Macro Morning

Another uneasy night on risk markets with concerns mounting over the Iranian situation as talks collapse while Wall Street took another tumble on tech stock volatility. The USD came back against some of the majors, particularly Yen while a fall in commodities like copper and gold saw the Australian dollar lose ground to revert below the 70 cent level. All eyes are pivoting to the ECB meeting tonight and tomorrow’s US unemployment print.

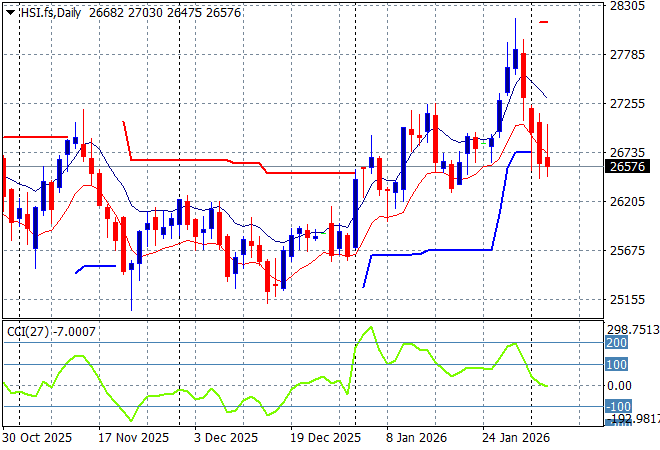

Looking at stock markets from Asia from yesterday’s session, where mainland Chinese share markets were up slightly in the afternoon session with the Shanghai Composite eventually moving 0.8% higher to just get back above the 4100 point level while the Hang Seng Index was only able to tread water and remain at the mid 26000 point level.

The daily chart of the Hang Seng Index showed a lot of wish washy action around the 26000 point level in the last couple of months with some recent weakness now turning into strength as it broke out above the 27000 point level. However momentum got extremely overbought with a reversal still in play here:

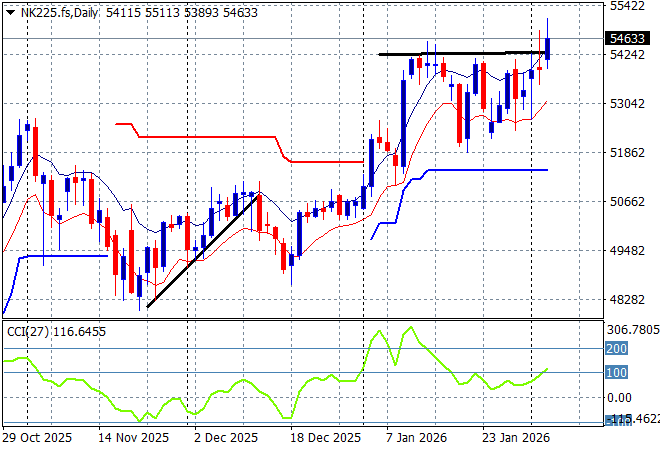

Japanese stock markets pulled back after a strong session previously with the Nikkei 225 down 0.8% to remain slightly above the 54000 point level.

Daily price action wavered a little during the BOJ hike in the previous weeks but has firmed up strongly with the 50000 point level forming key support. This was looking like a launch point through longer term overhead resistance but the selloff in Japanese bonds and the election snap call was causing a stall but this is looking promising here:

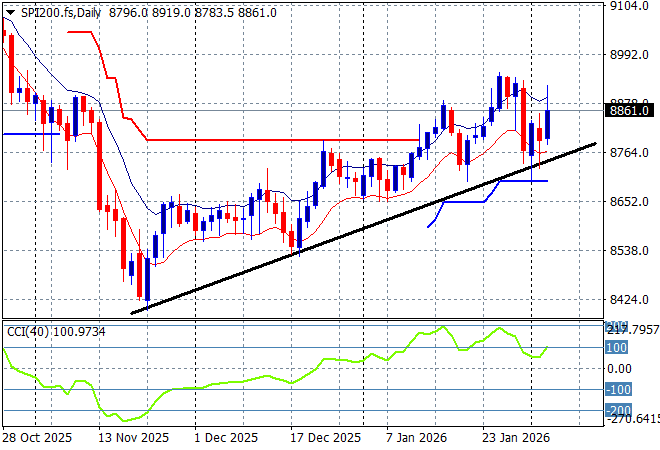

Australian stocks still managed a solid lift higher with the ASX200 closing up 0.8% to 8927 points however SPI futures are off by 0.2% due to the continued falls on Wall Street overnight.

The daily chart pattern shows that short term support has been reinforced after a period of hesitation before Christmas with a bounceback above resistance at the 8800 point area building into what looked like a solid breakout, but has since reversed. I’m watching ATR trailing support to come under pressure next in a wider risk off move but its holding so far:

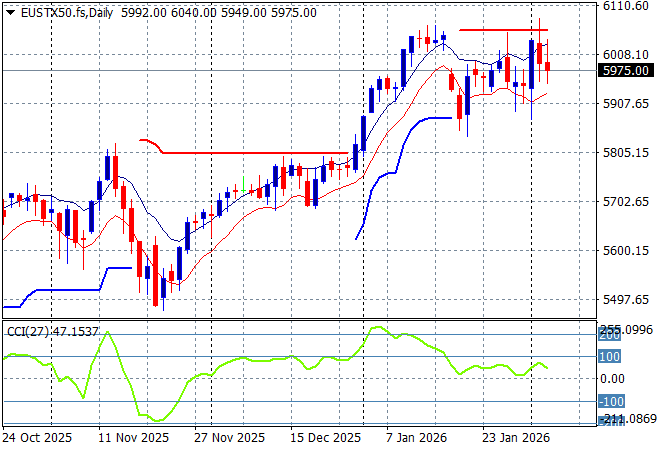

European markets have been loving the falling Euro but put in more wobbles overnight with the Eurostoxx 50 Index closing nearly 0.4% lower at 5970 points overnight, still unable to reach its former highs.

The market had been failing to make headway in recent months due to the too high valuations but short term support was very solid and has pushed well above recent highs to start 2026 stronger than expected. This was looking promising but again I’m cautious:

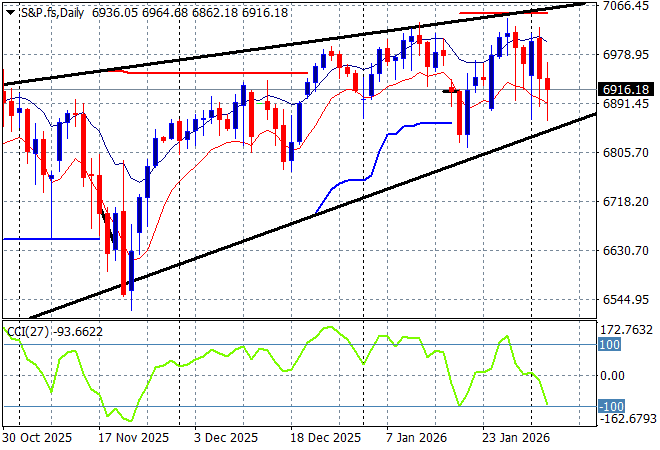

Wall Street continues to wobble around with any upside potential as the NASDAQ fell another 1.5% while the S&P500 lost 0.5% to close at 6882 points.

The four hourly price pattern was a solid fill and bounce back that is almost back to the recent highs after setting up for a rollover so watch for another attempt at cracking the 7000 point level proper next as this dump and pump operation keeps going:

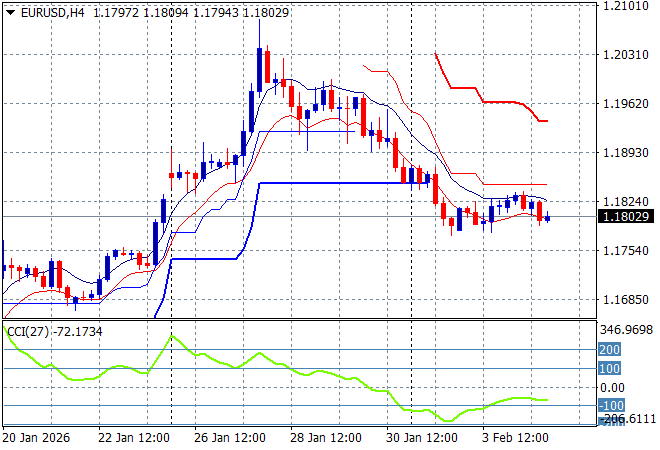

Currency markets kept swinging back to King Dollar overnight with Euro almost breaking below the 1.18 handle, with Pound Sterling giving back all its recent gains while the Canadian Loonie and Yen also appreciably weakened.

The union currency’s four hourly candle and technicals suggested an extremely overbought condition beforehand as I mentioned so some profit taking here but trailing support was not respected here so I’m looking for a further break below the 1.18 handle next:

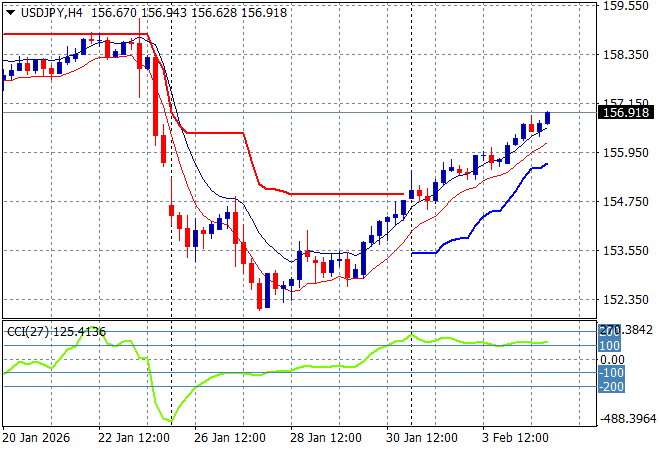

The USDJPY pair continued its bounceback with USD strength pushing it further overnight, extending the gains above the 156 level to almost break the 157 handle.

However the start of year position at the 158 handle is way out of bounds for now with this rebound being relatively inconsequential as we await the Japanese elections and other missives from the BOJ. Overhead resistance has been cast aside with price action now above the previous gap down level:

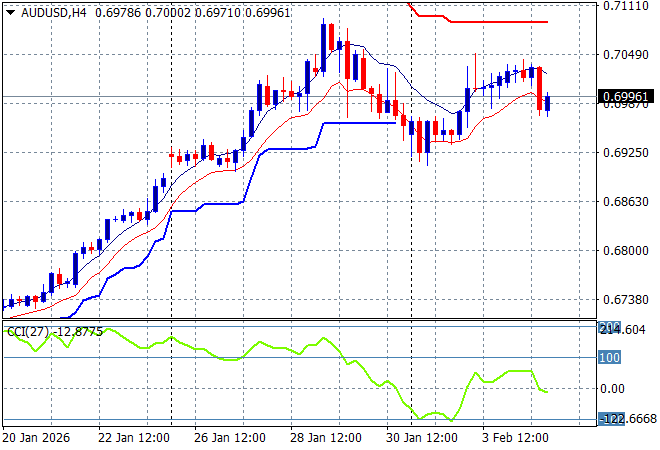

The Australian dollar had a small correction going into the RBA meeting with the bounceback above the 70 cent level on the expected rate hike unable to hold steady overnight on lower commodity prices.

This was looking to become a move back to the previous highs from last week but momentum was barely positive here so I expect a further retracement going into the NFP print:

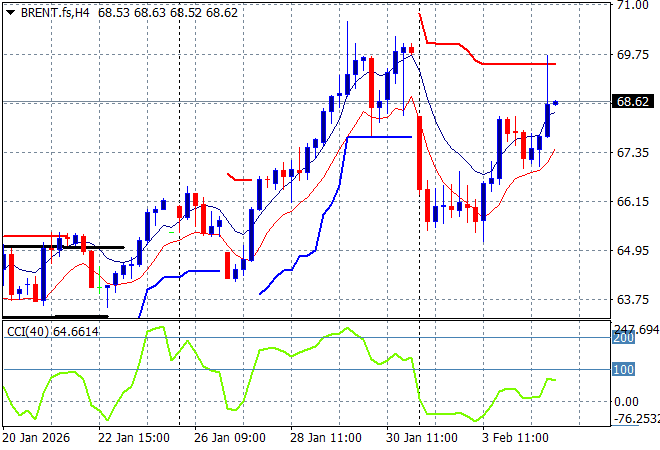

Oil markets have been on a multi week/monthly downtrend prior to the Venezuelan invasion but shot out of the gate last week with some big gains before settling into a sideways pattern and then breaking down when the Iranian war premium was discounted. However the bombs may yet start falling again as Brent crude steadied again at the $68USD per barrel level overnight:

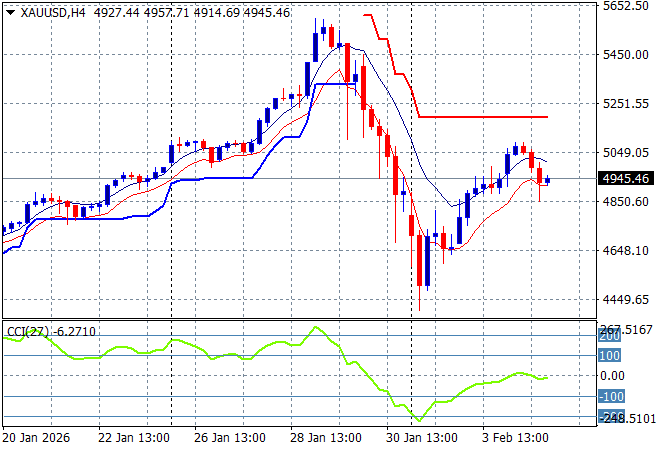

Gold is trying to get back on track after a near $1000USD per ounce drop that saw it bounceback to just below the $5000 level in the previous session but has since run out of momentum and dropped back to the mid $4900 level overnight.

The shiny metal had been lifting ever since the Dementia Don Davos drivel with trend lines becoming more and more parabolic – I did indicate a probable top but a one way trade that led to this volatility as no one wanted to go short until it was too late. Now we have the inevitable dead cat bounce with momentum not yet positive:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!