Below is an article written for News.com.au:

Last week saw the Albanese government release a consultation paper to enshrine an objective for superannuation in law.

That objective will be to “preserve savings and deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way”.

The consultation paper also states “there is a significant opportunity for Australia to leverage greater superannuation investment in areas where there is alignment between the best financial interests of members and national economic priorities”.

Various commentators have questioned the merits of the government’s objectives, raising concern that people’s retirement funds could be forced to invest in political projects with poor returns, such as social housing and climate change mitigation, which are at odds with super funds’ requirement to act in their members’ best interests.

Others, like former RBA governor Bernie Fraser, believe members’ superannuation savings should be permitted to be used to buy a home.

Nobody, however, has asked the pertinent question of whether the superannuation system should continue in its current form.

Australia’s compulsory superannuation system is failing

Australia’s compulsory superannuation system misses on almost every policy mark:

- It is poorly targeted and misses those in genuine need

- It costs the federal budget far more than it saves in aged pension costs

- It entrenches inequality by encouraging tax avoidance and wealth accumulation by the rich and their heirs

- It reduces workers’ take-home pay

The superannuation system effectively takes the disparities in working-life incomes and magnifies them in retirement, thereby enshrining inequality.

Consider the following facts:

Superannuation contributions and earnings are typically taxed at a flat 15% rate.

This means that those higher up the income scale generally receive the largest superannuation tax concessions.

For example, somebody earning $50,000 and paying a marginal tax rate of 32.5$ only receives a superannuation concession of 17.5%.

But somebody earning $250,000 and paying a marginal tax rate of 45% receives a superannuation concession of 30%.

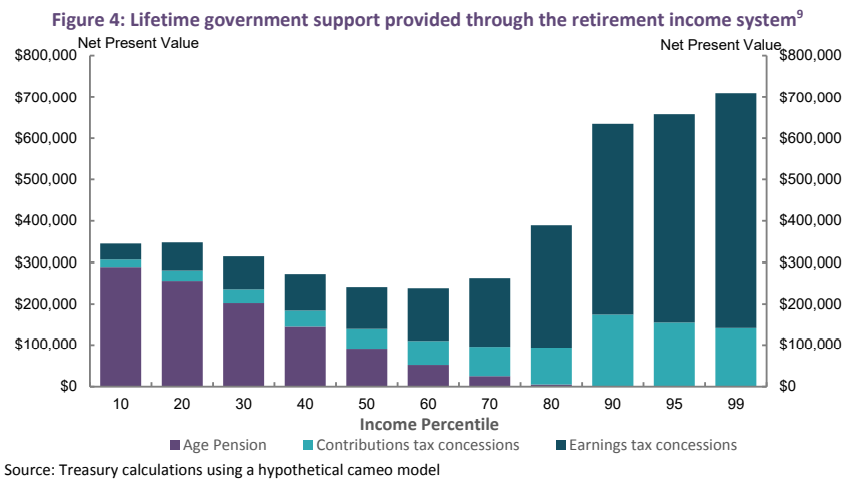

Because the size of one’s superannuation nest egg is a direct function of how long one works and how much they earn over their working lives, the lifetime taxpayer support provided through Australia’s retirement system is heavily skewed towards higher income earners.

This is illustrated in the below Australian Treasury chart, which shows that Australian taxpayers spend more than twice as much supporting the retirements of the top 1 per cent of income earners than they spend supporting somebody on the aged pension.

Specifically with regards to superannuation, the top 1% of income earners were projected by the Australian Treasury to receive more than $700,000 in superannuation concessions over their working lives. That is roughly 14-times the $50,000 of concessions received by the bottom 10% of income earners.

Since men typically earn more and have less interrupted working lives than women, they also accumulate much larger superannuation nest eggs.

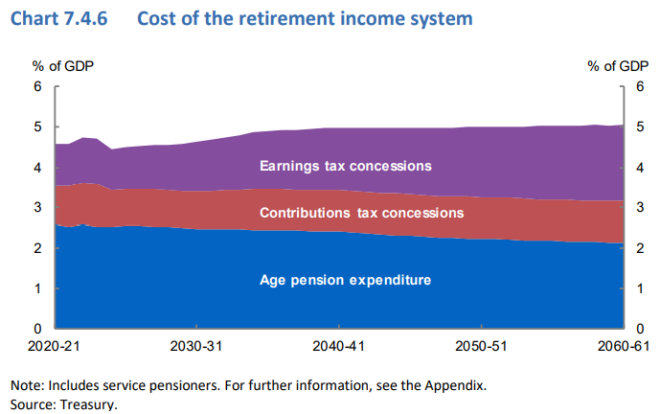

The above imbalances are a primary reason why superannuation tax breaks will cost the federal budget a whopping $52.5 billion in 2022-23, almost as much as the aged pension ($55.5 billion).

In fact, the Australian Treasury’s Intergenerational Report projected the cost of superannuation concessions to overtake the cost of providing the aged pension by around 2040.

The high cost of superannuation concessions, in turn, means other taxes will need to be higher than necessary, or other social programs (e.g. the aged pension) will need to be cut back.

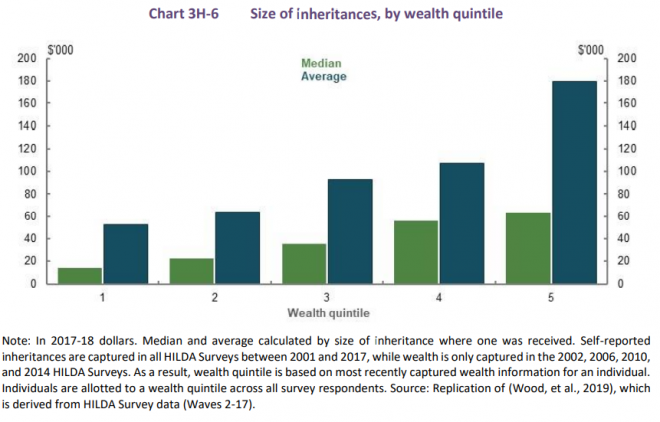

If that wasn’t bad enough, the Australian Treasury’s Retirement Income Review warned that Australia’s superannuation system has transformed into a wealth accumulation and inheritance scheme that is increasing inequality.

“Superannuation death benefits are projected to increase from around $17 billion in 2019 to just under $130 billion in 2059”, the review noted.

“Inheritances are significant, representing the transfer of wealth from one generation to another. They are not distributed equally and increase inequity within the generation that receives the bequests”, the review warned.

The next chart tells the tale, with “wealthier people tending to receive larger inheritances than those with lower wealth”. As such, superannuation inheritances “increase intergenerational inequity”, according to the Retirement Income Review.

Compulsory superannuation contributions also reduce take home pay since they are paid by employers in lieu of wages.

Indeed, former prime minister Paul Keating’s own explanation of the super system from 2007 stated that “had employees not paid 9 percentage points of wages as superannuation contributions to employee superannuation accounts, they would have paid it in cash as wages”.

Therefore, compulsory superannuation is especially troublesome for lower income earners struggling to pay their bills.

Australia’s compulsory superannuation system should be shut down

The aged pension suffers none of the above flaws and should be considered Australia’s genuine retirement pillar.

The aged pension is universally available for those most in need. It is not based upon how much one works or earns prior to retirement. And the pension is not subject to adverse movements in financial markets.

Given the massive cost and poor targeting of superannuation concessions, it would make sense to shut the system down and to divert the billions in budget savings into a more generous universal aged pension.

This would never happen of course. The superannuation industry has grown too large and powerful and would bring down any government that dared tried to curtail it.

Sadly, instead of pursuing root-and-branch reform, the Albanese government has instead chosen to double down on the system’s failures by raising the superannuation guarantee to 12%.

Labor has explicitly chosen to increase superannuation’s cost to the federal budget.

In turn, other taxes will need to be higher than necessary, or the federal budget will need to make spending cuts elsewhere to make room for the growing cost of superannuation concessions.