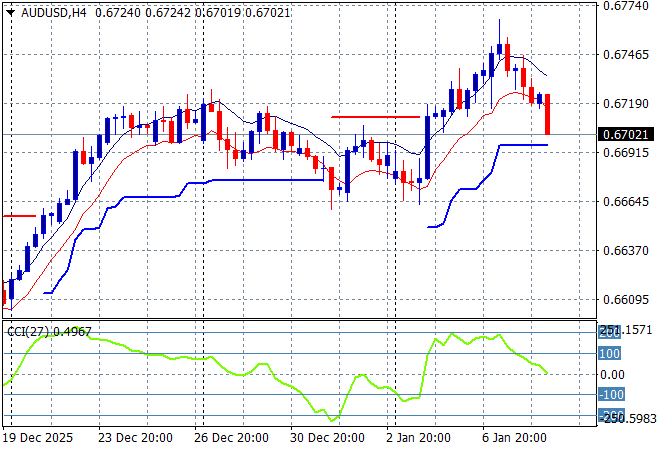

Asian share markets are not doing well as the positive lead from Wall Street dissipated overnight with commodity volatility continuing to dominate other risk markets while bonds go sleepy. Currency markets are selling off commodity currencies while Euro and Pound Sterling are trying to stabilise after a wobbly start to the new year, relatively speaking although as King Dollar remains under long term pressure. The Australian dollar fell back to the 67 cent level.

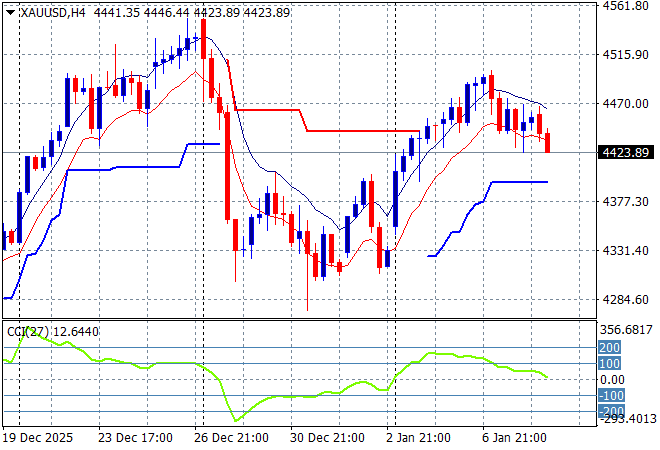

Oil markets remain unstable as weakness is starting to creep in again as Brent crude flops around the $60USD per barrel level while gold has eased off from its start of year rally to drop back to the $4400USD per ounce level:

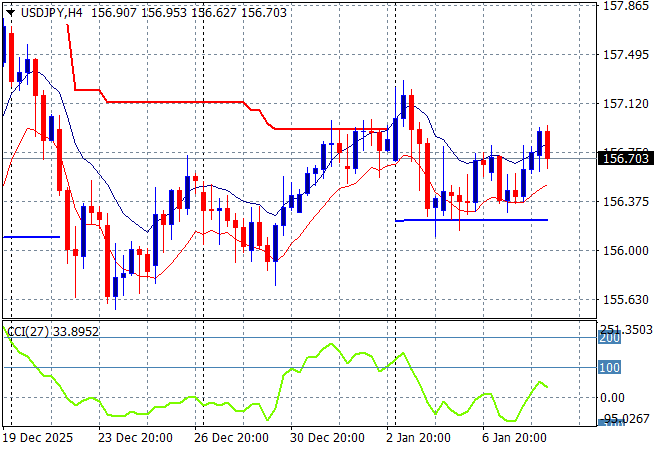

Mainland Chinese share markets are a bit wobbly going into the afternoon session with the Shanghai Composite down slightly but still above 4000 points while the Hang Seng Index has fallen back significantly down more than 1.5% to 26040 points. Japanese stock markets are also seeing a selloff after recent exuberance with the Nikkei 225 losing 1.6% to almost crack the 51000 point level with the USDPY pair putting in a false breakout in today’s session, currently jostling around at the mid 156 level:

Australian stocks were the standout again with the ASX200 lifting nearly 0.3% higher to 8720 points while the Australian dollar lost ground on RBA comments around inflation to almost crack below the 67 cent level:

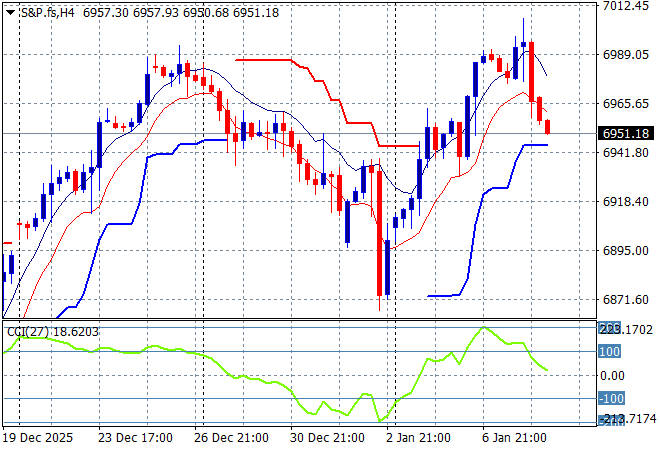

S&P and Eurostoxx futures are moving lower after a couple of wobbly mid week sessions with the S&P500 four hourly chart showing support coming under threat at the 6900 point level as the 7000 round figure seems a bridge too far:

The economic calendar includes some European unemployment data as does the US session with the latest initial weekly jobless claims and some trade data.