When the National Disability Insurance Scheme (NDIS) was first implemented in 2016, I warned that it would draw an army of scammers and middlemen looking for a piece of the multibillion-dollar honey pot on offer.

We witnessed comparable rorting in the private vocational education and training (VET) and pink batts schemes, as well as in childcare subsidies.

In 2018, the National Disability Insurance Agency (NDIA), which runs the NDIS, established a 100-officer fraud task force to investigate over 500 allegations of fraud or “sharp practice”, including cases where tens of thousands of dollars were “syphoned” from support packages.

Social Services Minister Dan Tehan stated at the time, “We are putting criminals on notice, you come after the NDIS and we will come after you”.

Criminal syndicates were also revealed to have syphoned millions of dollars out of the NDIS.

By 20223, little had changed, with Australian Criminal Intelligence Commission boss Michael Phelan calling for a new multi-agency taskforce to combat organised crime’s abuse of the NDIS.

Phelan estimated that as much as 15% to 20% of the $30 billion that the NDIS cost in 2022 might have been misused.

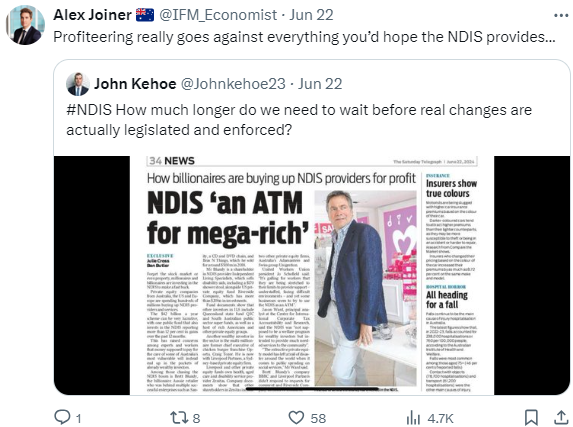

Last week, Murdoch Press reported that billionaires and private equity providers are piling into the NDIS seeking riches:

“Private equity companies from Australia, the US and Europe are spending hundreds of millions of dollars buying up NDIS providers and services”, the article reported.

“The flood of cash into the NDIS has raised concerns among experts and workers that money supposed to pay for the care of some of Australia’s most vulnerable will instead end up in the pockets of already wealthy investors”.

Jason Ward, principal analyst at the Centre for International Corporate Tax Accountability and Research, said the NDIS was “not supposed to be a welfare program for wealthy investors but intended to provide much needed services to the community”.

“The extractive private equity model has left a trail of disaster around the world when it comes to public spending on social services”, Ward said.

Alongside fraud and profiteering, the NDIS has also funnelled people with minor ailments into the system.

Last year, The SMH reported that children were the fastest-growing cohort of NDIS participants, with around 10% of boys aged five to seven now on the scheme.

Does anybody genuinely believe that one-in-ten young boys in Australia have ailments that require NDIS funding?

It was suggested that youngsters were being diagnosed with more severe autism than was warranted in order to increase their chances of receiving NDIS funding. This, in turn, has led to greater funding strain.

“It is without question that clinical behaviour has become biased towards making certain levels of an autism diagnosis in order to provide families a better chance at receiving the support they need through the NDIS”, Andrew Whitehouse, professor of autism research at the Telethon Kids Institute and the University of Western Australia, told The Australian last year.

Whenever the government sets up a privatised market with a gigantic pot of money on offer, rorting, misuse, and waste are inevitable.

Disclosure: I have a profoundly non-verbal autistic son on the NDIS.