Treasurer Jim Chalmers on Thursday said the government has ruled out a higher tax rate on super contributions or earnings.

However, he gave indications that the government may be open to capping super balances at $3 million, which would impact less than 1% of Australians.

Independent Teal MPs representing some of the nation’s wealthiest voters have warned against another raid on superannuation, saying people had invested in good faith.

Independent MP Zoe Daniel says the appeal of superannuation is being harmed by governments of both persuasions constantly tinkering with it.

Fellow independent MP Allegra Spender referred to the government’s plans as an “ad hoc tax grab”, while North Sydney MP Kylea Tink described them as “unsophisticated”.

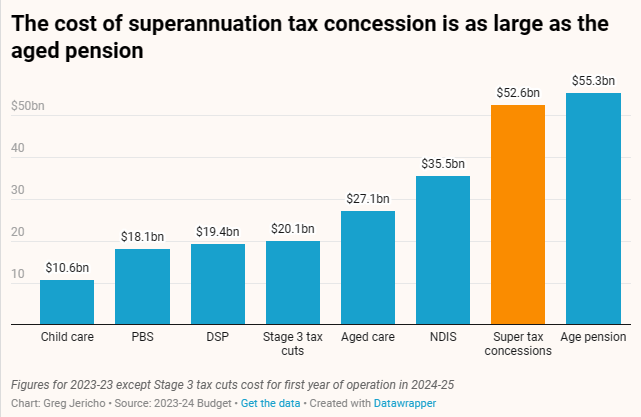

Treasurer Chalmers noted that tax concessions on super cost around $50 billion a year and said the government “can’t ignore the cost of these tax concessions with all of the other pressures which are on the budget”.

Labor’s superannuation Frankenstein is truly out of control.

The cost of superannuation concessions is already almost as large as the aged pension:

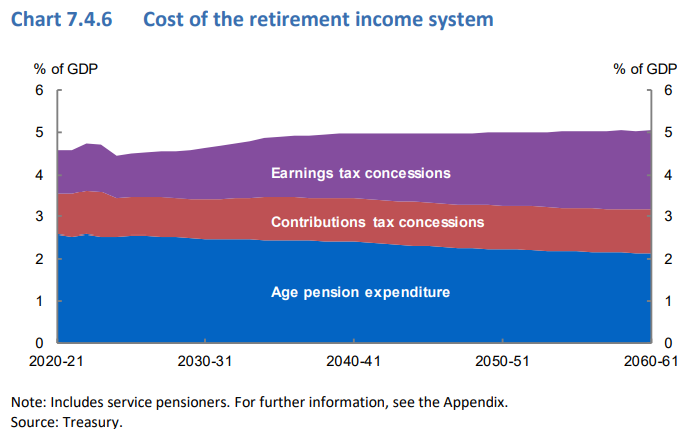

The Intergenerational Report projected that Australia will spend more on superannuation concessions than providing the aged pension by around 2040:

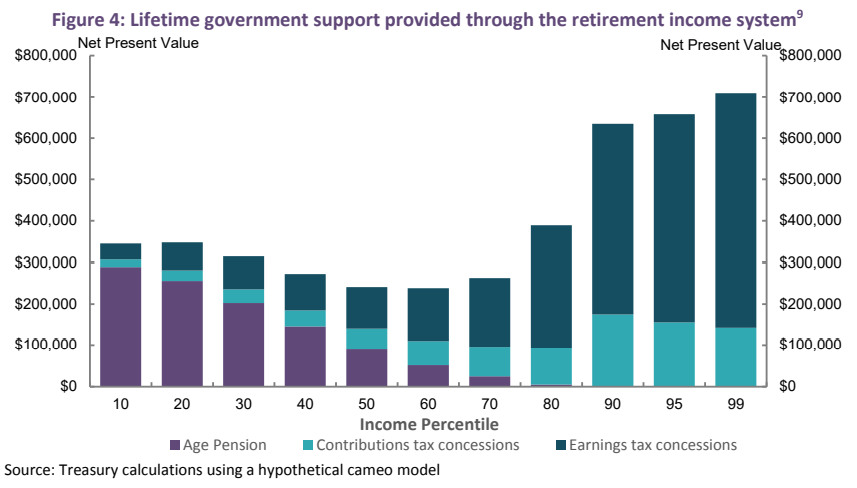

Everybody knows that superannuation concessions are unequally distributed, with the top 1% of taxpayers receiving about 14 times as much in tax concessions as the bottom 10% of income earners, according to the Australian Treasury:

The fact remains that superannuation has morphed into an expensive and inequitable wealth accumulation and inheritance tool, which takes the disparities in working-life incomes and magnifies them in retirement.

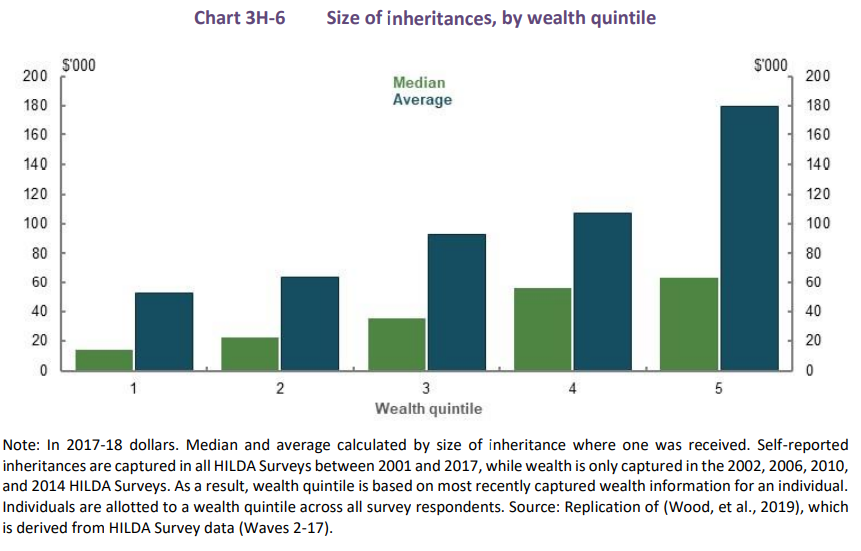

The Australian Treasury’s Retirement Income Review warned that “superannuation death benefits are projected to increase from around $17 billion in 2019 to just under $130 billion in 2059”.

The next chart tells the tale, with “wealthier people tending to receive larger inheritances than those with lower wealth”. As such, superannuation inheritances “increase intragenerational inequity”, according to the Retirement Income Review:

The fact remains that Australia’s compulsory superannuation system fails nearly every policy mark, including:

- It is poorly targeted and largely misses those most in need (i.e. lower income earners).

- It costs the federal budget more than it saves in aged pension costs.

- It entrenches inequality by encouraging tax avoidance and wealth accumulation by the rich and their heirs.

- It lowers take-home pay, which is especially detrimental to lower income earners struggling with cost-of-living.

The entire superannuation system needs to be torn down with the budget savings directed into a more generous and universal aged pension: Australia’s true retirement pillar.

The aged pension suffers none of superannuation’s flaws.

The pension is universally available for those most in need. It is not based upon how much one works or earns prior to retirement. And the pension is not subject to adverse movements in financial markets.

Genuine reform will never happen of course.

The superannuation industry has grown too large and powerful and would bring down any government that dared tried to curtail it.

Worse, the Albanese Government has instead doubled down on the system’s failures by raising the superannuation guarantee to 12%.

Labor has explicitly chosen to increase superannuation’s cost to the federal budget.

As a result, other taxes will need to be higher than necessary, or the federal budget will need to make spending cuts elsewhere (e.g. the aged pension) to make room for the exploding cost of superannuation concessions.