Superannuation industry feels baby boomer burn

Australia’s retail superannuation market is experiencing a surge in outflows due to the influx of baby boomers approaching retirement age, reports The AFR.

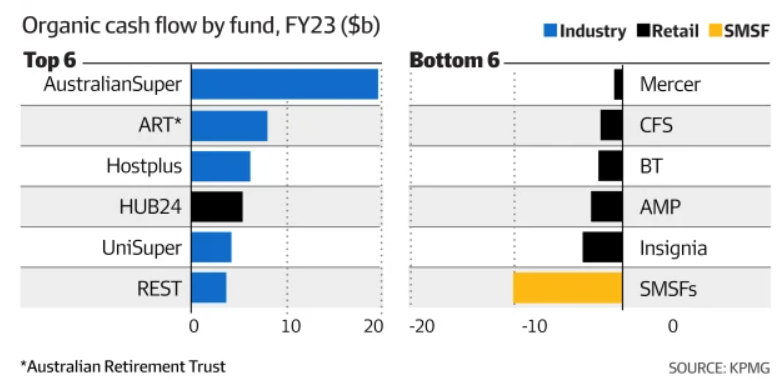

Mercer, Colonial First State, AMP, BT, and Insignia had net outflows of $10.6 billion in 2022-23, while industry behemoths like AustralianSuper, the Australian Retirement Trust, and Hostplus saw high investment returns and client retention.

Industry funds’ younger user base also benefited, as retail funds have traditionally targeted workers nearing retirement age.

Retail funds in Australia are facing challenges in managing their cash demands as they age, with more members drawing down on their savings.

Minister for Financial Services Stephen Jones emphasised the need for funds to consider their membership profile and liquidity needs to meet the needs of their members.

“With 5 million Australians at or approaching retirement, more members will begin drawing down on their savings”, he said.

“Funds should be mindful of their membership profile and what liquidity they need to meet the needs of their members”.

Around half of retirees withdraw only the legally required minimum amounts from their super funds, while the other half withdraw higher quantities or lump payments.

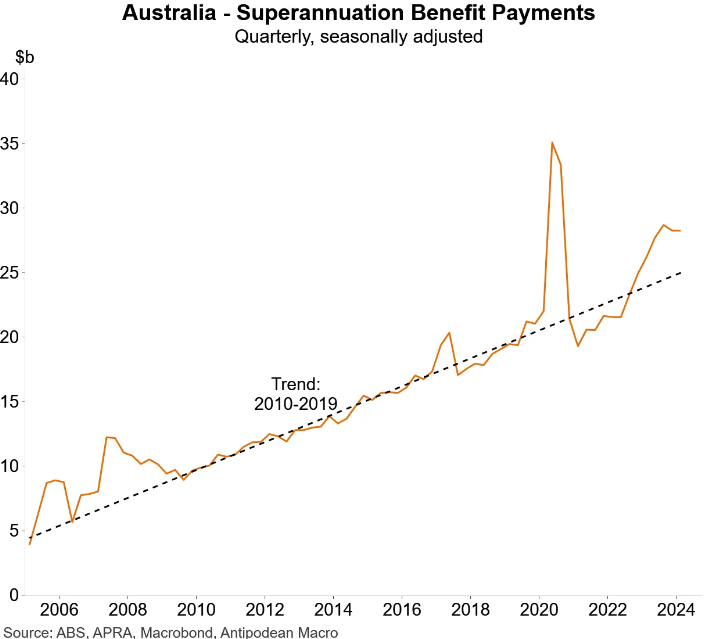

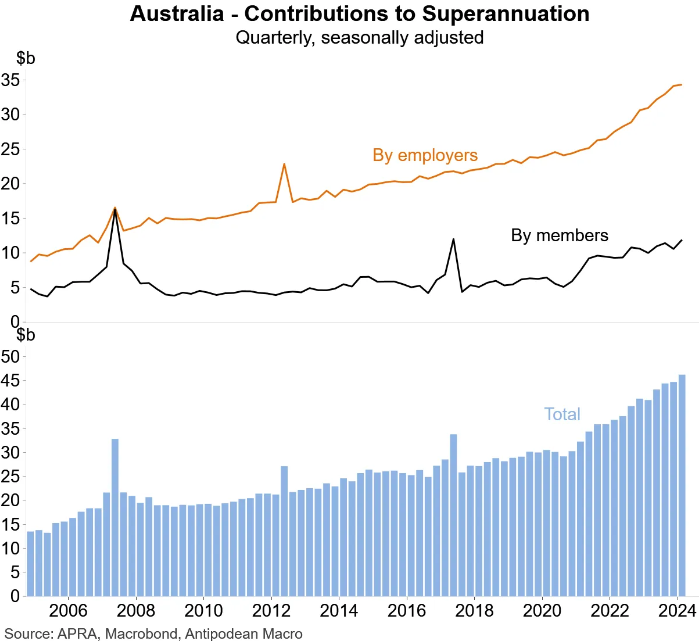

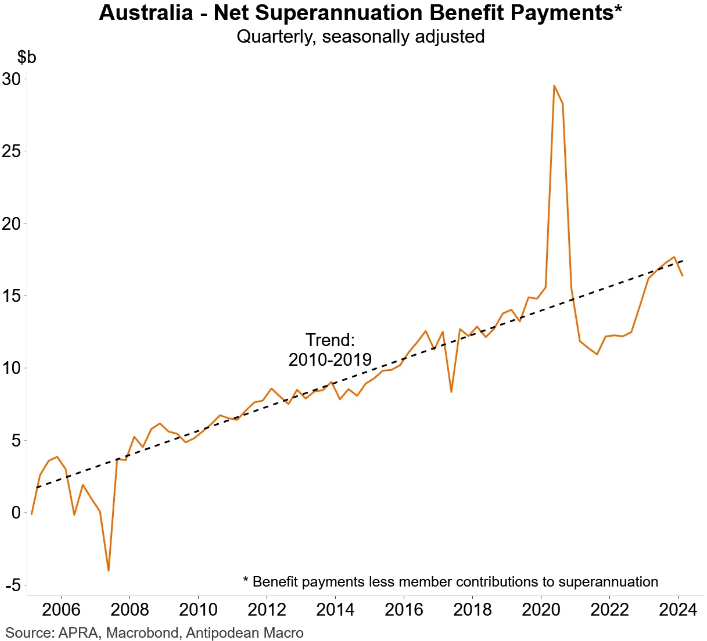

The below charts from Justin Fabo at Antipodean Macro provide more colour.

While superannuation payments have certainly risen over the past couple of years:

Quarterly superannuation contributions are closing in on $50 billion:

As a result, net superannuation benefit payments to Australian households have merely returned to the 2010-19 trend:

With the superannuation guarantee still to increase by another 1.0% by 1 July 2025, net cash flows for superannuation funds should remain positive for a while yet.

Indeed, KPMG projects that the superannuation system as a whole will not experience negative net cash flows until after 2040, although there will be differences between funds.

The exact point at which it could occur is unknown, given the influence of investment returns, varying super contributions, and individuals’ retirement decisions.