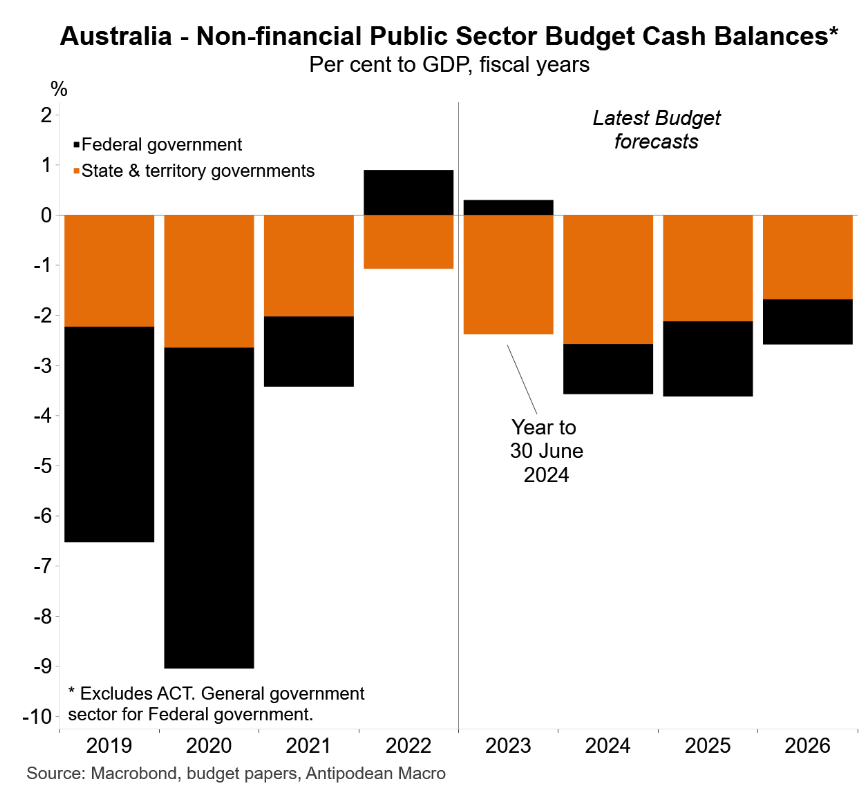

Earlier this week, Justin Fabo at Antipodean Macro published the below chart showing how Australia’s consolidated budget deficits will remain in deficit for as long as the eye can see, driven by the state governments:

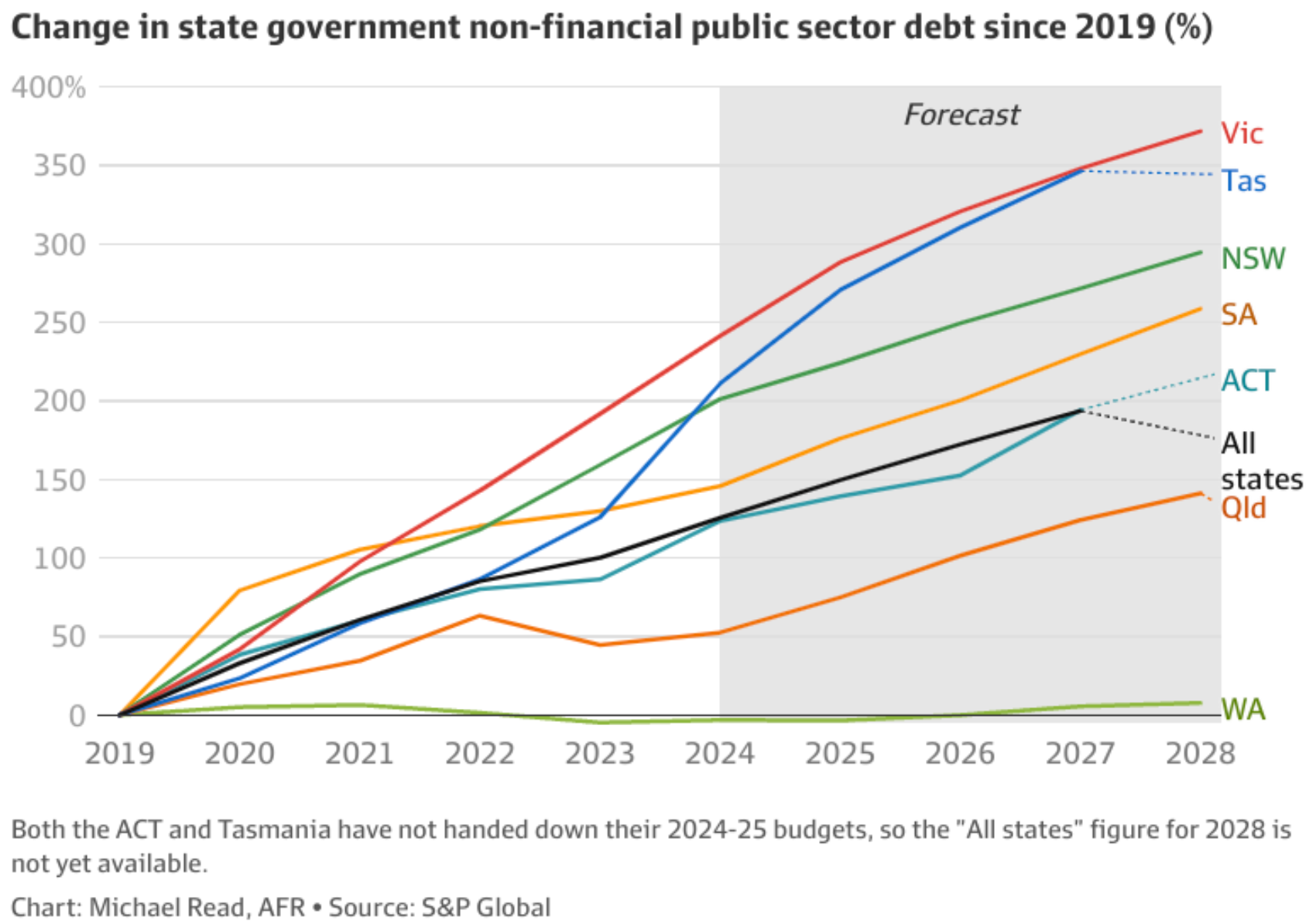

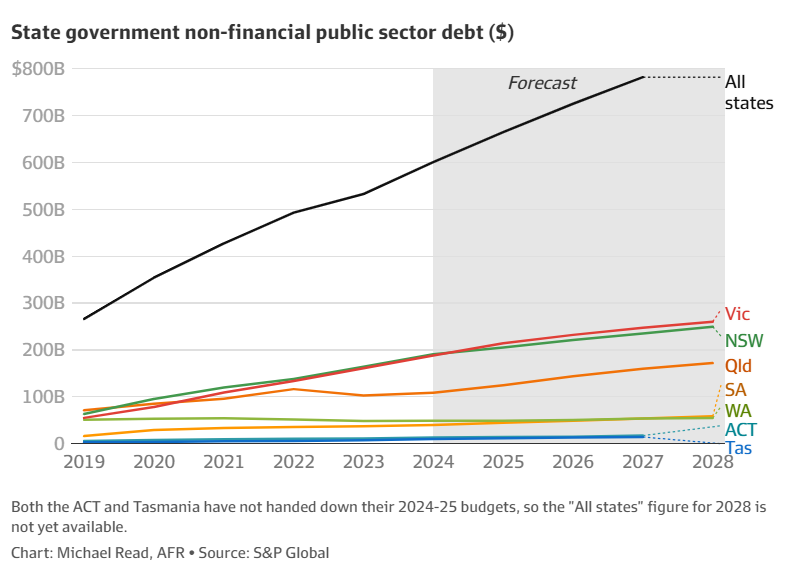

On Wednesday, Michael Read at The AFR reported analysis from ratings agency S&P Global showing that Australia’s state governments are recording some of the largest deficits in the developed world, with state debt on track to triple by 2028.

S&P Global warns that the collective debt bill could hit $800 billion in 2028, up from $266 billion in 2019.

“Relative to pre-pandemic levels in 2019, total gross state debt across the country had doubled by 2023, and it could triple by 2028”, S&P Global analyst Martin Foo said.

Infrastructure investment and a decline in fiscal restraint are what are driving the spending spree, with Victoria’s debt rising the most since 2019.

By 2028, Victoria’s non-financial public sector debt is expected to hit $260 billion, 372% above pre-pandemic levels.

NSW’s debt is expected to be 295% higher than pre-pandemic levels in 2028 at $250 billion.

S&P Global found that Australia’s subnational government deficits are among the largest of all developed countries.

“This is partly because Australian states (in common with Canadian provinces) are not constrained by firm fiscal rules, meaning they have more flexibility to ramp up investment”, Foo said.

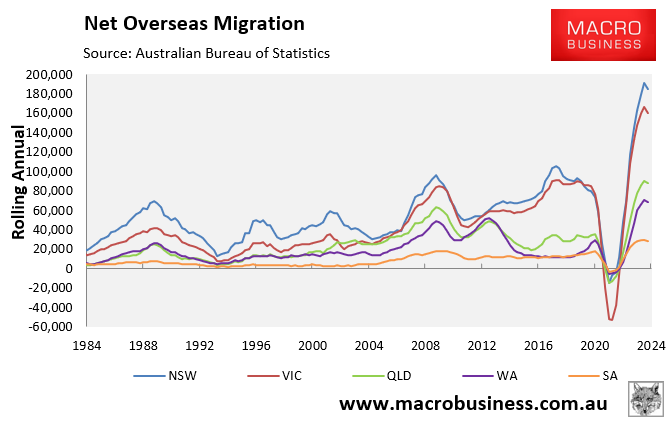

These migrants require infrastructure, housing, and services, the costs of which fall primarily on the state governments.

As I’ve previously stated, the majority of the financial benefits of net overseas migration flow to the federal government, which collects more than 80% of the nation’s tax revenue and receives the increased personal and corporate taxes that come with a larger workforce and more economic activity.

In contrast, the costs of serving the growing population, such as the need for additional infrastructure, social housing, schools, and hospitals, are borne primarily by states.

It is, therefore, unsurprising that Victoria and New South Wales are leading the nation’s debt binge, given they are also receiving an unprecedented volume of migrants:

Over the last two calendar years, Victoria has received 293,000 net overseas migrants and New South Wales has received 330,000 net overseas migrants.

As a result, these states are drowning in debt, despite selling off the majority of public assets, which has resulted in increasing user fees or ‘private taxes’ for residents.

Both states should team up and demand $50,000 from the federal government for every migrant that settles in their jurisdiction to cover the costs of infrastructure and services.

If the federal government wishes to run a mass immigration policy, it must share the financial benefits and costs with the states.