Australian workers buried by bracket creep

In March, the Centre for Independent Studies (CIS) released research showing that bracket creep will quickly eat away at the upcoming Stage 3 tax cuts.

Last week, Michael Read at The AFR published analysis showing that Australia’s tax system is becoming increasingly reliant on slugging workers.

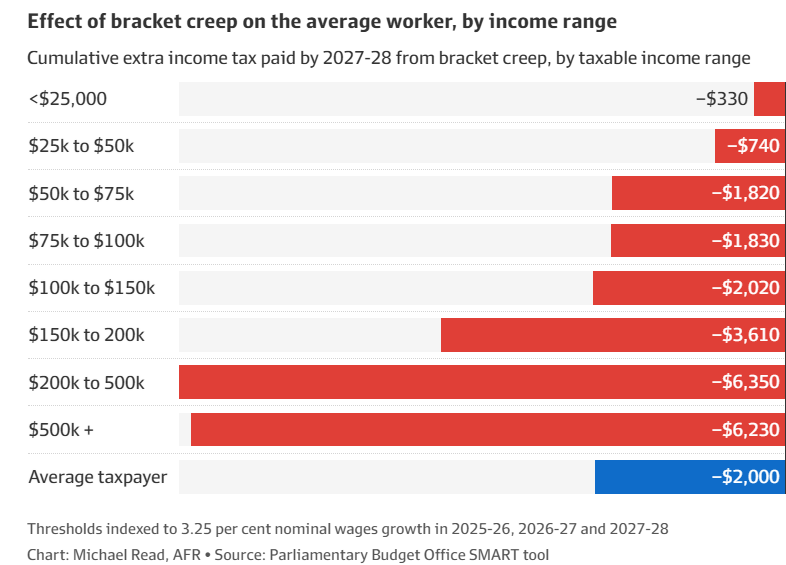

The average taxpayer will lose $2000 to bracket creep by 2028 unless another round of tax cuts is implemented:

Read’s analysis is based on the Parliamentary Budget Office’s updated small model of Australian representative taxpayers (SMART) tool.

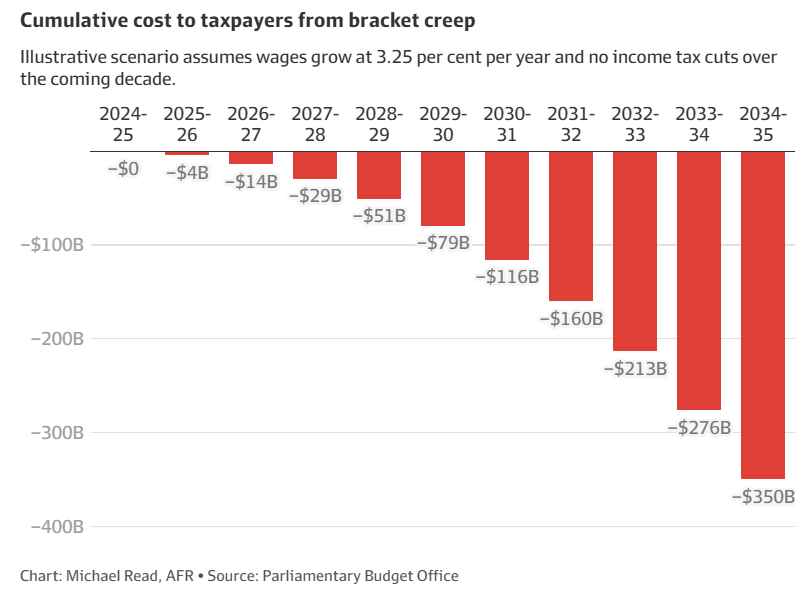

The SMART tool estimates the federal government will “stealth” raise about $29 billion from bracket creep over the next four years and $350 billion over the next decade if the tax scales remain unchanged:

Without policy change, personal taxes are set to hit 60% of the overall federal tax base.

It is unsustainable, inefficient, and inequitable to have Australia’s tax system so heavily reliant on a diminishing share of workers while the proportion of taxes collected indirectly (e.g., GST and fuel excise) falls.

This is especially true considering that the cohort of older Australians is growing in size and paying less tax than ever before, despite owning the vast bulk of the country’s wealth.

These older Australians, the majority of whom own their homes outright, have not been impacted by the surge in mortgage rates, rents, or bracket creep.

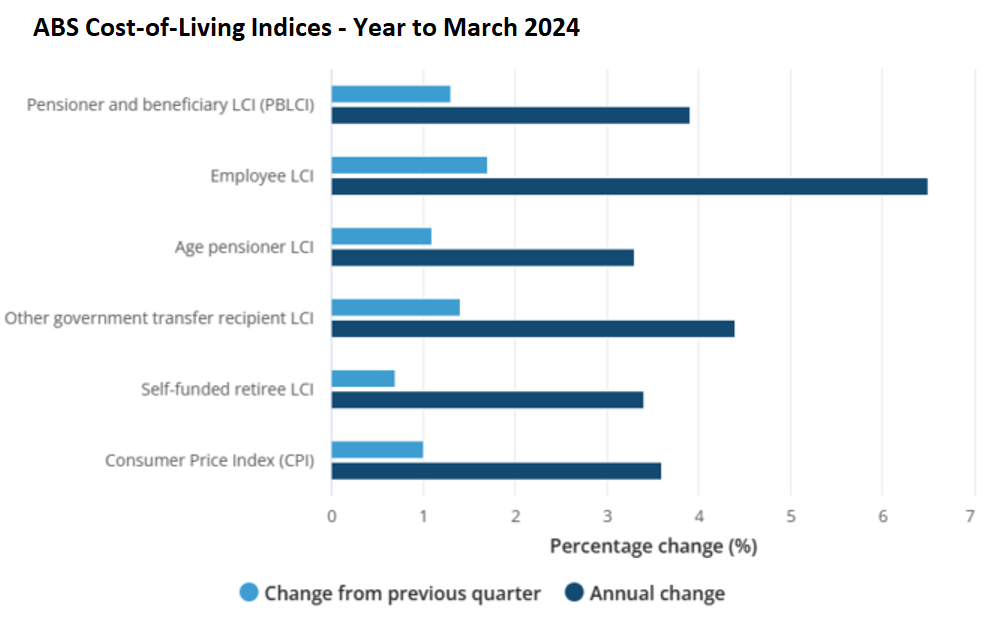

Accordingly, their cost of living rose by less than CPI inflation in the year to March 2024, while working Australians’ cost of living rose at nearly double the inflation rate.

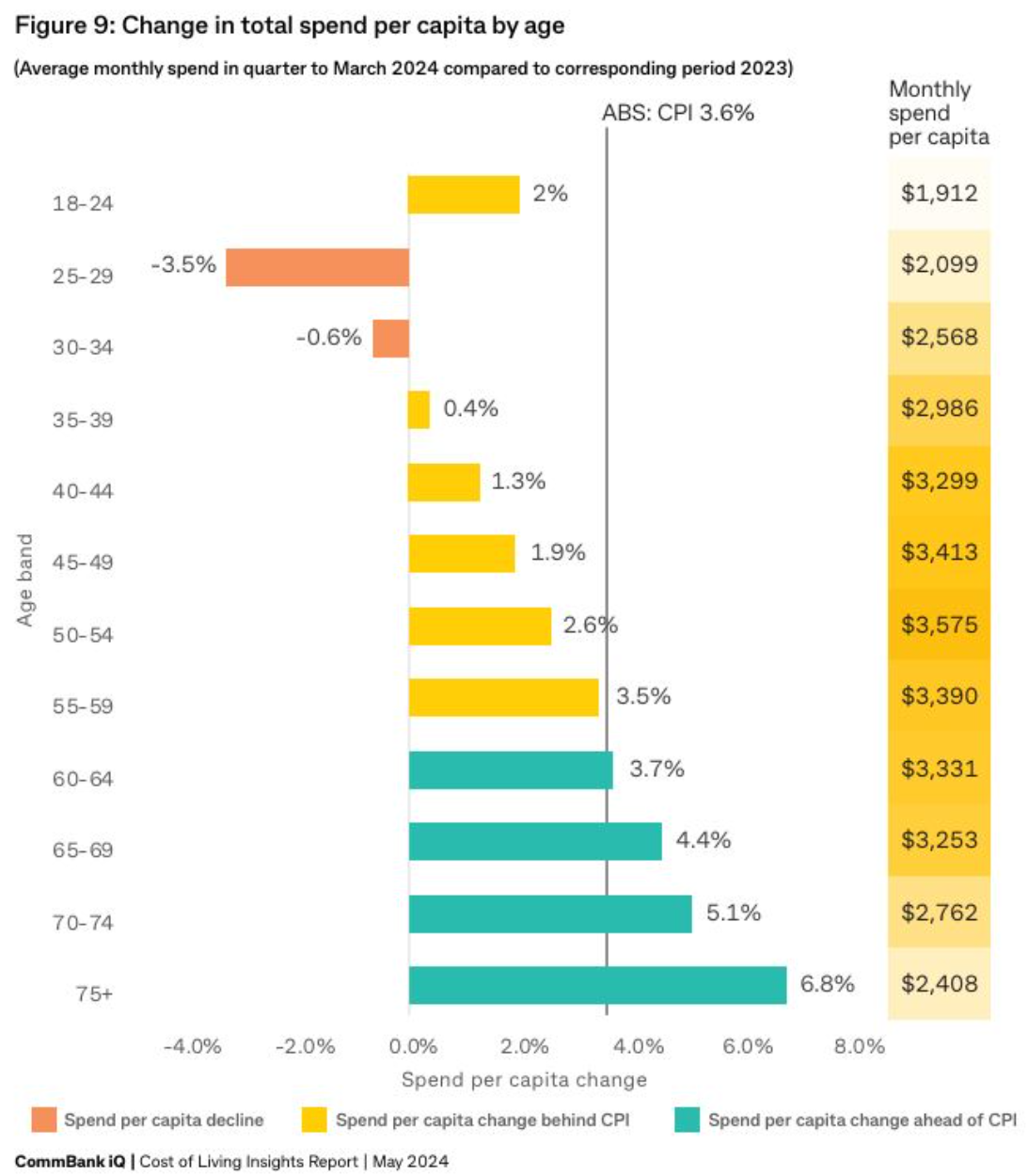

Survey data from CBA showed that younger Australians’ spending increased by less than inflation in the year to March 2024, with those aged between 25 and 34 experiencing outright declines over the past year:

By contrast, Australians aged over 60 have seen their expenditure go up by more than CPI inflation over the past year.

The bottom line is that Australia’s current tax structure is grossly unfair. It is built around smashing a shrinking pool of working Australians who are actually productive.

Those same people are typically the ones who have mortgages and are paying high interest rates in an effort to control inflation.

Richer older Australians who own their homes outright are unaffected by any of these things and are not paying enough tax.

Australia urgently needs comprehensive tax reform that shifts the tax base away from productive effort (taxing work) and towards more efficient sources such as resources, land, and consumption.

These types of tax reforms are much fairer than continually punishing one-third of Australians carrying owner-occupier mortgages with high interest rates to try and tame inflation, as well as punishing working Australians with forever higher income taxes.