Three years ago, the Australian Treasury’s Retirement Income Review was released, which lamented that superannuants have been extremely hesitant to draw down their nest eggs. They instead rely on investment gains to fund their retirements.

In turn, superannuation has evolved into a wealth accumulation and transfer scheme that is exacerbating inequality.

“Inheritances are significant, representing the transfer of wealth from one generation to another”, the Review noted.

“They are not distributed equally and increase inequity within the generation that receives the bequests”.

“Most people die with the majority of wealth they had when they retired. If this does not change, as the superannuation system matures, superannuation balances will be larger when people die, as will inheritances”, the review warned.

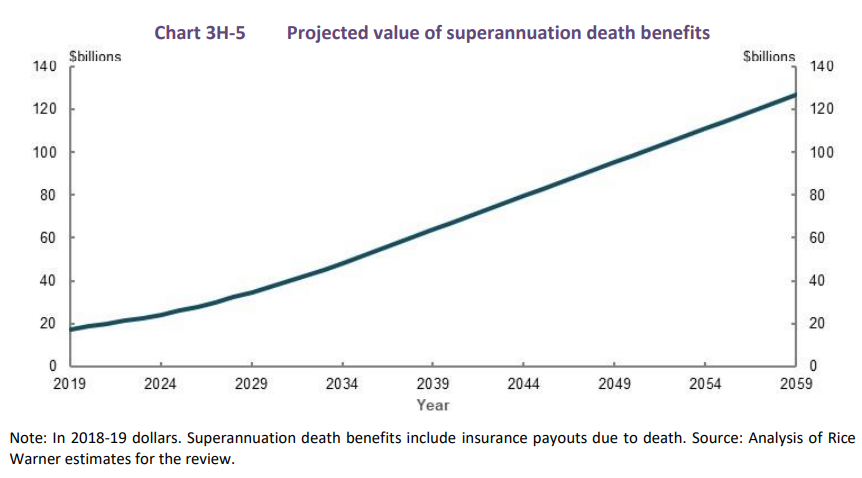

The next chart from the Retirement Income Review was especially jarring. It shows that “superannuation death benefits are projected to increase from around $17 billion in 2019 to just under $130 billion in 2059”:

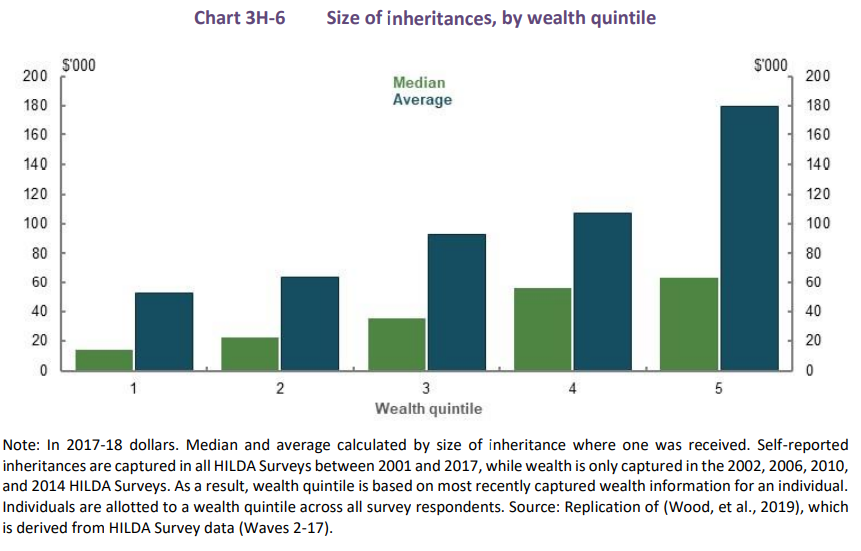

To make matters worse, these inheritances will be inequitably distributed, with “wealthier people tending to receive larger inheritances than those with lower wealth”.

As a result, superannuation inheritances will “increase intragenerational inequity”, according to the review:

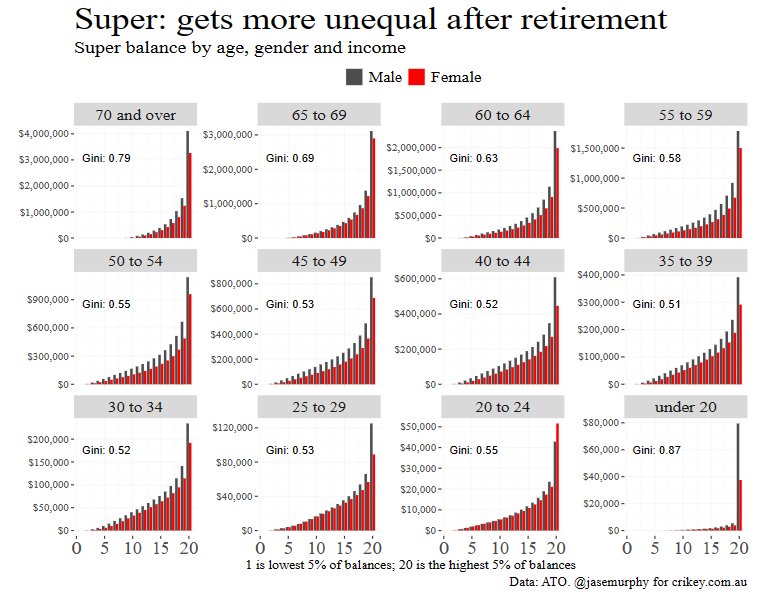

On Monday, economist Jason Murphy published a report in Crikey showing how “just 5% own nearly half of Australia’s $3.5 trillion in superannuation assets”.

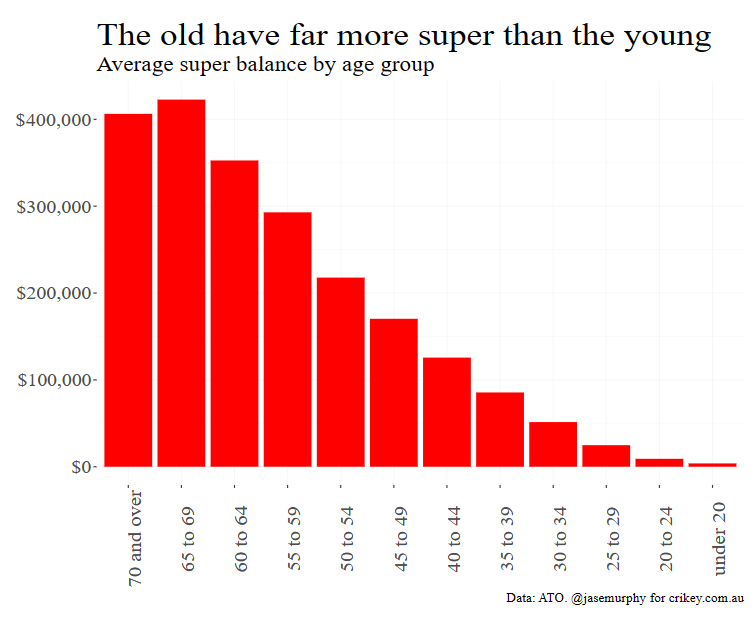

Murphy shows that older Australians own the lion’s share of the nation’s superannuation assets, which makes sense given they have had more time to accumulate a nest egg:

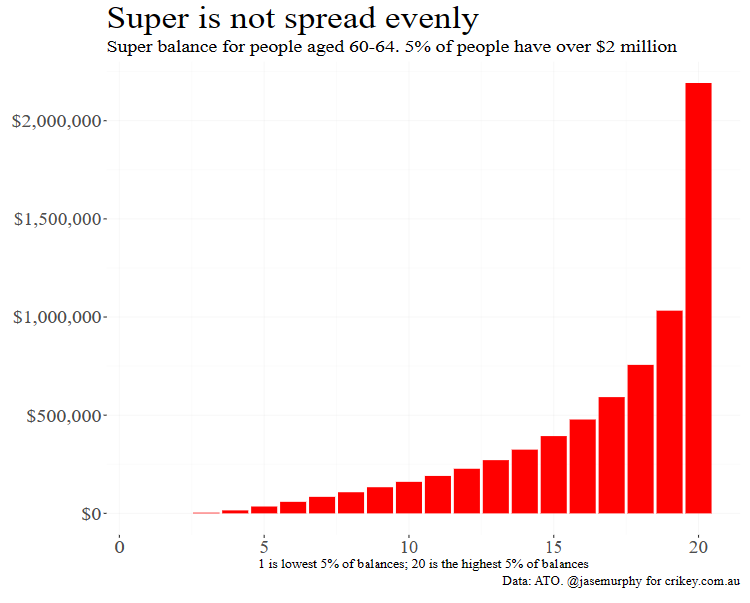

What is more disturbing is the breakdown among people aged 60-64:

As you can see, super balances are spread very unevenly, with only 20% holding balances above $500,000.

“Our super system is closer to inequality than equality, and it gets worse the older you get”, according to Murphy:

Recent Morningstar research showed that “hundreds of thousands of Australians have no intention of running down their super to $1 on the day they die”.

Many Australians are instead using superannuation “as more of a tax-advantaged savings vehicle than a source of retirement income”.

When asked why they are choosing to maintain capital, nearly half responded “for beneficiaries”.

As a result, superannuation is being utilised primarily as a tax-efficient means of accumulating wealth to pass on to their children, rather than as a genuine retirement vehicle.

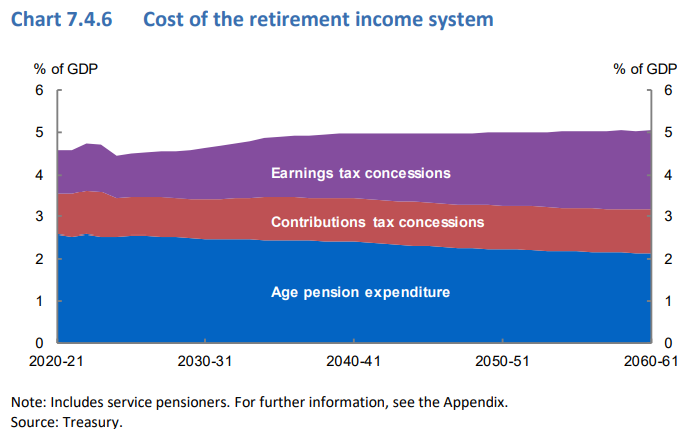

This is problematic as superannuation concessions are projected to cost federal budget more than the aged pension by 2060:

Given the enormous fiscal cost and the detrimental effects on equity, the federal government should have taken action to rein in the superannuation system.

Instead, Labor chose to double-down by lifting the superannuation guarantee to 12% by 2025.