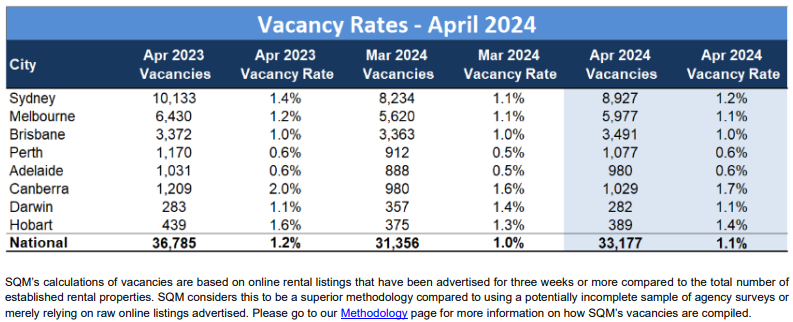

SQM Research has released its rental vacancy report for April, which recorded a slight seasonal uptick in the nation’s vacancy rate to 1.1%, up 0.1% from March:

However, the national vacancy rate was still 0.1% lower year-on-year.

As shown above, all major capital city markets remained extremely tight, with vacancy rates just above or below 1%.

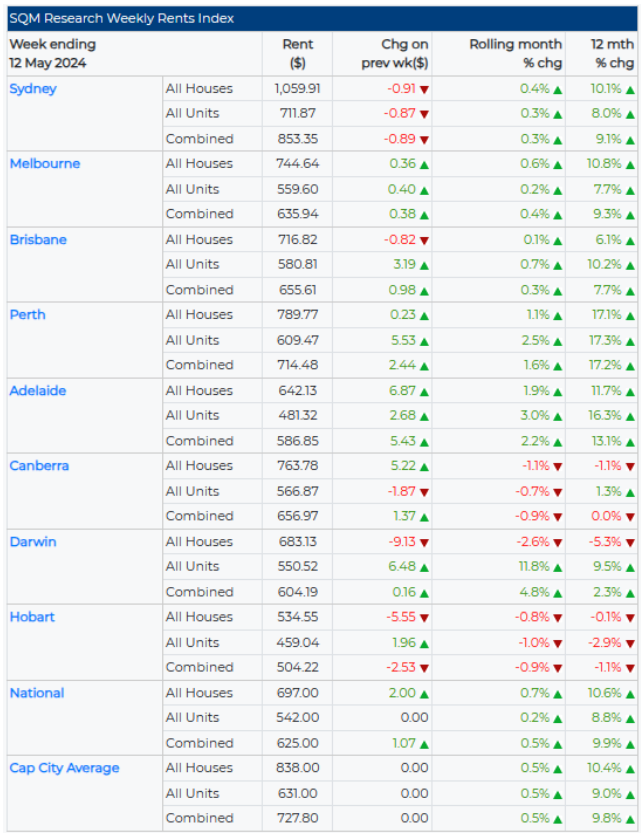

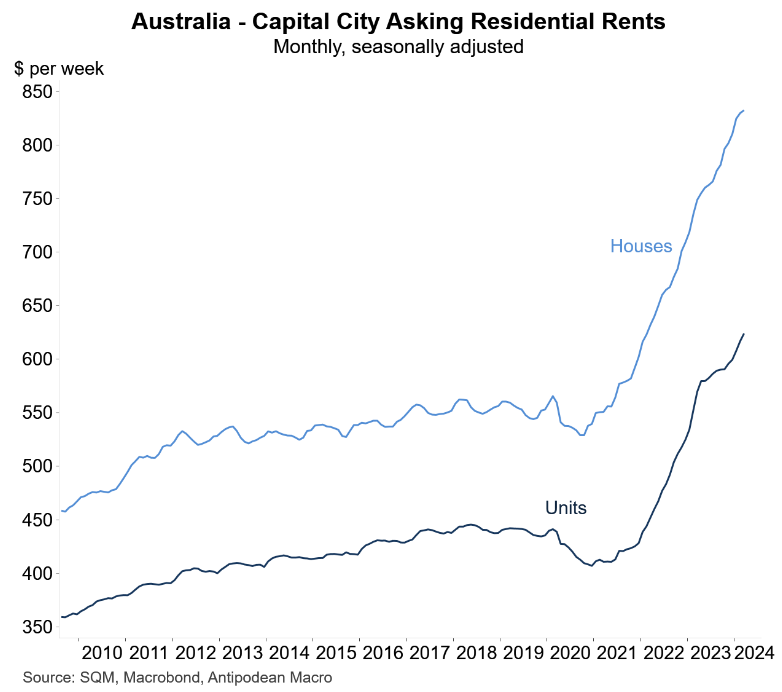

Asking rents also recorded only 0.5% growth in the 30 days to 12 May, which “represents one of the slower rises in market rents since the outbreak of the national rental crisis in 2021”.

Nevertheless, SQM Research managing director, Louis Christopher, warned against getting too excited over the result, which has been driven by typical Winter seasonality:

“As stated in our last update, we have recorded a slight easing in rental vacancy rates for April, but the rental crisis is still, far from over at this stage”.

“The immediate outlook is vacancy rates are set to rise somewhat into winter. This is the normal seasonality we get at this time of year so one should be a little careful about reading into these rises”.

“Nevertheless, it might provide some minor relief to tenants who still have excessive difficulties in finding longer term rental accommodation around the country”.

“The full year outlook remains the same in that we expect overall tight vacancy rates to be with us for 2024, driven by a fall in dwelling completions relative to ongoing growing demand”.

Indeed, it is hard to get too excited when capital city renters are facing the following diabolical situation:

Hopefully, the Albanese government’s announced reforms to student visas will bite hard, resulting in sharper-than-expected falls in net overseas migration.

I will believe it when I see it.