Société Générale uses options markets to read psychological pivots for precious metals.

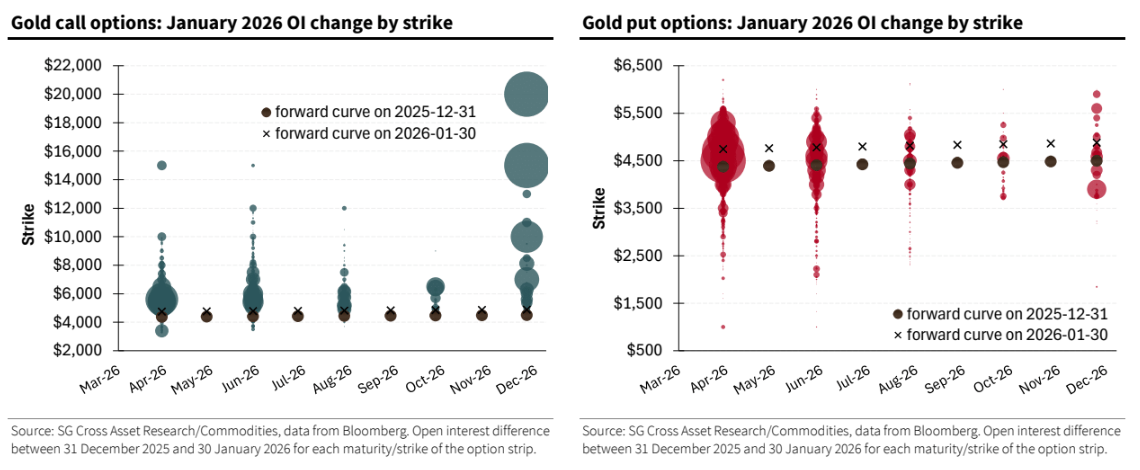

Gold:Fast up, fast down.As we wrote last week, we remain bullish on gold as we believe the fundamental rationale for precious upside remains despite one area of uncertainty being removed–namely lower Fed institutional chaos. We always believe a correction can be very healthy. Nonethless, beyond our own outlook, looking to recent changes in the option landscape helps us gauge sentiment and monitor levels risk that are being managed. We can see that based on the closing Friday data, the most notable build, relative to the forward curve is December 2026 with a large build in the $10,000/oz strike and an even larger one at $15,000/oz and $20,000/oz (see section below on timing of these). Looking to the puts, we see much less extreme bets of notable open interest. In December 2026 we see a build at $4,000/oz. By all accounts the extremes to the upside versus downside are very asymmetrical.

I am gold seller at this point. The reason is that several of the key foundations of the rally have been undermined in recent weeks.