expected”.

“The biggest shock of all was that the committee had discussed lifting rates”, a view Kiwibank strongly disagreed with.

“Any talk of hikes now would be overkill. The data has clearly turned. Actually, it turned a very long time ago, at the end of 2022. And the economy is becoming weaker by the day”.

“Rate cuts should be considered”, Kiwibank argues. “We would recommend a cut in August… but we’re more concerned about the health of many businesses and households. We shall keep up the good fight”.

A separate note from BNZ economists argues that “the economy is now looking well and truly derailed”.

“Front of mind will be last week’s Quarterly Survey of Business Opinion which provided more evidence that the current recession will roll on for a while longer, the unemployment rate will rise rapidly and, most importantly, business intentions to raise prices are declining at pace”.

“But it’s not just the QSBO that’s telling us this. The evidence from all quarters is now overwhelming”.

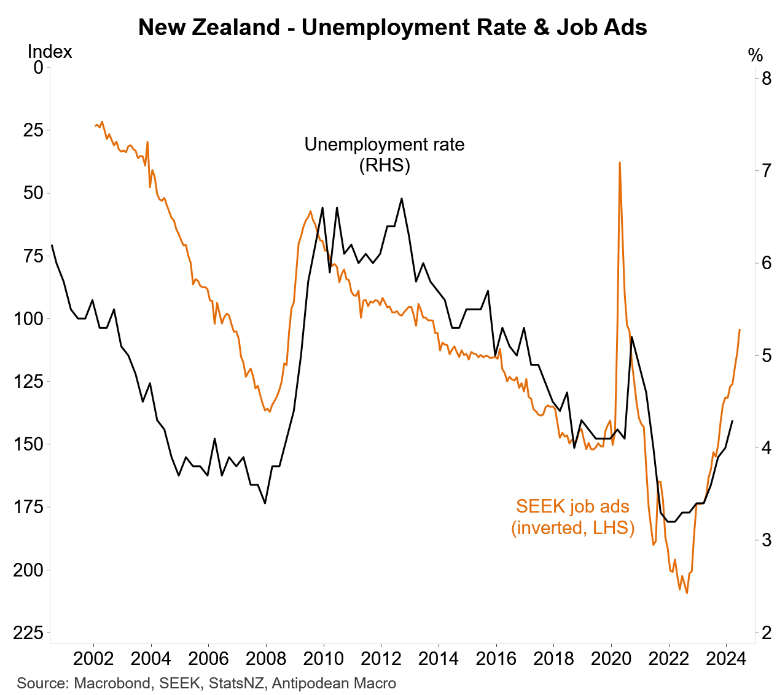

The case for a rate cut firmed following the latest employment report from SEEK, which showed that the number of job ads newly advertised on the portal plunged 8.2% in June, with the trend deteriorating.

The next chart from Justin Fabo at Antipodean Macro plots SEEK’s job ad survey against New Zealand’s unemployment rate:

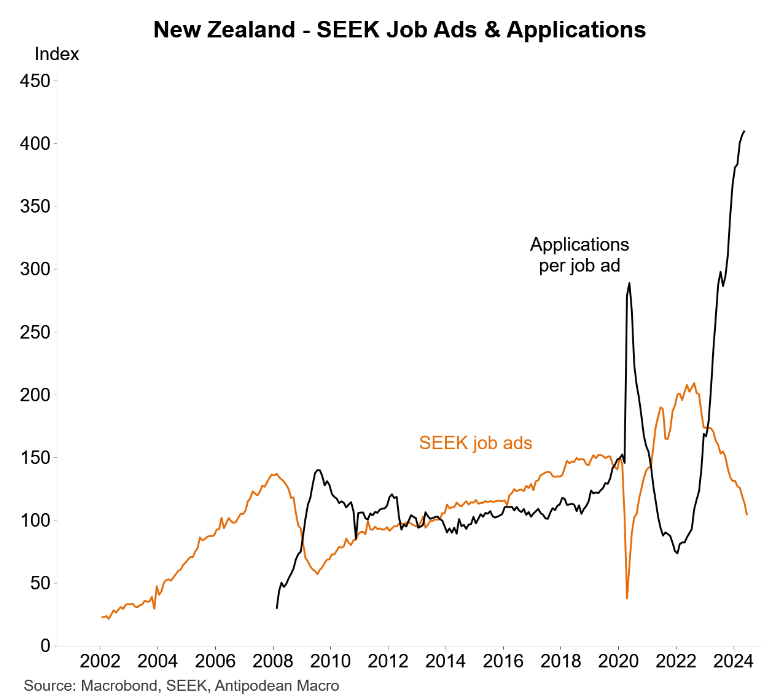

The number of applicants per job advertisement is also off-the-charts:

Justin Fabo commented that the Reserve Bank “should be getting very uncomfortable” following this data.

That is an understatement.