The Bank of Canada (BoC) cut its policy rate by 25 basis points to 4.75%, becoming the first G7 central bank to begin an easing cycle.

Governor Macklem said it was “reasonable to expect further cuts”.

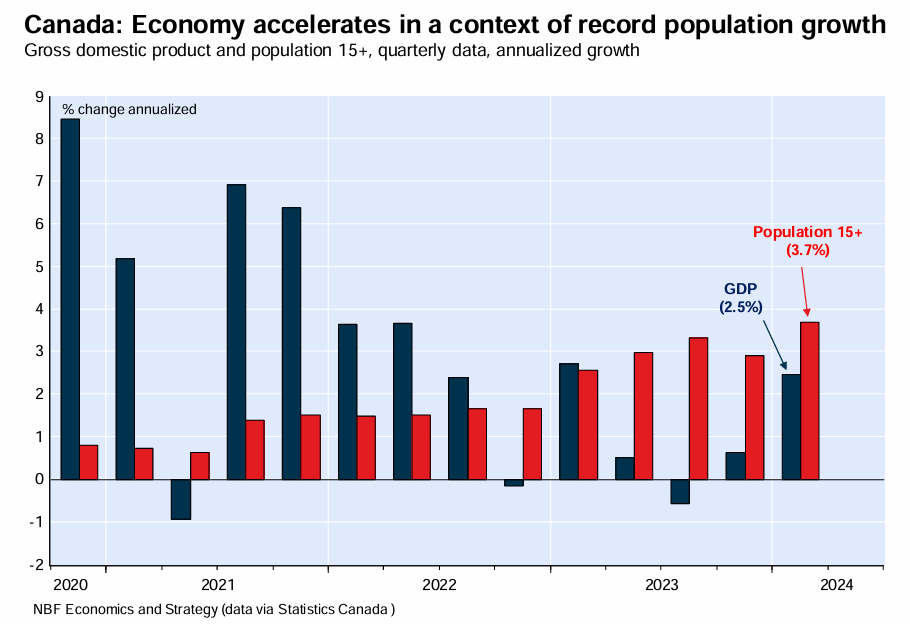

The BoC cited the need to cut due to the economy’s slower-than-expected growth. It also warned that the economy is experiencing a period of excess supply, albeit policy will remain restrictive in the near term.

“Overall, recent data suggest the economy is still operating in excess supply”, the BoC said.

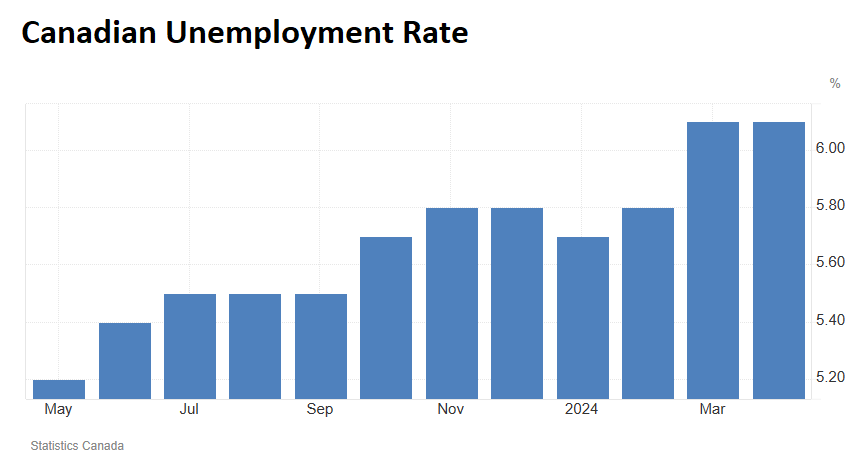

The BoC also noted concerns around employment, which is growing much more slowly than it had expected.

CBA’s international economics team anticipates two more interest rate cuts from the BoC this year.

CBA also expects the European Central Bank to drop its key policy rates by 25 basis points tonight.

The theme of monetary policy relaxing, along with some weaker US data, caused stocks to gain on both sides of the Atlantic.

US bond rates were about 5 basis points lower across the curve, with the market almost completely pricing in two Fed cuts this year.

The rate cut from the BoC is sensible given the collapse in Canadian per capita GDP:

In addition to the surge in Canada’s unemployment rate:

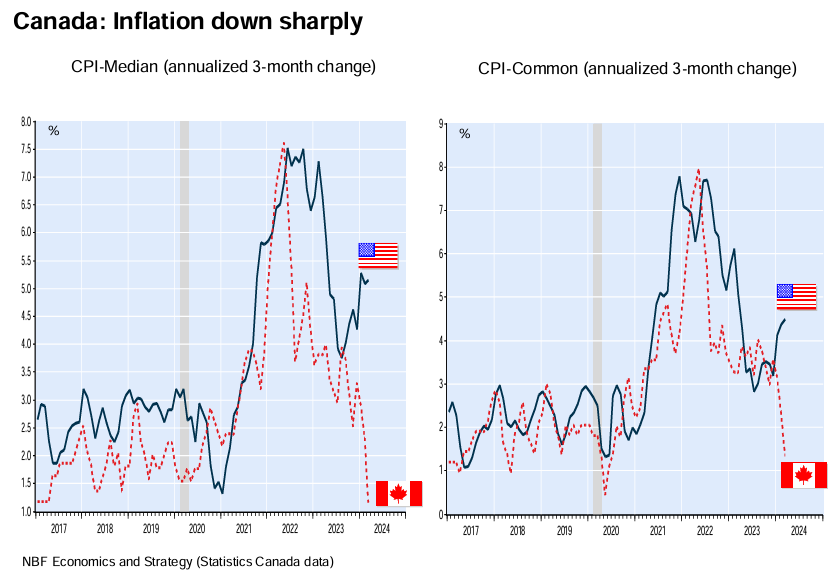

Canada’s CPI inflation has also plummeted:

The BOC’s next decision will take place on 24 July.