Every year, consumer confidence surveys perk up as households bask in the afterglow of the holiday season and make New Year’s resolutions, creating a brief rise in optimism that conditions might be better in the year ahead.

According to the latest data from the ANZ-Roy Morgan Consumer Confidence Index, this year might be a little bit different.

Consumer confidence did indeed rise as seasonality would suggest, up 3 percentage points to 84.5. But this is still a deeply anaemic result.

Roy Morgan had this to say in their version of the press release to accompany the data:

“Analysis of long-running Consumer Confidence trends shows this is the lowest rating to start a New Year since January 1991 (78.5)—when the survey was conducted on a monthly basis.”

Looking at the internal subindexes, many of them paint a bleak picture.

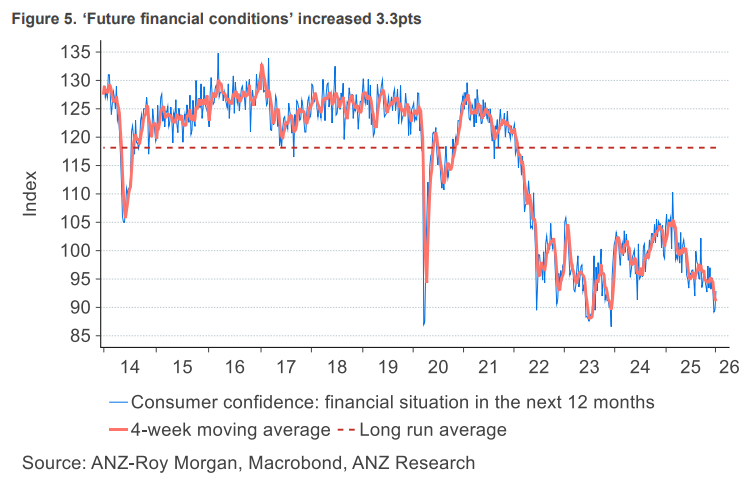

The outlook for the financial situation for households over the next 12 months remains near Covid era lows.

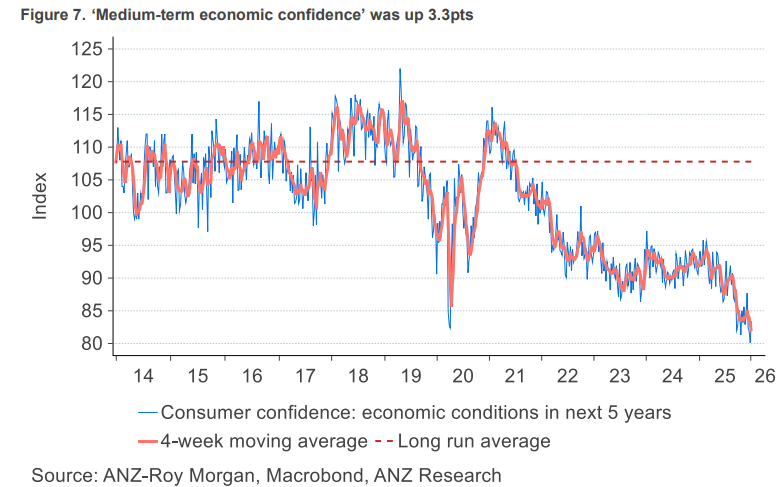

The medium term outlook for the economy is also deeply depressed, with the current 4 week moving average below even the crisis and panic defined Covid era.

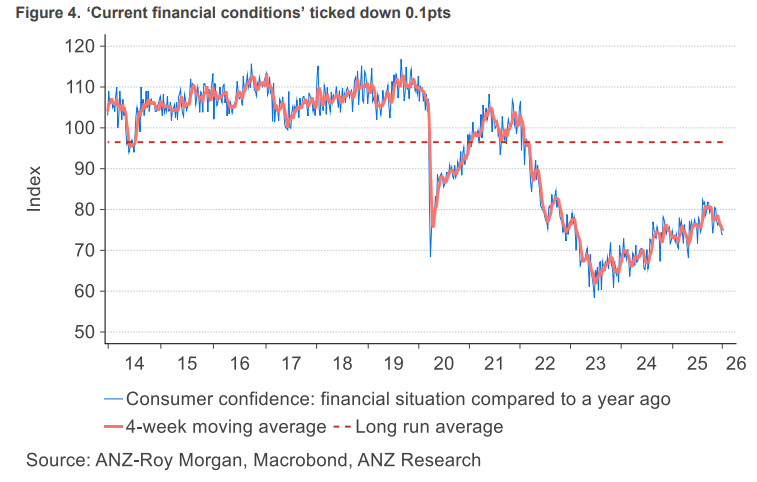

In somewhat better news, current financial conditions are up from the 2023 lows.

However, there are signs that confidence is rolling over and we may have seen a peak for the immediate future.

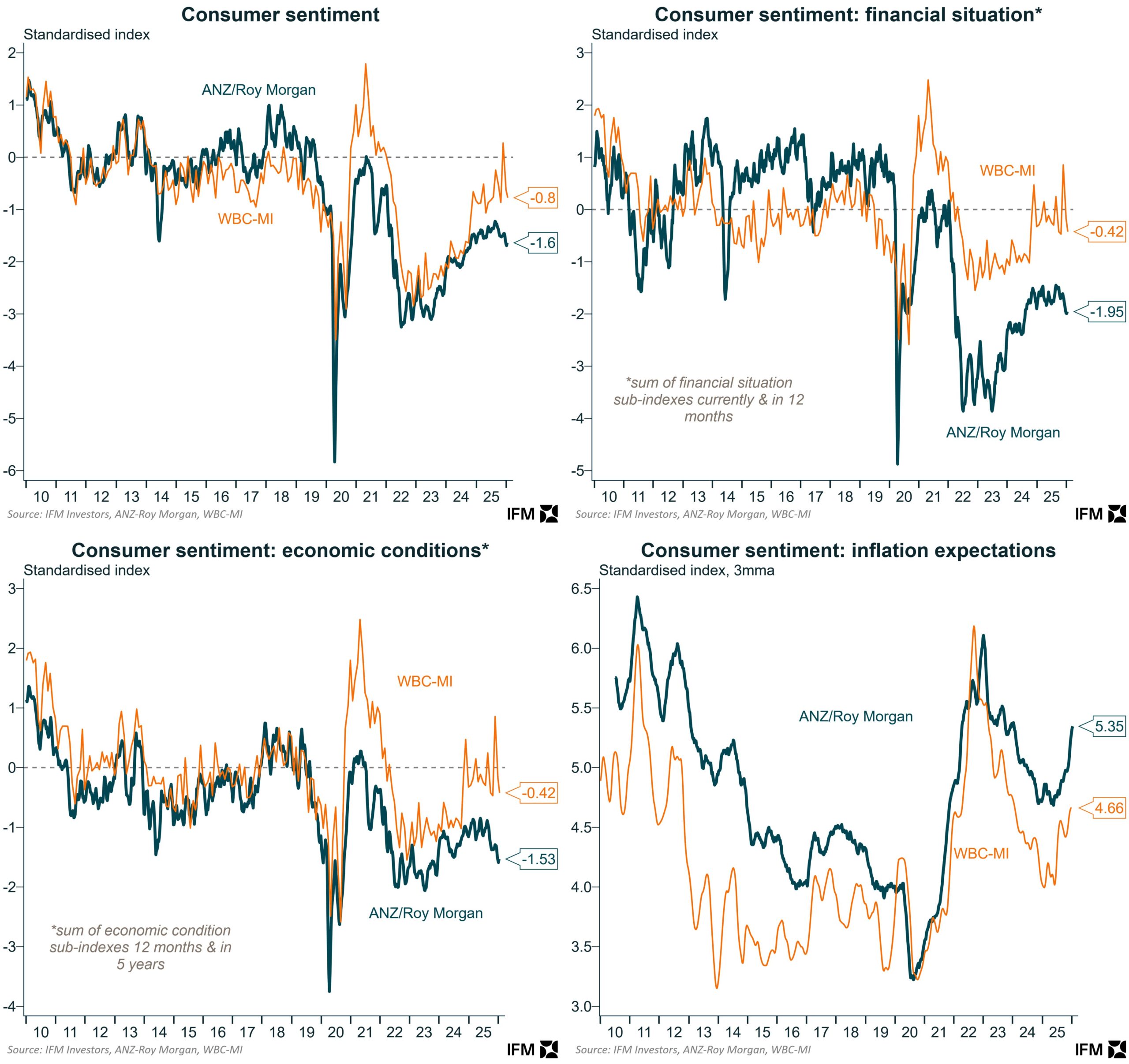

IFM Investors Chief Economist Alex Joiner had this to say on the issue in a recent Twitter (X) post:

“The WBC-MI consumer sentiment measure has been volatile in recent months but is seemingly turning over similar to the much more timely and pessimistic ANZ-RM index. “

As the prospect of rate rises looms on the horizon and the future pathway of the labour market hangs in the balance, there are big questions about further potential downside ahead for the sentiment of the nation’s households.

While Australia is ostensibly a free market capitalist economy, the answer to many of the nation’s most important economic questions is effectively: What is the government going to do?

Are they going to continue to support headline GDP growth and fund more than two-thirds of employment growth? Or are there limits to the scope of government interventions in 2026?

If one knows the answer to that question in detail, then knowing the potential paths where the future may take us becomes a whole lot easier.