Macro Afternoon

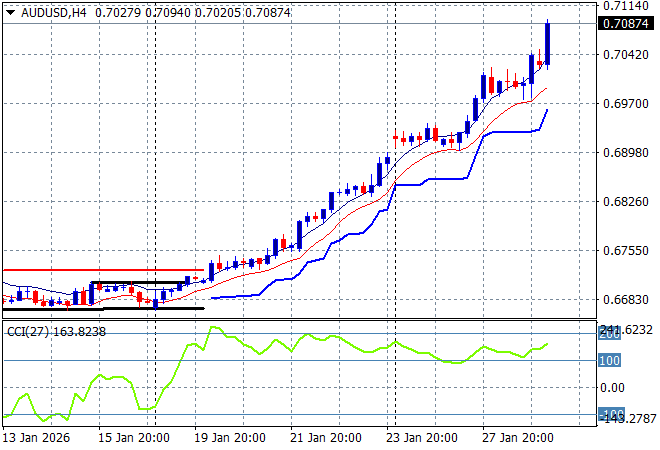

Asian share markets are generally higher as all risk markets look on with hesitation around the seemingly inevitable Iran/US war as both oil and gold prices blowout. This is keeping the Australian dollar on a tear as it barrels in on the 71 handle while other undollars took a breather overnight after a wide dumping of the “King” of currencies, following the hold from the Fed overnight.

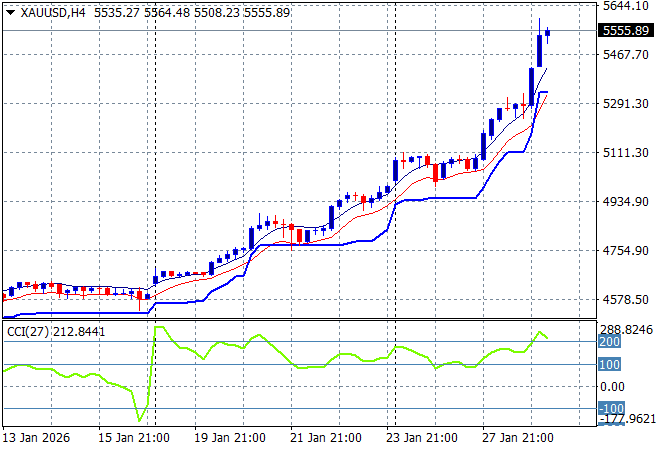

Brent crude is breaking out above the $68USD per barrel level while gold is on fire as it bursts through the $5500USD per ounce level in a blowout!

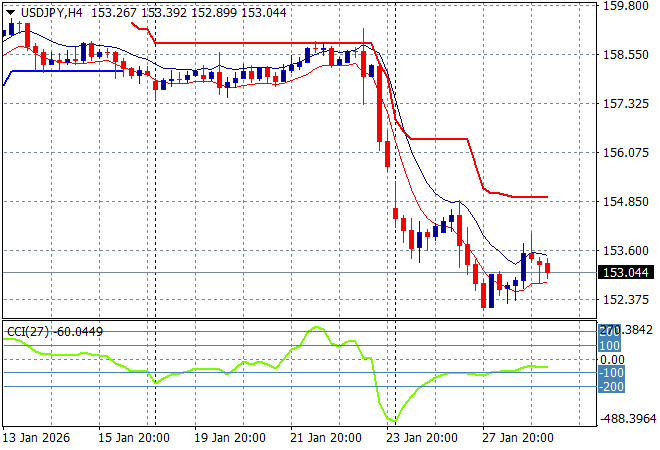

Mainland Chinese share markets are barely up in the afternoon session with the Shanghai Composite just 0.1% higher to stay well above the 4100 point level while the Hang Seng Index is up around 0.4% as it continues to make new highs. Japanese stock markets are back in the positive zone with the Nikkei 225 up nearly 0.5% to stay just above the 53000 point level while Yen is trying to stabilise after USD sold off sharply with the USDPY pair bouncing around the 153 level:

Australian stocks were the only ones to stumble across the region with the ASX200 closing 0.1% lower to 8927 points while the Australian dollar is continuing its surge above the 70 handle in near correlation with gold:

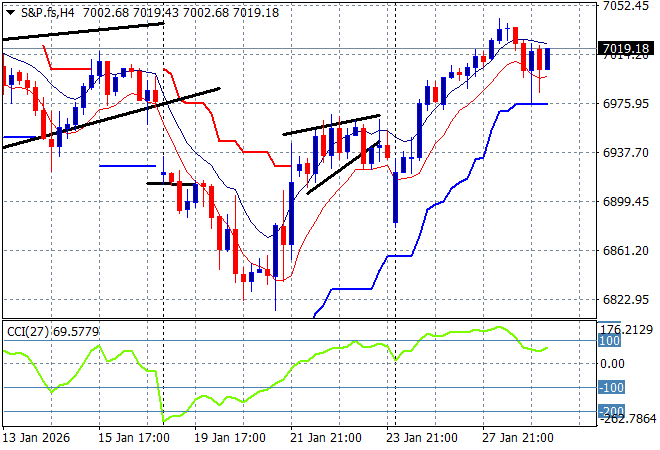

S&P futures are drifting slightly higher with the S&P500 four hourly chart showing a pause of the bounce off support at the 6800 point level with a stall here at the recent highs:

The economic calendar includes the latest trade data from the US, plus factory orders and weekly initial jobless claims.