Statistics Canada released its GDP estimate for Q1 2024.

The economy expanded at an annualised rate of 1.7%, lower than consensus estimates of a 2.2% increase and more than a full percentage point below the Bank of Canada’s forecast in its April Monetary Policy Report.

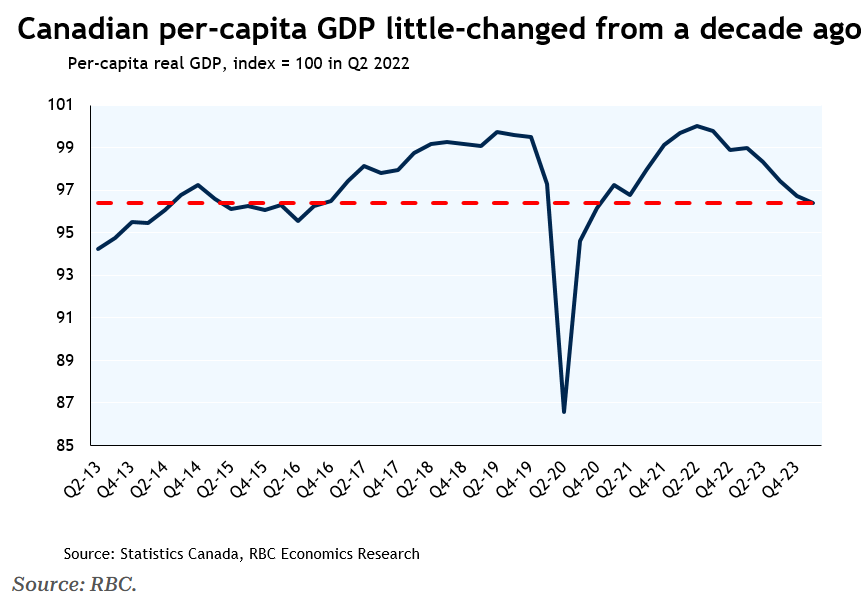

Canada’s GDP increase was also well below the 3.0% population growth rate. As a result, GDP per capita continued its downward trend in the March quarter and is now 3.5% below the peak recorded at the beginning of this monetary tightening cycle.

A decline of this magnitude has never been seen outside of a recession. It has also meant that Canada’s per capita GDP is little changed from a decade ago:

“Canadians just experienced a lost decade, with all progress made in the first 8 years wiped out within the past two”, noted Better Dwelling.

“A decline in per-capita GDP tends to mean a declining quality of life, as the same economic output is expected to carry more people”.

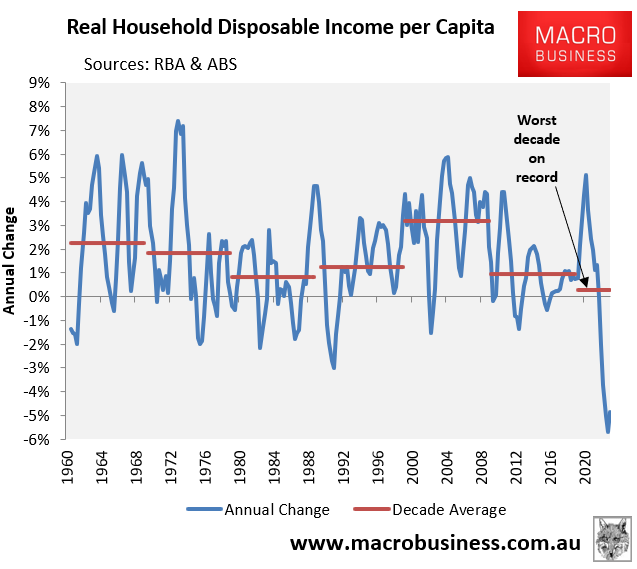

Similar forces are at play in Australia, which is also experiencing a deep per capita recession and falling living standards.

The past 15 years have delivered Australians the slowest growth in real per capita household disposable income on record:

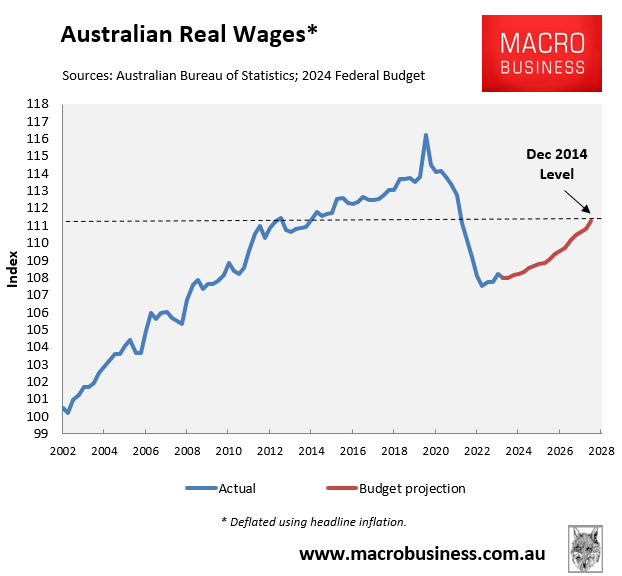

Australian real wages have collapsed to 2010 levels and even the federal budget’s forecasts suggest that real wages will only recover to December 2014 levels by mid-2028:

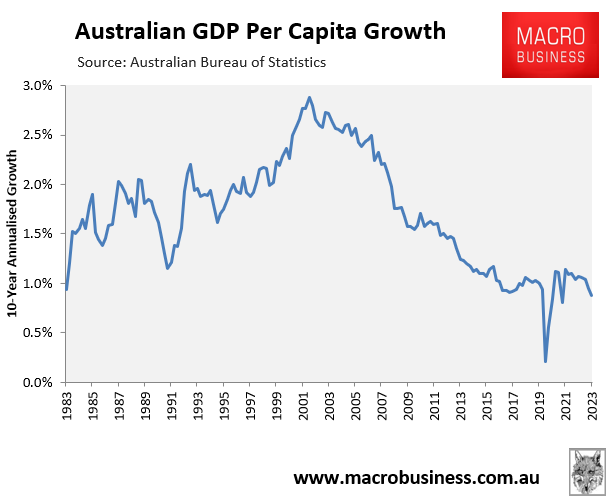

Australia’s per capita GDP growth is also tracking at its lowest rate in decades outside of the pandemic lockdown:

The problem is that Canada and Australia have switched to population-led growth models that have starved both nations of capital deepening investment.

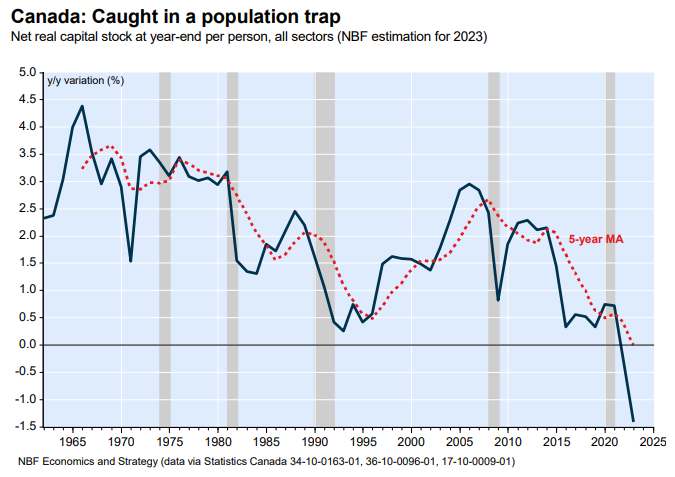

Accordingly, Canada’s productivity growth has suffered from capital shallowing as immigration-driven population growth has outrun business, infrastructure, and housing investment:

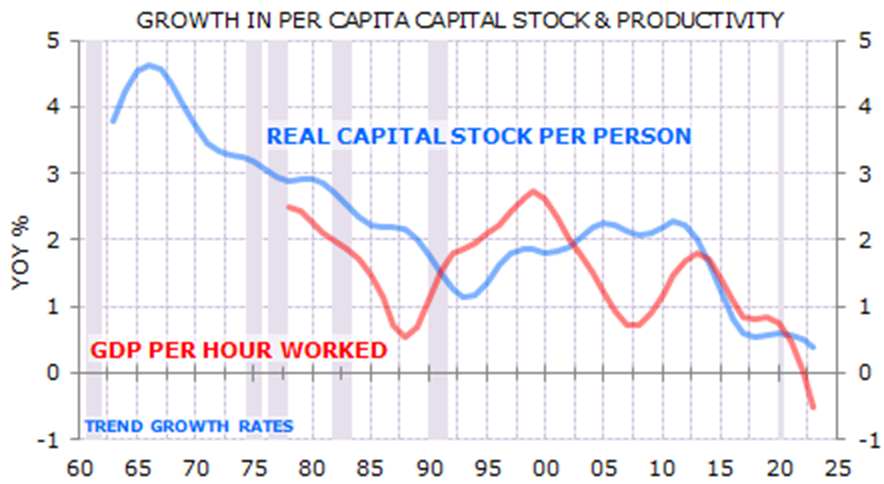

The same situation has occurred in Australia, where the real-capital stock per person has collapsed, wrecking productivity:

The end result is that the living standards of Canadian and Australian residents are falling at a record rate.