The Super Members Council of Australia has released research showing that debt in retirement is increasing.

According to the research, more than 40% of workers retire with mortgage debt, up from 16% 20 years ago.

Moreover, 40% of singles and 33% of couples will use their whole nest egg to pay off their debts.

AMP retirement director, Ben Hillier, made similar observations last year:

“For as long as we can remember, the Australian dream has been debt-free homeownership, which provides the financial foundation and security for a comfortable retirement”.

“While home values and super balances are increasing, research shows that more and more Australians will be retiring with increasing levels of household debt”.

These outcomes directly threaten Australia’s retirement system, which has always been based on the presumption that the overwhelming majority of people would own their homes outright when they retire.

Due to falling homeownership rates and households carrying mortgages into their retirement years, that assumption is clearly failing.

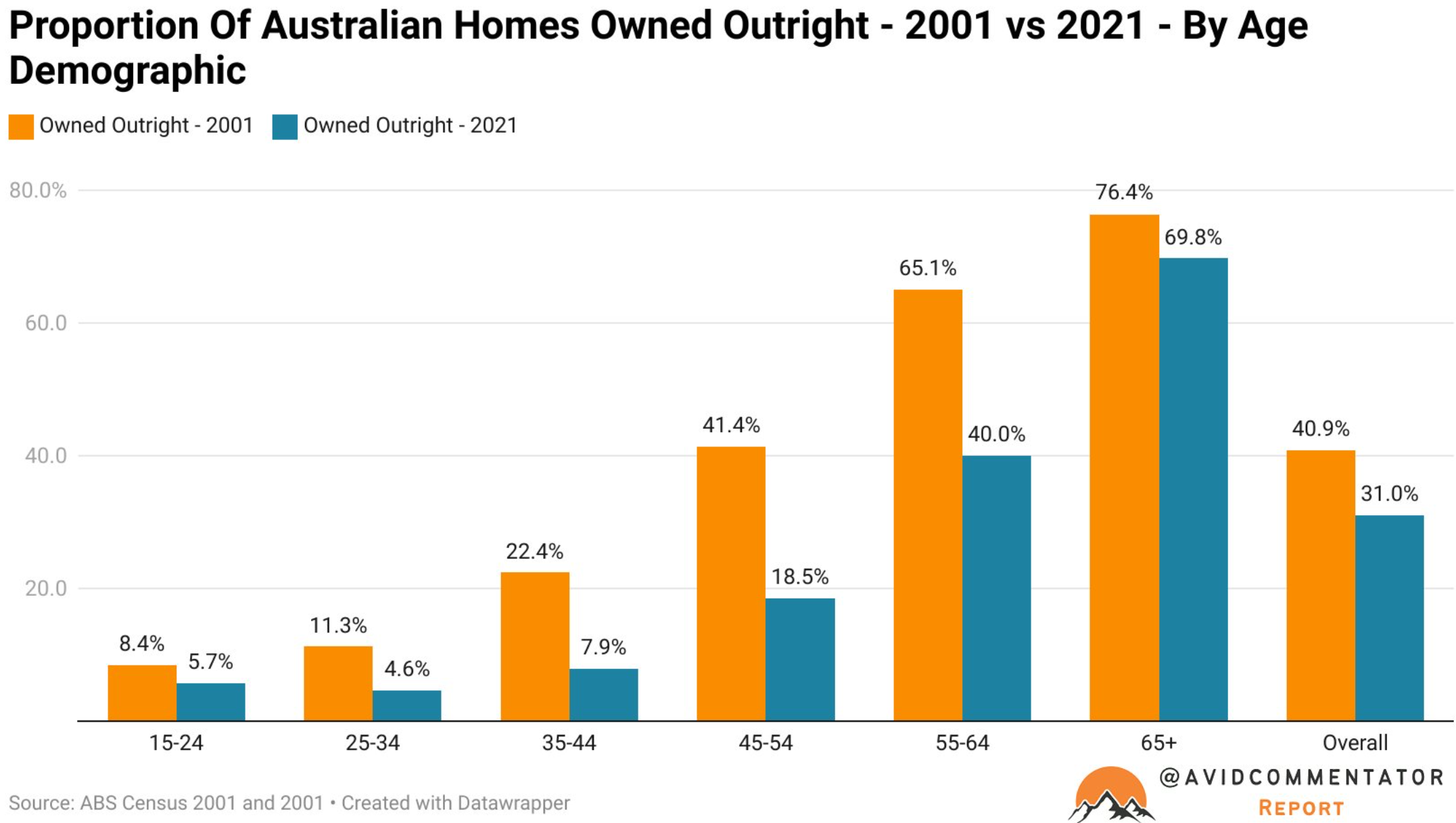

Indeed, the next chart from independent economist Tarric Brooker shows that there has been a significant increase in Australians aged 55-64 and 45-54 who are carrying mortgage debt, as well as a smaller increase among those already at retirement age (i.e. 65-plus):

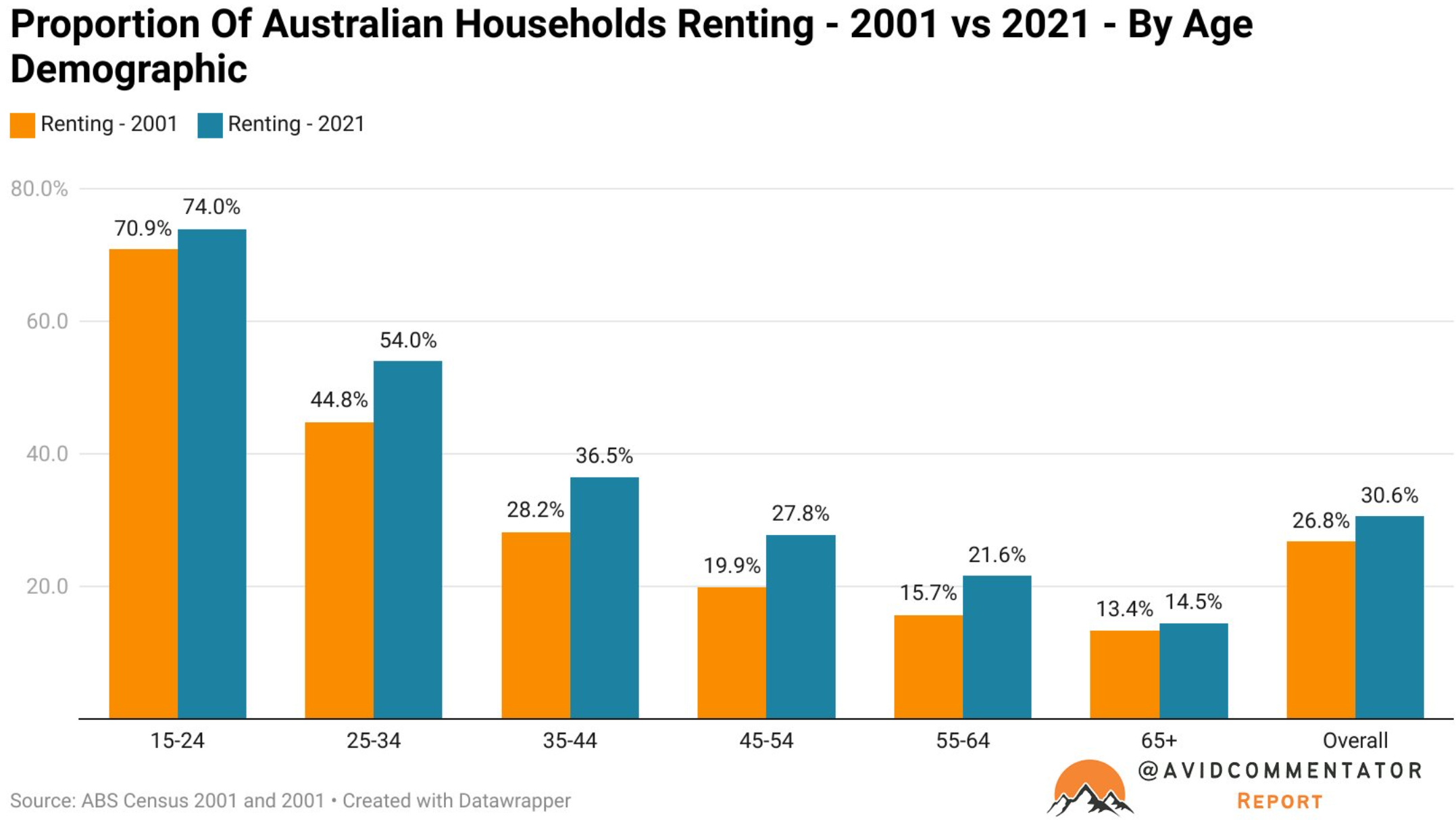

Not surprisingly, there has also been a significant increase in the share of households renting, reflecting the general decline in housing affordability:

Research from the Grattan Institute projected that the proportion of people aged 65-plus who will own a home would decline from 76% currently to 57% by 2056:

As illustrated above, less than half of low-income pensioners will own a home by mid-century, compared to more than 70% now.

Whichever way you cut it, an increasing proportion of retirees will rent, while others will be saddled with large mortgage debts.

Both developments threaten to blow apart Australia’s retirement system.