Nothing much to move markets overnight except a looming war in Iran and a pause in the continued structural decline of the USD with both the Fed and Bank of Canada holding interest rates with ECB officials broadcasting a similar sentiment. A small bounceback in USD wasa not across the board however as the Australian dollar held up due to yesterday’s hot CPI print with a February rate hike by the RBA all but dialed in, while gold also went up another 2% as it soars to the stratosphere. Oil prices continue to breakout on Trump’s war mongering while US 10 year Treasury yields remained near the 4.3% level.

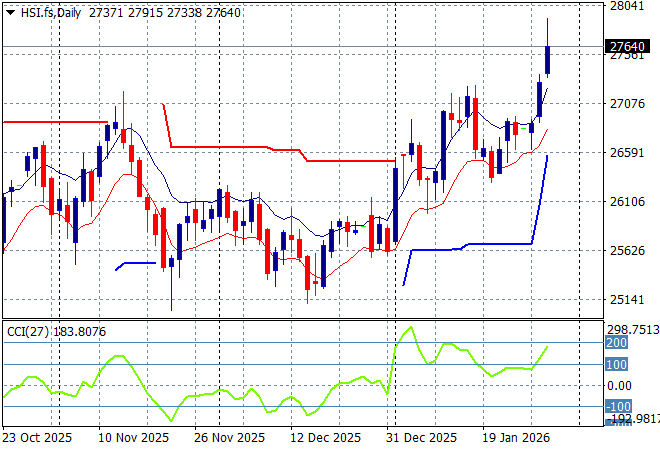

Looking at stock markets from Asia from yesterday’s session, where mainland Chinese share markets were up in the afternoon session with the Shanghai Composite pushing 0.3% higher to remain well above the 4100 point level while the Hang Seng Index was up more than 2% as it pushes through resistance to make a new monthly high.

The daily chart of the Hang Seng Index showed a lot of wish washy action around the 26000 point level in the last couple of months with some recent weakness now turning into strength. Momentum is now overbought with price indicating a breakout:

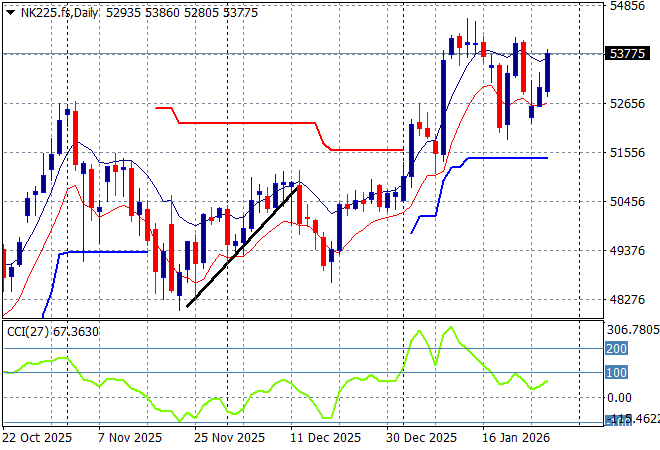

Japanese stock markets were the odd ones out with the Nikkei 225 down 0.5% at one stage before finishing with a scratch session to stay just above the 53000 point level.

Daily price action wavered a little during the BOJ hike in the previous weeks but has firmed up strongly with the 50000 point level forming key support although it has gotten ahead of itself. This was looking like a launch point through longer term overhead resistance but the selloff in Japanese bonds and the election snap call is still worrying here:

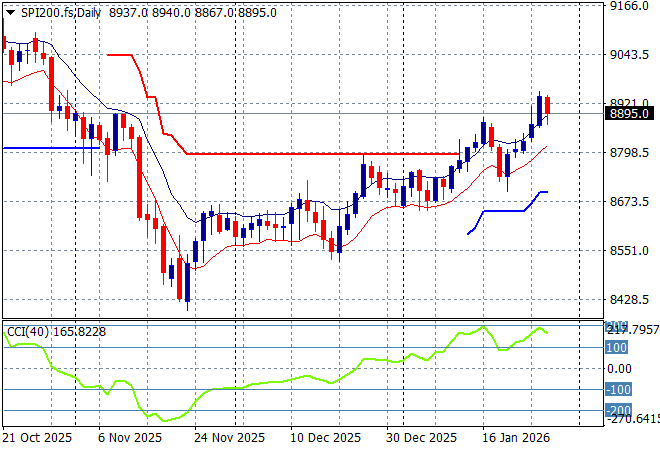

Australian stocks were doing well until the hot CPI print with the ASX200 closing 0.1% lower to 8933 points as SPI futures indicating a flat start to the session.

The daily chart pattern shows that short term support has been reinforced after a period of hesitation before Christmas with a bounceback above resistance at the 8800 point area building into what could be a solid breakout:

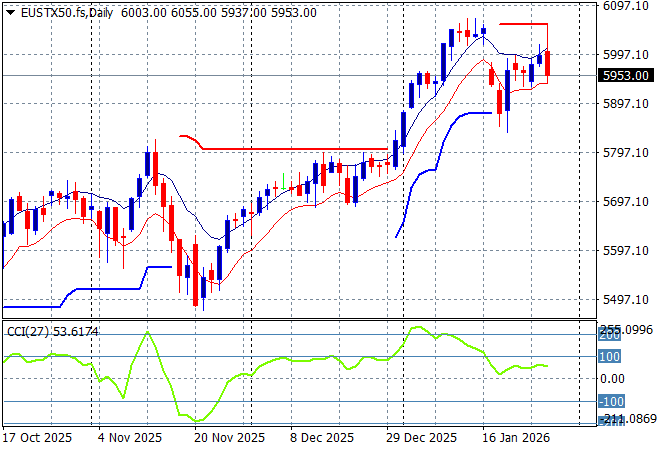

European markets returned to their hesitant mood across the continent as the Eurostoxx 50 Index closed 1% lower to 5933 points, still unable to get back on track after the breakdown of the recent rally.

The market had been failing to make headway in recent months due to the too high valuations but short term support was very solid and has pushed well above recent highs to start 2026 stronger than expected. Watch for any support levels to be built here after the Davos Diatribe:

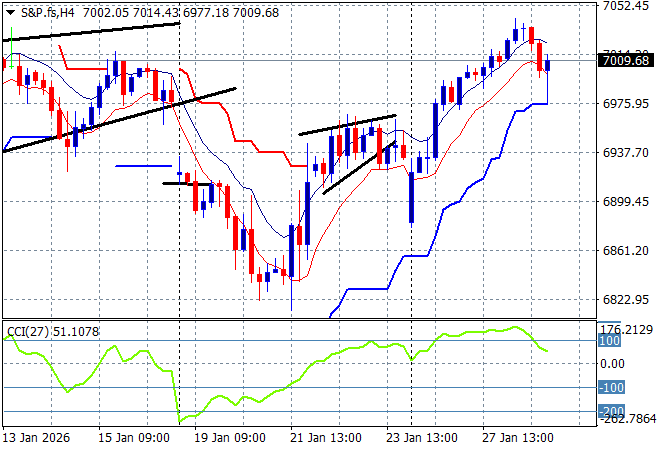

Wall Street wants to stay in a positive mood despite the recent poor consumer confidence print but some mixed earnings overnight spoiled the party with the NASDAQ down nearly 0.4% while the S&P500 eked out a small lift closing at 6982 points.

The market manipulation here has been interesting to watch from the inverted J pattern bottoming out at the 6800 point level on the four hourly chart and now this one sided bid to take the market through the gap down level, negating a dead cat bounce as we go through yet another Trump Chicken Outs trade:

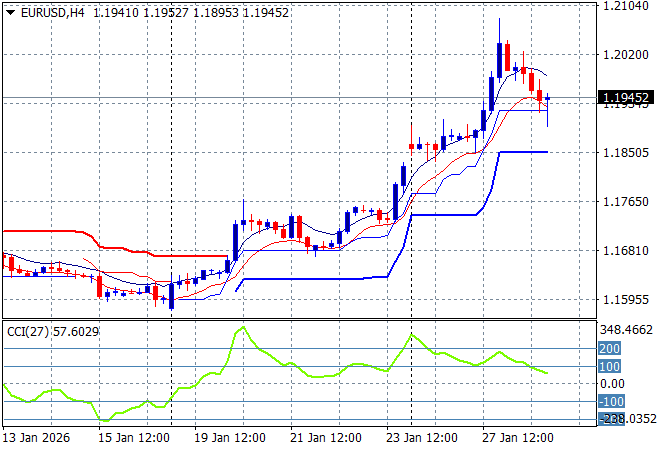

Currency markets remain in a firm anti-USD mode but had to contend with the Bank of Canada and Fed meetings overnight, let alone the Iranian situation with the extremely oversold DXY Index bouncing back from its four year low against most of the undollars. Euro was leading the way with surge above the 1.20 handle but was pulled back to the mid 1.19 level overnight.

The union currency’s four hourly candle and technicals suggested an extremely overbought condition beforehand as I mentioned so some profit taking here (cough cough) was inevitable but I would suggest trailing support should be supported here:

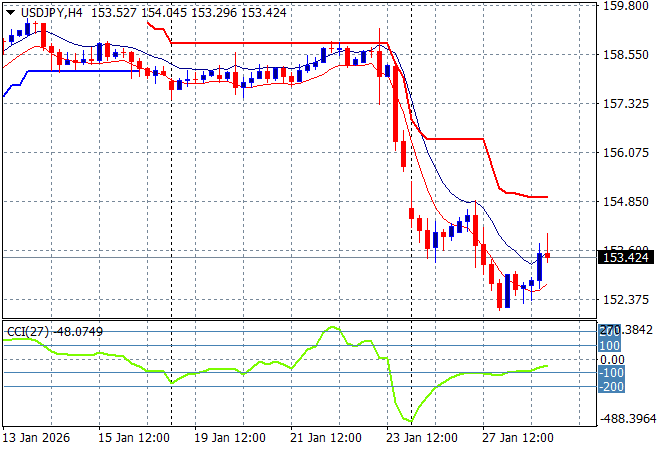

The USDJPY pair had been through a massive rout lately and into an unbearably oversold condition so no surprise a small bounce back by USD sent the pair above the 153 level overnight.

However the start of year position at the 158 handle is way out of bounds for now with this rebound being relatively inconsequential as we await the Japanese elections and other missives from the BOJ. There is a potential for a bounce back to the gap level around the mid 154 handle but its not high:

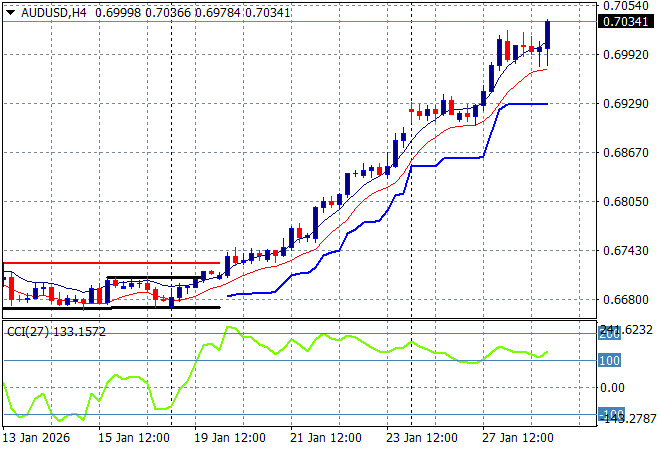

The Australian dollar has soared higher alongside gold due to USD weakness, now extending its push above the 70 handle on overall “Sell America” volatility despite other undollars giving up ground overnight.

Price action was not looking good for the Pacific Peso in the medium term as the interest rate differential squeeze sent it back to the doldrums, but short term support is shoring up as overhead resistance is pushed aside here:

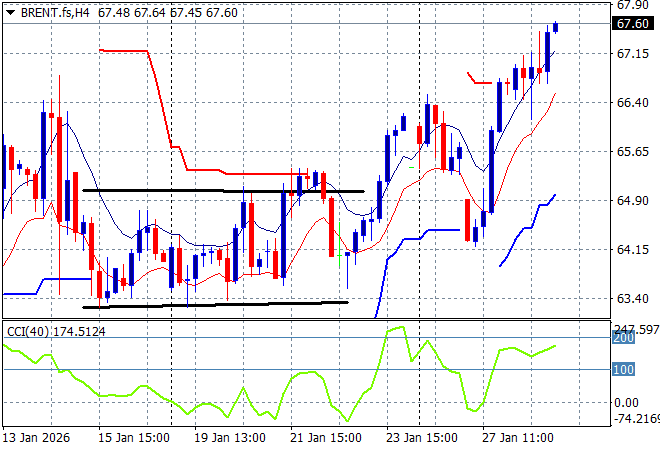

Oil markets have been on a multi week/monthly downtrend prior to the Venezuelan invasion but shot out of the gate last week with some big gains but have now morphed from a sideways pattern to a breakout on the upcoming Iranian war. Brent crude has surged again to move above the $67USD per barrel level overnight:

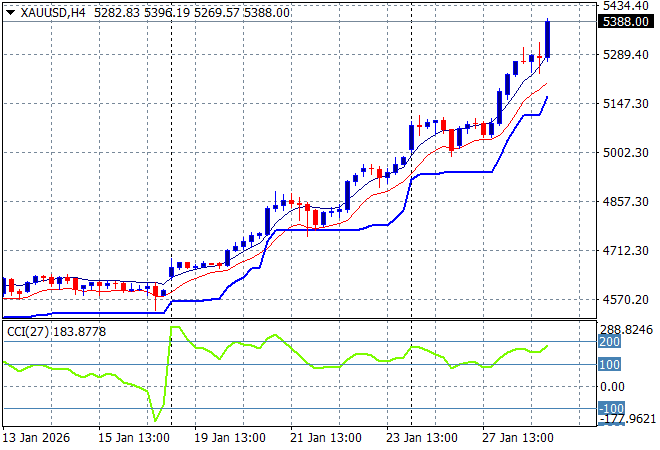

Gold is now accelerating into a blowoff pattern having blasted through the $5000USD per ounce level in recent sessions with another big surge that almost took it through the $5400 level overnight. The shiny metal has lifted ever since the Dementia Don Davos drivel with trend lines becoming more and more parabolic – this does indicate a probable top soon but no one is going to short this:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!