Superannuation fear factory scares retirees on living costs

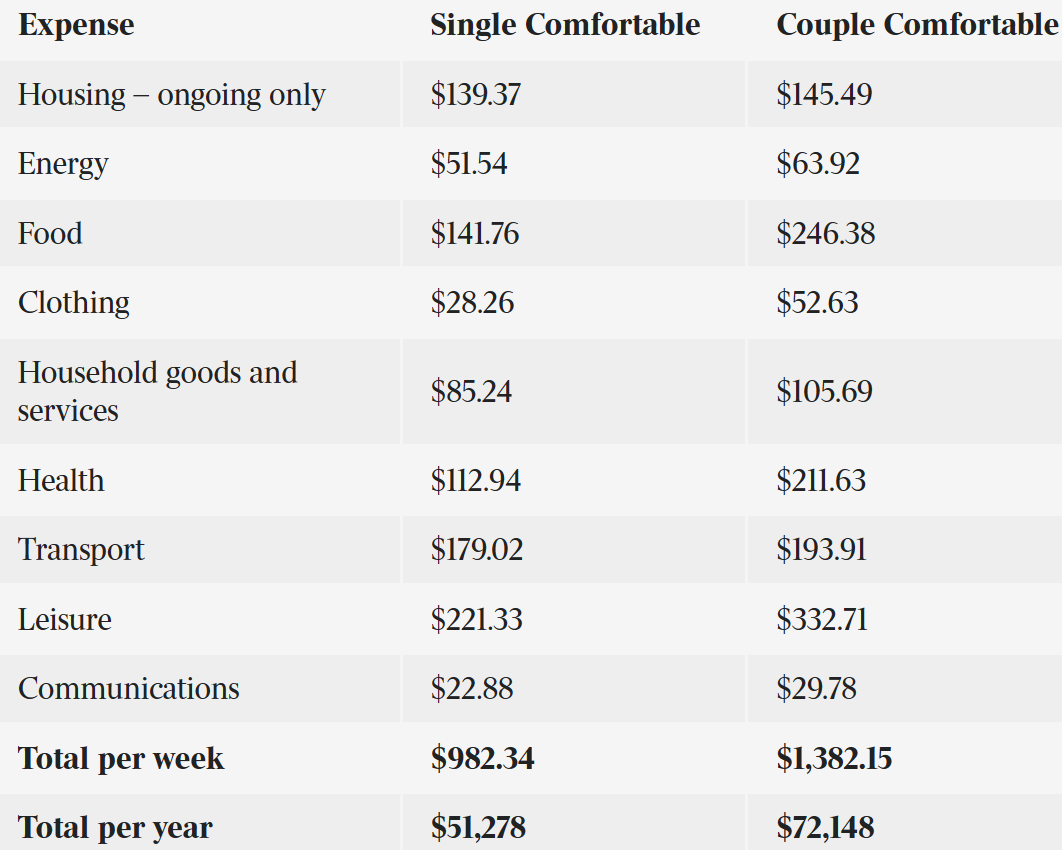

Data from the Association of Superannuation Funds of Australia (ASFA), published in The Australian, shows that couples now require $72,148 a year ($1382 a week) to live comfortably in retirement, while single people need $51,278 ($982 a week).

The cost of a comfortable retirement increased by 3.5% in 2023, according to ASFA, below the official inflation rate of 4.1%.

The rising cost of insurance, electricity, and food contributed to the increase in ASFA’s retirement standard for the December quarter.

Published in The Australian

CEO Mary Delahunty says the compulsory super guarantee’s increase to 12% by mid-2025 will help more people to reach ASFA’s comfortable retirement standard level.

It is important to point out that ASFA’s definition of a “comfortable retirement” is above what a typical Australian worker enjoys.

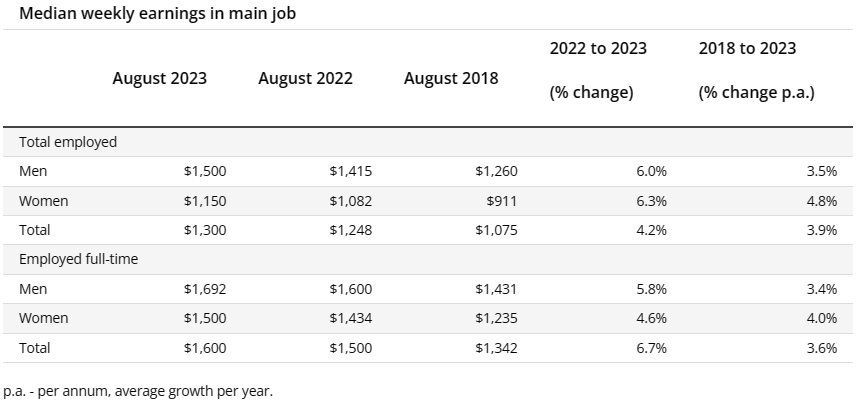

The Australian Bureau of Statistics (ABS) says the median Australian employee earned just $1,300 a week ($67,600 a year) as at August 2023:

These are gross earnings, however, with the typical Australian employee also needing to deduct around $12,400 in personal income tax plus the Medicare Levy.

Unlike most retirees whom own their home outright, the most working Australians must pay rent or a mortgage. Many also have children to support.

Accordingly, analysis from the Grattan Institute repeatedly shows that retirees feel more comfortable financially than all other groups of Australians.

Retirees are the most financially comfortable cohort in Australia.

ASFA’s assessment of a “comfortable retirement” is significantly more opulent than what most Australians enjoy during their working lives.

It is a clear scare campaign aimed at persuading policymakers and members to put more money into the superannuation system, thereby allowing the industry to increase assets under management and collect higher management fees. It is purely rent-seeking.

The superannuation sector will continue to fearmonger about a ‘comfortable retirement’ as it is in their financial interests to do so.