Independent economist Tony Alexander has written a detailed note on New Zealand’s stagflation economy and its implications for interest rates.

Although domestic inflation remains stubbornly high, Alexander believes that the steepening recession will prompt the Reserve Bank to commence its easing cycle in November, if not earlier.

Statistics New Zealand released the June quarter inflation data yesterday and what they showed is inflation falling to its slowest pace since June quarter 2021.

Over the June quarter the basket of 649 goods and services tracked by SNZ increased in cost by 0.4%. This is an unusually low rise and the lowest since the start of 2019 if we exclude the immediate pandemic period.

Back in 2019 there were deep worries about deflation (falling prices), and this led the Reserve Bank to cut the cash rate from 1.75% to a then record low of 1.0% before the pandemic sent it down to 0.25%.

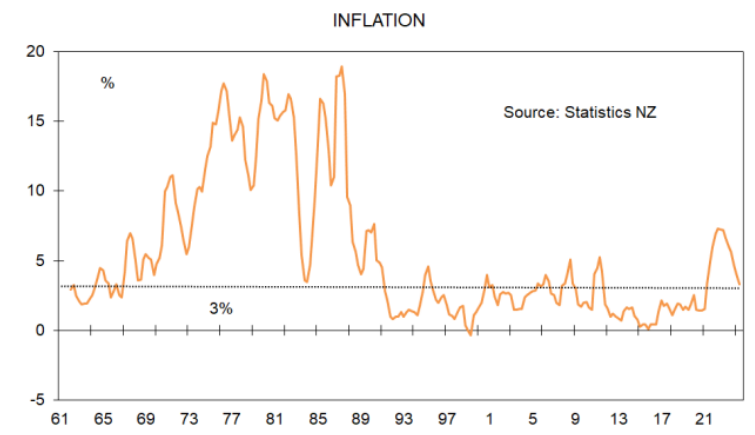

The annual inflation rate now sits at 3.3% from 4% in the March quarter, 6% a year ago, and the 31 year peak of 7.3% hit exactly two years ago.

Inflation soared over 2021 to mid-2023 as the Reserve Bank oversaw excessively loose financial conditions. They failed to sufficiently factor into their analysis the large easing of fiscal policy by the Labour government, and did not pay enough attention to data showing soaring house prices, strong economic growth, and rapidly falling unemployment when they left conditions too easy through 2021.

Now monetary policy is belatedly tight, and the results of their delayed tightening are clear in the weak state of the economy.

The question is whether the weakness and business failures they have engineered following their incompetence is enough to get inflation locked back into the 1%-3% target range.

To get a feel for that we economists don’t just look at the headline inflation numbers of 0.4% for the quarter and 0.6% and 0.5% for the previous two quarters (2% annualised). We also don’t just look at the year-ended rate of 3.3%. We examine measures which try to extract factors we think won’t persist in order to see what true underlying inflation is doing.

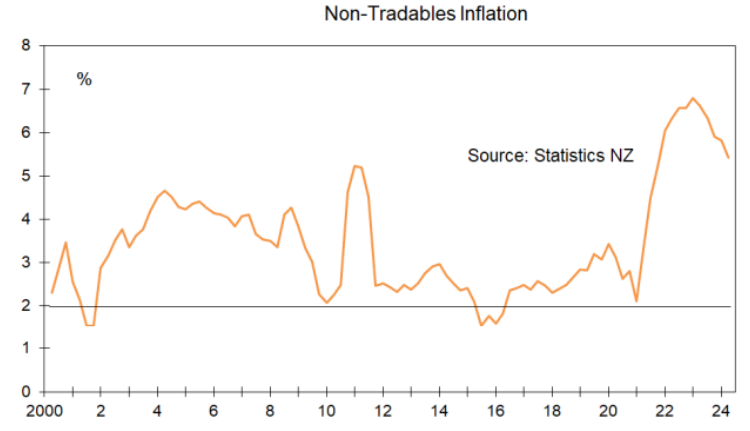

One measure is called non-tradeables inflation. This involves the 60% or so of the 649 items which are not traded across the border. This measure rose 0.9% in the June quarter after rising 1.6% in the March quarter and 1.1% in the December quarter.

The annual non-tradeables inflation rate is now 5.4% from 5.8% three months ago and 6.6% a year back.

These numbers are all too high and could not allow one to say that when you strip away the impact of exchange rate changes and fluctuations in international commodity prices that inflation is comfortably headed to the 1-3% range on a sustained basis.

Within the NZ economy inflationary forces are still too strong. Businesses are still raising their prices too much and it doesn’t matter if they are pushed to do so by rising costs. As long as cost-plus pricing continues monetary policy will not be eased.

It is worth noting, however, that since the data became available in 2000 the annual rate of tradeables inflation has averaged 1.4% compared with 3.5% for non-tradeables inflation. We have only had inflation averaging 2.6% since 2000 because of low inflation offshore. If that does not continue then you have to allow for higher than previous annual inflation here and that means higher than otherwise interest rates.

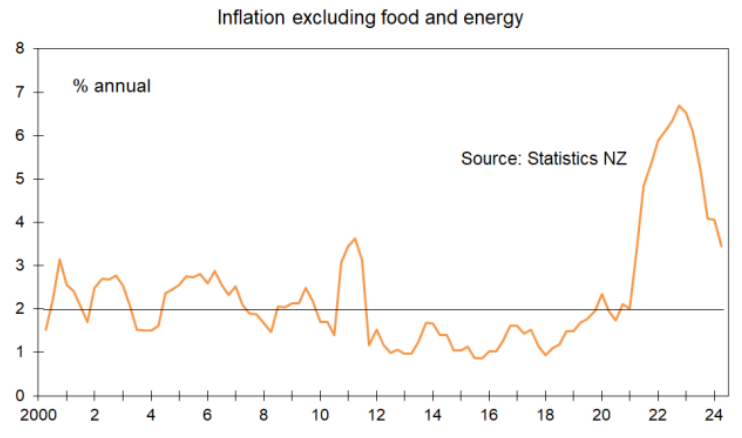

Another way of trying to gauge underlying inflation is to do what many analysts do in the United States and exclude food and energy. This measure rose just 0.3% in the quarter to sit 3.4% up from a year ago. Three months ago this annual rate was 4.1% and a year back was 6.1%. There is progress but not enough.

We also can look at a measure of inflation which excludes the top 10% of items rising in price and the top 10% falling in price.

This trimmed mean measure rose by 0.6% in the quarter and 3.6% on a year ago from 4.5% last quarter and 5.8% a year earlier. It shows the same thing as the other underlying measures.

Overall the data series we have available tell us that the rate of inflation in New Zealand is headed in the right direction and we can be confident that the 1-3% range will soon be achieved.

We can be especially confident of this because the flow of unusually weak economic data gets greater and greater.

The Business NZ-BNZ Performance Management Indexes for services and manufacturing are plumbing new depths more consistent with worsening recession than the end of a tight period.

Job advertisements are running 35% down from a year earlier.

Businesses on average report no plans for boosting staff numbers whilst indicating also that they plan spending less of machinery and equipment as well as new buildings.

The number of consents being issued for new dwellings to be built is running 14% down from a year earlier and still falling.

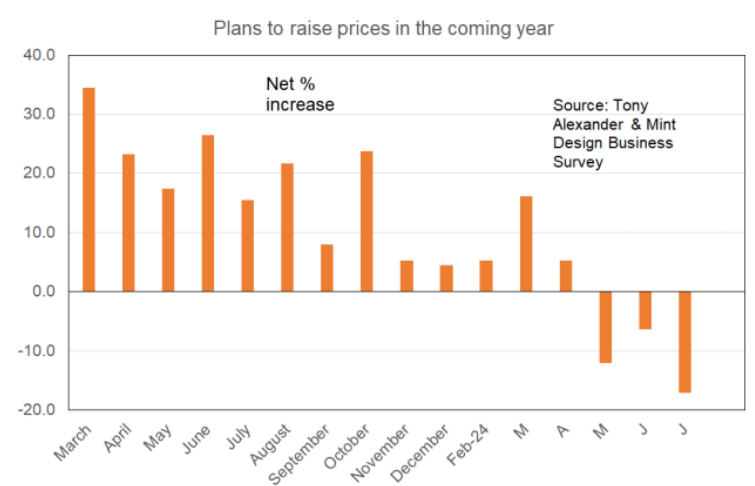

I can also cite many measures from my five monthly surveys but here is the one which is most up to date and of strong relevance. My latest Business Survey sponsored by Mint Design has just been written up and results will be released in a week or so.

The survey shows that a record net 17% of respondents do not plan raising their selling prices over the coming year.

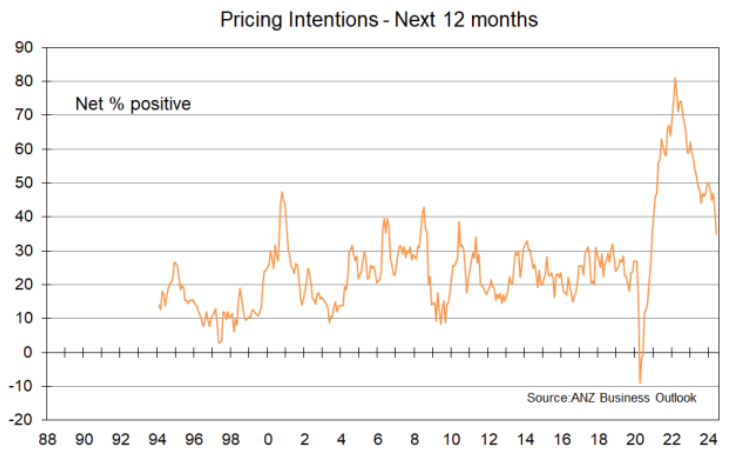

This outcome suggests that when the ANZ Business Outlook Survey is released in a fortnight it will show a further decline in the net proportion of businesses planning to raise their selling prices in the coming year.

This measure needs to fall appreciably below the three decade average of +25% for the Reserve Bank to radically shift its predicted official cash rate track.

My view remains that the first cut in the official cash rate will come in November, but with an increasing chance given the deepening woe in the economy that the first decline will come earlier than that – maybe next month though that feels optimistic.