New Zealand’s Q2 Consumer Price Index (CPI) was released on Wednesday.

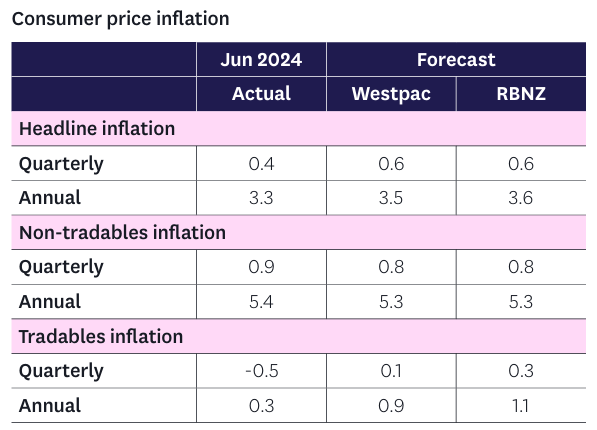

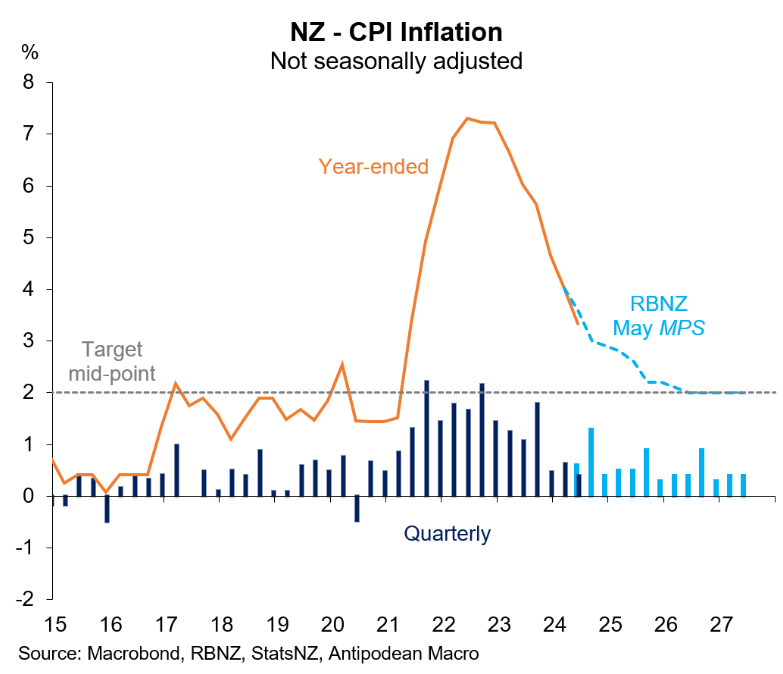

Inflation was lower than expected in the June quarter, with consumer prices rising by 0.4%. That saw the annual inflation rate slow to 3.3% (down from 4.0% in the year to March).

Source: Westpac

The print was below the Reserve Bank’s forecast of 0.6% QoQ:

Lower tradables inflation (-0.5% qtr / +0.3% yr) drove the fall in the CPI and was much weaker than economists or the Reserve Bank anticipated. That is consistent with weak household spending and is likely to continue.

However, domestic inflation (+0.9% qtr / +5.4% yr) continues to be sticky, driven by strong rises in road user changes, rents, insurance charges, and energy prices.

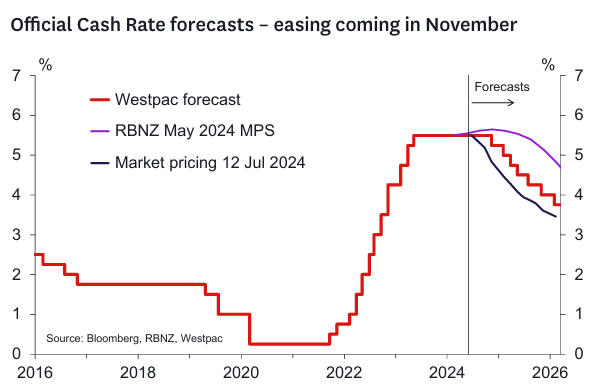

Even so, banks are now predicting that the Reserve Bank will cut the official cash rate (OCR) as early as August 2024.

ANZ had previously predicted that OCR cuts would begin in February 2025. However, on Wednesday, it revised its forecast: “We have brought forward our forecast timing of the first 25bp [basis point] cut in the Official Cash Rate (OCR) to November, rather than in February”.

ANZ said rate cuts would more likely start earlier than later and that we would see a series of cuts to the OCR all the way down to 3.5% (from 5.5% currently).

ASB tipped rate cuts could begin next month: “The remaining OCR decisions over 2024 are effectively ‘live’ and cuts could start as soon as next month”.

Kiwibank also believes that rate cuts are imminent: “We still think inflation is on track to fall below 3% in the current (September) quarter. And today’s progress on core inflation has us growing in confidence that the RBNZ’s 2% target will be achieved in 2025. Rate relief is on its way”.

Finally, Westpac now predicts that the first OCR cut will arrive in November:

“We now expect the RBNZ to cut the OCR by 25 bp at the November Monetary Policy Statement. Thereafter we expect 25 bp cuts at each of the first three meetings of 2025 (February, April, and May) which will take the OCR to 4.5% by mid-2025”.

“Thereafter we think the RBNZ will take a more cautious data dependent approach and reduce the OCR in 25 bp increments at the August and November 2025 Monetary Policy Statements bringing the OCR to 4% by end 2025”.

“We see a final easing to 3.75% in early 2026 where we see the terminal rate”.

The New Zealand economy is mired in a deepening recession with a rapidly deteriorating labour market.

The Reserve Bank needs to cut rates urgently to stem the bleeding.