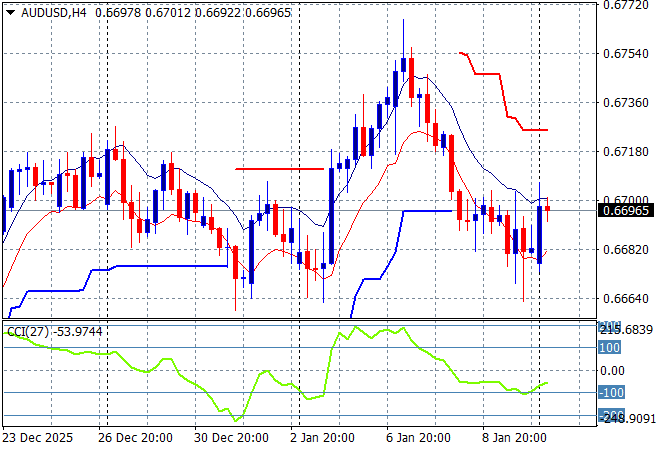

Asian share markets are generally higher in the first session of the trading week however volatility continues to rise in currency markets as the Trump regime tries to take away the Federal Reserve’s independence via open legal threats against Chairman Powell. The USD sank immediately on the news while oil prices are slowly rising as Exxon also gets in Trump’s sights for speaking the truth about how “univestable” Venezuela is post-intervention. Add the Iranian situation into the mix and this is becoming a volatile start to the trading year! The Australian dollar almost got back above the 67 cent level on the Powell put-down.

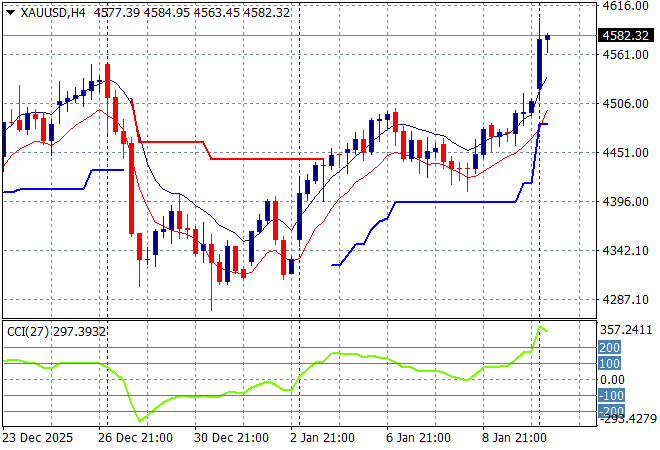

Oil markets are seeing a small lift again with Brent crude pushing above the $63USD per barrel level while gold has spiked on the Powell news with a big surge above the $4500USD per ounce level:

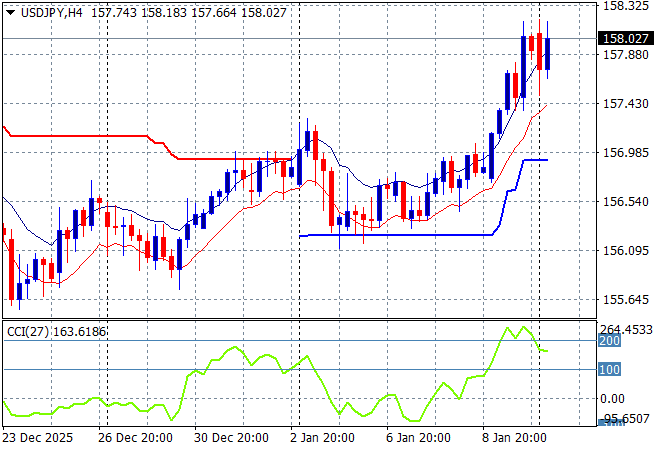

Mainland Chinese share markets are doing well in the afternoon session with the Shanghai Composite up nearly 1% to 4159 points while the Hang Seng Index has made a similar move to extend well above the 26000 point level. Japanese stock markets were closed for the first of seemingly 100 holidays for the year while trading in the USDPY pair has stalled at the 158 level:

Australian stocks finally put some runs on the board as the ASX200 closed nearly 0.5% higher at 8759 points while the Australian dollar is trying to bounceback on the USD weakness, almost lifting through the 67 cent level:

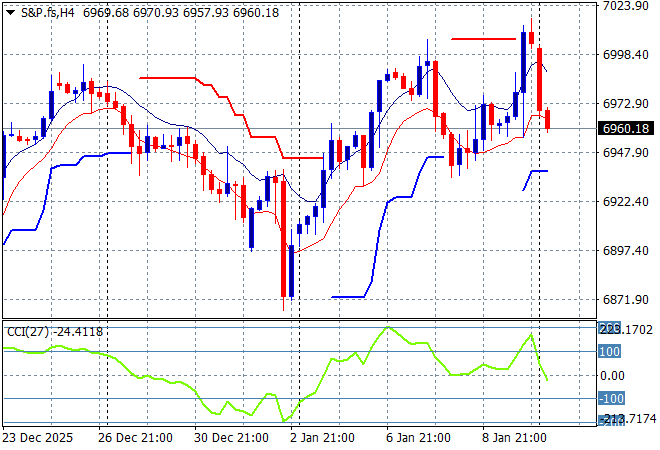

S&P and Eurostoxx futures are not liking the Powell putdown with the S&P500 four hourly chart showing a reversal of Friday night’s gains with the 7000 point level a bridge too far:

The economic calendar will focus on the latest massaged US inflation print tonight plus new home sales data.